TABLE OF CONTENTS

ECONOMY: 2025 will be ‘extremely volatile,’ says Philippe Gijsels

ECONOMY: Jason Trennert on why a 2nd wave of inflation may be coming

ECONOMY: Matt Piepenburg on the ‘craziest times’ he’s ever seen

PRECIOUS METALS: Nicky Shiels gives her 2025 gold and silver outlook

MARKET RECAP

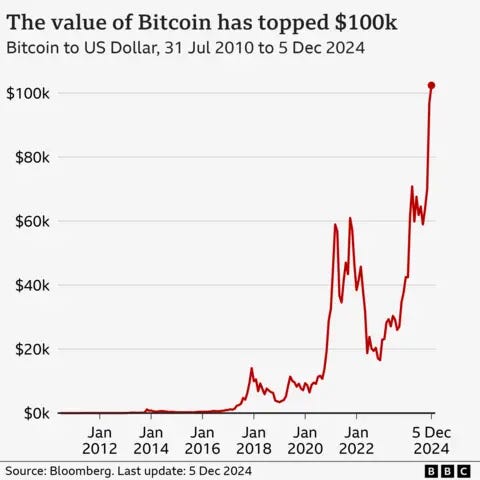

Latest News. President-elect Donald Trump’s nomination of pro-crypto businessman Paul Atkins as Chair of the Securities and Exchange Commission triggered vigorous buying of Bitcoin, pushing it above the $100k mark on Wednesday, December 4th. The coin hit an all-time-high of $103,332 on December 5th before falling slightly.

Bitcoin has risen markedly since Trump won the presidency, rising from $69,374 on election day to over $100k this week. Crypto markets appear to be treating Trump’s election as a boon for digital assets, given his pro-crypto campaign messaging.

The Bitcoin price may have also been pushed up by Federal Reserve Chair Jerome Powell’s remarks on December 4th that investors saw Bitcoin as a “competitor for gold.”

Let’s revisit Bitcoin analyses and forecasts, both short-term and long-term from recent experts on our program: Clem Chambers, Chris Vermeulen, Ran Neuner, Aaron Arnold, Benjamin Cowen, Samson Mow, and Jack Mallers.

The view shared by Chambers and Vermeulen was there would be strong selling pressure around the $100k Bitcoin level.

“This is no longer an appealing [Bitcoin] price for someone to get in at,” said Chambers, Founder of AnewFn. “At some point — in six months, a year — it’s going to be down to $60,000 again.”

Vermeulen, who is Chief Market Strategist at TheTechnicalTraders.com, held a similar view. He predicted that once Bitcoin hits $100k, “we’re going to see some selling,” because this would be a “mental resistance level.”

However, he said that he had recently bought some Bitcoin.

“I like Bitcoin, not as an investment,” he said. “The reason I like it is that it is such a herd mentality trade… I still think it’s going higher.”

Pointing to his chart, Vermeulen said, “this tells us where Bitcoin should go next, which is about 108 to 109 thousand dollars.”

We also interviewed Neuner, Host of Crypto Banter, on December 5th.

He said that Bitcoin has the potential to reach $100k, but he predicted a lot of selling by January, characterizing it as part of the market’s natural rhythm.

“It’s pretty normal to have these 25 or 30 percent pullbacks [in Bitcoin]” he said. “That is why I’m starting to accumulate cash.”

Aaron Arnold, Co-host of Altcoin Daily, said that the next several months would be a bullish environment for crypto because of Securities and Exchange Commission (SEC) policy changes.

“For the last seven plus years, the crypto market has been suppressed, and now that that suppression is being lifted, these assets — Bitcoin, Ethereum, Solana — they’re in price discovery again,” said Arnold. “The next nine-ish months are when you see the biggest gains, the highest rallies.”

Benjamin Cowen, Founder of Into the Cryptoverse, said that Bitcoin’s dominance would reach 60 percent of the total crypto market cap.

“60 percent was my target because it was essentially just retracing where the bubble began with alt[coin]-Bitcoin pairs,” he said. “The one thing to remember about Bitcoin dominance is that it tends to spend three years going up, and then one year going down.”

In the long-term, Samson Mow and Jack Mallers expected Bitcoin to hit as high as $1 million.

“I believe Bitcoin is severely under-valued right now,” said Mow, CEO of Jan3. “I believe we’re on track to $1 million. The ETFs have been an enormous influx of capital into Bitcoin… We’re getting to the point where we should be going parabolic very soon.”

Mallers, CEO and Founder of Strike, held a similar view.

