Is The Market Pricing In War Escalation?

What spike in oil, VIX, signals, according to experts

TABLE OF CONTENTS

Market Recap: Brian Belski on longshoremen’s strike, MidEast tensions

EQUITIES: Cameron Dawson on the potential for a ‘dangerous’ melt-up

COMMODITIES: Jeff Christian on why new market highs are possible

MARKET RECAP

Latest News. The past week experienced a mix of tumultuous events: the unfolding damage from Hurricane Helene, labor strikes across U.S. coastal ports, and escalating tensions in the Middle East between Israel, Iran, and Hezbollah.

Helene, the deadliest hurricane since Katrina hit in 2005, tore across the U.S. south-east, resulting in a death toll that stands at 200 so far. Hundreds of people are missing, and 780,000 homes lack power a week after Helene ravaged the region. Tens of thousands of people lack running water. An Accuweather report states that the damage from the hurricane could end up costing $160 billion.

Another major event that played out over the past week was the International Longshoremen’s Association (ILA) strike, involving 47,000 port workers from Maine to Texas. The strike, which temporarily shut down 60 percent of containerized ship traffic into the U.S., has since been suspended until January of 2025. Harold Daggett, the President of the ILA, had threatened to “cripple” the U.S. economy through his union’s strike.

In the Middle East, growing conflict has heightened tensions between Israel, Iran, and Hezbollah. On Tuesday, October 1st, Iran fired more than 180 ballistic missiles at Israel in response to the latter’s targeting of Hezbollah in Lebanon. Hezbollah is backed by the Iranian government, which provides it with military and financial support. Iran’s missiles struck near Nevatim Airbase, which houses Israel’s F-35 fighter jets. Israel has vowed to retaliate.

To help bring clarity to these events, we were joined by Brian Belski, Chief Investment Strategist at BMO Capital Markets. At the time of the interview, the longshoremen’s strike was still in effect.

Belski highlighted that if the dock workers’ strike continues, it could worsen inflation, particularly in the retail sector, as companies struggle to manage inventory delays and rising shipping costs.

“The effects on supply chains are already being felt,” Belski said, “and this could lead to higher prices for consumers and broader economic slowdowns if not resolved soon.”

He also commented on escalating Middle East tensions, noting that they have led to increased volatility in oil prices and further destabilized the region. Belski indicated that geopolitical risks, such as the recent missile attacks and airstrikes, could have short-term economic consequences, especially in terms of energy supply disruptions.

Belski said that to hedge against geopolitical risk, gold is a good option.

“We’ve been bullish on gold since 2022 when Bitcoin was rolling over,” he said. “Gold obviously is going to have a premium, and usually does, during these types of volatile geopolitical events.”

Finally, despite chaotic times, Belski said that he remains bullish on stocks, forecasting that the S&P 500 will rise to 6,100 by the end of the year. He also predicted that the stock market will continue to perform well over the next half-decade.

“We believe that we’re on a path over the next five years where the United States’s stock market will average a compound annual growth rate of 10 to 15 percent,” he said. “From a liquidity basis, and from a stability basis, and from a consistency basis, U.S. stocks are number one.”

Market Movements

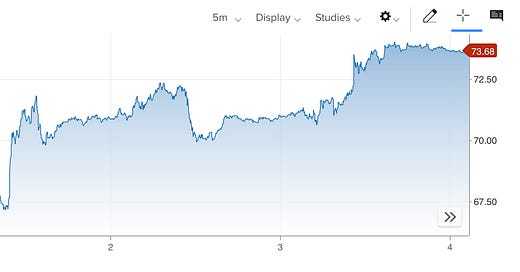

From September 26 to October 3, the following assets experienced dramatic swings in price. Data are up-to-date as of October 3 at 4pm ET (approximate).

VIX Index — up 33.3 percent.

WTI Crude Oil — up 9.3 percent.

AP Moller-Maersk A/S — down 11.6 percent.

Stellantis NV — down 13.8 percent.

Dell Technologies — down 8.6 percent.

What follows are the price movements of major assets.

DXY — up 0.96 percent.

Bitcoin — down 3.4 percent.

Gold — down 0.4 percent.

10-year Treasury yield — up 1.3 percent.

S&P 500 — down 0.8 percent.

Russell 2000 — down 1.3 percent.

USD/Yen — up 0.6 percent.

EQUITIES:

’DANGEROUS’ MARKET MELT UP AHEAD?

Cameron Dawson, October 2, 2024

Cameron Dawson, Chief Investment Office at NewEdge Wealth, returned to the show to discuss her outlook on financial markets and investing.

Dawson observed that the market has been consistently hitting all-time highs despite volatility, attributing this to stimulative fiscal policies and supportive monetary policies. She said that since the Federal Reserve has cut interest rates with further cuts expected, this has bolstered risk assets.

“If you're going to run highly stimulative fiscal policies that help support growth, at the same time as shifting to more easy and supportive monetary policies...risk assets typically love [this combination],” she explained.

