Gold Signals 'Bigger Crisis' Ahead

'You're Too Late' If You Wait

TABLE OF CONTENTS

Will Fed Shock Markets This Week? Forgotten Stocks That Could Soar Next

Fed’s Latest Surprise Will Shock Economy

Will Fed Cut Rates To 0%? Former Fed President Reveals Next Move

Signs Of 2001 Bubble Crash Repeat Warns Economist

Get Ready: Gold Crash To $3,500, Bitcoin To Collapse 90%

Inflation Reaches ‘Inflection Point’; Fed Rate Hikes Could Return In 2026 Warns Economist

Hiring Freeze Accelerates, Social Security Risks Insolvency

Market Recap

United States equity markets extended the strong momentum of October into the final week of the month, before encountering volatility as investors parsed mixed signals from Federal Reserve policy and earnings from technology giants. The S&P 500 opened last week with robust gains, rising 1.2% on Monday, October 27, to close at 6,875.16, while the Dow Jones Industrial Average advanced 0.7% to 47,544.59 and the Nasdaq Composite surged 1.9% to 23,637.46, all marking fresh record closes amid renewed optimism surrounding artificial intelligence investments and easing trade tensions. Markets extended gains Tuesday and Wednesday morning, with the S&P 500 breaching 6,900 intraday for the first time, before reversing course Wednesday afternoon following the Federal Reserve’s policy decision to cut interest rates by 25 basis points to a range of 3.75% to 4.00%. Chairman Jerome Powell tempered enthusiasm by indicating the central bank may not cut rates again in 2025, citing inflation that “remains somewhat elevated” and an economy expanding at a moderate pace. Thursday brought sharp declines as disappointing guidance from Meta Platforms and Microsoft, which both signaled significantly higher capital expenditures for artificial intelligence infrastructure, weighed on sentiment. The S&P 500 fell 0.99% to 6,822.34, and the Nasdaq Composite dropped 1.57% to 23,581.14. Markets rebounded Friday on strength from Amazon and Apple, with October closing out gains of 2.3% for the S&P 500, 2.5% for the Dow, and 4.7% for the Nasdaq, marking the sixth consecutive monthly advance for the S&P 500 and Dow. On Monday, November 3, the Nasdaq rose 0.46% and the S&P 500 edged up 0.17%, while the Dow slipped 0.48%.

The third-quarter earnings season delivered standout performances across multiple sectors, with approximately 80% of reporting companies beating analyst expectations. United Parcel Service (UPS) exceeded estimates dramatically on Tuesday, reporting adjusted earnings per share of $1.74 against expectations of $1.30, while also announcing workforce reductions of 34,000 positions, which drove shares up 12%. Wayfair similarly surged 12% after topping estimates, and Caterpillar jumped more than 13% Wednesday on strong results that single-handedly powered Dow gains that session. Technology sector results proved decisive for market direction, with Alphabet delivering a 23.7% earnings surprise earlier in the week, followed by mixed reactions to reports from the largest technology companies. Meta Platforms beat expectations by 8.7% but disappointed investors with guidance for capital expenditures of $70 billion to $72 billion in 2025, noting that 2026 spending would be “notably larger,” sending shares down more than 11%. Microsoft exceeded estimates by 1.6% but similarly faced selling pressure, declining by roughly 3% due to elevated spending outlooks. Apple reported fourth-quarter earnings per share of $1.85, beating estimates of $1.76 by 5.1%, and provided upbeat guidance for 10% to 12% revenue growth in the December quarter, driven by strong iPhone 17 demand. Amazon delivered the week’s blockbuster result on Thursday, reporting earnings of $1.43 per share, which exceeded expectations of $1.14, representing a 25.4% beat. Additionally, Amazon Web Services revenue increased 20% year over year. Chief Executive Andy Jassy noted that AWS was “growing at a pace we haven’t seen since 2022,” driving shares up 9.6% on Friday. Strategic developments have reshaped the artificial intelligence landscape as Microsoft finalized a new agreement with OpenAI, granting the software giant a 27% ownership stake valued at approximately $135 billion. Meanwhile, OpenAI announced a $38 billion infrastructure deal with Amazon Web Services on Monday, signaling its reduced reliance on Microsoft. Nvidia crossed the $5 trillion market capitalization threshold on Wednesday. In comparison, Apple briefly topped $4 trillion, and the chipmaker received a boost on Monday from Microsoft securing export licenses to ship advanced GB300 graphics processing units to the United Arab Emirates. Meanwhile, President Trump and Chinese President Xi Jinping concluded their October 30 meeting in South Korea with an agreement reducing the United States’ fentanyl tariffs on China to 10% and delaying Chinese rare earth export controls by one year, with Trump declaring that the “rare earth issue has been settled.”

