‘Early Phase Of WW3’: What Happens When Iran Retaliates?

Market Implications of the Israel-Iran Conflict

[Iranian Ballistic Missiles. Source: Moslem Danesh via unsplash.com]

TABLE OF CONTENTS

ECONOMY: Economic ‘Murder’ Alert: Is The Next Big Crisis Here?

ECONOMY: Overpriced Markets Set To Burst: Will Layoffs Freeze The Economy?

ECONOMY: Fed's Bold Announcement: Powell Makes Shocking Economic Forecast

ECONOMY: 'Zombie' Companies In Danger Of Collapse; $2 Trillion Credit Bubble Popping?

ECONOMY: Why You're Getting Poorer: Major Slowdown Ahead

CRYPTO: Bitcoin to $250k By December; The Money Printing Storm Is Coming

MARKET RECAP

Markets opened Monday with heightened volatility as investors assessed the implications of weekend U.S. strikes on Iranian nuclear facilities, marking a dramatic escalation in Middle East tensions. Oil futures initially surged over 4% on supply disruption fears, with Brent crude reaching $79 per barrel and WTI climbing above $76, before moderating as traders questioned Iran's commitment to retaliatory threats.

The situation intensified Monday afternoon when Iran launched missile strikes on the U.S. Al Udeid Air Base in Qatar, though no American casualties were reported. Secretary of State Marco Rubio warned that Iranian retaliation would be "the worst mistake they've ever made" while urging China to dissuade Iran from closing the Strait of Hormuz, noting Beijing's heavy dependence on the waterway for oil imports. Iran's parliament approved measures to potentially block the strait—a chokepoint for 20% of global oil flows—though final authorization rests with the Supreme National Security Council. U.S. equity markets showed mixed performance amid the escalating crisis, with energy stocks rallying alongside rising crude prices as investors remained focused on potential disruptions to critical shipping lanes.

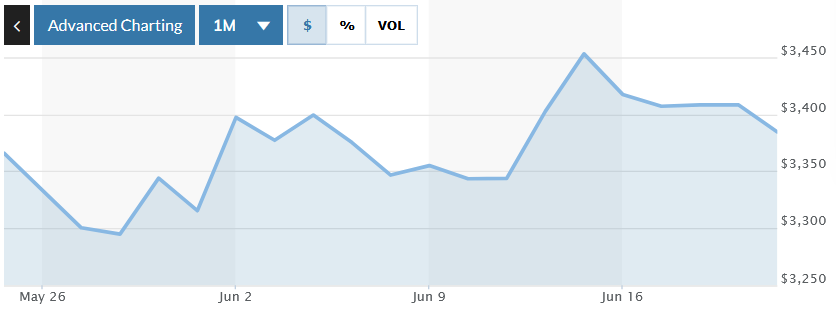

June 16-23: U.S. markets showed resilience amid uncertainty last week as investors weighed evolving geopolitical developments and mixed economic indicators. The week began with modest gains following Iran's stated desire to end hostilities with Israel, but markets remained volatile as the conflict continued to weigh on sentiment. By Friday's close, both the Dow Jones Industrial Average and S&P 500 posted weekly declines, while the Nasdaq Composite managed a slight gain, marking its third positive week in four. The Dow closed at $42,171.66 on June 18, down from earlier levels, reflecting broader market uncertainty. Economic data painted a concerning picture, with analysts noting "materially weaker" readings across sales, output, and housing metrics, while rising import prices suggested mounting inflationary pressures from trade policies. Despite equity market struggles, Bitcoin demonstrated resilience, trading around $104,690 on June 20, maintaining levels near recent highs and representing a remarkable 61% gain from the previous year.

Doomberg characterized escalating Middle East tensions as part of a broader global conflict during an interview following Iranian parliamentary votes to potentially close the Strait of Hormuz.

"This is just the next phase of World War III," Doomberg said, arguing that historians will view current conflicts as interconnected warfare between NATO and an axis of Russia, China, Iran, and North Korea. Oil markets remained surprisingly calm at $73 per barrel despite the strategic chokepoint threat. "The oil market is pricing in that the strait will not be closed," he explained.

The analyst criticized recent Israeli strikes on Iranian nuclear facilities as potentially counterproductive. Weekend attacks achieved minimal damage to critical infrastructure, prompting inflammatory responses from Russian officials about nuclear proliferation. Former Russian President Medvedev's social media posts referenced supplying nuclear warheads to Iran, drawing sharp rebukes from American officials.

