‘I’m Petrified’: What’s Next Is 'Far Worse' Than 2008 Warns Trader

Is this the beginning of the end?

TABLE OF CONTENTS

Gold Plunges 6% In Largest Selloff Since 2013

Is The Market Bubble Finally Imploding?

Global Debt At Tipping Point: Gold, Silver Rally ‘Just Starting’

SPONSORED POST: MONETARY METALS

Trader Called Gold Price Explosion; Now Has Shocking Update

Gold At ‘Extreme Price’ Warns Economist, What’s Next After Bubble?

22 States Already In Recession Or On Brink Warns Moody’s Chief Economist

Stock Market Trap: Investor Reveals ‘Very Hot’ Q4 Trade

Market Recap

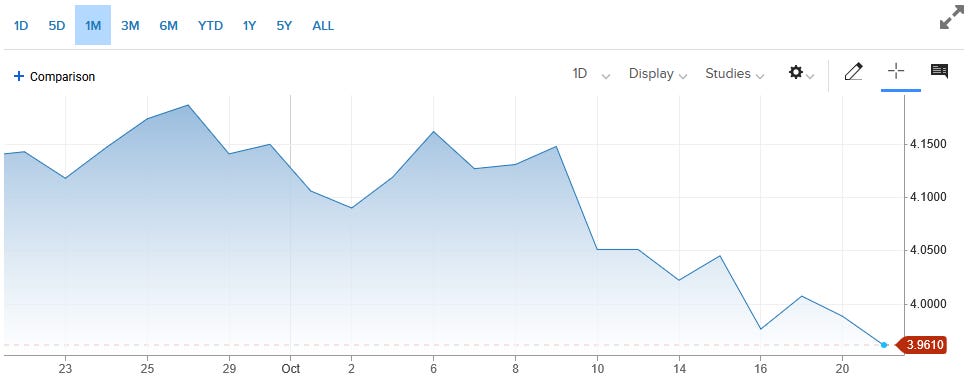

Precious metals experienced their most dramatic reversal in over a decade on Tuesday, October 21, as gold plunged more than 5% to $4,082 per ounce, marking its steepest single-day decline since April 2013, while silver tumbled more than 7% to $47.89, posting its largest drop since February 2021. The sharp selloff followed weeks of record-breaking rallies that had pushed both metals to successive all-time highs, with gold reaching $4,381.50 on Monday before the reversal. The correction came as optimism grew about a potential easing of United States-China trade tensions, which reduced demand for precious metals as safe-haven assets. Mining stocks bore the brunt of the decline, with major gold producers falling 4 to 6% and silver miners experiencing losses of 6 to 8%. Market analysts attributed the selloff to a confluence of factors, including stretched valuations, profit-taking after the extended rally, and growing expectations that upcoming inflation data could come in softer than anticipated, diminishing the appeal of inflation hedges.

The broader equity markets demonstrated resilience through the past week despite persistent headwinds from the government shutdown, which entered its third week with the Senate failing for the eleventh time to advance funding legislation. Last Monday, October 13, the S&P 500 climbed 1.56% to 6,654.72. The Nasdaq Composite surged 2.21% to 22,694.61 after President Trump signaled optimism about trade relations with China, stating “it will all be fine” and expressing confidence in reaching a “fantastic deal” with President Xi Jinping at their expected meeting in South Korea later this month. Tuesday, October 14, brought renewed volatility as the S&P 500 whipsawed throughout the session before closing down 0.2% at 6,644.31, pressured by Trump’s late-day criticism of China over soybean purchases. Markets approached record territory by Monday, October 20. The S&P 500 gained 1% to finish near 6,735, buoyed by strong corporate earnings reports and Treasury Secretary Scott Bessent’s confirmation that trade talks with his Chinese counterpart would continue in Malaysia to prepare for the leaders’ summit.

Market Movements

The following assets experienced dramatic swings in price this past week. Data are up-to-date as of Oct 21 at approximately 4pm EST.

