TABLE OF CONTENTS

EQUITIES: Fr. Emmanuel Lemelson on finding ‘deep value’ stocks

ECONOMY: Douglas Holtz-Eakin on a potential bond market ‘revolt’

REAL ESTATE: Ron Butler on the ‘catastrophic’ housing problem in Canada

MARKET RECAP

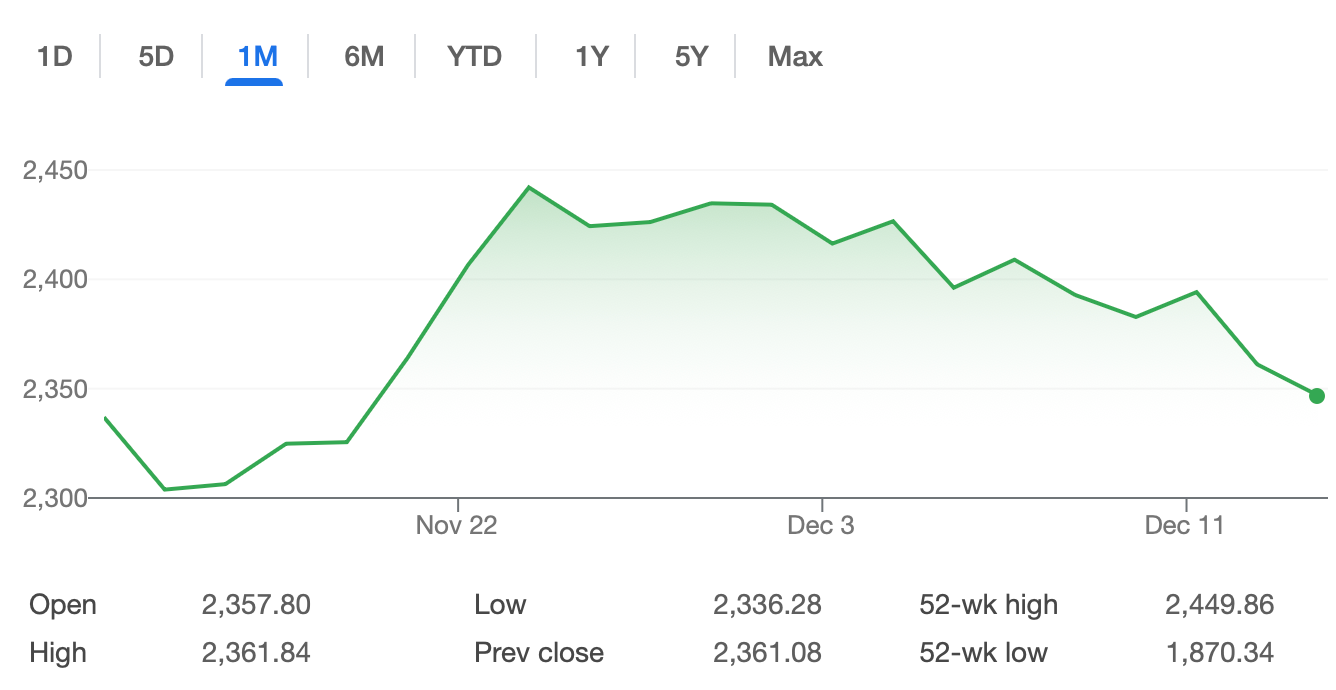

Latest News. Consumer Price Index (CPI) data were released on Wednesday, December 11th, showing an uptick in inflation in November. Year-over-year headline inflation was 2.7 percent, in line with expectations, while core inflation, which excludes food and energy, rose 3.3 percent.

Markets reacted positively, with tech stocks leading the way. The Nasdaq Composite rose 1.7 percent on Wednesday, with Alphabet, Tesla, Meta, and Amazon hitting record highs. The S&P 500 rose 0.8 percent. Bitcoin soared from under $98k to $101,300 per coin in intraday trading. The 10-year Treasury yield rose by 0.07 percentage points.

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, discussed the latest CPI report, as well as what the future holds for risk assets and commodities.