Doomberg outlined catastrophic scenarios should the strait actually close, noting "there's only a dozen core targets that Iran would have to take out to [disrupt] everyday life in Israel." Such closures would eliminate global oil pricing mechanisms while devastating European energy supplies.

"Wars are much easier to start than to get out of or to win," Doomberg warned.

Market Movements

The following assets experienced dramatic swings in price this past week. Data are up-to-date as of June 20 at approximately 4pm EST.

COIN - up 27.06%

CRWV - up 24.72%

AMD - up 10.4%

APP - down 10.92%

ACN - down 8.45%

DXY - up .52%

Bitcoin - down 1.68%

Gold - down 2.62%

10-year Treasury Yield - down .69%

S&P 500 [SPX] - down .61%

Russell 2000 [RUT] - down .27%

ECONOMY: Economic ‘Murder’ Alert: Is The Next Big Crisis Here?

Jim Bianco predicted that rising inflation would justify the Federal Reserve's caution as geopolitical tensions escalated between Israel and Iran. The strategist warned that tariff-driven price increases were beginning to appear in high-frequency data despite benign official reports.

"I actually think they are right, and I actually do think inflation is coming," Bianco explained regarding Fed Chairman Powell's hawkish stance. He noted that online price-tracking services had shown increases over recent weeks that had not yet been reflected in government statistics. Powell confirmed expectations for tariff effects to emerge throughout the summer months.

Market anxiety intensified as prediction markets assigned 63% probability to US military action against Iran before the month-end. Trump delivered an ultimatum demanding that Tehran negotiate or face potential bunker-buster bomb supplies to Israel. "Iran's got a lot of trouble," Trump said, while maintaining strategic ambiguity about military plans.

Bianco recommended defensive positioning across energy stocks, gold, and money market funds. He coined the "four-five-six markets" thesis, predicting cash returns of 4%, bonds of 5%, and equities of 6% annually due to elevated valuations. The strategist criticized overpriced technology names, particularly the Mag Seven, arguing they required "lots of things going right" amid heightened uncertainty.

ECONOMY: Overpriced Markets Set To Burst: Will Layoffs Freeze The Economy?

Steve Hanke warned of an impending economic slowdown as escalating Middle East conflicts and domestic policy uncertainty create headwinds for growth. The monetary expert criticized both military interventions and sanctions as counterproductive tools that actually strengthen the targeted regimes rather than achieving their stated objectives.

"All sanctions are a fool's game; they never work," Hanke explained during analysis of Iran-Israel tensions. He argued that financial sanctions represent a form of warfare through dollar weaponization, citing recent criticism of American monetary policy. The professor advocated for the immediate audit of defense spending.

Hanke dismissed Federal Reserve Chairman Jerome Powell's inflation forecasts, noting that "tariffs don't create inflation, changes in the money supply create inflation." He predicted continued disinflation, as money supply growth remains below his target rate of 6%. The economist called both Trump and Powell financially illiterate for focusing on interest rates rather than monetary aggregates.

Regarding fiscal policy, Hanke condemned the "Big Beautiful Bill" as fiscally irresponsible, particularly defense spending increases. He recommended 50% Pentagon budget cuts, noting the department cannot pass audits. The professor suggested following Warren Buffett's strategy of holding cash and quality assets while awaiting bubble deflation.

ECONOMY: Fed's Bold Announcement: Powell Makes Shocking Economic Forecast

Lobo Tiggre predicted zero Federal Reserve rate cuts this year despite official projections of two reductions. He cited Chairman Powell's unprecedented warnings about tariff-driven inflation as evidence of policy paralysis ahead.

"I think there's a good chance we get no cuts," Tiggre explained during post-FOMC analysis. Powell delivered unusually stark inflation expectations during the press conference, stating that "everyone that I know is forecasting a meaningful increase in inflation in coming months" from tariff implementation. The Fed maintained unchanged rates while acknowledging economic uncertainty.

He noted market reactions during Powell's remarks, observing that "when Powell started talking, suddenly things went down" across major indices. The analyst dismissed traditional inflation hedging assumptions, explaining that gold "tends to lead inflation" rather than respond to it contemporaneously.

Silver's recent outperformance versus gold caught attention as the metal approached $37 per ounce. Tiggre suggested industrial demand rather than safe-haven buying drove the rally, noting concurrent moves in platinum and palladium. He recommended defensive positioning in uranium and copper stocks, citing supply shortfalls and the Trump administration's support for nuclear development. Trump's criticism of Powell as "a stupid person" highlighted ongoing executive-Fed tensions over monetary policy independence.

