$100 Trillion Debt To Trigger 'Financial Crisis'?

IMF Projects Global Debt To Reach $100 Trillion

TABLE OF CONTENTS

Market Recap: Steve Hanke on the post-election economic downturn

EQUITIES: David Bahnsen on whether a post-election market crash will happen

EQUITIES: Ted Oakley on whether 2025 will be the worst year for investors

CRYPTO: SEC Commissioner Hester Peirce on SEC’s stalling on Bitcoin ETF

MARKET RECAP

Latest News. The International Monetary Fund (IMF) said that global debt is set to reach $100 trillion this year, or 93 percent of world GDP. In its latest Fiscal Monitor report, the IMF warned that “sustained debt buildups can raise the probability of debt distress or broader financial crisis.” The report provided recommendations, such as tax increases, to help governments manage rising debt levels.

In other news, the BRICS countries (Brazil, Russia, India, China, and South Africa) met in Kazan, Russia from October 22nd to October 24th for their annual summit. The meetings concluded with China and India resolving their border disputes, which had led to tensions between the two countries. It was also announced that China and Brazil would release their proposals for an end to the Ukraine conflict.

In the United States, betting markets like Polymarket are suggesting a Trump presidential victory in November, with Donald Trump having a sizeable lead over Kamala Harris.

To discuss these developments, we were joined by Steve Hanke, professor of economics at Johns Hopkins University.

Hanke said that betting markets are usually better at predicting election outcomes than polling data.

“I tend to look at the betting markets… because they are objective and reliable and more accurate than the polling data,” said Hanke. “People are betting real money when they're engaged in those markets.”

Regardless of who is elected president in November, Hanke said that a recession will occur due to Federal Reserve policy. He explained that the Fed has been on a swift tightening cycle, increasing interest rates dramatically in response to high inflation. Yet, Hanke said that the Fed’s rate hikes had been too drastic.

“I think we'll have a recession because of this contraction in the money supply,” said Hanke, who pointed to past data which show that such contractions are associated with recessions.

When it comes to the IMF’s global debt projections, and concerns about a more debt crises, Hanke agreed that the rising debt is unsustainable. However, he criticized the IMF's typical solution.

“The only problem I have with the IMF, you know, their solution is more taxes,” he said. “Mine is less government spending.”

Hanke added that increasing taxes often causes economic slowdowns, and can lead to social unrest.

Finally, Hanke commented on the recent BRICS summit in Kazan, Russia, saying that “They [BRICS] are against sanctions. Well, I'm against sanctions too. It's a form of protectionism; they always backfire. They never work.”

He singled out sanctions on Russia in response to the Ukraine-Russia conflict, saying that diplomacy should be sought to end the war. He also said that the most concrete result from the BRICS Summit was an agreement between India and China to resolve their border conflict.

Market Movements

From October 18 to October 25, the following assets experienced dramatic swings in price. Data are up-to-date as of October 25 at 9pm ET (approximate).

Trump Media & Tech Group (DJT) — up 31.7 percent.

Newmont Corporation — down 15.4 percent.

Tesla — up 22 percent.

Cocoa — down 8.3 percent.

Coffee — down 5 percent.

DXY — up 0.8 percent.

Bitcoin — down 2.6 percent.

Gold — up 1 percent.

10-year Treasury yield — up 3.4 percent.