(Data from StockAnalysis.com)

American Express Company - up 9.75%

AMD - up 9.12%

RTX - up 8.56%

Oracle - down 9.34%

RobinHood Markets - down 6.28%

(Data from https://www.marketwatch.com)

DXY - up .03%

Bitcoin - down 2.50%

Gold - up 2.74%

Platinum - down 5.71%

10-year Treasury Yield - down 2.22%

(10-year data from https://www.cnbc.com)

S&P 500 - up 1.68%

Russell 2000 - up 2.60%

Market Analysis

Gareth Soloway, Chief Market Strategist at Verified Investing, characterized Friday’s $19 billion cryptocurrency liquidation event as exposing excessive leverage permitting 50-to-1 and 100-to-1 positions across digital asset markets, noting XRP’s plunge from 280 to 175 demonstrated volatility exceeding traditional equity and futures markets while Bitcoin’s relative 10% decline from 120,000 to 110,000 revealed growing institutional ownership stabilizing price action compared to historical 20-30% single-day crashes. The technical strategist identified critical support at 110,000 derived from a multi-year trendline connecting 2023 lows through 2024-2025 advance, projecting that confirmed daily closes below that threshold would trigger a sub-100,000 breakdown while emphasizing probabilities favor continued uptrend provided longer-term bull market support at 92,000-93,000 holds intact despite potential head-and-shoulders pattern formation on shorter timeframes.

Soloway emphasized Trump’s rapid tariff reversal following a 2.77% S&P 500 decline exposed the most critical market dynamic whereby global leaders possess zero tolerance for equity weakness given economic dependence on wealth effects driving consumer spending, arguing politicians recognize stock market declines would trigger cascading recessions, making policy reversals inevitable until the system reaches a breaking point. The analyst highlighted the S&P 500 wedge pattern dating to the October 2023 lows, where upper resistance repeatedly rejected advances, while the Friday breakdown through the lower trendline lacked the confirmation required by a second consecutive close, projecting the reestablishment above 6,685 returns price into a tightening formation targeting prior highs, while confirmed support violations signal a minimum 10% corrections. He noted markets ascending gradually through fractional percentage gains contrast sharply with 3-4% single-day air pocket declines, characterizing an asymmetric volatility profile as a roller coaster ascending slowly before plummeting rapidly.

The strategist dismissed AI sector momentum despite 75% of S&P 500 two-year gains attributable to technology concentration, arguing AMD-OpenAI arrangements, where companies exchange warrants for spending commitments, represent circular financing propping valuations reminiscent of the dot-com era when Greenspan’s 1996 irrational exuberance warnings preceded four additional rally years before NASDAQ’s 66% collapse. Soloway projected gold’s nine consecutive weekly advances represent unsustainable parabolic extension warranting pullbacks toward 3,500 support levels, providing buying opportunities, while acknowledging precious metals catch-up trade follows prolonged underperformance relative to inflation-adjusted 1980 peaks as global powers abandon dollar confidence amid tariff tirades and fiscal spending trajectories. He warned that the approaching recession will surpass 2008-2009 severity, potentially approaching Great Depression magnitudes, once AI capital expenditure stimulates 3.8% GDP growth exhaustion, arguing that Federal Reserve rate cuts represent temporary drugs prolonging inevitable patient death, as 2008 shorting bans and emergency measures demonstrated the limits of policy intervention at system-breaking points.

Gold Price Facing ‘Violent Pullback’ Like 2008 Warns Trader

Chris Vermeulen, Chief Market Strategist at The Technical Traders, described gold’s largest single-day decline since 2013 as an initial shakeout in crowded trade conditions, where FOMO-driven investors piled into parabolic price action. The chartist emphasized intraday selling bouts preceding the plunge indicated institutional unloading. At the same time, retail participants chased momentum, projecting current pullback toward 20-day moving average support represents typical bull market retracement allowing consolidation before anticipated final surge potentially reaching $4,800-$5,000 levels using Fibonacci extensions from current cycle lows, acknowledging subsequent 30-45% corrections representing 38-61% retracement sweet spots matching 2008’s 34% decline and historical gold bear market patterns once ultimate tops establish across monthly.