“The bond market is in trouble… and so, if central banks and governments are going to try to save that market, the amount of liquidity that’s needed is going to send assets very high,” said Mallers. “If that happens, it’s impossible to speculate on an asset as scarce as Bitcoin, but I think $250,000 to $1 million… in that range.”

Market Movements

From November 29 to December 6, the following assets experienced dramatic swings in price. Data are up-to-date as of December 6 at 9pm ET (approximate).

Intel Corporation — down 13 percent.

DocuSign — up 34.3 percent.

Coinbase Global — up 16 percent.

Arabica Coffee — up 34 percent.

UnitedHealth Group — down 9.9 percent.

The following major assets experienced the following price movements during the same time interval.

DXY — up 0.2 percent.

Bitcoin — up 3.4 percent.

Gold — down 1 percent.

10-year Treasury yield — down 0.7 percent.

S&P 500 — up 1 percent.

Russell 2000 — down 1 percent.

USD/yuan — up 0.4 percent.

EQUITIES:

MARKETS ARE ‘OUT OF WHACK’

Mark Zandi, December 3, 2024

Mark Zandi, Chief Economist of Moody’s Analytics, gave his views on markets and the economy. He said that markets are “off kilter” and potentially overvalued.

Zandi said that the U.S. economy is strong, and he did not predict a recession in 2025. He ascribed the recent rise in unemployment to immigration, which had caused a surge in the labor force.

“[Unemployment’s uptick] wasn’t anything to do with [labor] demand,” he said. “I think the economy is on solid ground… I think the fundamentals are good.”

As a result of strong fundamentals, Zandi expected earnings to grow “at the rate of [nominal] sales.”

However, he warned that market valuations are “out of whack,” and that assets may be overvalued.

“I think asset values are feeling on the high side, and they continue to march higher,” said Zandi. “They’re getting increasingly disconnected from… the good fundamentals, and that does open up the asset markets to a sell-off.”

He gave the examples of all-time-highs in the stock market, low corporate bond spreads, and rising real estate prices. He said that active investors need to think more “carefully” about portfolio valuation.

“If you go back, the only other point in time where [corporate bond] spreads were thinner was right before the financial crisis in 2007,” he explained. “The markets… are discounting that nothing is going to go wrong here at all… and that is very unlikely.”

He pointed to President-elect Trump’s proposed tariffs and deportations, which could trigger “mean reversion” to the downside.

“Those tariffs will result in more inflation and that means higher bond yields,” he said. “I think in general, you’ll get higher bond yields, higher interest rates, higher inflation, and a higher value of the dollar.”

ECONOMY:

2025 TO BE ‘EXTREMELY VOLATILE’

Philippe Gijsels, December 5, 2024

Philippe Gijsels, Chief Strategy Officer at BNP Paribas Fortis, discussed his economic forecast and the implications for assets.

Gijsels said that 2025 would be a “extremely volatile” geopolitically and economically. He said that the world is becoming increasingly divided, and is moving away from globalization towards “multi-globalization.”

“The Pax Americana is over,” he explained. “You have different [trading] blocs, and that will create a lot of geopolitical uncertainty. That geopolitical uncertainty will translate into volatility in the financial markets.”

He predicted that every asset class would experience volatility in 2025, including the U.S. dollar.

“Whatever move it will be, I think it will be volatile,” he said. “If the Euro/Dollar moves, then everything attached to the Euro/Dollar moves, and that’s all the rest of the currencies… [they] will be volatile as well”

He warned that equities markets seem overvalued, which could cause a “serious correction” in stocks or bonds, which could affect the real economy.

“In economics, when you have a huge boom, you run the risk of having a huge bust,” he explained. “If there is an accident, it will come more from the financial side, and it will translate into the economy.”

In the long-term, Gijsels said that commodities are on the brink of a “super cycle” as commodity demand struggles to keep up with supply. He said he was “bullish” on commodities.

“There is a lot of demand coming from the electrical revolution,” he said. “If you look at the longer-term picture… I think this will be the strongest bull market we’ve seen in the last 100 years.”

Gijsels was particularly bullish on copper, predicting that its price could double.

“You need about 200 new mines in the copper space,” he explained. “A lot of the older mines are losing on production, and there is not enough coming upstream.”

ECONOMY:

SECOND WAVE OF INFLATION

Jason Trennert, December 3, 2024

Jason Trennert, CEO of Strategas, provided his perspective on inflation, Fed policy, and the incoming Trump administration.

