Why World War 3 Is Closer Than You Think

Predictions from the 'Nostradamus' of geopolitics, and much more

TABLE OF CONTENTS

MARKETS: ‘Beginning Of The End’ Of Bull Run

ECONOMY: Will Fed Cut Rates By 3%? Is Massive Inflation Returning?

COMMODITIES: Dollar Purchasing Power To Decline ‘75%’ Over Next Decade

CRYPTO: Ethereum To $10k This Year? Why This Crypto Bull Run Is Unlike Any Other

CRYPTO: ‘Godfather’ Of Crypto Explains How Bitcoin Reaches $1M by 2033

CRYPTO: SEC Commissioner Reveals Biggest Crypto Policy Changes Ahead

MARKET RECAP

Markets posted strong gains last week (July 14-18), with all major indices reaching multiple record highs despite early concerns over escalating trade tensions. The Nasdaq led the charge, surging 1.8% to close at 20,987.45, driven by strong tech earnings and optimism surrounding AI. What began as a cautious Monday, following President Trump's weekend tariff announcements, transformed into a week of sustained momentum. Thursday marked the strongest session, as investors embraced solid economic data and better-than-expected quarterly results from major corporations. Trade tensions continued to dominate headlines throughout the week, with Trump's tariff threats initially creating volatility before the markets demonstrated resilience.

This week (July 21 - 25), markets delivered an exceptional week of performance, with all major indices extending their record-breaking runs amid intensifying trade negotiations and robust earnings. The S&P 500 achieved its first-ever "perfect week," posting record closes all five trading days. The Nasdaq gained this week, notching its 15th record high of 2025, while the Dow surged to 44,901.92. Tuesday's breakthrough trade agreement with Japan served as the week's catalyst, setting a 15% tariff rate that investors viewed as far more manageable than previously threatened 25% duties.

Earnings season provided strong support, with 83% of reporting S&P 500 companies beating expectations. Alphabet delivered standout results with $2.31 per share earnings that exceeded estimates by 7.44% and 13.8% revenue growth to $96.43 billion. However, Intel disappointed, plunging after reporting losses when profits were expected. The VIX dropped to February lows as market confidence grew around navigating trade uncertainties, with EU negotiations now capturing Wall Street's attention ahead of Trump's August 1 deadline.

Xueqin Jiang, dubbed "China's Nostradamus" for accurately predicting Trump's 2024 victory and the escalation in the Middle East, warned that converging conflicts could trigger World War III. Jiang employs the "predictive history" methodology, which combines historical analysis and game theory to forecast geopolitical developments.

The analyst warned that Iran seeks to trap the United States into committing ground troops, which would trigger an unwinnable conflict. "The only way for Iran to win a conflict with the United States is if the United States sends in ground troops," Jiang explained, noting Iran's mountainous terrain differs from Iraq's desert geography that favored American military doctrine.

Jiang traced current tensions to the 2020 assassination of Iranian General Soleimani, characterizing it as a declaration of war based on historical precedents. He compared the killing to ancient Athens and Sparta assassinating Persian ambassadors, which precipitated the Persian invasion of Greece.

The convergence of the Middle East and Ukraine conflicts poses global risks. Iran could collapse East Asian economies by closing the Strait of Hormuz, cutting oil supplies to Japan and other nations. He predicted that the next major battle in Ukraine would occur in Odessa, forcing a NATO ground commitment.

Putin's strategy involves prolonging the Ukraine conflict to force regime changes in Western Europe through unpopular military commitments. "It's in Putin's best interest to drag this war out as long as possible because what he wants to do is bring in NATO," Jiang said.

Despite trade tensions, Jiang predicted a rapprochement between China and the United States, noting that 300,000 Chinese students study in America and the "Chinese dream" remains tied to emigration to the United States.

Market Movements

The following assets experienced dramatic swings in price last week. Data are up-to-date as of July 25 at approximately 4pm EST.