Vermeulen disclosed 100% cash positioning following equity market weakness signals where proprietary NASDAQ sentiment analysis revealed extended institutional rotation away from equities during recent all-time high approaches mirroring pre-tariff divergences when big money anticipated adverse developments, arguing cash represents legitimate position preserving capital through 4-4.5% yields while avoiding 20-50% wealth erosion concerns despite inflation exceeding returns, projecting real estate opportunities emerge post-correction when REITs replicate 2008’s 75% collapses enabling 16% dividend yield acquisitions contrasting current environments where mortgage rate declines fail offsetting weakening economy preventing buyer qualifications and spurring supply dumping cycles. The strategist characterized Bitcoin’s broadening formation exhibiting progressively larger higher-highs and lower-lows as a dangerously volatile pattern requiring extended sideways consolidation and controlled bull-flag structures before re-entry consideration, emphasizing that stock market stabilization within the coming trading sessions determines whether the news-driven selloff represents a shakeout preceding continuation or an initial breakdown signaling a larger reset. He advocated inverse ETF trading to capture downside momentum during multi-week to multi-month bear market phases. This approach avoids forced positioning across overvalued asset classes that lack compelling risk-reward setups, which demand patient capital deployment for high-probability trade configurations.

Is The Market Bubble Finally Imploding?

Jim Bianco, President of Bianco Research, identified unprecedented concentration where S&P 500 and NASDAQ 100 share identical top eight stocks representing 37% and 70% of respective indices, arguing markets replicate late-1999 dynamics when dot-com suffixes inflated valuations despite inevitable winnowing where pets.com exemplified bubble casualties, while noting current environment prices all artificial intelligence participants as victors despite prominent players acknowledging competitive impossibility. The strategist emphasized analysis revealing 45 AI-related stocks captured 71% of S&P 500 gains since ChatGPT’s November 2022 launch while remaining 459 companies contributed 29%, forcing passive index investors into 45% AI exposure regardless of diversification intentions as software and information technology equipment contributed unprecedented 1% to GDP across three quarters exceeding late-1990s internet adoption and early-1980s personal computer buildouts.

Bianco characterized September’s record $100 billion retail investor inflows as transforming markets into the most retail-driven environment witnessed in decades, contrasting hedge fund and institutional positioning while noting 10-year Treasury yields remained static since April-May, indicating passive bond market interest despite equity enthusiasm encompassing indices, artificial intelligence names, and nervous participants rotating into precious metals hedges. The researcher dismissed labor market deterioration concerns given Congressional Budget Office projections showing 0.1-0.5% population growth representing 80-year lows since 1940s-1950s, arguing Federal Reserve Chair Jerome Powell’s September acknowledgment that breakeven payroll creation ranges between zero and 50,000 jobs with 25,000 midpoint means August’s 22,000 and three-month average 29,000 additions satisfy requirements absent historical immigration-driven expansion, warning continued economic stimulation targeting obsolete 150,000 monthly benchmarks risks wage and consumer price inflation pressures elevating bond yields.

The market analyst projected JP Morgan CEO Jamie Dimon’s 30% correction probability assessment appears reasonable given extreme valuations requiring companies exceed Wall Street high-end earnings estimates to justify current prices, acknowledging near-term momentum likely persists while emphasizing probability-based expectations favor 4% cash returns, 5% bond yields, and 6% equity gains over five-to-ten year horizons representing average historical performance versus recent 20-30% annual gains fostering unrealistic entitlement psychology. Bianco dismissed dollar debasement narratives despite gold reaching $4,000 and silver approaching $50 all-time highs, arguing precious metals represent tiny asset class vulnerable to speculative retail flows competing with cryptocurrency for safe-haven allocations where earlier 2025 Bitcoin surges toward $120,000 preceded current precious metals mania, projecting silver breaches $50 psychological threshold with continued upside momentum before inevitable parabolic reversal liquidations wipe profit-taking participants. He characterized Ethereum outperformance versus Bitcoin as reflecting stablecoin, decentralized finance, and real-world asset tokenization adoption following the SEC greenlight for securities blockchain migration, arguing permissionless decentralization principles favor Ethereum over Solana’s centralized architecture despite speed advantages, while warning investors accepting censorship and blacklisting capabilities might prefer Federal Reserve server-based systems controlling purchasing permissions, including dietary restrictions on tokenized asset utilization.

Global Debt At Tipping Point: Gold, Silver Rally ‘Just Starting’

Matthew Piepenburg, Partner of Von Greyerz AG, characterized gold’s 55% year-to-date advance to $4,200, reflecting an inevitable secular trajectory continuing until sound money returns to G7 and global sovereign nations, arguing that precious metals hold value. At the same time, fiat currencies lose purchasing power through unsound debt monetization, regardless of short-term DXY fluctuations, given the world reserve currency milkshake theory, exporting inflation despite M2 expansion and credit extension diluting dollars like mineral water tossed into wine quarterly. The strategist dismissed correlation analysis between dollar strength and gold performance, emphasizing debasement thesis confirmed by BRICS de-dollarization, central banks stacking 1,000-ton annual purchases since 2014 while dumping treasuries marking first period since 1996 holdings favor gold over US debt, petrodollar erosion, BIS tier-one designation, COMEX gymnastics, and Genius Act desperation signaling slow replacement by physical precious metals as superior strategic reserve asset and store of value across central bank and commercial bank allocations.