McGlone said that much of the uptick in the recent CPI reading came from a 4.7 percent year-over-year increase in shelter costs. He said that many market observers do not predict inflation will drop significantly in the near-term.

“It might be kind of silly to expect inflation to drop a lot when we have the stock market related wealth effect the highest in 100 years,” he said. “That is, we’ve had this massive pump in equities — it’s two times GDP — and that’s a massive wealth effect. So why should consumers stop spending?… And also we have a wonderful situation for [the] wealth effect: we have the stock market going up, and the Fed’s easing.”

McGlone warned, however, of “significant deflationary forces” in China, the world’s second-largest economy, where the 10-year note was “at 1.84 percent” on December 11th. He also said that U.S. stocks are highly “elevated,” when looking at metrics like market indices relative to GDP, which could imply a correction.

“The number one force for deflation in this country is a backup in the highest stock market valuation to GDP in 100 years,” he said. “Tariffs will happen right away [under a new Trump administration]… and maybe a little purging of some of those excesses there [in the U.S. bureaucracy]'; that means 2025, I think, is finally going to have a little bit of a backup.”

“We’re at the point now where every single outlook for next year assumes the stock market is going to go up,” said McGlone. “Just imagine if it drops 10 percent. That’s severe deflation, on the back of what’s happening in commodities.”

Bitcoin is a leading indicator for risk assets, according to McGlone, who said that the Bitcoin-gold ratio can be used to help determine when a correction in risk assets will occur. He mentioned that this ratio is currently around its 2021 cycle peak.

“The best leading indicator [for risk assets] might be Bitcoin,” he said. “On a 100 day basis, the Bitcoin to S&P 500 correlation is about 0.50, it’s the highest in its history.”

McGlone said, “The best case I think for gold, is if Bitcoin resistance around $100,000 holds, and eventually kicks down. That means all risk assets are expensive, signalling lower. That means a major, I think, tilt towards gold and treasury bonds.”

Market Movements

From December 6 to December 13, the following assets experienced dramatic swings in price. Data are up-to-date as of December 13 at 9pm ET (approximate).

Walgreens Boots Alliance — up 21.4 percent.

American Superconductor Corp. — down 17.2 percent.

Adobe Inc. — down 15.8 percent.

Natural Gas (Henry Hub) — up 6.2 percent.

Tesla — up 12.1 percent.

The following major assets experienced the following price movements during the same time interval.

DXY — up 0.8 percent.

Bitcoin — up 3.8 percent.

Gold — up 0.5 percent

10-year Treasury yield — up 0.6 percent.

S&P 500 — down 0.6 percent.

Russell 2000 — down 2.6 percent.

USD/yuan — No significant change.

EQUITIES:

MARKETS ARE ‘INSANE’

Gareth Soloway, December 11, 2024

Gareth Soloway, Chief Market Strategist of Verified Investing, gave his market outlook, warning of a potential correction ahead.

Soloway predicted an “unbelievably nasty” downturn may occur in 2025, based on his chart analysis, as well as historically high stock market valuations when looking at PE ratios.

“Stock valuations are insane,” he said. “We are priced beyond perfection. In fact there’s no doubt there’s a bubble here… I am very skeptical that the markets will continue to go up.”

He said that U.S. consumer spending had been held up by the wealthy, whose stock market portfolios had seen substantial increases, allowing them to buy more goods and services.

“Anyone making under $50,000 can’t even go to McDonald’s anymore,” he said, “but the high end, which spends the most money, they are keeping the economy going. As long as the stock market keeps going up, the merry-go-round and the music will continue to play, but at some point it can’t.”

However, Soloway said that he is bullish on Chinese stocks, as well which he said would outperform global equities in 2025.

“So, number one, China is talking [about] massive stimulus now… [and] that’s bullish for equities in China,” he explained. “Number two, Trump has threatened massive tariffs on China. He generally threatens monstrous tariffs, and then he imposes something less. It’s a negotiating tool. So I think prices on China equities are reflecting a potential of these massive tariffs. My guess is… it won’t be as high as markets anticipate. That will be bullish.”