Market Movements

The following assets experienced dramatic swings in price this past week. Data are up-to-date as of Nov 3 at approximately 4pm EST.

(Data from StockAnalysis.com)

Amazon - up 11.91%

Palantir - up 9.52%

Eli Lilly - up 9.08%

Meta - down 15.06%

UnitedHealth - down 8.80%

Oracle - down 8.37%

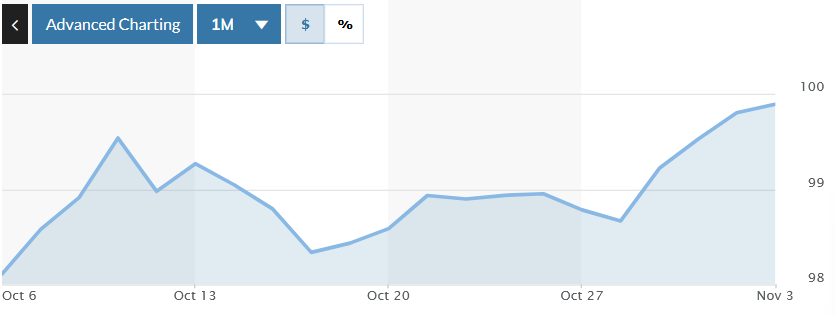

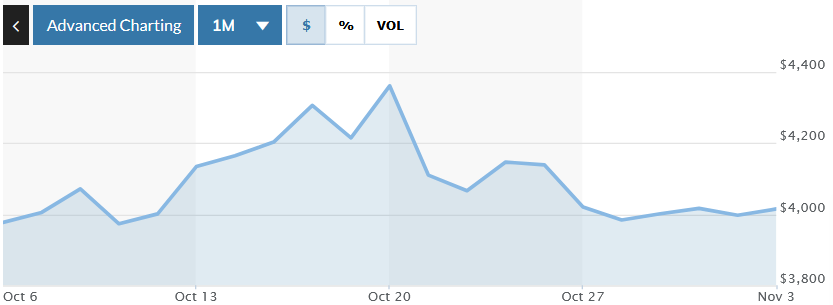

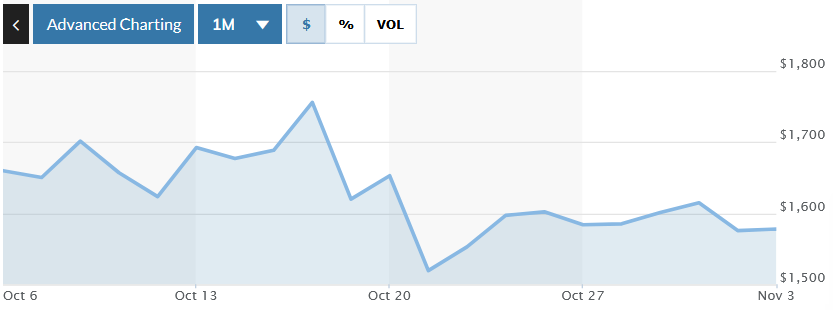

(Data from https://www.marketwatch.com)