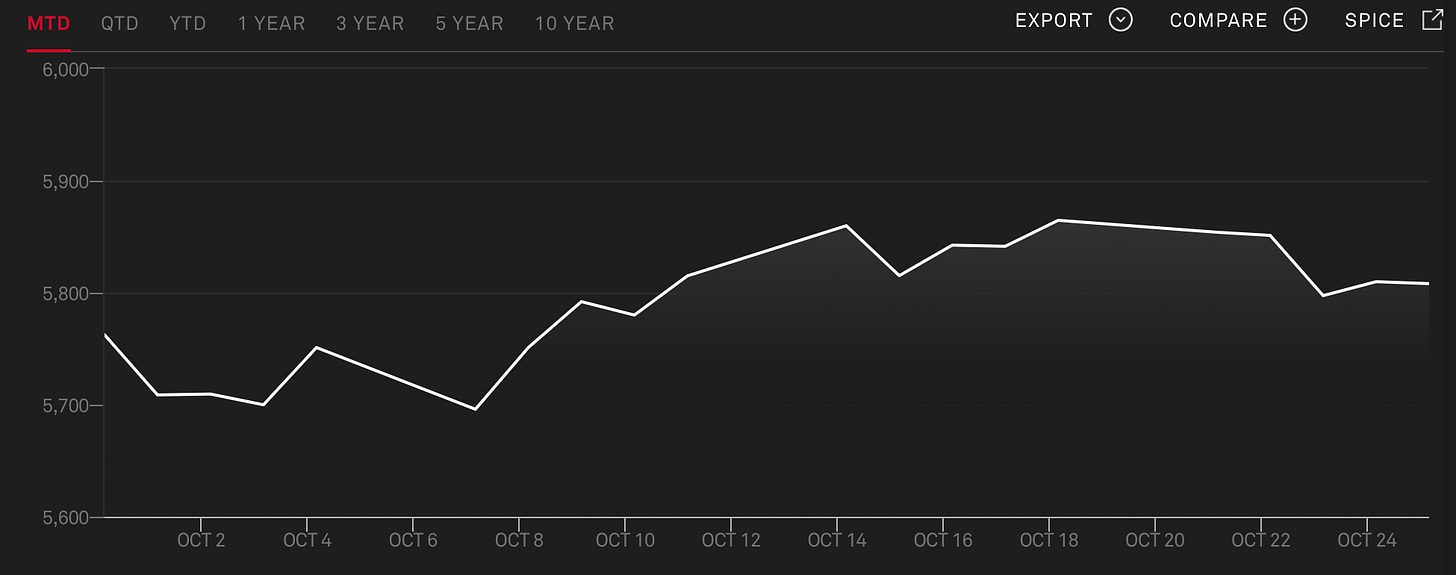

S&P 500 — down 0.9 percent.

Russell 2000 — down 1.8 percent.

USD/Yen — up 1.8 percent.

EQUITIES:

POST-ELECTION MARKET CRASH?

David Bahnsen, October 24, 2024

We were joined by David Bahnsen, Managing Partner of The Bahnsen Group, to get his outlook on where markets are headed as the U.S. heads into an election. Bahnsen said that his firm’s investment strategy remains consistent regardless of election outcomes.

“It doesn’t make a difference to us whatsoever,” he explained. “The way in which we invest capital at my firm… does not require the wind to be blowing a certain direction.”

Bahnsen said that any changes that the U.S. President proposes would have to go through Congress, making drastic economic policies unlikely.

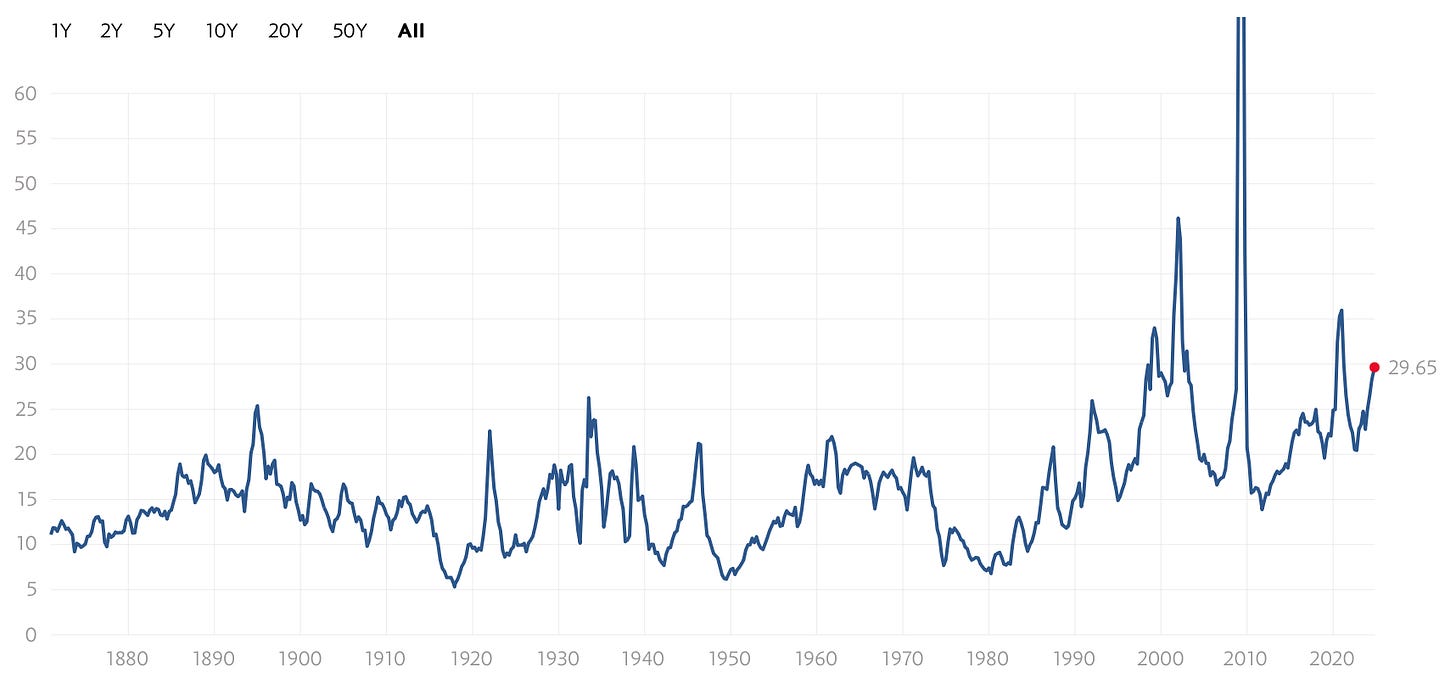

However, when it comes to markets, Bahnsen warned that stock valuations are overly high, with P/E ratios well above historic norms.