Piepenburg argued that US Treasury Secretary Scott Bessent’s decoupling warnings represent political theater masking mathematical reality, where less than 10% Chinese export dependence on America versus Triffin’s law dictating world reserve currency status guarantees trade deficits through elevated dollar demand, likening the situation to blaming shopping malls for excessive credit card spending when the root problem resides in household fiscal discipline. The analyst emphasized Liberation Day treasury auction silence forcing policy retreat, October 9th Chinese rare earth export restrictions leveraging 70% mining and 90% processing dominance, and October 10th 100% tariff announcement triggering $19 billion cryptocurrency liquidations before weekend reconciliation attempts demonstrate US prosecuting trade war without adequate ammunition given offshore manufacturing migration since 2001 World Trade Organization accession resulted from American CEO labor arbitrage decisions rather than Chinese malfeasance. He noted rising 10-year treasury risk premiums signal the market demanding higher compensation for a declining dollar and unsustainable debt, despite Bessent’s focus on short-end auction performance, ignoring long-duration vulnerabilities.

The precious metals advocate projected debt-to-GDP crossing 100% Rubicon mathematically slows growth by one-third per 1750s David Hume observations, arguing current 120%-plus ratio vastly exceeds reported 99% figures as IMF forecasts 143% trajectory by decade-end absent entitlement and defense cuts representing double 2016’s 65% tax receipt burden from interest expense alone, forcing constructive default through negative real yields when measuring inflation honestly via John Williams’ 1980s Volcker-era methodology revealing 10-11% actual rates. Piepenburg recommended a five-year plan prioritizing honesty about the debt crisis, followed by austerity and constructive destruction permitting necessary recession, GDP growth through reshored manufacturing incentivized via CEO tariffs rather than nation-state penalties, and potential gold standard adoption forcing spending discipline despite short-term pain and electoral suicide prospects given polarized electorates unwilling to endure harsh medicine across divided Western democracies, including European Union fragmentation.

The strategist projected central bank gold accumulation reflects strategic recognition of settlement currency role foreshadowed by BRICS frameworks during recent years, questioning Fort Knox audit silence and arguing US holdings declined from 22,000 tons in 1940s to 9,000 tons by 1971 Nixon shock with current 8,100-ton claims likely understated relative to Russia’s probable 12,000 tons and China’s significantly-above-3,000-ton reserves remembering Kissinger’s warning that gold revaluation winners depend on accumulation leadership. Piepenburg characterized silver’s $53 first-ever all-time high breakthrough as smart investor positioning in massively undervalued monetary metal rewarding infrequently but extravagantly during gold bull markets, noting 80:1 gold-silver ratio compression potential toward historical 15:1 and 32:1 peaks, entire silver market capitalization representing half Nvidia’s valuation vulnerable to modest demand surges, supply deficits alongside weakening COMEX and LBMA paper manipulation capacity evidenced by 80,000-contract short positions failing to suppress prices as London float contracts to 155-million-ounce single-day trading volumes, and 45-year cup-and-handle technical formation supporting fat-pitch opportunity for retail investors priced out of $4,200 gold. He warned markets exhibit more dangerous characteristics than 2008 given 10 technology names commanding 40-50% S&P 500 concentration, 20% American population subprime status with 11-12% year-over-year bankruptcy increases, auto default surges, opaque private credit payment-in-kind trends where borrowers substitute securities for cash interest obligations, and artificial intelligence circular financing arrangements resembling dot-com era excesses preceding NASDAQ’s 66% collapse, while acknowledging bubbles easily measured through Buffett indicators and price multiples but notoriously difficult timing absent income margin southward inflection signals.

SPONSORED POST: MONETARY METALS

Monetary Metals is reimagining how gold works for investors. Rather than letting it sit idle and hoping it gains value, investors can now put their gold to work and earn a yield—paid in physical gold. With returns reaching up to 4%, this model allows gold owners to steadily grow their holdings in ounces, not just dollars.