DXY - up 1.05%

Bitcoin - down 6.19%

Gold - down 2.21%

Platinum - down 1.20%

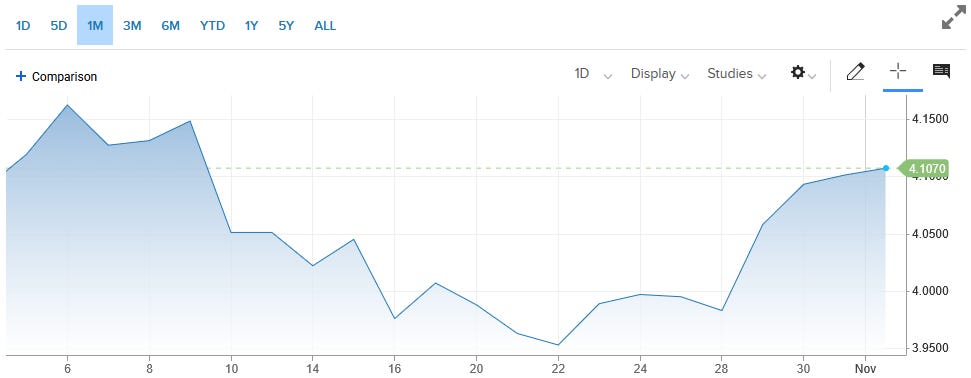

10-year Treasury Yield - up 2.09%

(10-year data from https://www.cnbc.com)

S&P 500 - up .10%

Russell 2000 - down 2.26%

Market Analysis

Peter Schiff, Chief Economist & Global Strategist at Euro Pacific Asset Management, argued the gold rally remained early despite comparisons to 2011. The metal pulled back 6.5% in one day but held support above $4,000. “4,000 is really the new 3,000 for gold,” Schiff said. He distinguished this rally from previous peaks driven by speculators. Central banks bought gold to replace dollar reserves while retail investors remained absent. “China isn’t buying gold to flip it,” he explained. The shift represented a transformation bigger than the 1970s abandonment of the gold standard. “It’s the world going off the dollar standard and returning to the gold standard,” Schiff said. He predicted that the United States would lose its reserve currency privileges, which enabled it to live beyond its means. Silver broke through $50 for the first time since 2011. “Silver has clearly broken out. It’s proven that 50 isn’t a ceiling anymore,” he said.

Schiff criticized Trump’s Big Beautiful Bill for preserving Biden-era deficits and stacking the Federal Reserve with political cronies. The president’s government investments in quantum computing companies were seen as unconstitutional socialism. “There’s nothing in the US Constitution that authorizes the US government to invest money in companies,” he said. Schiff dismissed stablecoins as hype designed to benefit Trump insiders and referred to crypto as a giant Ponzi scheme. Regional bank troubles signaled wider systemic problems. He compared gold’s warning to the 2007 subprime collapse. “Gold soaring like this is telling you that the dollar is going to go down, that bonds are going to go down,” Schiff explained. He recommended diversifying into foreign markets, where his dividend fund gained 50% compared to 13% for the S&P 500.

“Trade War” Update

President Trump and Chinese President Xi Jinping reached a significant trade truce during their meeting in Busan, South Korea, on October 30, marking their first face-to-face meeting since Trump’s return to the presidency. Trump immediately reduced fentanyl-related tariffs on Chinese goods from 20% to 10%, bringing the overall effective tariff rate on Chinese imports down from 57% to 47%. In exchange, China agreed to suspend for one year the sweeping export controls on rare earth minerals that it had announced on October 9, and the US suspended the planned 100% tariff increase on Chinese goods that was set to take effect on November 1. The White House released a detailed fact sheet over the weekend confirming that China will purchase at least 12 million metric tons of US soybeans during the last two months of 2025, and then 25 million metric tons annually through 2028, while also suspending all retaliatory tariffs announced since March 4, 2025.

