TABLE OF CONTENTS

Market Recap: Chris Vermeulen on why investors should brace for ‘chaos’

ECONOMY: Lyn Alden on what happens when tariffs destroy the economy

ECONOMY: Steve Keen explains why private debt is the real crisis in the U.S.

INVESTING: Robert Kiyosaki on which assets will soar, how to invest

MARKET RECAP

Latest News. U.S. retail sales plunged in January, falling 0.9 percent, larger than the expected 0.3 percent. This was the largest monthly fall in retail sales in two years.

The sales data were released on February 14th; stocks and the dollar reacted by falling, while Treasury yields rose. Since the morning of the 14th, stocks have pared losses.

Yet, market volatility will only get worse in 2025, according to Chris Vermeulen, Chief Market Strategist at TheTechnicalTraders.com.

“In the next month or two, I believe the markets are going to put in a major market top, so I am bearish,” he said.

Once the market reaches a top in the coming months, Vermeulen forecasted a major crash.

“I think we’re going to see way bigger than a 25 percent pullback,” he predicted. “I do think this year we’re going to see a huge correction… until then, don’t bet on that with the trend, which is up at this point.”

When it comes to the Trump White House, Vermeulen said that uncertainty about policy would affect markets.

“All we have to know is, Trump’s in power [so] expect chaos,” he said. “Expect… all kinds of stuff that will be in place one day and removed the next day. All it means is expect increased volatility.”

Long-term, Vermeulen said that he was bullish on the U.S. dollar.

“I’m still bullish, long-term, on [the dollar],” he said. “If we were to do a Fibonacci extension on here, to where that upside target could be, we’re looking at potentially 124 [in the DXY].”

Market Movements

From February 7th to February 14th, the following assets experienced dramatic swings in price. Data are up-to-date as of February 14th at 9pm ET (approximate).

Papa John’s International — up 28.9 percent.

DraftKings Inc. — up 26.5 percent.

Alibaba Group Holding — up 24.1 percent.

Iron Mountain Inc. — down 10 percent.

Zillow Group — down 8.4 percent.

The following major assets experienced the following price movements during the same time interval.

DXY — down 1.2 percent.

Bitcoin — no significant change.

Gold — up 0.8 percent.

10-year Treasury yield — down 0.2 percent.

S&P 500 — up 1.5 percent.

Russell 2000 — no significant change.

USD/yuan — down 0.5 percent.

ECONOMY:

WHEN TARIFFS DESTROY THE ECONOMY

Lyn Alden, February 13, 2025

Lyn Alden, Founder of Lyn Alden Investment Strategy, said that large tariffs could lead to slower growth and higher inflation in the U.S. economy.

“If you implement large tariffs, and then especially if you get in counter-tariffs, that’s basically a big global tax increase,” said Alden. “That can increase the odds of recession, or makes business planning a lot harder.”

Alden said that unless the Trump administration reduces regulations or improves energy output, “at scale” tariffs would be inflationary.

“Generally speaking, [with tariffs] you’re either taxing stuff that stays foreign, which [results in] higher prices, or you relocate to a higher-cost area, which has benefits, but then generally comes with higher prices,” Alden explained. “So, there is potentially inflationary effects, but only if this is done at scale.”

When it comes to inflation in 2025, Alden said that slow-moving components of the CPI and PCE indices would keep inflation elevated.

“I think we’re probably still going to end 2025 above [The Fed’s] target [of 2 percent],” said Alden. “This gives the Fed a little bit more hawkishness in their narrative, at least until we get maybe a couple of more soft prints.”

