TABLE OF CONTENTS

REAL ESTATE: Commercial real estate in crisis? We ask Willy Walker

GEOPOLITICS: Aram Nerguizian on Israel’s next moves in Lebanon

GEOPOLITICS: Marko Papic explains whether Israel will nuke Iran

MARKET RECAP

Latest News. Tensions in the Middle East have cooled after Israel announced that it will not strike Iran’s civilian infrastructure. Markets were previously gripped with uncertainty over whether Israel would target Iran’s oil facilities, which may have spiked oil prices, or the Islamic Republic’s nuclear sites, which would have risked a broader regional conflict.

Oil prices fell following the cooling geopolitical tensions, with WTI dropping 5 percent and Brent Crude falling 5.6 percent over the past week.

A more specific fear was that in response to Israeli escalations, Iran would close the Strait of Hormuz, which transports 20 to 30 percent of the world’s crude oil. If Israel-Iran tensions escalate further, then this scenario could still be in play.

Bjarne Schieldrop, Chief Commodities Analyst at SEB Research, joined the show to discuss these geopolitical possibilities and their effects on oil prices. Schieldrop said that Iran closing the Strait of Hormuz would cause oil prices to spike to $350 per barrel, before falling below $200 over time.

“When you have severe disruption in the supply of specific commodities, they tend to move like 5x or 10x to normal price,” said Schieldrop. “Look at nickel prices when Russia invaded Ukraine—it went from $20,000 to $200,000 per ton.”

Schieldrop predicted that a Strait closure is unlikely, and said that U.S. and Chinese forces would likely intervene militarily to reopen the Strait in the event of a shutdown.

He said that OPEC (The Organization of Petroleum Exporting Countries) would respond to Iranian oil disruptions by expanding its spare capacity. He explained that OPEC+’s major oil producers, such as Saudi Arabia and Russia, hold 5 to 6 million barrels per day of reserve capacity. The oil cartel can therefore quickly fill any supply gaps caused by Iranian oil export disruptions.

Schieldrop said that short-term spikes in oil prices, due to geopolitical conditions, do not predict where long-term prices will settle. Supply and demand would meet at a stable point, buttressed by OPEC+’s careful management of oil reserves.

“The hypothesis of the market is that the long-term balancing point, where you have just enough supply and just enough demand, is around $70,” he said. “But that hypothesis is changing all the time depending on circumstances.”

For example, in 2014, the hypothesis was that the long-term price was $90 per barrel, but after the surge in U.S. shale oil production and other factors, this hypothesis shifted to around $55 in the years following 2016.

Market Movements

From October 11 to October 18, the following assets experienced dramatic swings in price. Data are up-to-date as of October 11 at 9pm ET (approximate).

WTI Crude Oil — down 8.2 percent.

Weibo Corporation — down 5.5 percent.

Coinbase Global Inc. — up 24.8 percent.

JetBlue Airways — up 10.3 percent.

VIX Index — down 11.9 percent.

DXY — up 0.6 percent.

Bitcoin — up 9.1 percent.

Gold — up 2.4 percent.

10-year Treasury yield — up 0.2 percent.

S&P 500 —up 0.8 percent.

Russell 2000 — up 1.9 percent.

USD/Yen — up 0.3 percent.

EQUITIES:

MARKET CRASH IN 2025?

Chris Vermeuelen, October 15, 2024

We were joined again by Chris Vermeuelen, Chief Market Strategist at TheTechnicalTraders.com, who gave us his year-end outlook, and his predictions for 2025.

Vermeulen said that while the market could continue to rise in the short term, particularly into the end of 2024, he predicted a significant downturn within the next year.

“This time next year could be a totally different story,” said Vermeulen. “We could see a lot of asset classes tumbling 20%, 30%, 50% or more.”

His reasoning was based on growing market exhaustion and the increasing likelihood of a major correction or “Black Swan event,” akin to the 2008 financial crisis or the dot-com bubble.

Vermeulen’s outlook for the end of 2024 was cautious, but he said that the S&P could rally another 4 to 6 percent, and that investors should be careful about shorting stocks.

“All-time highs mean there’s no overhead resistance,” he said. “It can float as high as it wants... shorting a trend or new all-time highs is a recipe for disaster.”

He said that investors should avoid catching “falling knives” and instead take advantage of market pullbacks within a broader uptrend.

Vermeulen also discussed the relationship between stock market trends and rising commodity prices. He observed that gold had reached his target of $2,750 per ounce, a signal that the market could be nearing a top.