ECONOMY: 'Zombie' Companies In Danger Of Collapse; $2 Trillion Credit Bubble Popping?

Clem Chambers predicted escalating global conflicts would drive continued outperformance in defense stocks and precious metals. The ANewFN founder characterized current conditions as "World War 2.5" due to rising tensions across multiple geopolitical flashpoints simultaneously.

"I kind of see it as World War 2.5," Chambers explained during market analysis. He noted that European defense contractors had significantly outperformed their American counterparts as NATO allies pursued military independence. Germany's remilitarization plans reflected broader continental shifts toward self-reliance following the United States' strategic pivots.

Chambers highlighted platinum's 20% gain since his May Forbes article, maintaining heavy positioning in the metal alongside gold. He distinguished between crisis assets, stating, "Bitcoin is for flight, gold is for war," when describing investor rotation patterns during geopolitical stress.

The analyst warned of brewing private credit risks, comparing current conditions to those of the pre-2008 mortgage crisis. He estimated $2 trillion in opaque lending arrangements between interconnected financial institutions represented systemic vulnerabilities. "Zombie companies," which survived on perpetual refinancing, faced potential collapse as borrowing costs increased.

Chambers recommended Warren Buffett's literature for novice investors, while advocating for broad index fund exposure over individual stock selection. He predicted continued market volatility driven by geopolitical uncertainty rather than traditional economic fundamentals.

ECONOMY: Why You're Getting Poorer: Major Slowdown Ahead

Donald Boudreaux validated World Bank projections that tariffs would slash American economic growth by half, calling the forecast "very credible." The professor argued that Trump's trade policies would "unambiguously make Americans poorer" by disrupting complex global supply networks.

Boudreaux challenged the "China stole our jobs" narrative, noting that unemployment remains low while manufacturing output approaches all-time highs. "You cannot find any evidence for it in the data," he explained regarding job theft claims. Manufacturing employment declined primarily due to mechanization rather than trade, with technology accounting for 80% of workforce shifts since the 1950s.

Legal challenges to presidential tariff authority gained traction as federal courts questioned Trump's use of emergency powers. Boudreaux predicted constitutional violations, arguing that trade deficits spanning decades hardly constitute emergencies justifying sweeping duties.

The economist expressed alarm over fiscal deterioration, stating that "any semblance of fiscal sanity that existed in America now seems to be gone." He warned future taxpayers would bear deficit burdens through higher taxes, reduced services, or dangerous debt monetization.

Regarding the 2008 crisis, Boudreaux blamed government housing policies rather than deregulation, citing federal mandates for subprime mortgage purchases by Fannie Mae and Freddie Mac.

CRYPTO: Bitcoin to $250k By December; The Money Printing Storm Is Coming

Arthur Hayes, CIO of Maelstrom and BitMEX co-founder, warned of brewing tensions between generations over asset ownership during a wide-ranging interview covering cryptocurrency markets and global economic dynamics.

"I think there's going to be a lot of intergenerational conflict," Hayes said. "The boomers have stocks to sell. Does anyone want these stocks? Maybe to some extent. Do they want that big suburban house? I don't know."

Hayes predicted Bitcoin would reach $250,000 by year-end, driven by massive money printing. "Everything leads to money printing basically. That's the solution of everything," he explained.

The crypto veteran discussed recent volatility in Asian currencies, particularly Taiwan's 10% dollar surge against the USD. He attributed this to life insurers repatriating funds and hedge funds unwinding carry trades under pressure from potential Trump administration policies.

On altcoins, Hayes remained skeptical of venture capital-backed projects. "Most of them are probably not going to go up in price again because they don't have product market fit," he said. Hayes also addressed Korean trading culture, noting "very low opportunity for most individuals to escape a shitty life" drives heavy speculation. The interview touched on capital controls, exchange competition, and traditional finance entering crypto markets.

WHAT TO WATCH

Tuesday, June 24:

Fed Chair Powell testifies to House Financial Service Committee

Wednesday, June 25:

New home sales

Thursday, June 26:

Advanced US trade balance in goods

Initial jobless claims

GDP (second revision)

Pending home sales

Friday, June 27:

Consumer sentiment

Personal income

Personal spending

PCE index

Core PCE index

They get bombed again