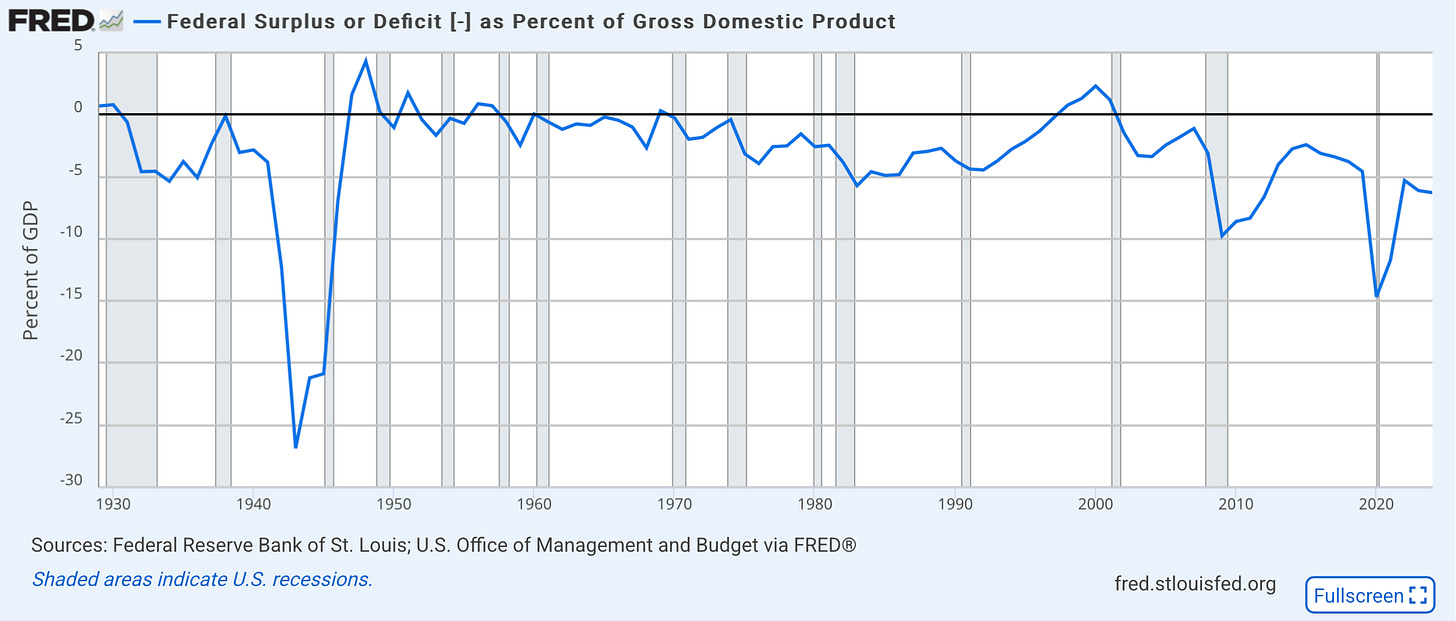

Alden stressed that fiscal dominance would drive inflation in 2025.

“Instead of rapid bank lending causing this inflation, it’s generally large budget deficits,” Alden explained. “50 basis points rates in either direction is greatly outweighed by [deficits]… and what does tariff policy look like in three months, six months, 18 months from now? Those are way more important in my view.”

ECONOMY:

PRIVATE DEBT IS THE REAL CRISIS

Steve Keen, February 12, 2025

Steve Keen, Honorary Professor at University College London and Publisher of

, said that the real problem in the U.S. is not inflation or the budget deficit, but rather private debt.“The real problem in America is not the level of government debt, it’s the level of private debt,” he said. “Everybody’s obsessing about government debt being 100 percent of GDP, roughly, right now. Private debt is 170 percent of the GDP… Private debt is what causes financial crises.”

He said that the solution to this is to use the government’s ability to “create money” to buy up private debt.

“I would actually use the government capacity to create money… to cancel private debt,” he said. “… That would give you a much, much wealthier middle class.”

Keen said that government deficits are not inherently bad, since increasing money supply leads to a growing economy.

“If you want to have a growing economy, you’ve got to have a growing money supply,” he explained. “There’s two sources of increasing money: the government creates money by running a deficit, [or] the private banks create money by lending more than they get back in repayments. And you actually [have] too much credit money creation, and not enough fiat money creation.”

Responding to the Congressional Budget Office’s projection that the 2025 deficit would be 6.2 percent of GDP, Keen said he’d be “happy” to maintain it at that level.

“I’d actually be happy to maintain the deficit on the order of 6 percent of GDP, and reduce the amount of money created by banks, because most of that money created by banks goes into share market speculation and housing speculation,” he said. “It makes housing more expensive. That’s not a good thing… Private debt is the real problem.”

INVESTING:

THESE ASSETS WILL SOAR

Robert Kiyosaki, February 11, 2025

Speaking at the Vancouver Resource Investment Conference (VRIC), Robert Kiyosaki — best-selling author of the Rich Dad, Poor Dad series — stressed that investors need to know about how inflation affects asset prices.

“[The U.S.] is printing $1 trillion every 100 days,” said Kiyosaki. “When they print that much money, what happens is this: the rich get richer… because there is asset inflation.”

He added that “the dollar is fake, we’ve got to start going to hard assets.”

Kiyosaki cautioned that investors should be careful about relying too heavily on financial planners.

“The most stupid people I meet, they actually let a financial planner handle their finances,” he said.

In terms of specific investments, Kiyosaki said that he was investing in silver.

“[My friend Andy Schechtman] says that every time they fire those Tomahawk rockets, I think there is 1.4 pounds of silver in them, and you never get it back,” he said. “Silver is an industrial metal, it’s also a strategic metal in war.”

He said that investing in assets like real estate, which generate a passive income, is also an important aspect of investing.

“I make about $250,000 a month in apartment houses,” he said. “It’s not big money, but I can pay my bar bill.”

FIXED INCOME:

ARE INTEREST RATES ABOUT TO SPIKE?

Kathy Jones, February 14, 2025

Kathy Jones, Chief Fixed Income Strategist at Charles Schwab, said that inflation could stay sticky and higher than the Fed’s target, which in turn would affect bond yields.

“We have tariffs and we have immigration changes [under the new Trump administration], and those two components have the potential to be somewhat inflationary,” she said. “The risk is towards higher rather than lower inflation, so I would say, yeah, we could stick around this 2.5-2.6 percent inflation for a while, if some of these potentially inflationary policies really come to fruition.”

She said that these inflationary pressures could cause Treasury yields to rise.

“Between those policies and the fact that the economy has just been very resilient in the face of a lot of things that have been thrown at it over the number of years, I would say that the risk is that we go back in Treasury yields to retest the 5 percent area on the 10-year,” she said.

Commenting on Treasury Secretary Scott Bessent’s plan to reduce 10-year yields by promoting energy output and slashing government spending, Jones said that Bessent’s outlook was “very optimistic.”

“So far we’ve seen a lot of potential reduction in workforce at the federal level,” she said, referring to the Department of Government Efficiency’s budget cuts. “But you only have 3 million government workers… and if the average worker in the federal government makes $100,000 a year, let’s say, you know you’re not going to get $2 trillion in deficit reduction even if you cut the entire federal workforce.”

Jones also expressed skepticism about the possibility of energy prices being driven down lower through an increase in output.

“[Lowering energy prices] requires getting production up to even higher levels than it is domestically… and driving the price down,” she said. “Well, that depends on whether the investors in the energy companies want those companies to increase production and potentially drive down their own profits… Investors don’t want that.”

I won’t listen to anyone who is friends with Trump.