Separately, Trump’s 25% tariff on medium and heavy-duty trucks took effect on November 1, covering Class 3 to Class 8 vehicles, including large pickup trucks, cargo trucks, and tractor-trailers. The Supreme Court is scheduled to hear oral arguments on November 5 in consolidated cases challenging the legality of Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs, after both the Court of International Trade and the Federal Circuit Court of Appeals ruled the tariffs exceeded presidential authority. Trump posted on Truth Social that the case would be “one of the most important in the History of the Country”, warning of America’s potential “ruination” if the court rules against him. Meanwhile, the US Senate passed resolutions on October 31 to repeal several of Trump’s country-specific tariffs with a 51-47 vote, with four Republican senators joining Democrats in the symbolic rebuke. However, the measure is unlikely to advance in the House of Representatives.

Will Fed Shock Markets This Week? Forgotten Stocks That Could Soar Next

Thomas Hayes, Founder, Chairman, and Managing Member of Great Hill Capital, predicted that markets would rally on a potential framework for a China trade deal. Treasury Secretary Scott Bessent said officials had “a very successful framework” ahead of November 1st tariff deadlines. Hayes expressed concern about Mag 7’s multiple expansion despite decelerating earnings growth. “MAG7 earnings growth is decelerating from 32% in Q3 of 2024 to what’s expected to be 14% in Q3 of 2025,” he said. The group committed $400 billion to capital expenditures with little evidence of return on invested capital. Hayes recommended alternative AI plays instead. Alibaba tripled from $60 to $175. Intel’s stock price doubled from $19 to $39 after the government provided backing. “You couldn’t give Intel away at $19. Now everyone wants it at $39,” he said. Comstock Resources offered natural gas exposure for data center demand.

Hayes defended the Intel government equity stake as responsible stewardship. “I think it’s going to make the taxpayer a tremendous amount of money over the next five years,” he explained. The administration demanded returns for taxpayer capital already committed. The energy sector weighting reached its lowest level since 2020. “The only way you don’t make money is if you buy low-quality stuff that has balance sheet risk,” Hayes said. On precious metals, he remained skeptical. Gold represented a non-productive asset requiring speculation on future buyers. “Why play that game when there are so many other opportunities where you actually have some level of control?” he said.

Fed’s Latest Surprise Will Shock Economy

Danielle DiMartino Booth, CEO of QI Research, criticized Federal Reserve Chair Jerome Powell following the October rate cut. The Fed lowered rates by 25 basis points and announced an end to quantitative tightening on December 1st. Two members dissented. Kansas City Fed President Jeffrey Schmid voted to pause cuts entirely despite cooler September inflation data. Powell said a December cut was not guaranteed due to the government shutdown. “What do you do if what do you do when if you’re driving in the fog? You slow down,” he said. DiMartino Booth dismissed the explanation. “Powell can choose to hide behind as an excuse, putting in turn more pressure on the administration to reopen the US government,” she said. She called the stance openly political and a violation of the Federal Reserve Act. October layoff announcements were tracked as the second-highest in two years.

DiMartino Booth argued rates should decline for small businesses. Consumer companies reported spending weakness as essential costs rose. She predicted passive inflows would sustain the stock market rally despite economic disconnection. “The flows know, and right now the flows go in,” she explained. The Fed would reinvest maturing mortgage-backed securities into treasuries after ending quantitative tightening. On precious metals, she warned about froth in gold despite its retreat from $4,000. The dollar strengthened quietly despite anticipated rate cuts. “I would be very hesitant to say that the dollar is necessarily going to weaken,” she said.

Will Fed Cut Rates To 0%? Former Fed President Reveals Next Move

Thomas Hoenig, former President of the Kansas City Fed and former Vice Chairman of the FDIC, currently serves as a Distinguished Senior Fellow at the Mercatus Center, and has warned that the economy has entered early bubble stages driven by artificial intelligence speculation. Regional banks faced credit risk problems after fraud cases emerged at Western Alliance and Zions Bank. “We’re in the early stages of a bubble,” Hoenig said. “It will continue until it stops, and then it’ll be a really nasty exit.” He compared the AI investment frenzy to the dotcom bubble. Nvidia’s $1 billion stake in Nokia and Microsoft’s funding of OpenAI exemplified cross-financing among tech companies. Hoenig expected a Federal Reserve rate cut but questioned its necessity, given strong economic growth and inflation above the 3% target. He predicted the administration would select a dovish Fed chair from finalists including Christopher Waller, Michelle Bowman, Kevin Hasset, Kevin Warsh, and Rick Rieder.