“We’re right on the cusp of the market putting in a top,” he said, explaining that when gold rallies alongside the stock market, it often indicates that investors are nervous and looking for safe-haven assets. This pattern was reminiscent of the lead-up to the 2008 financial crisis.

EQUITIES:

THE ’EVERYTHING RALLY’ IS HERE

Eric Jackson, October 14, 2024

We welcomed Eric Jackson, CIO of EMJ Capital, to the show to discuss his bullish outlook on markets.

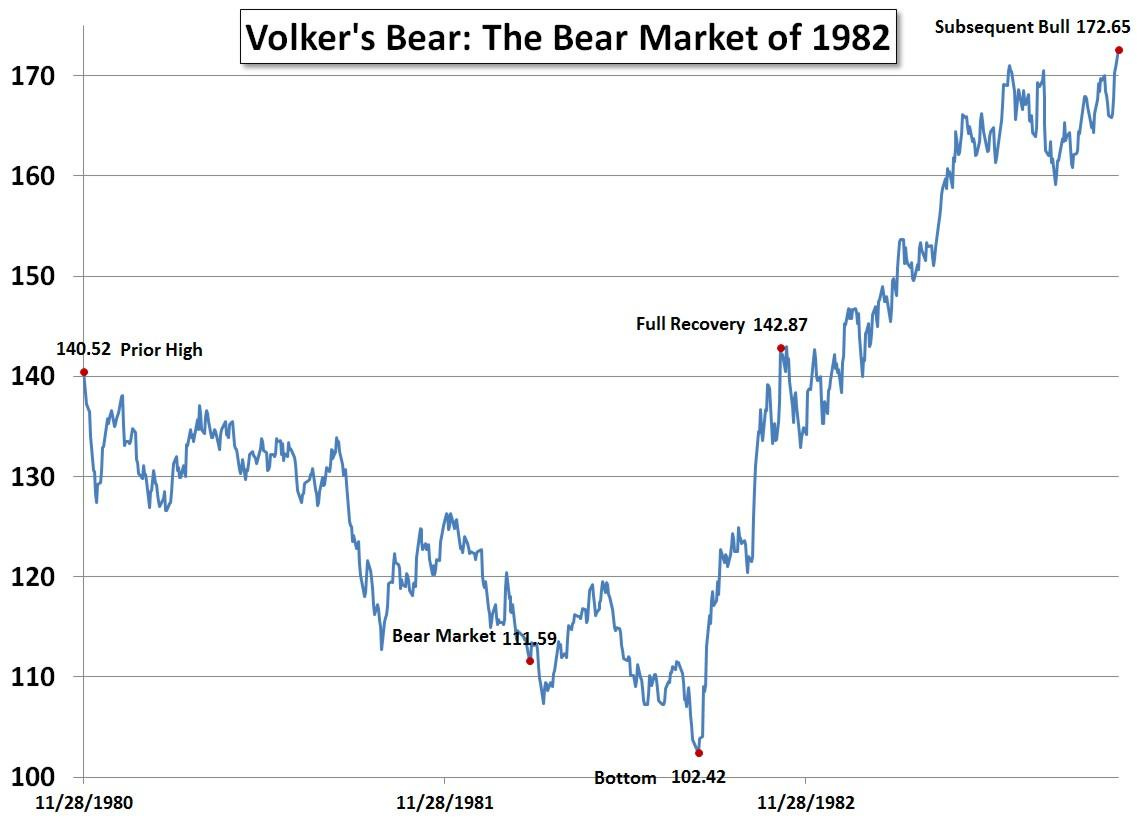

Jackson said that conditions are ripe for an “everything rally,” similar to 1982’s bull run, which saw a 200 percent increase over a five-year-period. He said that, just as in 1982, today's market has seen recovery after a period of inflation and rising interest rates, particularly in the aftermath of the COVID-19 lockdowns.

Commenting on the similarities between today and 1982, Jackson said, “The real similarities are that just ahead of that market bottom, we had the peak in interest rates... Once long-term interest rates started to go down, the market started to rally, and we have many of those things similarly in place today.”

In response to fears of a tech bubble, Jackson said that such concerns are premature, pointing out that people have become “too quick to want to label anything that shows signs of life as a bubble” due to the scars left by the dot-com crash and the housing crisis. He said the current rally is more sustainable, driven by improving economic conditions and the support of central banks worldwide.

While it may be more difficult to find “screaming buys” now compared to last year, Jackson remained optimistic about tech stocks.

“Nvidia is still undervalued, still a great stock,” he said. When it comes to large-cap tech stocks, he said, “They deserve to be as big as they are... A stock like Apple, it’s effectively a long-term subscription we have with them. They’re going to be fine for a long time.”