He predicted that this “bubble” would pop, saying that, “the notion that we have moved the historical mean valuation to 22 times earnings, or in the technology sector 40 times earnings, these are conversations that always precede a bubble bursting.”

Bahnsen said that his dividend growth strategy helps mitigate such risks by focusing on companies with stable cash flows, which tend to exhibit lower volatility.

On economic conditions, Bahnsen predicted a potential “soft landing” for the U.S. economy. He said that while labor markets and corporate profits appear strong, housing activity remains sluggish.

EQUITIES:

MARKETS IN FINAL ‘BLOW-OFF TOP’

Bill Smead, October 22, 2024

Bill Smead, Chairman of Smead Capital Management, was back on the show to provide his market analysis.

Smead said that the current market is in the final stages of a “financial Euphoria” episode, marked by overcapitalization in popular stocks and sectors. He drew historical parallels with past market cycles, such as the radio boom in 1929 and the tech boom of the late 1990s.

“The problem is the Euphoria episode overcapitalizes things and doesn’t do a very good job of sorting out, over 10 years, who the winners and losers are going to be,” he said. “You kill a financial Euphoria episode with a blow-off top.”

Smead said that the overvaluation is not limited to the tech sector but applies broadly to growth stocks. According to Smead, this reflects a market-wide stretch in valuation driven by the belief in perpetual prosperity. He singled out Costco, traditionally seen as a stable investment, which now trades at a much higher valuation multiple than it did historically.

Warning that this market euphoria can lead to a “lost decade,” Smead said that market indices like the S&P 500 could produce negligible or zero returns over a long period. He said that this isn't unprecedented, pointing out similar stagnant periods in the past, such as from 1964 to 1981 and 1999 to 2009.

“It is a very strong historical possibility that the S&P 500 will make nothing in appreciation over the next 10 years,” said Smead.

EQUITIES:

WHY THE WORST YEAR IS COMING FOR INVESTORS

Ted Oakley, October 19, 2024

Ted Oakley, Founder of Oxbow Advisors, said that he is cautious going forward, and that next year could be a perilous one for investors.

“The markets are extremely overpriced,” he said. “People are not thinking about anything they’re buying; they’re just pushing it into the market not worried about a thing.”

