New Tariffs: Final Economic Collapse Trigger Or Nothingburger?

From Market Bloodbath to Bitcoin Bulls, Fed Policy Failures, and the New Economic Reality

TABLE OF CONTENTS

MARKETS: Market Bloodbath On New Tariffs: What’s Next For Stocks, Bitcoin, Commodities

CRYPTO: What Would Crash Bitcoin? This Is Single Biggest Risk Now

ECONOMY: Did Fed Doom The Economy? What 'Policy Error' Means For Jobs, Home Prices

CRYPTO: Bitcoin Cycle Is ‘Broken’; When Will It Hit $200k?

ECONOMY: Consumer Sentiment Flashing Recession Signals? Economist Explains Latest Data

CRYPTO: $200k Bitcoin Within A Year? This Is Next Major Catalyst

MARKET RECAP

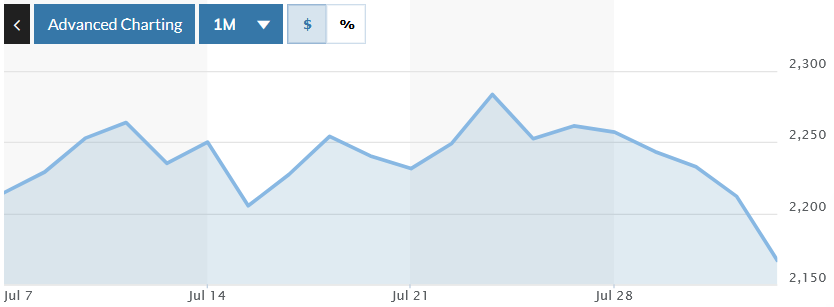

Stock markets started last week on a strong footing, with the S&P 500 and Nasdaq hitting new record highs for six consecutive sessions through Monday, July 28th. The rally gained momentum from Trump's trade deal with the European Union that imposed 15% tariffs on most EU imports. However, the positive sentiment quickly reversed by Friday as Trump officially implemented sweeping tariff increases on nearly all US trading partners. Overall, for the week, the Dow, thew S&P, and the Nasdaq all fell after a disappointing jobs report showed only 73,000 jobs added, versus the expected 104,000.

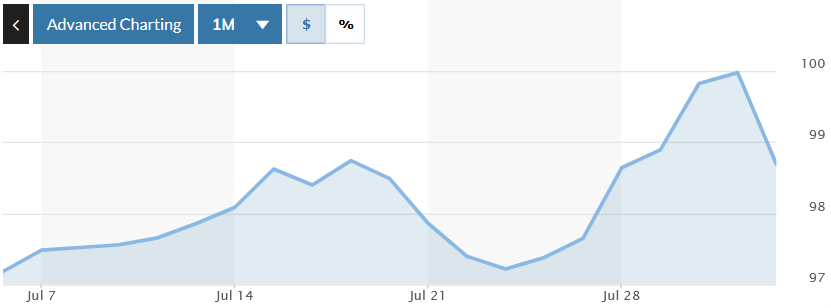

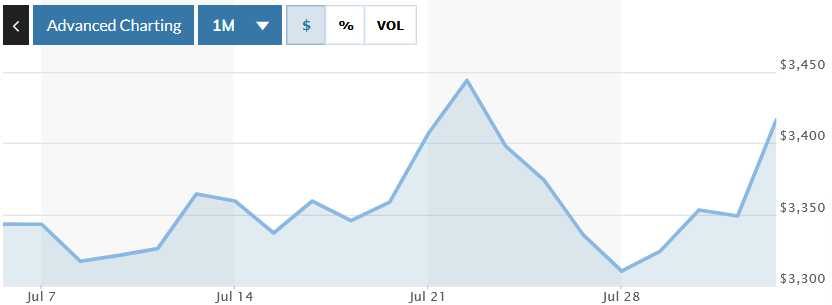

The Federal Reserve held interest rates steady at 4.25-4.5% during its July 29-30 meeting, with Chairman Powell indicating uncertainty about a September rate cut. Gold traded around $3,327 per ounce by week's end after consolidating near recent highs and gaining 26.29% year-over-year. Platinum surged to an 11-year high of $1,454.50 on July 14 and currently trades around $1,251 per ounce with gains of 27.77% from last month. Trump's August 1 tariff deadline dominated headlines as he imposed new duties ranging from 15% to 40% on dozens of countries, but delayed implementation by one week to allow continued negotiations. The tariff announcement, combined with weak employment data, created headwinds that erased early-week gains across major indices.