ENERGY:

WILL OIL RUN OUT?

Doomberg, October 18, 2024

Doomberg, Head Writer of the

substack, offered his insights on the energy markets and the impact of ongoing geopolitical events. While OPEC has slightly lowered its oil demand forecast for 2024, global tensions—particularly in the Middle East—remain a critical factor in energy price volatility.“We think everything changed on October 1st,” Doomberg said, referring to missile strikes from Iran that penetrated Israel’s air defense system. This development, according to Doomberg, could lead to a strategic stalemate where Israel may avoid attacking Iran’s critical facilities, including nuclear and oil infrastructure.

Despite the rising tensions, Doomberg said that the likelihood of a major escalation, such as the closure of the Strait of Hormuz, remains low.

“The market is severely discounting the chances of a conflict spiraling out of control,” he said.

Looking ahead, Doomberg expressed skepticism about predictions of declining fossil fuel demand. The International Energy Agency (IEA) forecasts that global oil demand could peak by 2030 at 102 million barrels of oil per day.

Doomberg dismissed these reports, labeling them as “wish casting,” based on political agendas rather than realistic modelling.

He said, “The demand for fossil fuels is infinite. Every molecule of oil produced will be burned by someone, somewhere… We will be burning way more than 102 million barrels a day of oil by 2030.”

REAL ESTATE:

REAL ESTATE CRISIS LOOMING?

Willy Walker, October 17, 2024

Willy Walker, CEO of Walker & Dunlop, said that while he is concerned about the commercial real estate sector, he does not see a crisis brewing. Walker predicted that the Federal Reserve’s recent 50 basis point rate cut will spur future growth in commercial real estate.

Walker said that the current delinquency rate of 1.4 percent in commercial real estate loans pales in comparison to the financial crisis of 2008 when it exceeded 8 percent.

“There are certainly office buildings that are impaired,” he said, “but to talk in generalities, commercial real estate is doing very well.”

In particular, he singled out other asset classes within commercial real estate (CRE), such as multifamily housing and retail, which are performing well. He also referred to recent commercial mortgage-backed securities (CMBS) data, indicating that delinquency rates stayed flat in August, and that some loans were being cured or extended.

“It’s my assumption that with rates coming down, delinquency levels will continue to come down," he said, emphasizing that the CRE sector remains resilient despite challenges.

In particular, with rates coming down, Walker predicted a two to four-year period of growth in volumes and values. However, he also said that rising borrowing costs will temporarily slow down activity: “When the cost of debt capital goes up as significantly as it has, that's going to slow things down.”

“I’m bullish on office,” said Walker, who predicted that while Class B and C office spaces may struggle, high-end Class A spaces continue to attract tenants. He also praised the resilience of the retail sector, attributing strong U.S. consumer spending to stable mortgage rates, which have insulated many homeowners from the effects of rising interest rates.

GOVERNMENT DEBT:

WHAT HAPPENS WHEN DEBT HITS 122 PERCENT OF GDP

Phill Swagel, October 14, 2024

We welcomed Phillip Swagel, Director of the Congressional Budget Office (CBO), to the show to discuss the CBO’s budget projections and the growing federal debt and deficit levels.

By 2034, the CBO projects that U.S. federal debt is expected to hit $50 trillion, or 122 percent of GDP, and the deficit is forecast to rise to 6.9 percent of GDP.

Swagel said that “this level of debt, combined with projected deficits of nearly 7% of GDP by 2034, puts the U.S. on an unsustainable fiscal path.”

“What’s especially unusual is that we have such a large deficit when the U.S. economy has recovered from the pandemic,” he said, adding that while the economy is “doing reasonably well,” with job growth and a relatively low unemployment rate, the size of the deficit is reminiscent of past crises such as WWII and 2008 financial crisis.

According to Swagel, by 2034, the government will be allocating “almost 40 percent of individual income taxes” just to cover interest payments on its debt. This, he explains, is a substantial portion of federal revenue that will not be available for other purposes, such as defense, healthcare, or tax relief.

Swagel identifies spending on entitlement programs like Social Security and Medicare as the primary contributors to long-term debt growth, especially due to demographic changes and healthcare cost inflation.

“Social Security and Medicare are the biggest drivers of our long-term deficits,” he said, emphasizing that healthcare spending is rising faster than the overall economy due to an aging population and the rising healthcare costs.