On stablecoins, Hoenig criticized the Genius Act for creating systemic risks. He predicted issuers would lobby to back coins with riskier assets beyond government securities. “The stable coin industry will ask for permission to have other types of assets back the stable coin,” he explained. “Then you have a moment where people lose confidence, and then you have a run, and they’ll turn to the Fed for bailouts.” Hoenig opposed FDIC insurance for crypto wallets, despite the growing adoption of cryptocurrencies. He argued consumers chose risk by avoiding traditional banks. The February Bybit hack demonstrated vulnerabilities but did not require a government backstop. Hoenig warned stablecoins would disintermediate banks while creating moral hazard through implicit Federal Reserve support.

Signs Of 2001 Bubble Crash Repeat Warns Economist

Peter Berezin, Chief Global Strategist and Director of Research at BCA Research, warned investors faced a tightrope walk between recession and overheating. The S&P 500 exceeded his expectations due to Trump’s trade war de-escalation, stimulative fiscal policy, and the AI wealth effect. “Right now, we’ve had since August declining real disposable income in the US, and yet consumer spending has remained pretty robust,” he said. Berezin compared current valuations to those of the dot-com bubble. The S&P 500 traded at a price-to-sales ratio 50% higher than the 2000 peak. He watched for a “metaverse moment” when major tech companies announced massive GPU spending and stocks declined instead of rising. “If that happens, it’ll be time to run for the hills, but it hasn’t happened yet,” he explained. An MIT study found that only 5% of 300 AI projects delivered measurable gains, despite $400 billion in annual infrastructure spending.

Berezin remained tactically neutral but recommended defense over 12 months. He sought increased layoffs before turning bearish, noting Amazon’s 14,000 job cuts reflected pandemic overhiring rather than systemic weakness. His quantitative model stayed bullish on gold despite the pullback from the highs. “We’re still kind of in the middle innings of a structural bull market in gold,” Berezin said. Central banks accumulated reserves while retail participation remained subdued compared to 2022. He predicted US tech would underperform in 2026. “I’m skeptical that it’ll be a great trade in 2026,” he said, recommending emerging markets, consumer staples, and healthcare instead.

Get Ready: Gold Crash To $3,500, Bitcoin To Collapse 90%

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, warned that gold reached a peak near $4,000, similar to Bitcoin’s $100,000 top in 2024. Gold rallied 52% year-to-date, the fourth-best annual performance in a century, without typical catalysts of stock volatility or major inflation. “You can’t just buy gold here. It’s too expensive,” McGlone said. He predicted a 20% to 30% correction toward $3,500. The rally occurred alongside a 14% decline in crude oil, creating a 65% disparity unprecedented in history. McGlone shifted from bullish on gold to bullish on Treasury bonds, expecting deflation to follow inflation. “The only thing I really have left is the US Treasury bond far out in the duration,” he explained. Stock market wealth creation reached historic extremes, creating unsustainable conditions.

McGlone turned bearish on Bitcoin after correctly predicting a price of $100,000 by 2025. “I think Bitcoin’s at risk of losing a zero, dropping 90%, the whole rest of the space dropping 95, mostly maybe 99%,” he said. He cited Strategy’s 200-day moving average rollover and unlimited cryptocurrency supply as warning signs. The gold-silver ratio rising to 85 historically preceded higher stock volatility. McGlone argued that everything depended on continued stock gains. “The 10 of the 10 for inflation going higher is the stock market going up, and the 10 of the 10 for deflation is the stock market going down,” he said.