TM - Toyota Motor Corporation - up 11.76%

NVO - Novo Nordisk - up 11.49%

TMUS - T-Mobile US - up 7.19%

PM - Philip Morris - down 9.96%

LMT - Locheed Martin - down 9.22%

IBM - International Business Machines - down 9.15%

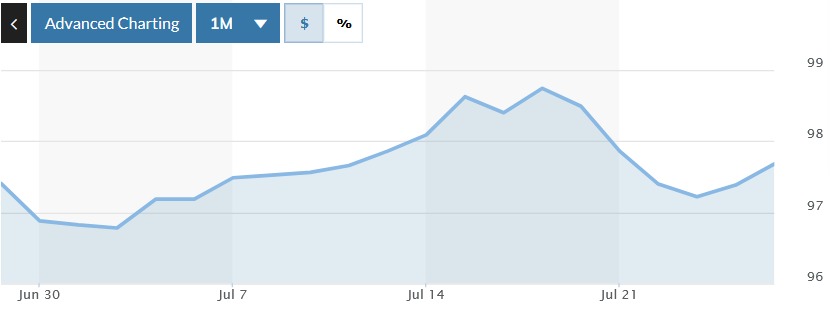

DXY - down .71%

Bitcoin - down .75%

Gold - down .52%

Platinum - down 1.73%

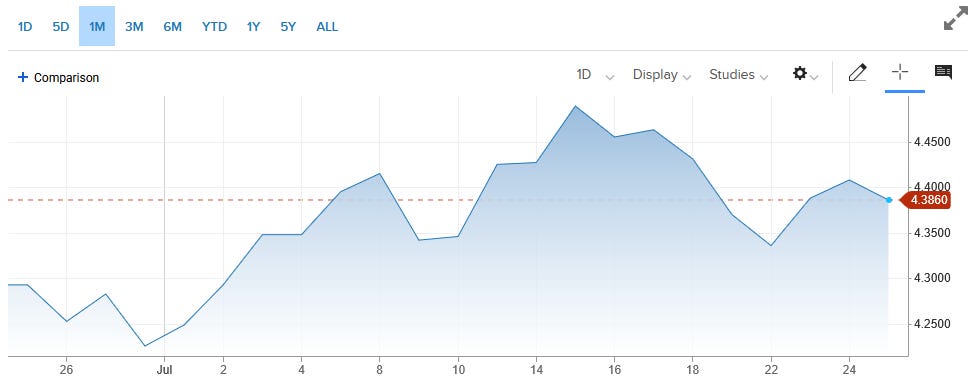

10-year Treasury Yield - up .41%

S&P 500 - up 1.31%

Russell 2000 - up .57%

MARKETS: ‘Beginning Of The End’ Of Bull Run

Gareth Soloway, Chief Market Strategist at Verified Investing, warned of potential market reversals after June's inflation report showed consumer prices rising 2.7% annually, exceeding expectations. The report coincided with significant market movements, including Bitcoin falling nearly 4% from highs above $121,000 and the Dow dropping 300 points.

"For the stock market, this is kind of the beginning of the end," Soloway said, pointing to technical indicators suggesting major assets may have peaked. He predicted Bitcoin could fall to $90,000 by year-end despite its recent surge.

The inflation uptick has complicated Federal Reserve policy decisions. While mainstream media attributed rising prices to Trump's tariff policies, Soloway questioned whether those effects are materializing yet. "I argue that maybe the impacts are not quite yet being felt here," he explained.

Technical analysis revealed concerning patterns across markets. Bitcoin displayed a "topping tail" formation, while the S&P 500 approached multiple resistance levels near current highs around 6,200. Soloway identified key support at 6,265 for the S&P, warning that breaks below could trigger algorithmic selling.

The 10-year Treasury yield approaching 4.5% added pressure, raising borrowing costs and making bonds more attractive relative to stocks. Soloway predicted inflation would remain "stubbornly around 3%" due to Trump's policies and wealth effects from market gains.

ECONOMY: Will Fed Cut Rates By 3%? Is Massive Inflation Returning?

Steve Hanke, Professor of Applied Economics at Johns Hopkins, delivered sharp criticism of both Federal Reserve Chairman Jerome Powell and President Trump following the June inflation report, which showed consumer prices rising 2.7% annually, while producer prices remained flat at 2.3%.

"Both Trump and the chairman I would give a letter grade F to," Hanke said, arguing that neither understands monetary policy fundamentals. He dismissed mainstream media claims attributing inflation increases to Trump's new tariffs, citing his "95% rule," which holds that most press coverage proves "either wrong or irrelevant."

The mixed inflation signals created confusion among analysts. While consumer prices jumped from 2.4% to 2.7%, producer prices defied forecasts by remaining unchanged. Hanke explained this divergence through his framework, distinguishing between "tradables" and "non-tradables," with tariffs primarily affecting internationally traded goods, as captured in producer price indices.

Trump's demand for a 300-basis-point Federal Reserve rate cut sparked particular derision from Hanke, who called the president's calculation of $1 trillion in savings "rubbish." Trump's analysis incorrectly assumed that government borrowing occurs at the federal funds rate rather than at longer-term Treasury rates, which average six to seven years in duration.