Looking ahead, Swagel warns that while the U.S. is able to finance its current deficits, relying on borrowing at historically low interest rates, this cannot continue indefinitely. He said that “at some point, adjustments will need to be made” as the debt levels become unmanageable. Although Swagel doesn't predict an imminent crisis, he stresses the importance of policymakers addressing this growing fiscal imbalance before it becomes unsustainable.

GEOPOLITICS:

ISRAEL BOMBS LEBANON, WHAT IS NEXT?

Aram Nerguizian, October 16, 2024

The conflict in the Middle East continues to play out, with Israeli jets striking Beirut, Lebanon on Wednesday, October 16th, and Israel hitting a municipal building in southern Lebanon, killing a town mayor and five others. Israel previously assassinated Hassan Nasrallah, the leader of Hezbollah — an Islamist paramilitary group based in Lebanon — and killed dozens of Hezbollah operatives using exploding pagers and walkie-talkies.

To understand these developments and their importance for the region, we were joined by Aram Nerguizian, Senior Associate at the Center for Strategic and International Studies (CSIS).

He said that “Israel has vowed to retaliate” against Hezbollah’s missile attacks, which were largely funded and supported by Iran. This development, according to Nerguizian, heightened the risk of a broader regional conflict.

Nerguizian discussed the challenges faced by the United Nations Interim Force in Lebanon (UNIFIL). Despite Israeli Prime Minister Benjamin Netanyahu’s request for UNIFIL to leave the region, Nerguizian emphasized that the peacekeeping force “operates under a mandate from the UN Security Council” and could not easily withdraw.

“UNIFIL is caught in the middle with very few good options, as both the Lebanese and Israeli sides seek to cast blame on its personnel,” he said.

Nerguizian also discussed Hezbollah’s reliance on civilian infrastructure for operations, which complicated efforts to minimize civilian casualties. He remarked that irregular forces like Hezbollah often “collocate with civilian infrastructure” as part of their warfare tactics.

The Lebanese Armed Forces (LAF) played a marginal role in the conflict, with Nerguizian pointing out that their capacity to intervene in southern Lebanon was “fragile” and exposed them to significant risks.

“They [The Lebanese military] are exposed, have no air defenses, and risk being caught in the crossfire between Israeli forces and Hezbollah,” said Nerguizian.

He concluded by questioning whether Israel’s goal was to "degrade Hezbollah" or to aim for broader strategic changes, including Iran’s influence in the region.

GEOPOLITICS:

WILL ISRAEL NUKE IRAN?

Marko Papic, October 12, 2024

Marko Papic, Chief Strategist of GeoMacro Strategy at BCA Research, joined the show to discuss the ongoing Middle East conflict, and how Israel would respond to Iran’s recent missile strike near Tel Aviv.

“Israel does have constraints, and those constraints are ultimately that the United States of America is not just going to let Israel do whatever it wants,” said Papic. “If Israel retaliates before the U.S. election, it will need the housekeeping seal of approval from the U.S. government.”

Papic emphasized the high stakes with Iran, describing it as a “sovereign nation” with significant military capabilities, unlike Hezbollah or Hamas. He warned that if Israel targets Iranian oil facilities or nuclear sites, Iran could retaliate by blocking global oil supplies. He also pointed to Iran’s influence over Iraq, which could lead to a broader loss of oil production if the conflict escalates.

However, Papic dismissed claims that Iran would block the Strait of Hormuz, which transits 20 to 30 percent of the world’s crude oil supply. He pointed to a similar attempt by Iran in 1988, which resulted in the U.S. Navy derailing Iran’s operation.

“Iran knows the consequences of trying to close the Strait of Hormuz,” said Papic. “If they tried, the U.S. could destroy their entire military in a matter of days.”

If Donald Trump were to win the 2024 presidential election, Papic said that he would be aggressive in negotiating with Iran. Trump had previously claimed he was close to securing a deal with Iran, and Papic said that Trump could quickly issue an ultimatum.

“He will probably tell them something in unequivocal terms like, 'You will get bombed within the next 48 hours unless you come back to the negotiating table,’” said Papic.

WHAT TO WATCH

Monday, October 21, 2024

U.S. Leading Economic Indicators: This is a composite index of key economic metrics, such as employment, manufacturing activity, and financial market performance.

Wednesday, October 23, 2024

Existing Home Sales: This shows the number of sales of existing homes, and is released monthly by the National Association of Realtors (NAR).

Bank of Canada Rate Decision: The Bank of Canada’s Governing Council will make a decision on their policy rate.

Thursday, October 24, 2024

New Home Sales: This measures the number of newly constructed single-family homes sold.

Great summary! Thanks