Their system turns the traditional cost of storing gold into an opportunity to earn. Instead of paying to store your metal, you get paid to own it. The yield is issued monthly in physical gold, which you can redeem and take delivery of at any point.

More and more investors are turning to Monetary Metals to grow their wealth and generate consistent income in one of the world’s oldest, most stable assets. With continued economic uncertainty, this approach to gold investment offers both security and return. Learn more at Monetary-Metals.com/Lin

Trader Called Gold Price Explosion; Now Has Shocking Update

Gary Wagner, Editor of TheGoldForecast.com, acknowledged his $3,700-3,800 upside target established late August proved conservative as gold exceeded projections by $200 reaching $4,076, characterizing the seven-to-eight consecutive weekly green candles from $3,300 as near-parabolic movement representing most aggressive rally velocity witnessed across extended timeframes despite historical precedents for multi-week advances lacking equivalent price differentials between Monday opens and Friday closes. The chartist emphasized underestimating speed and pace constitutes preferable forecasting error versus overshooting targets, projecting corrections represent necessary components preventing unrealistic parabolic overextensions where markets exhibiting strong bullish undertones alternate between price ascent periods and consolidation or retracement phases, while noting $700 upside move from mid-August warrants acceptable 23.6% Fibonacci retracement toward $3,890 with deeper 61.8% corrections remaining consistent with bull market dynamics absent bearish invalidation.

Wagner identified technical resistance at $4,000 psychological threshold, where weekly candle upper wicks reveal intraweek $4,076 highs followed by $80 pullbacks to $3,990, marking the first instance during the August-initiated rally where gold challenged new all-time closing levels before backing off, contrary to the prior pattern where closing prices approached intraweek highs with minimal upper wick formation. The analyst upgraded upside breakout targets to $4,100-4,200 range contingent on sustained $4,000 breach, emphasizing uncharted territory complications where consecutive weeks of closes above Monday opens accompanied by record-setting Friday settlements represent rare occurrences exceeding historical norms, while acknowledging timing challenges persist despite probability-based price target methodologies enabling directional bias determinations. He distinguished Heikin-Ashi candlestick analysis, revealing six consecutive weeks without lower wicks, indicating no intraweek trading below prior candle midpoints, contrasting the March 2025 rally from $2,890 to $3,100, where comparable body-size patterns preceded sideways consolidation rather than accelerated advances.

The technical strategist attributed gold’s unprecedented velocity to anticipated Federal Reserve accommodation through two final 2025 FOMC meeting rate cuts already factored into current pricing, projecting potential consolidation or correction outcomes if dovish policy materializes as expected, given the market tendency toward sell-the-news dynamics following anticipated event confirmations. Wagner contrasted 2015-2019 narrow trading ranges where gold failed to ascend and consolidate at successively higher levels versus current environment replicating 2019 patterns when prices surged from $1,200 to $2,000 before correcting to $1,600 in normal retracement fashion, emphasizing January-to-May 2025 period demonstrated $6,300-to-$3,200 gains through smaller weekly price differentials preceding recent eight-week explosion combining new record closes with higher Monday openings creating extraordinary momentum rarely witnessed across historical datasets.

Wagner projected silver consolidation around $47 support and $48.50 resistance following parabolic advance from July’s $36 levels, testing $50 intraweek highs for the first time since Hunt Brothers’ 1980s market manipulation, noting four consecutive weeks of near-identical $48 opening and closing prices with lower wicks probing $47 support suggest a defined trading range preceding potential breakout or breakdown resolution. The analyst emphasized silver’s historical characteristic outperforming gold through larger percentage gains during upward trends while suffering greater percentage drawdowns during corrections, attributing elevated volatility to metal’s dual industrial and monetary roles contrasting gold’s primary safe-haven inflation hedge perception, while acknowledging 12-month performance revealing 57-58% silver gains versus 52% gold appreciation masks six-month divergence where June-onward silver’s 47% surge dwarfs gold’s 19-20% advance. He identified effective $49-50 close requirement for sustained silver rallies above psychological resistance, projecting $44-45 correction targets if $47 support fails on closing basis using 78% Fibonacci retracement from $36-50 range, while noting consecutive weeks testing $48-50 intraweek ranges without decisive breakouts suggests further consolidation precedes directional resolution potentially lagging gold’s momentum given contrasting price action where precious metal established consecutive record highs while silver maintained flat sideways pattern.