Hanke predicted that inflation would continue its downward trajectory based on a money supply growth of just 4.5%, well below his "golden growth rate" of 6.3%, which is consistent with a 2% inflation target. He warned that tariff-induced price increases would prove temporary, creating "one-time blips" before monetary factors reassert control.

The professor advocated stopping quantitative tightening as the primary policy tool rather than adjusting interest rates. "Changes in the money supply indicate what is going on with monetary policy," Hanke explained, emphasizing that his new book, "Making Money Work," aims to restore the quantity theory of money to economic thinking.

COMMODITIES: Dollar Purchasing Power To Decline ‘75%’ Over Next Decade

Rick Rule, Founder and CEO of Rule Investment Media, warned of severe dollar debasement following Tuesday's inflation report, which showed consumer prices rising 2.7% annually while core inflation reached 2.9%. Rule predicted the dollar would lose 75% of its purchasing power over the next decade, mirroring the 1970s stagflation period.

"They pay you 4.5% in a currency which I believe is deteriorating in terms of purchasing power at 7.5% a year," Rule explained regarding Treasury yields. He calculated that investors holding 10-year Treasuries face real losses of 3% annually, compounding to wealth destruction over the investment period.

Rule dismissed government inflation metrics as inadequate measures of actual cost increases. Consumer price indices exclude taxes and fail to capture the true deterioration in purchasing power experienced by Americans across essential categories, including energy, healthcare, housing, and groceries.

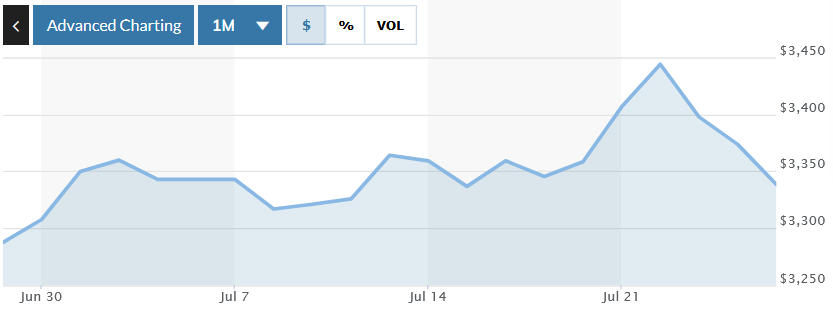

The gold market reached $3,300 per ounce amid unprecedented central bank accumulation, with 95% of surveyed central bankers expecting continued reserve increases. Rule attributed this trend to decreased trust in American monetary policy following the weaponization of dollar-based payment systems and the seizure of Russian Treasury holdings.

"The US dollar is the worst currency in the world with the sole exception of all of the others," Rule said, explaining why central banks default to gold purchases despite limited alternatives.

Mining equity valuations present significant opportunities despite recent gains. Rule identified substantial valuation gaps between senior producers trading at two times net asset value and development-stage companies available at 30% of estimated worth. He cautioned that contrarian "hate trades" in junior mining companies have concluded, requiring investors to focus on fundamental analysis.

CRYPTO: Ethereum To $10k This Year? Why This Crypto Bull Run Is Unlike Any Other

Scott Melker, Host of The Wolf Of All Streets, analyzed the ongoing rotation from Bitcoin to Ethereum, attributing the shift to institutional adoption rather than traditional retail-driven altcoin seasons. Bitcoin dominance has fallen significantly since mid-June as Ethereum ETFs began outperforming Bitcoin spot ETFs.

"Ethereum ETFs are massively outperforming Bitcoin spot ETFs. Not something that most people ever expected," Melker explained, noting days when Ethereum saw $300 million in inflows while Bitcoin experienced $100 million in outflows. He attributed this pattern to institutional interest catalyzed by analysts positioning Ethereum as an institutional-grade asset.

Melker expressed skepticism about Bitcoin treasury companies, arguing most will struggle during market downturns. "I don't think the 75th Micro Strategy impostor is going to do well at the top of the bull market," he said, predicting these companies will sell during corrections while advocating for conservative Bitcoin allocation strategies.

Trump Media and Technology Group emerged as the sixth-largest Bitcoin holder with $2 billion invested, representing two-thirds of their available cash. Melker viewed this as indicative of the Trump family's rotation from real estate to cryptocurrency, noting advantages including the absence of property taxes.