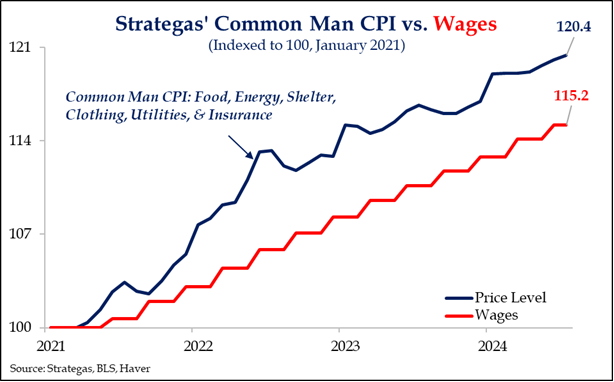

Trennert forecasted that a second wave of inflation could be coming, based on his analysis of historical data.

“What we’ve found is that about 90 percent of the time, when you have one wave of inflation over 6 percent, you get a second wave of inflation,” he said. “As time goes on… unions and workers demand not only higher wages, but also higher wages to make up for what they have missed in the last several years.”

Trennert explained his ‘Common Man CPI’ measure, which showed that inflation in goods and services had outpaced wages.

“The headline numbers looked pretty good,” he said. “Inflation came down, stock prices were high, the unemployment rate was low. And yet, there was a sense of unease in the economy, and I think the unease was largely among the average person.”

He said that the Federal Reserve had cut rates too quickly.

“I think, frankly… The Fed should slow down on its easing campaign,” he said. “If your goal truly is 2 percent [inflation]… you want to be careful, for a lot of the reasons I mentioned before, about easing too quickly.”

Trennert also addressed President-elect Trump’s threat to punish BRICS countries with a 100 percent tariff if they avoid using the U.S. dollar. Trennert said that the dollar is unlikely to be replaced as the world reserve currency.

“If President Trump is true to his word about government efficiency [with DOGE]… you won’t have to worry about any other currency,” he said. “The U.S. is the reserve currency. There’s nothing that will change that… in my lifetime.”

ECONOMY:

’CRAZIEST TIMES I’VE SEEN’

Matt Piepenburg, December 2, 2024

Matt Piepenburg, Partner at Von Greyerz AG, joined the show to discuss economic growth, tariffs, and other topics.

Piepenburg addressed Trump’s threat to levy tariffs on goods coming from Mexico and Canada, until, as Trump wrote, “drugs, in particular fentanyl, and all illegal aliens” stop passing through the northern and southern borders into the U.S.

“[Trump’s] ultimate goal is to re-shore production and companies and the C-suites and the manufacturing back to U.S.,” explained Piepenburg. “I think what Trump is trying to do, on the positive side of these tariffs, is convince companies in the world that we’re focusing on America, we’re focusing on American productivity, American manufacturing, re-shoring jobs… that’s expensive, and that takes more than one term.”

