TABLE OF CONTENTS

Market Recap: Shaun Rein on China’s stimulus and its global impact

EQUITIES: Darius Dale on investing amidst ‘Fourth Turning’ crisis

MARKET RECAP

Latest News. The Consumer Price Index (CPI) report on Thursday, October 9th, showed that year-over-year inflation had fallen to 2.4 percent in September, the lowest in three years. This was still higher than the expected inflation rate of 2.3 percent.

Markets fell slightly on Thursday in response to the news; the S&P was down 0.2 percent, the Dow fell 0.1 percent, and the Nasdaq ended trading down by 0.1 percent. The 10-year Treasury yield edged higher from 4.065 percent to 4.093 percent. Markets are ascribing an almost 90 percent probability that the Federal Reserve will cut rates by 25 bps in November.

In geopolitical news, the conflict between Israel and Iran is intensifying, risking a broader regional war that could have serious implications for the global economy.

On October 10th, Israeli airstrikes struck Beirut, Lebanon, killing 22 people. The Israeli Defence Forces said that their fight in Lebanon is against Hezbollah, an Islamist paramilitary organization. Israel has already killed multiple Hezbollah figures, including the leader Hassan Nasrallah.

In response to Israel’s attacks on Lebanon on October 4th, Iran launched nearly 200 ballistic missiles to strike Israel – many penetrating the Iron Dome. Israel has since vowed to retaliate against Iran.

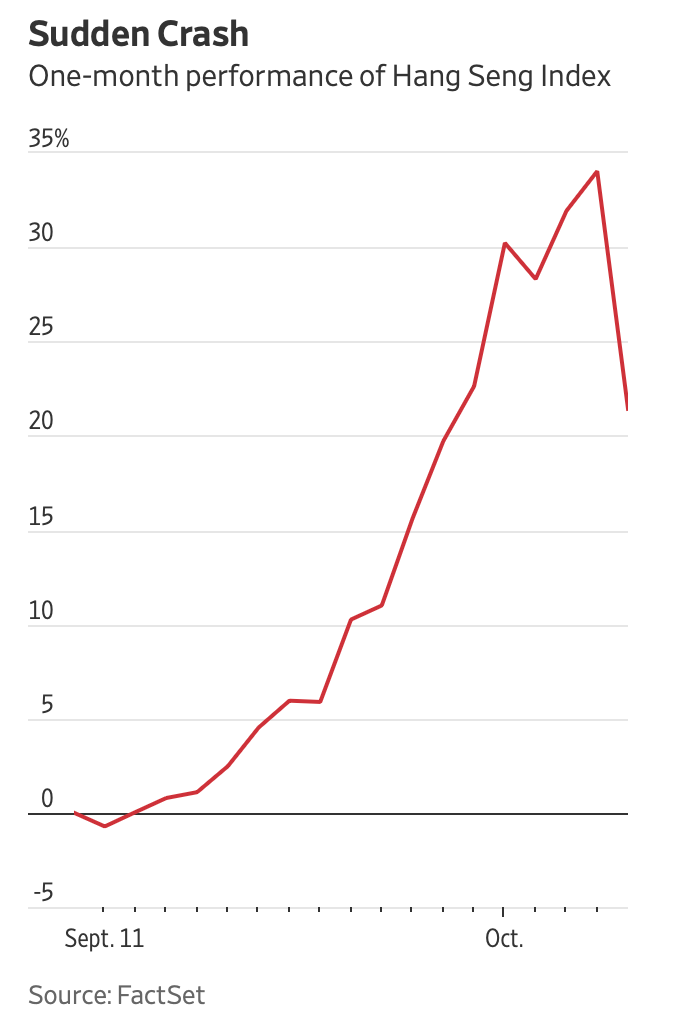

Markets were also particularly attuned to what was happening in China, where stocks experienced a week of volatility. After the CSI 300 Index gained over 30 percent in two weeks, stocks crashed on Tuesday, October 8th, with the CSI down 6 percent in a day of trading. The Hang Seng Index crashed 9.4 percent on the same day, its worst performance since 2008.

To make sense of what was happening in China, and how its events could affect the global economy, we were joined by Shaun Rein, Founder and Director of the China Market Research Group, who discussed the ongoing economic challenges China faces.

Rein explained that amidst a significant real estate collapse and rising youth unemployment, the Chinese government last month had rolled out a monetary stimulus to boost markets and the economy. This, in turn, had caused a tremendous rally in stocks.

However, Rein cautioned that it was not enough, and that stocks had crashed following economic planner Zheng Shanjie’s comments to media about the government’s upcoming additional stimulus policies.

“What we need is a fiscal stimulus,” said Rein. “We need to get money that's going to be pumped into the system.”