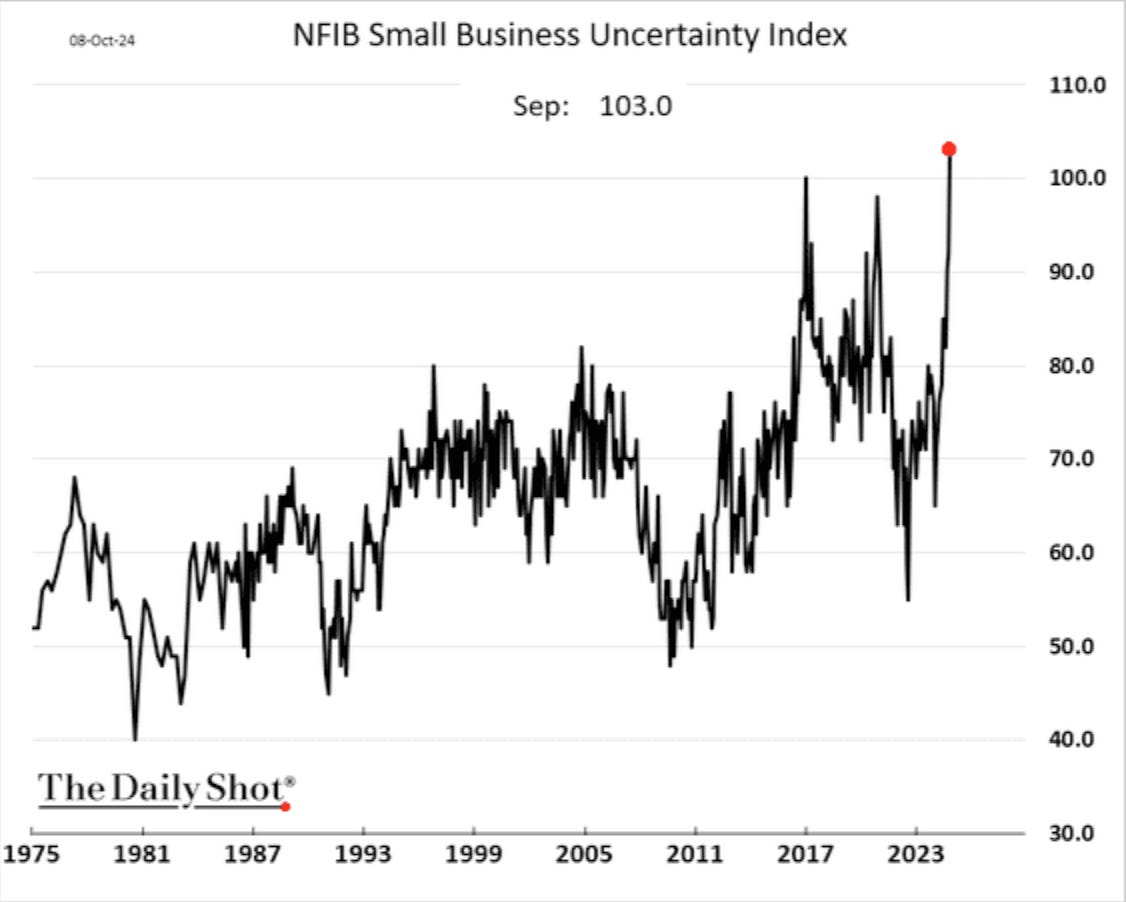

In addition, Oakley saw troubling signals in economic data. He noted a divergence between strong consumer spending and growing uncertainty among small businesses, which are struggling with rising costs and inflation. He argues that consumers are borrowing more to sustain their lifestyles, relying heavily on credit.

“People are starting to... borrow more to live and to do the things they want,” he said, adding that consumer debt levels are unsustainable.

The Federal Reserve’s recent actions are another point of concern for Oakley. He said that the Fed has historically mishandled interest rates, often making decisions that lead to unintended consequences.

“They haven’t lowered [rates] fast enough,” said Oakley, “and now I think what they'll have to do... is lower them lower than they think, which is going to create another inflationary spiral.”

With geopolitical uncertainty, including conflicts in Eastern Europe and the Middle East, and an upcoming U.S. presidential election, Oakley saw the potential for heightened market volatility. To mitigate these risks, Oakley said that investors should shift towards tangible investments such as commodities, real estate, and gold, which he said will serve as effective hedges in an inflationary environment.

CRYPTO:

”WE SHOULD HAVE APPROVED” BITCOIN ETF YEARS AGO

Hester Peirce, October 23, 2024

We welcomed Hester Peirce, SEC Commissioner, to the show to discuss crypto regulation, and how the Securities and Exchange Commission (SEC) has handled enforcement actions.

Pierce said that the agency has “fallen down on our duty as a regulator” when it comes to clarifying whether crypto tokens are securities. She emphasized that clarity is crucial for the crypto industry, as it affects how tokens are treated in secondary sales and how platforms handle them.

She said that the “Howey Test”—used to determine if an asset is a security—does not always fit well with crypto.

For Bitcoin, she said, “The key to remember is that what the SEC is trying to get at is...instances where you have information asymmetry.”

Peirce mentioned the delayed approval of a Bitcoin ETF, acknowledging that it took a court decision to force the SEC's hand. She expressed frustration with the pace of regulatory actions, saying, “We should have done this many years ago.”

Commenting on the collapse of crypto platforms like FTX, Pierce addressed concerns of overregulation, saying that while bad actors need to be pursued, the SEC has “taken an approach that is throwing a lot of enforcement resources at the space,” which she did not see as an effective way to regulate. This enforcement-driven strategy, she said, makes it harder for legitimate players to navigate the market and stifles innovation.

WHAT TO WATCH

Tuesday, October 29, 2024

S&P Case/Shiller Home Price Index: This measures the change in the value of U.S. residential real estate by tracking the price variations of single-family homes over time.

Job Openings: Reported by the Job Openings and Labor Turnover Survey (JOLTS), this measures the number of available positions employers are actively seeking to fill.

Wednesday, October 30, 2024

Q3 GDP: This measures the total economic output of the U.S. for the third quarter.

Thursday, October 31, 2024

Personal Consumption Expenditures (PCE) Index: Rhis measures the average level of prices for goods and services consumed by households in the U.S.

Friday, November 1, 2024

Unemployment Rate: Reported by the Bureau of Labor Statistics, this measures the portion of unemployed adults in the U.S. labor force.

Your podcasts are engaging and thoughtful, your choice of speakers superlative. My investing acumen is sharpened and my thesis challenged. Thank you very much.