Inflation Reaches ‘Inflection Point’; Fed Rate Hikes Could Return In 2026 Warns Economist

Lauren Saidel-Baker, an economist at ITR Economics, defended the Federal Reserve’s rate cuts despite 3% inflation, citing labor market concerns. The Fed reduced rates by 25 basis points amid a descent from both sides. “Someone said we should have cut more, and someone else said we should not have cut at all,” she said. Saidel-Baker argued that the labor market remained balanced but had weakened from its historic tightness. Job openings for unemployed workers dropped from a 2:1 ratio in 2022 to 1:1 currently. “The bottom has not fallen out from under the labor market,” she explained. Tech sector layoffs appeared isolated rather than recessionary in nature. Amazon announced 14,000 corporate job cuts, citing the need for automation. Saidel-Baker predicted 2.5% GDP growth for 2025, with slower rates of 2.1% following. “I do not think we are headed for a recession. However, I do think we’re headed for a slower pace of growth,” she said.

Saidel-Baker warned inflation would resurge as the primary risk ahead. “The bond market’s taking a very clear view that inflation is worrisome,” she explained. Trump’s China meeting produced limited progress, with fentanyl tariffs reduced from 20% to 10%. Trade relationships have already shifted toward Europe, Mexico, and Canada. Consumer confidence showed K-shaped divergence. Lower-income households struggled with tariffs on imported goods while upper-income earners benefited from equity rallies and locked-in low mortgage rates. Saidel-Baker remained bullish on high-tech manufacturing, semiconductors, clean energy, and medical services. She expected long-term bond yields to rise due to demographic pressures, despite near-term Federal Reserve cuts.

Hiring Freeze Accelerates, Social Security Risks Insolvency

Mark Hamrick, Senior Economic Analyst at Bankrate, predicted the Federal Reserve would cut rates 25 basis points despite 3% inflation. The Fed prioritized labor market weakness over price stability within its dual mandate. “The Fed is primarily concerned about the weakness in the job market,” Hamrick said. He expected inflation to remain around 2.5% through 2026, above the Fed’s 2% target. Energy, airfares, and clothing contributed upside pressure while shelter costs showed relief. Social Security is projected to face insolvency by 2033, with mandatory benefit cuts of 23%. Bankrate surveys found that 52% of non-retirees expected to rely on Social Security, while 75% worried that promised benefits would disappear. Housing affordability reached its worst level in decades. Home prices have risen 50% since the pandemic, while mortgage rates remain at 6.3%, down from recent highs but still far above the pre-pandemic 3% levels.

Hamrick described the labor market as balanced but softening. “The unemployment rate, uh, has remained stable at 4.3%,” he said, comparing it to the previous 2:1 ratio of job openings to unemployed workers. Bankrate surveys revealed a disconnect between official data and lived experience. Consumer sentiment deteriorated despite stable retail spending, reflecting concerns about tariffs and the outlook for the job market. The wealth transfer of $124 trillion from baby boomers would benefit recipients, but it failed to address middle-income housing challenges. “The US economy has proven more resilient than would have been expected for several years now. I would not want to bet against it,” Hamrick said, citing dynamic financial markets and continued innovation as long-term strengths despite political volatility.

What To Watch

*Data subject to delay if government shutdown continues

Tuesday, Nov 4

*U.S. trade deficit

*Factory orders

*Job openings

AMD earnings

Shopify earnings

UBER earnings

Pfizer earnings

Wednesday, Nov 5

ADP employment

S&P final U.S. services PMI

ISM services

Toyota earnings

Novo Nordisk earnings

McDonald’s earnings

Robinhood Markets earnings

Doordash earnings

Thursday, Nov 6

*Initial jobless claims

*U.S. productivity

*Wholesale inventories

Astrazeneca earnings

Friday, Nov 7

*U.S. employment report

*U.S. unemployment rate

*U.S. hourly wages

*Hourly wages year over year

Consumer sentiment (prelim)

Consumer credit

Schiff's point about China not buying gold to flip it cuts through a lot of the noise about short-term price action. The shift from dollar reserves to gold represents a structual realignment, not just portfolio diversification. When central banks hold through 6.5% single-day pullbacks, it signals conviction that dollar risk exceeds volatility risk.