On Bitcoin, Soloway said, “As long as the stock market is going up, Bitcoin likely goes up with it. But once we see that correction in the stock market, or pullback in the stock market, Bitcoin likely comes back in.”

Yet, Soloway said he would buy Bitcoin if it corrects, especially given the incoming Trump administration’s pro-crypto stance.

EQUITIES:

MARKET’S HIDDEN GEMS

Fr. Emmanuel Lemelson, December 10, 2024

Fr. Emmanuel Lemelson, a Greek Orthodox priest and CIO of Lemelson Capital Management, discussed investing in “deep value” stocks in the midst of historically high market valuations.

Lemelson said that the markets are at “scary” levels when looking at The Russell 5000 to U.S. GDP.

“I think through the close of business yesterday… we hit a new record, it’s 2.09, I want to say,” he said, referring to the Russell 5000 divided by GDP. “The previous record was like 2.084.”

Yet, despite record market valuations, Lemelson said that there are sectors and strategies which can help investors turn a profit.

He singled out off-price retail as an undervalued sector, mentioning that his firm held stakes in Walgreens, Kohl’s, and Big 5 Sporting Goods.

“We own a stake in Big 5, which is a very unpopular sporting goods store,” he said. “They’ve been around for a very long time, they fill a niche market. They’re trading at a pittance, frankly, a fraction of tangible book value… Are people going to have their kids not do school sports next fall because the economy is [down]? Probably not.”

Lemelson said many of the major tech stocks are over-valued, and that his company had taken a short position in Tesla.

“A lot of these big tech names, it’s like the lemmings going over the cliff,” he said. “If you look at Tesla, for example… Do you really want to buy a company that the NTSB [National Transportation Safety Board] just said had the highest fatality rates, on the road, for its cars?… and yet people buy it, because it’s like a meme stock.”

When it comes to a broader macroeconomic outlook, Lemelson said that he was hopeful about the new Trump administration.

“He’s got a lot of really great businessmen that he’s appointing in his cabinet,” he said, pointing to the examples of David Sacks and Paul Atkins. “I do believe he [Trump] will do what’s in the best interests of the country.”

EQUITIES:

’THIS WILL END BADLY’

Michael Gayed, December 7, 2024

Michael Gayed, Publisher of

, talked about his bearish outlook for markets, and the assets he is most bullish on.In 2023, Gayed had predicted the unwinding of the carry trade between Japan and the U.S. This trade involves investors borrowing from Japan at near-zero interest rates, and using the money to buy U.S. risk assets.

When the Bank of Japan (BoJ) raised its interest rates in July of 2024, this triggered a sell-off in U.S. risk assets, so that investors could cover higher interest payments in Japan.

Gayed said that the unwinding of the carry trade may not be over, and that it is still “lingering.”

“I have a bad feeling about December… because there is a BoJ decision coming up,” he said. “It seems like they need to hike rates… Japan has a real inflation issue, and if The Bank of Japan does panic to try to counter the inflationary pressure, then you might have a repeat of August [when the carry trade unwound].

He warned that U.S. markets are caught up in a “speculative mania” that would “end badly.”

“It’s unlike other speculative manias in the sense that it’s very concentrated… in tech stocks, it’s concentrated in Bitcoin and some certain cryptocurrencies,” he said. “It’s concentrated also in levered funds… It’s very clear, we’ve become a gambling nation. Everyone is just trying to YOLO into 2X and 3X and individual stocks… [T]he last time we had that feeling as a society was the peak in 2021.”

However, Gayed said that he was bullish on long-duration treasuries and small caps.

“They’re interconnected,” he explained. “If you end up having long-duration treasury yields collapse [due to deflation worries or the reverse carry trade],… In that collapse in yields, now small caps finally have their lifeline, because now they can refinance into lower yields.”

ECONOMY:

IS U.S. DEBT DEFAULT COMING?

Douglas Holtz-Eakin, December 9, 2024

Douglas Holtz-Eakin, former Director of The Congressional Budget Office (CBO) and President of The American Action Forum, discussed his long-term outlook for U.S. deficit and debt, and their impact on the economy.