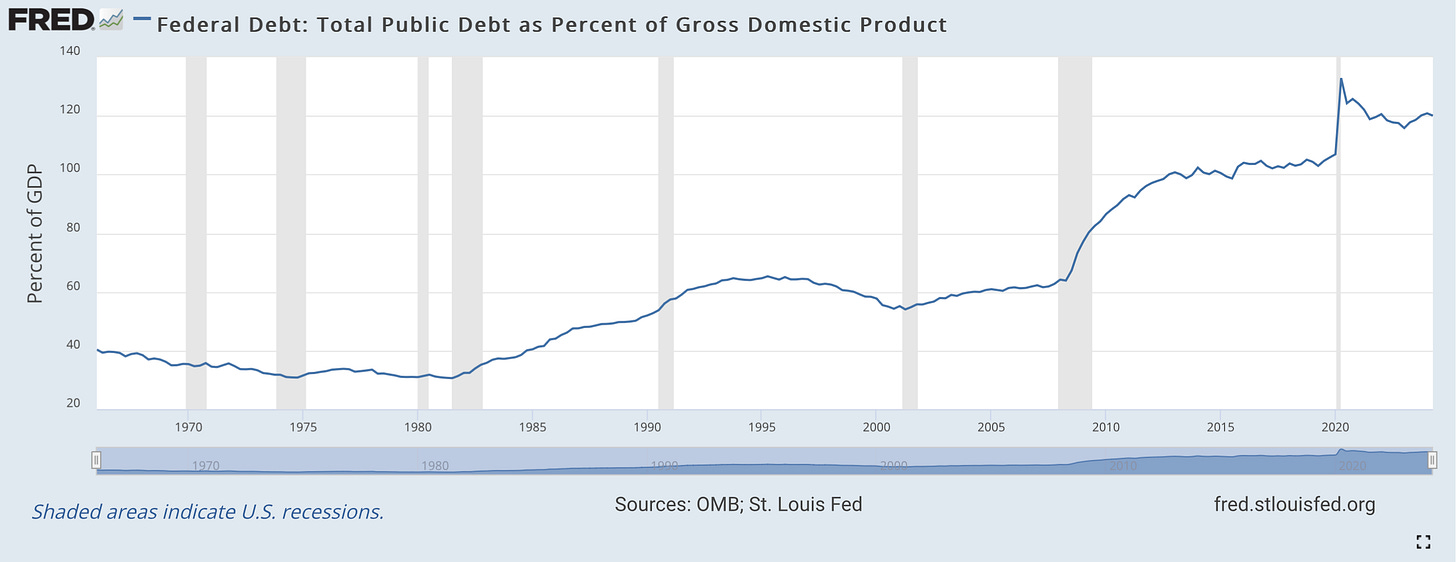

When it comes to economic growth, Piepenburg said that the important metric is the U.S.’s debt-to-GDP ratio, which is now above 120 percent.

“You can’t get growth when your debt-to-GDP crosses the 110, 120 percent rubicon,” he explained. “Once you cross 100 percent, growth slows by one-third… if you want to get growth, you’ve got to cut the debt-to-GDP ratios. That takes more than four years.”

Piepenburg was skeptical about the ability of Trump’s Department of Government Efficiency (DOGE), run by Elon Musk and Vivek Ramaswamy, to sufficiently cut debt. DOGE aims to cut the size of the federal workforce by as much as 75 percent, and trim $2 trillion from government spending.

“It’s great optics, it’s very appealing,” said Piepenburg. “But if you cut $2 trillion worth of jobs, then what happens to the… U3, U6 [un]employment? What happens to the cost to keeping those people on welfare for a year, or on the dole for a year? Where do they find new jobs? And even if you do those, the cost of re-shoring, the cost of these other great ideas, are going to be more than $2 trillion.”

Given these challenges, Piepenburg said that Trump’s second term may be daunting.

“It’s absolutely the craziest time I’ve ever seen in a macro setting,” he said. “It’s the craziest geopolitical scene. It’s the craziest geo-economic scene.”

PRECIOUS METALS:

2025 GOLD AND SILVER OUTLOOK

Nicky Shiels, December 4, 2024

Nicky Shiels, Head of Research & Metals Strategy at MKS PAMP, gave her 2025 outlook for gold and silver.

She said that MKS PAMP’s bull case for gold is a “repeat of 2024,” though “[the gold price] will be a lot more volatile” in this scenario. Shiels said that she ascribes a 55 percent probability to this potential situation.

“We expect milder gains [than 2024],” she explained, referring to MKS PAMP’s bull case for gold. “Gold potentially could hit $3,200 next year.”

However, Shiels said that in a bear case, gold could fall to as low as $2,200 if political and geopolitical fears ease, the crypto industry benefits under a Trump administration, and the Federal Reserve gets “ahead of the inflation curve.”

When it comes to inflation, Shiels was skeptical as to whether the Fed has inflation under control. She expected inflation to remain higher than the Fed’s 2 percent target in the long-term.

“I think in terms of this decade, we’re putting the past behind us in terms of… a low interest rate, low inflation structural regime for developed markets,” she said. “Certainly with policy uncertainty, with de-globalization, de-dollarization, ESG, all of these structural policies are coming together to support a higher-for-longer inflation floor.”

She said that the new floor is likely 3 percent, and said that higher inflation is bullish for gold.

Sheils had a positive outlook for silver in 2025, given its industrial demand.

“Silver, which is a high-beta sister metal [to gold] that can capitalize on both the fear premium in gold and the industrial cyclical reflation story behind copper… can attract the best of both worlds,” she said. “Silver has an opportunity… to recalibrate into much higher territory, and we’re talking about $35 to $40.”

WHAT TO WATCH

Wednesday, December 11, 2024

Bank of Canada rate decision — The Bank of Canada’s Governing Council will make decision on its key policy interest rate.

Consumer Price Index (CPI) Release — This shows the price level of consumer goods and services.

Thursday, December 12, 2024

Swiss National Bank rate decision — The Swiss National Bank will make a decision on its key policy interest rate.

European Central Bank rate decision — The ECB will make a decision on its key policy interest rate.

Producer Price Index (PPI) Release — This shows the level of prices that producers receive for their output.