He explained that the Chinese economy remains fragile, with consumer confidence and spending still low. Rein is skeptical about the long-term impact of the monetary measures, emphasizing the need for fiscal stimulus to create jobs and boost consumer spending.

He also said that the stimulus is not enough to forestall deflation.

"People will just take that money and again save it because they're going to be scared that they're not going to be able to have recurring income in the coming months or coming years,” he said.

Rein also said that disruptions in China's economy, whether due to regulatory changes or shifts in consumer behavior, could affect production costs and availability for U.S. businesses, ultimately impacting U.S. market performance.

He said, "when China slows down, it hurts not just Chinese companies but multinationals that depend on the Chinese market."

However, he still expressed confidence in the short-term future of the Chinese stock market.

“The Chinese equity markets could go up another 10-30% over the next one to three weeks,” he said. “I’ve gone all-in.”

Market Movements

From October 4 to October 11, the following assets experienced dramatic swings in price. Data are up-to-date as of October 11 at 9pm ET (approximate).

Trump Media & Technology Group — up 53.2 percent.

Hang Seng Index— down 10 percent.

JetBlue Airways — down 7.8 percent.

MicroStrategy Incorporated — up 20.4 percent.

Natural Gas (Henry Hub) — down 7.7 percent.

What follows are the price movements of major assets.

DXY — up 0.39 percent.

Bitcoin — up 0.9 percent.

Gold — up 0.1 percent.

10-year Treasury yield — up 2.9 percent.

S&P 500 —up 1.1 percent.

Russell 2000 — up 1 percent.

USD/Yen — up 0.3 percent.

EQUITIES:

SIGNS OF MARKET REVERSAL?

Jason Shapiro, October 10, 2024

Jason Shapiro, Founder of The Crowded Market Report, returned to the show to explain his bullish sentiment on stocks, as well as his outlook on other assets.

“Stocks are going straight up” said Shapiro.

Shapiro, whose trading philosophy hinges on market sentiment analysis and pinpointing when trades become “overcrowded,” said that traders had generally become more bullish throughout the year, observing that “the bears are starting to get more hate.”

He said that central bank stimulus is behind much of the market rally. This stimulus, however, has created a dependency that may eventually fail, posing a longer-term risk.

“We are never ever going to have a problem again because whenever there’s a problem, the central banks come in and print a bunch of money,” said Shapiro. “That’s all fine until it’s not.”

He also explained that he is long on energy, forecasting that energy prices will rise because too many traders are “massively short” on energy. When markets become too crowded in one direction, there is often a reversal, with prices moving sharply in the opposite direction.

This, in turn, will cause a resurgence of inflation, said Shapiro, explaining that energy is “the number one impact on inflation.”

Because he predicted that inflation will rise, Shapiro is bearish on bonds.

“Yields are going to go up because of inflation,” he said.

He also sees gold and silver as overcrowded trades, and said that he has shorted the Australian dollar. He said that he is bearish on the Russell 2000, and is looking to take a short position on the yen.

EQUITIES:

CRISES WILL ‘DEEPEN’ AS ‘FOURTH TURNING’ HITS

Darius Dale, October 9, 2024

We welcomed Darius Dale, Founder of 42 Macro, to the show to discuss his outlook for financial markets. Dale said that an unfolding ‘Fourth Turning,’ a crisis that strikes every 80-100 years, is occurring now amidst growing populism and economic inequality — and that this would benefit risk assets.

Dale said that American economic policy will become “incrementally populist... it's Robin Hood policy if you will, taking from the rich and giving to the poor.”

He said that both the Republican and Democratic parties have recently adopted populist talking points, with Trump and Harris advocating for tariffs, worker protections, and a strong U.S. dollar. These, he said, are different from the ideas advocated by prior politicians in the 2000s, 1990s, and 1980s.

Despite social and geopolitical upheaval, Dale predicted medium-term bullishness in risk assets.

In particular, as populist policies take hold, Dale said that governments will use inflation and money-printing to fund these policies. This, in turn, will debase the currency, which has historically been beneficial for risk assets.

“As long as you have monetary debasement, it tends to perpetuate raging bull markets in risk assets,” he explained.

In particular, Dale said that, “in a Goldilocks market regime, you generally want to be long high-beta equities over low-beta, cyclicals over defensives, growth over value, and small- and mid-caps over large-caps.”

STOCK IDEA:

American Pacific Mining (CSE:USGD | OTCQX:USGDF)

(Sponsored Post)

American Pacific Mining (CSE:USGD | OTCQX:USGDF) is a gold and copper mineral exploration and development company focused on projects in some of the world's best mining jurisdictions within the western United States. With both gold and copper surging to new all time highs, American Pacific provides investors with leveraged exposure to these in-demand metals. The Company recently published high-grade drill results from its Madison Project in Montana with gold hits as high as 10.4 grams per tonne over 12 metres and copper samples up to 45.5%. With a nearly $20M budget for 2024 and an abundance of drill results expected from its Palmer Copper-Zinc VMS project in Alaska in the coming weeks and months, American Pacific is a Company to watch.