Gold At ‘Extreme Price’ Warns Economist, What’s Next After Bubble?

Mark Skousen, Editor of “Forecasts & Strategies” and Presidential Fellow at Chapman University, characterized gold’s dramatic 55% year-to-date advance to $4,200 as baffling given stable dollar conditions and absence of recession, attributing outperformance versus Bitcoin and S&P 500 throughout 21st century to catch-up phenomenon following 1970s-2000 Warren Buffett equity dominance era, while emphasizing central bank purchasing shifts where zero institutions currently sell gold combined with out-of-control national debt and Keynesian mandate violations lacking Clinton-Gingrich 1990s balanced budget discipline represent monetary metal’s yelling “have some discipline folks” against marketplace participants. The Chapman University presidential fellow recommended pivoting toward mining stocks including Kinross Gold trading 17 price-to-earnings multiples with sub-one PEG ratios offering triple potential versus physical bullion speculation at extreme nominal levels, acknowledging silver’s London short squeeze reminiscent of 1980 Bunker Hunt manipulation pushing prices beyond $50 represents hot market technicians favor while advocating pullback opportunities enabling sound investment positioning rather than current elevated entry points.

Skousen criticized Trump administration trade war policies contradicting Benjamin Franklin’s “no nation was ever ruined by trade” philosophy where consumers benefited from cheap Chinese, Mexican, and Latin American imports improving automobile quality through Toyota, Mercedes, and Kia competition demonstrating quantity, variety, and innovation advantages, while warning $100,000 H1B visa fees and fortress America xenophobia undermine 500,000 unfilled manufacturing and technology positions requiring global talent exemplified by foreign-born entrepreneurs including Elon Musk driving largest firms. The economist emphasized Gross Output statistics revealing supply chain deterioration where business-to-business spending declined 5.6% real terms, contrasting 3% GDP growth, masking total economic activity since consumer spending represents two-thirds of expenditure calculations, excluding production stage transactions exceeding GDP magnitude, projecting tariff-induced inventory buildup reversals and pairing-down cycles suppress B2B allocations. In comparison, Goldman Sachs interviews only 1% Chapman University senior applicants despite booming stock performance, indicating hiring reluctance amid trade war uncertainty. He characterized Yale Budget Lab estimates projecting $2,400 annual household income reductions from staggered tariff rollouts, risking persistently higher inflation rather than one-off shocks, arguing Trump’s two-year midterm window demands resolution before Democratic House and potential Senate takeovers mirror Argentine President Milei’s Peronista opposition electoral losses.

The forecaster distinguished 1987 Black Monday crash predictions from current environment where circuit breakers halting 10% declines, emergency coordination between Treasury, SEC, and Federal Reserve, plus aggressive intervention commitments prevent single-day 20% collapses while bear markets remain viable given technology stocks could decline 50% and remain overvalued at near-record price-to-earnings ratios approaching 1929 levels, acknowledging artificial intelligence revenue generating $50 billion annually against trillion-dollar market capitalizations replicates late-1990s dot-com disconnects vulnerable to black swan events including Treasury no-bid scenarios where central banks dumping holdings force $7 trillion annual refinancing failures. Skousen reported 45-year record portfolio returns through 2025 incorporating gold, silver, and uranium positions alongside diversified holdings, maintaining full investment with ascending stop-loss protections anticipating potential 2026 midterm election volatility while noting Main Street Capital’s 20% business development company correction following Federal Reserve rate cuts reducing investment income expectations across $2 trillion private credit markets appearing overvalued and frosty despite well-managed firm resilience, projecting uranium and biotech sectors offer undervalued opportunities. However, conservative bank stock allocations provide defensive alternatives absent clearly cheap equities following broad market run-ups.