Major financial institutions continue to expand their cryptocurrency services, with Charles Schwab adding Bitcoin and Ethereum spot trading, and JP Morgan evaluating crypto-backed lending by 2026. Goldman Sachs and BNY Mellon announced tokenized money market products, reflecting what Melker described as an "unstoppable" trend in tokenization.

CRYPTO: ‘Godfather’ Of Crypto Explains How Bitcoin Reaches $1M by 2033

Michael Terpin, Founder & CEO of Transform Ventures, outlined his ambitious Bitcoin price forecast during an interview, predicting the digital asset will reach $500,000 by 2029 and $1 million by 2033. Terpin, founder of Transformed Ventures and dubbed the "godfather of crypto" by CNBC, based his projections on historical cycle analysis and scarcity dynamics.

Terpin explained that Bitcoin is currently in its fifth four-year cycle, with daily mining production reduced to 450 Bitcoins following the latest halving event. "Michael Saylor buys more than 450 Bitcoin a day," Terpin said, noting that Strategy alone consumes the entire daily mining output while institutional demand continues expanding through exchange-traded funds.

The analyst emphasized calendar-based predictability in Bitcoin markets, explaining that peak prices have consistently occurred within a 37-day window between November 10th and December 17th during post-halving years. This cycle, he predicted Bitcoin would reach approximately $193,000 under neutral macroeconomic conditions, with potential ranges between $150,000 and $240,000 depending on regulatory and economic factors.

Terpin dismissed concerns that the cycle theory would become ineffective due to widespread adoption. He compared Bitcoin's current 5% global ownership to early internet adoption patterns, suggesting substantial growth potential remains as the asset transitions from speculative investment to mainstream treasury reserve.

His upcoming Bitcoin Super Cycle Genesis Fund aims to outperform buy-and-hold strategies through algorithmic trading around cycle peaks and troughs. Terpin maintained that Bitcoin represents the least risky cryptocurrency investment, possessing "almost 0% chance of going to zero" compared to alternative digital assets.

CRYPTO: SEC Commissioner Reveals Biggest Crypto Policy Changes Ahead

Securities and Exchange Commission Commissioner Hester Peirce outlined her principles-based approach to cryptocurrency regulation during an interview, emphasizing that most digital assets do not qualify as securities under existing frameworks. Peirce, who leads the SEC's crypto task force, argued for regulatory clarity based on American principles of freedom and innovation.

"The presumption should be that people have freedom to do things and only should there be a regulation stepping in when it makes sense," Peirce explained, connecting her regulatory philosophy to foundational American values. She referenced her ancestor, Samuel Whitmore, who fought in the American Revolution, to illustrate the importance of preserving freedoms that others fought to establish.

Peirce clarified that the Howey test remains relevant for determining whether a contract constitutes an investment contract. However, she acknowledged challenges in applying traditional securities frameworks to digital assets that trade on secondary markets. She distinguished between tokens sold in initial fundraising efforts and those that develop over time in decentralized networks, suggesting that the investment contract analysis may not follow the token permanently.

The commissioner stated that most existing cryptocurrencies are not securities, citing Bitcoin as a clear example. "When I just look across the landscape of assets, I come to a very different conclusion than some others at the SEC in the past have come to," Peirce said, challenging previous enforcement-heavy approaches to crypto regulation.

Regarding non-fungible tokens, Peirce provided specific guidance that NFTs programmed to return royalties to original artists do not constitute securities offerings. She advocated for technical participation in proof-of-stake systems to remain outside securities regulations, arguing that staking services represent technical assistance rather than investment opportunities.

Peirce acknowledged frustration with the delayed approval of exchange-traded funds but maintained that the SEC must follow proper procedures while processing numerous applications. She criticized the previous decade-long Bitcoin ETF approval process as mismanaged, noting that courts ultimately forced regulatory action due to procedural failures.

What To Watch

Wednesday, July 30 -

ADP employment

GDP

Pending home sales

FOMC interest-rate decision

Fed Chair Powell press conference

Microsoft earnings

META earnings

HSBC earnings

Thursday, July 31 -

Initial jobless claims

Employment cost index

Personal income

Personal spending

PCE index

Core PCE index

Apple earnings

Amazon earnings

Mastercard earnings

AbbVie earnings

Friday, August 1 -

U.S. employment report

U.S. unemployment rate

U.S. hourly wages

S&P final U.S. manufacturing PMI

ISM manufacturing

Berkshire Hathaway earnings (A and B)

Exxon Mobil earnings

Chevron earnings

Construction spending

Consumer sentiment (final)

Auto sales

All fiat fails always,just when ?