The stock market bounced back strongly today, August 4, after Friday's significant drop, with the Dow jumping nearly 600 points and the S&P 500 rising 1.5%, marking the best day since May. Investors are betting that the Federal Reserve will cut interest rates in September (with odds now at about 90%), following last week's disappointing jobs report, which showed the economy might be slowing down.

Lyn Alden, founder of Lyn Alden Investment Strategy, outlined her cautious economic outlook while discussing her recently raised $100 million EgoDeath Capital fund, which focuses on Bitcoin investments. Alden employs a three-pillar portfolio strategy, emphasizing high-quality equities, hard assets such as Bitcoin and gold, and cash equivalents. "I generally think that we are in more of a malaise going forward. So it is not doom and gloom," she explained, but warned of range-bound economic performance ahead. Her investment approach centers on what she calls "fiscal dominance"—a structural shift in which massive government deficits fundamentally alter the effectiveness of traditional monetary policy.

Alden expressed particular concern about ongoing tariff impacts on the U.S. economy, noting that import prices show little sign that foreign exporters are absorbing costs. "I do think that it will be an ongoing friction against the U.S. economy," she said, explaining that most tariff revenue comes from American consumers and businesses. She highlighted that companies front-loaded imports ahead of tariff implementations, creating temporary buffers that are now wearing off. The combination of tariffs and demographic pressures from an aging population, which requires more entitlement spending, creates structural fiscal pressures even during periods of low unemployment.

Despite near-term economic concerns, Alden remains bullish on Bitcoin, arguing the current cycle has more room to run before reaching previous peak valuations. She described her "nothing stops this train" thesis, referring to unstoppable fiscal deficits that benefit scarce assets. "When you have over 100% debt to GDP on the public sector, when the Fed does what they are doing now and they raise rates and try to keep them high, they blow out the fiscal deficit by a bigger number than they slow down bank lending," she explained. This fiscal dominance environment breaks the traditional correlation between interest rates and hard assets, making Bitcoin and gold attractive despite higher interest rates.

Market Movements

The following assets experienced dramatic swings in price last week. Data are up-to-date as of August 1 at approximately 4pm EST.

META - up 5.24%

Roblox - up 5.23%

Coinbase - down 19.65%

Anheuser-Busch - down 18.66%

UPS - down 18.40%

UnitedHealth - down 15.40%

PayPal - down 13.94%

Strategy - down 9.67%

DXY - up 1.18%

Bitcoin - down 3.26%

Gold - up 3.14%

Platinum - down 8.65%

10-year Treasury Yield - down 4.76%

S&P 500 - down 1.07%

Russell 2000 - down 2.50%

MARKETS: Market Bloodbath On New Tariffs: What’s Next For Stocks, Bitcoin, Commodities

Gareth Soloway, Chief Market Strategist at Verified Investing, warned investors against buying Friday's market dip as major indices suffered sharp declines. The S&P 500 fell 1.5 percent while the NASDAQ dropped 2 percent by 11 a.m. Eastern time following President Trump's new tariff announcements and disappointing employment figures. "This is all institutions unloading into retail FOMO," Soloway predicted, noting high valuations at 23 times forward earnings suggested more declines ahead.

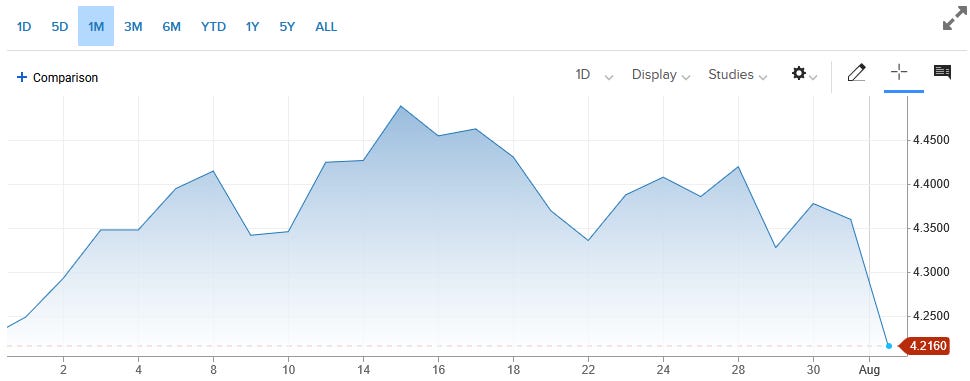

Trump imposed fresh tariffs after the August 1st deadline passed without agreements from several trading partners. However, Soloway argued the selloff reflected broader economic concerns beyond trade policy. "I do not think it is the tariffs necessarily, just them," he explained. "The combination of a more hawkish Powell, inflation creeping up, and a weaker jobs report, I think, already set the table." Non-farm payrolls registered just 73,000 new jobs versus expectations of 106,000, while unemployment ticked up to 4.2 percent and the underemployment rate spiked to 7.9 percent.