22 States Already In Recession Or On Brink Warns Moody’s Chief Economist

Mark Zandi, Chief Economist at Moody’s Analytics, characterized approximately half of US states as experiencing recession or near-recession conditions representing one-third of national GDP, attributing weakness to Doge cuts damaging DC-Maryland-Virginia corridor, manufacturing sector struggles from tariffs and immigration restrictions affecting goods-producing economies, and agriculture-transportation-distribution-mining industry contractions, while another GDP third including California and New York tread water supported by artificial intelligence investment booms and equity price surges lifting wealthy household spending, contrasting final third led by Texas and Florida benefiting from demographic inflows and population growth momentum. The economist emphasized that top-third income and wealth distribution constituents drive economic activity through concentrated purchasing power, warning equity market corrections threatening high-net-worth consumer spending represent plausible recession triggers alongside extended government shutdowns lasting months rather than weeks, disrupting air traffic, federal flood insurance, FDA manufacturing approvals, pharmaceutical oversight, and SEC IPO processing, creating broader economic paralysis beyond retroactive worker payment concerns.

Zandi projected economy-wide price-to-earnings multiples reaching 20 versus 1960-present 10 average and 24 Y2K bubble peak using Wilshire 5000 numerator against after-tax corporate earnings denominators, arguing high valuations extending beyond equities into gold, silver, and cryptocurrency suggest bubble formation concerns warranting investor nervousness despite definitional ambiguities and burst-timing impossibilities, while noting Jamie Dimon’s 30% correction probability assessment appears reasonable given complacency dangers where reduced AI bubble search interest following August peaks paradoxically heightens speculation risks as participants drive prices further absent concern discipline. The chief economist distinguished S&P 500 excluding artificial intelligence companies demonstrates stock gains consistent with tenuous economic expansion neither recessionary nor robust, arguing bubble dynamics concentrate within AI direct investments including platforms and hyperscalers plus indirect electric power, semiconductor, and chip-related activities operating independent dynamics from broader market fundamentals, while emphasizing labor market represents economy’s most vulnerable dimension where hiring standstill, recession-level hiring rates, 9% youth unemployment climbing three percentage points, declining temporary jobs and hours worked contrast sustained layoff restraint constituting firewall preventing self-reinforcing vicious cycles.

The Moody’s economist projected layoffs trigger rapidly once single industry participants initiate workforce reductions prompting competitors’ immediate responses creating sudden unemployment insurance claims spikes from low steady levels absent gradual transitions, identifying potential catalysts including equity corrections from AI company earnings disappointments, Federal Reserve chair nominations outside Kevin Hassett or Scott Bessent generating market concerns about independence erosion, or extended government shutdowns lasting months disrupting services, while maintaining baseline forecast that firewalls hold through six-to-twelve month horizons enabling monetary-fiscal stimulus supporting economic traction and recession avoidance despite elevated risks. Zandi characterized housing market weakness stemming from dual lock mechanisms where interest rate disparities between pandemic-era 3-4% mortgages and current 6.25-6.5% market rates deter sales alongside capital gains exclusion limits frozen since 1997 causing baby boomers sitting on unrealized appreciation to avoid tax obligations by remaining in demographically unsuitable empty-nester homes, projecting foreclosure increases from extremely depressed levels reflect FHA borrowers purchasing 2022-2024 properties experiencing flat or declining valuations in southern and western regions while vast homeowner majorities retain substantial equity cushions accumulated through 50-60% pandemic-era price appreciation. He dismissed dystopian artificial intelligence mass unemployment scenarios, citing historical technological diffusion patterns where legal compliance, financial constraints, and optimization requirements necessitate gradual adoption timelines enabling labor market adjustments through reduced weekly hour requirements and occupation transitions rather than structural displacement, arguing the agriculture sector’s historical majority workforce concentration preceded post-industrial revolution professional diversification, demonstrating adaptive capacity for future productivity transformations.

Stock Market Trap: Investor Reveals ‘Very Hot’ Q4 Trade

Jay Martin, Host of the Jay Martin Show and the Vancouver Resource Investment Conference, characterized current gold bull market as exceptionally methodical progression where capital systematically cascaded from 2023 central bank record purchases lifting physical prices through 2023-2024 best-in-class royalty company all-time highs, 2024-2025 major miner peaks, and subsequent 2025 mid-tier producer, funded developer, and exploration company advances contrasting 2020’s compressed six-month euphoria ending abruptly, emphasizing critical distinction between investments representing cash-flowing businesses like Agnico Eagle, Newmont, and Wheaton Precious Metals capable of riding secular bull market trends versus speculations including early-stage exploration and development plays requiring catalyst-driven exits when market momentum provides 100-300% gain de-risking opportunities. The conference organizer stressed legendary investors, including Rick Rule, Frank Giustra, and Thomas Kaplan, demonstrate superior selling discipline over buying acumen, arguing speculative frothiness warrants immediate profit-taking and capital redeployment into stable major producer positions maintaining gold sector exposure while reducing volatility risks, projecting October-November as hot market months contingent on continued methodical patience, avoiding bubble-like dynamics.