Holtz-Eakin said that “there is no excuse” for the U.S. to be running a deficit that is 7 percent of GDP, especially given that the economy is at “full employment” and is “not engaged in an overseas war.”

“We know that this is part of a larger trajectory where the debt relative to GDP has gone from 30 percent in 2000 to 100 percent now, and is on a trajectory to go steadily north as far as the eye can see,” he said. “And that’s literally unsustainable.”

If the government fails to control the debt and deficit levels, Holtz-Eakin predicted that interest rates could spike, and there would be a bond market “revolt.”

“[Long-term interest rates will] go up,” he said. “If they [The Trump administration] in fact do both extend the tax cuts and do another [set of spending measures] — his promises add up to another $3 or $4 trillion — I think you’ll see a revolt. I don’t think the bond markets are going to like that a bit.”

Holtz-Eakin expressed skepticism about Trump’s proposed Department of Government Efficiency (DOGE), headed by Elon Musk and Vivek Ramaswamy, which is tasked with trimming $2 trillion in government spending.

“If you want to talk about cutting $2 trillion out of spending, you have to recognize that the Constitution gives the power of the purse to Congress, and it gives the implementation of that spending to the Executive, and nowhere in there is the DOGE,” he said. “And so the question is, what authorities does the DOGE have on paper? They don’t have anything.”

He drew a comparison to The Grace Commission under President Ronald Reagan, which issued several recommendations for reducing spending.

Holtz-Eakin said, “it doesn’t look like it [The Commission] changed the size and scope of the federal bureaucracy very much.”

He said that to tackle the deficit, modifications need to be made to entitlement programs like Social Security and Medicare.

“I think more affluent individuals have to get less back in their Social Security,” he explained. “Medicare is harder… We have struggled mightily in this country to control healthcare cost growth. We’ve made some real progress, but that’s the next big challenge.”

REAL ESTATE

’CATASTROPHIC’ PROBLEM IN CANADIAN HOUSING

Ron Butler, December 12, 2024

Ron Butler, Host of “The Angry Mortgage Podcast” and Principal Mortgage Broker at Butler Mortgage, gave his outlook for Canadian real estate.

Butler said that a correction is “on the horizon” for condominiums in Toronto.

“We have seen an absolute catastrophic problem developing in investor-driven condominiums in [Toronto],” explained Butler. “We have brand new [condo] products coming on the market… This new product is priced so grossly higher than resale products right across the street… The delta is completely unmanageable.”

Toronto condo investors were driven by “absolutely ridiculous” assumptions when they purchased real estate, said Butler.

“The assumptions were… that prices would simply go up eternally and forever,” said Butler. “Another assumption would be that 2 percent interest would continue forever, and that mass immigration would continue forever. All of these things have become untrue, and the feasibility of even closing on these condominiums… is doubtful.”

However, Butler said that single-family homes in Vancouver and southern Ontario would not suffer from a correction, due to geographic, regulatory, and financial barriers to building new units.

“In Ontario, we suspect that the development of single-family homes in 2024 has just fallen off the face of the earth,” he said. “There’s no financing for development available for single-family homes, and the big builders of single-family homes in Ontario and in British Columbia all stopped building them about 12 or 14 months ago. They sold what they had pre-sold, and they closed their sales offices.”

WHAT TO WATCH

Tuesday, December 17, 2024

U.S. retail sales — The total revenue generated by retail businesses across the U.S.

Wednesday, December 18, 2024

FOMC Rate Decision — The Federal Open Market Committee will meet to make a decision on The Fed Funds rate.

Housing starts — The number of new homes being built across the U.S.

Thursday, December 19, 2024

Existing home sales — The number of pre-owned homes being sold across the U.S.

U.S. leading economic indicators — This is a composite of ten key metrics designed to forecast U.S. economic activity.

Friday, December 20, 2024

Personal Consumption Expenditures (PCE) Index — A measure of how much U.S. households spend on goods and services.