The market strategist described the toxic mix of rising inflation and economic weakness as "that favorite term of stagflation." Risk assets broadly declined, with Bitcoin tumbling 2.4 percent and oil crashing 2.7 percent. Treasury yields fell sharply while gold gained 1.4 percent as investors sought safe havens. Soloway warned the decline could extend over six to twelve months as economic fundamentals deteriorate.

CRYPTO: What Would Crash Bitcoin? This Is Single Biggest Risk Now

CryptoBanter Founder Ran Neuner predicted Bitcoin will reach $250,000 by year-end, arguing the market has entered the most aggressive phase of its four-year cycle, similar to 2021. Neuner’s analysis showed that Bitcoin typically climbs 50% during breakout phases, with the current rally achieving only 11% from consolidation levels, suggesting that significant upside remains. He pointed to Bitcoin dominance falling from 66% to 61% as evidence of capital rotation into altcoins, particularly Ethereum, which achieved a golden cross against Bitcoin after years of underperformance.

Despite bullish near-term prospects, Neuner warned of systemic risks from Bitcoin treasury companies creating synthetic leverage through equity and debt markets. He compared the current environment to previous crash catalysts, noting companies like Strategy opened crypto's $4 trillion market to Wall Street's $80 trillion in debt and equity assets. These treasury companies trade at premiums to net asset value, creating leverage bubbles that could unwind when companies become unprofitable or face debt refinancing challenges, forcing asset liquidation at discounts.

Neuner has adopted algorithmic trading through AI-powered bots, reporting monthly returns of 25.77% for Bitcoin strategies and 10.09% weekly for Ethereum bots. He argued that emotional human decision-making represents the primary obstacle to trading success, with artificial intelligence better equipped to identify patterns across thousands of charts and execute rule-based strategies without psychological interference. His approach reflects the broader adoption of quantitative models on Wall Street, though democratized through accessible AI rather than expensive actuarial expertise.

ECONOMY: Did Fed Doom The Economy? What 'Policy Error' Means For Jobs, Home Prices

Danielle DiMartino Booth, former Fed insider and CEO of QI Research, criticized the Federal Reserve's decision to maintain rates unchanged, arguing Chair Jerome Powell is committing a significant policy error amid deteriorating labor market conditions. Booth pointed to the Cleveland Fed's new tenant rent index, showing a quarterly decline of 9.8%, which, when incorporated into market-based core PCE as Powell previously instructed, reveals inflation running at a rate of negative 0.3% annually. "Absolutely, policy error," Booth stated, emphasizing widespread disinflationary signals across shelter, the largest inflation component.

The Fed faces political pressure as two dissenting members, Bowman and Waller, both potential successors to Powell, voted for rate cuts. Booth noted seven consecutive months of increasing "jobs are hard to get" readings from the Conference Board, a pattern never seen outside of a recession. Despite a 3% GDP growth in Q2, she highlighted that business investment collapsed from 10.3% to 1.9%, a historical precursor to a recession. At the same time, job openings fell by 300,000 to 7.4 million as companies adopt cost-cutting measures through AI replacement and offshoring.

Housing market stress indicators continue to mount, with high-income earners showing increased delinquencies, and Fannie Mae taking a $946 million charge-off for expected mortgage losses. Booth argued that maintaining elevated rates, while painful in the short term, could facilitate necessary housing corrections to restore affordability for first-time buyers. She warned that markets remain vulnerable to flows from $7.5 trillion in money market funds earning 4.25%, with any dramatic rate cuts potentially triggering massive outflows from equity markets despite current speculative mania supporting all-time highs.

CRYPTO: Bitcoin Cycle Is ‘Broken’; When Will It Hit $200k?