Martin disclosed personal Canadian divestment and Indonesian relocation following decade-long confidence erosion despite recognizing country’s inherent advantages including second-largest global landmass with small population, resource richness enabling high per-capita wealth potential, 2008 GFC emergence as healthiest G7 balance sheet, and superior environmental-social-governance mining standards making Canada ideal extraction jurisdiction, characterizing current GDP-per-capita parity with Alabama representing hypothetical 51st-state third-poorest ranking as poor management squandering ingredients where resource extraction and export pillar industry vilification during past ten years cascaded through ancillary sectors. Martin acknowledged new prime minister’s surprisingly favorable resource industry pivot while maintaining Asian optionality given political uncertainty, drawing Argentina parallels where early-20th-century wealthy commodity exporter status collapsed through 80-year socialist intervention following Great Depression recovery failures demonstrating countries possessing correct ingredients nonetheless make horrible political choices squandering opportunities, while noting current Canadian mining sector stewardship impresses through high-quality companies and world-class management raising capital on favorable terms deploying productive investments following decade-long bare market squeezing bad actors rewarding survivors with elevated shareholder expectations.

Martin projected stock market concentration where four-five companies support indices represents house-of-cards fragility given Trump administration’s $100,000 H-1B visa worker fees potentially imposing billion-dollar Amazon tax and half-billion-dollar levies on Meta, Apple, Microsoft each employing 5,000-10,000 affected workers, acknowledging sensational headline patterns preceding pragmatic strategy rollouts while warning big tech stumbles threaten equity markets given 20 venture capitalists’ post-China high-tech tour determining five-six American industries including battery manufacturing, electric vehicles, and solar generation deemed uninvestable due to insurmountable Chinese competitor advantages, noting 2-million Chinese robotic workforce additions versus 34,000 American deployments creating 10x automation speed gaps widening technological disparities making broad equity participation imprudent absent competitive advantage knowledge. The resource investor emphasized barbell portfolio approaches balancing safe-haven assets with speculative industries possessing competitive advantages where asymmetric bet profits migrate toward conservative buckets enabling duration through good and bad markets, recommending one-page worksheets documenting three-to-five purchase reasons, share price impact factors, and wrong-thesis sell triggers following Rick Rule’s essay methodology ensuring conviction versus whimsical trading, while characterizing US-China competition lens as essential filter understanding global headlines including South Korea’s $350-billion investment promise representing tariff avoidance rather than genuine foreign capital given currency devaluation or asset liquidation funding mechanics. He welcomed state capitalism emergence where Department of Defense financing MP Materials rare earth refineries, $2.45-billion US Antimony funding, and Lithium Americas’ 10% government stake demonstrate productive monetary printing allocation securing friendly-nation resource supplies through strategic subsidization matching Chinese practices, arguing deglobalization era creates geopolitical scrambling including Saudi Arabia’s Pakistan defense pact providing Chinese nuclear umbrella replacing traditional American petrodollar protection frameworks reshaping alliance structures over coming decades.

What To Watch

*Data subject to delay if government shutdown continues

** CPI will be published to determine Social Security COLA

Wednesday, Oct 22

Tesla earnings

IBM earnings

AT&T earnings

Thursday, Oct 23

*Initial jobless claims

Existing home sales

T-Mobile earnings

Intel earnings

Honeywell earnings

Blackstone earnings

Newmont earnings

Friday, Oct 24

**Consumer price index

**CPI year over year

**Core CPI

**Core CPI year over year

S&P flash U.S. services PMI

S&P flash U.S. manufacturing PMI

Consumer sentiment (final)

*New home sales

Procter & Gamble earnings

General Dynamics earnings

The gold sell off was a hijacking by the usual suspects. No prizes for naming them.

It was 5+ sigma event. Only likely to happen once in 63 years. A 1:3.5 million probability.

Gold is telling a story,which most Americans are ignoring. Good luck.

Finding it hard to believe that US/ China trade was the reason for the sell off.

There is more than meets the eye than traders dumping gold for fiat.

Too many details and so little time.

I wish you well.