CEO Warwick Smith recently interviewed American Pacific's largest shareholder, Michael Gentile, as part of the Company's new interview series, The Speculators. The Speculators delves into the world of high-stakes risk-takers and visionaries across finance, business, sports, and beyond. Each episode features in-depth interviews with individuals who have dared to speculate on themselves, risking it all in pursuit of their dreams and ambitions.

You can watch the full Michael Gentile interview here:

Michael Gentile, who is the former portfolio manager for the $500 million Formula Growth Fund and Founder of Bastion Asset Management, and owns approximately 12% of American Pacific, said this, of the last drill results from the Palmer project in Alaska published January 10, 2024: "When I saw this press release this afternoon, I nearly fell off my chair. I couldn't believe how good these results were. These are truly world-class copper intercepts." Additionally, institutions such as Merk Investments, Ixios Asset Management, Palos Management and Intact Financial own a collective 15%.

ECONOMY:

THIS IS TRIGGER FOR ‘WORLD DEPRESSION’

Steve Hanke, October 7, 2024

Steve Hanke, professor of applied economics at Johns Hopkins University, was back on the program to discuss the latest jobs report, his economic outlook, and geopolitical risks that face the global economy.

Hanke discussed the recent U.S. jobs report, released on October 4th, which showed a surprisingly high addition of 254,000 jobs, far exceeding the expected 140,000. Despite the headline number looking strong, Hanke said the situation revealed underlying weaknesses.

“The top line number looks great, but I don’t pay too much attention to it anymore,” said Hanke. “If you look under the hood, it’s fairly clear that things are deteriorating.”

Full-time jobs had decreased by almost 500,000, while part-time jobs had increased significantly by 800,000, and manufacturing jobs continued to decline, explained Hanke, who also suggested that the headline figures might be revised downward in the future. He implied that such job reports could be politically influenced, given the proximity of elections.

Turning to global risks, Hanke warned of escalating tensions in the Middle East, particularly if Israel strikes Iran’s oil infrastructure. He explained that Iran produces 2 percent of the world’s oil, and if its production were disrupted, oil prices would rise sharply.

However, the bigger concern, he said, was the Strait of Hormuz, which Iran controls and could potentially shut down in response to Israel’s escalation.

"If you shut the Strait of Hormuz... that accounts for about 20% of the world’s oil production,” Hanke explained. “You would have a world depression if 20% of the oil was cut.”

He emphasized that while the U.S. might attempt to counteract such a crisis by increasing shale oil production or drawing from its Strategic Petroleum Reserve, these measures would be insufficient to offset the massive loss of global oil supply.

ECONOMY:

JOBS REPORT SHOCKS MARKETS

Adrian Day, October 4, 2024

Adrian Day, President of Adrian Day Asset Management, returned to the show to discuss the latest jobs data, and to provide his economic outlook and market analysis.

While certain indicators, like the strong jobs report, appeared positive on the surface, Day said that the economy is “bifurcated,” noting that although Wall Street was performing well, a significant portion of the population was struggling. He said that “40 to 50 percent of the population is living paycheck to paycheck,” and noted that many were already in a recessionary environment.

On Federal Reserve policy, the market was overly optimistic in expecting multiple rate cuts, Day said. In his view, while additional cuts might occur, they were unlikely to materialize as quickly as anticipated.

“I think he [Jerome Powell] is also maybe pushing back a little bit on market expectations of rate cuts,” said Day.

Day also commented on the impact of rising oil prices on inflation.

“If we get to over $80 [per barrel of oil] and stay there, then that has a meaningful impact both on the economy and on inflation,” he said.

Rising energy costs, according to Day, would not only drive up transportation costs but also the price of goods across the board, further exacerbating inflationary pressures.

Regarding gold,, Day remained optimistic about its long-term prospects. He said that gold was “due for a pause” in the short term, but its resilience in the face of fluctuating economic conditions underscored its strength as an investment. He attributed this to several factors, including central bank buying, geopolitical risks, and inflationary pressures.

WHAT TO WATCH

Thursday, October 17, 2024

U.S. retail sales: This measures the total receipts of retail stores in the United States, reflecting consumer spending.

Friday, October 18, 2024

Housing Starts: This tracks the number of new residential construction projects that have begun.

Monday, October 21, 2024

U.S. Leading Economic Indicators: This is a composite index of key economic metrics, such as employment, manufacturing activity, and financial market performance.