CleanSpark Co-Founder and Executive Chairman Matt Schultz predicted Bitcoin will exceed $200,000 in 2025, citing unprecedented demand from ETFs and Bitcoin treasury companies against fixed daily production of just 450 new coins. Schultz challenged the common misconception that miners control Bitcoin supply, explaining that daily production remains constant regardless of mining activity. At the same time, companies like MicroStrategy purchase hundreds of thousands of Bitcoins at market prices far above mining costs.

CleanSpark differentiated itself from competitors by avoiding share dilution, instead selling portions of newly mined Bitcoin to cover operating expenses while using credit lines secured by existing holdings for expansion. The company mines Bitcoin at approximately $42,000 per coin compared to current market prices above $100,000, creating substantial margins while maintaining a treasury of 12,500 Bitcoin. Schultz criticized the Bitcoin-per-share metric favored by some miners, arguing earnings-per-share provides a more transparent performance measurement.

The mining executive emphasized Bitcoin's transition from cyclical behavior to "price discovery" mode, suggesting traditional four-year cycles may be broken due to institutional adoption and government support. CleanSpark operates as the largest pure-play Bitcoin miner in the United States, partnering with rural utilities to monetize excess power capacity while creating local economic benefits. Schultz noted the shift from Chinese mining dominance following that country's ban, with operations relocating to regions with abundant, low-cost electricity, such as rural American communities.

ECONOMY: Consumer Sentiment Flashing Recession Signals? Economist Explains Latest Data

Joanne Hsu, Director of the University of Michigan's Consumer Sentiment Surveys, reported that Americans remain concerned about their economic prospects despite recent improvements in the closely watched index. The July 2025 preliminary reading of 61.8 marked a five-month high. Still, it remained well below historical averages, with consumers across all income levels expressing concerns about trade policy uncertainty and a potential resurgence of inflation.

The survey revealed unprecedented consensus among consumers regarding tariff concerns, with a majority of respondents spontaneously mentioning trade policy in open-ended questions over recent months. "It's hard in normal times to get half of the people agreeing on anything," Hsu explained, noting that even wealthy consumers supported by strong asset prices expressed pessimism about future economic conditions. Two-thirds of consumers expect unemployment to rise, with many anticipating personal job market impacts despite current employment stability.

Hsu emphasized that the survey's forward-looking nature distinguishes it from backward-looking economic indicators, as consumers consider prospects when making major financial decisions, such as mortgages or car purchases. Historical analysis shows that consumer sentiment typically precedes economic downturns, although the 2022 inflation peak represented a notable exception, as weak sentiment did not trigger a recession. The current environment differs significantly, with weakened labor market expectations and reduced income confidence potentially undermining the consumer spending that drives economic growth.

CRYPTO: $200k Bitcoin Within A Year? This Is Next Major Catalyst

Sean Bill, CIO of Blockstream, predicted Bitcoin will trade above $200,000 within 6-12 months, citing massive supply-demand imbalances as ETFs purchase 500,000 coins annually while corporate treasuries acquire another 300,000 against just 165,000 newly minted coins. Bill, who led the first US pension fund's Bitcoin purchase in 2021, argued that modern portfolio theory supports Bitcoin allocation due to its superior Sharpe ratio.

Despite institutional interest growing, Bill noted significant gaps between individual and institutional adoption. During recent presentations to Texas pension funds, approximately half of investment professionals owned Bitcoin personally, but only three institutions had actual Bitcoin exposure. "We think there's a very strong case that Bitcoin can 10x from here. Million-dollar Bitcoin would not be surprising to us," Bill explained, comparing Bitcoin's $2 trillion market cap to gold's $20 trillion valuation.

Blockstream launched three Bitcoin-focused funds targeting different investor segments: a low-yield fund offering 2-4% returns for holders, an alpha fund for active management around passive Bitcoin positions, and an income fund providing Bitcoin-backed lending services. Bill emphasized the underdeveloped nature of Bitcoin credit markets, with only $5 billion in hedge fund activity around a $2 trillion ecosystem, creating significant arbitrage opportunities for sophisticated investors willing to provide liquidity and efficiency to the emerging Bitcoin financial infrastructure.

What To Watch

Tuesday, August 5

US trade deficit

S&P final US services PMI

ISM services

AMD earnings

Caterpillar earnings

Wednesday, August 6

McDonald’s earnings

Walt Disney earnings

UBER earnings

Shopify earnings

SONY earnings

Doordash earnings

Thursday, August 7

Initial jobless claims

US productivity

Wholesale inventories

Consumer credit

Eli Lilly earnings

Toyota earnings

Mitsubishi earnings