Despite the market’s momentum, Dawson flagged several risks, including extended valuations, positioning, and earnings estimates. She said that the market has yet to reach a truly overbought condition, though she did warn of a potential “melt-up” in which the market rises too quickly, which could lead to a significant correction.

Dawson noted that inflation expectations, as measured by market break-evens, suggest a return to pre-pandemic levels, with no major return of inflation anticipated in the near term. Yet, she raised concerns about potential unexpected shocks, such as a spike in oil prices, which could upend this outlook.

She said, “Just because the Fed’s cutting interest rates doesn’t necessarily mean that inflation will take back off — you might need an exogenous shock like an oil shock.”

Looking forward, Dawson predicted that the stock market would continue to hit new highs through the end of the year, but warned of uncertainty in 2025. She suggested that some market gains could be pulled forward, which might complicate the market’s future outlook.

EQUITIES:

FED TO ‘KICKSTART’ INFLATION

Gareth Soloway, September 30, 2024

Gareth Soloway, Chief Market Strategist at VerifiedInvesting.com, returned to the show to give us his market and macroeconomic outlook.

Soloway predicted that inflation would return if the Fed continued its easing policies. This, he said, would lead to stagflation: a period of high inflation combined with economic stagnation. He pointed to the 1970s, when inflation persisted despite a slowing economy.

According to Soloway, “I do worry that the Fed being so aggressive on these cuts, you're going to see inflation start to move up, but you're not going to see the economic growth that you're hoping to get.”

He pointed to signs of economic weakening, including rising delinquency rates on credit cards, warnings from major companies like McDonald’s and Disney about consumer spending, and a slowing housing market. He cited these as evidence of a broader economic slowdown, which will likely be reflected in future corporate earnings.

Soloway said that many stocks, especially in the AI and tech sectors, were over-valued and vulnerable to corrections. Soloway was generally bearish on the market's long-term prospects. He expected that as the economy slowed, stock valuations would come under pressure, especially as earnings began to decline. He also mentioned the impact of rising debt levels and potential stagflation, which would weigh on the stock market’s future performance.

He warned that the next market correction could be severe, making the August 2024 dip “look like a small dip in the markets.”

STOCK IDEA:

Li-FT Power (TSXV: LIFT | OTCQX: LIFFF)

(Sponsored Post)

Li-FT Power) is emerging as a notable player in the lithium mining sector, just as global demand for lithium is set to accelerate. Located near Yellowknife in Canada's Northwest Territories—a region celebrated for its mining-friendly policies—the company boasts a world-class lithium deposit with unique advantages that position it strongly in the industry.

Key Highlights:

Exceptional Lithium Deposit: Li-FT Power's project features high-grade lithium-rich spodumene, with preliminary estimates suggesting over 50 million tons of lithium (to be verified in the upcoming resource estimate). Remarkably, much of this resource is at or near the surface, potentially reducing extraction costs and enhancing project economics.

Strategic Infrastructure Advantage: The deposit is just four miles from a major highway connecting to Yellowknife, a mining hub with existing infrastructure and a skilled workforce. This proximity offers significant logistical benefits and cost savings compared to remote projects.

Mining-Friendly Jurisdiction: The Northwest Territories contributes 30% of its GDP from mining activities. With a supportive local government and a community experienced in mining, Li-FT Power operates in a stable and low-risk environment.

Strong Leadership and Backing: Led by CEO Francis Macdonald, Li-FT Power is backed by industry experts and significant investors. The company has invested over $50 million in exploration and drilling, underscoring confidence in the project's potential.

Environmental Considerations: As lithium is crucial for batteries in electric vehicles and renewable energy storage, Li-FT Power's project aligns with the global push toward sustainable and green technologies.

Upcoming Catalysts: The company is expected to release its initial resource estimate and metallurgical studies soon. These developments could further validate the project's viability and attract increased attention.

Li-FT Power presents a compelling opportunity for those interested in the future of clean energy and the critical minerals that support it. With its high-grade deposit, advantageous location, and upcoming milestones, the company is well-positioned to meet the rising demand for lithium driven by the electric vehicle revolution and renewable energy expansion.

Discover More:

Watch our recent interview with Li-FT Power CEO Francis Macdonald, where we delve into the project's unique strengths, the dynamics of the lithium market, and how Li-FT Power aims to play a significant role in powering the world's shift to sustainable energy.

EQUITIES:

WILL THERE BE A COLLAPSE OR MASSIVE RALLY?

Jack Janasiewicz, September 29, 2024

We welcomed Jack Janasiewicz, portfolio manager at Natixis Investment Managers, to discuss how Fed policy could affect markets.

The Fed recently cut its key interest rate by 50bps, and Janasiewicz said that, “we’re pretty comfortable that inflation is continuing to head towards that 2% target, and now the key risk… is that the unemployment rate starts to drift up.”

In particular, although the labor market seems strong, Janasiewicz suggested that a slowing hiring pace and an increasing unemployment rate could be possible risks moving forward.

Despite the labor market risk, Janasiewicz said that markets are too aggressive in projecting another 200 basis points of rate cuts by the end of next year, explaining that, “if growth remains a little more resilient… the market may have to start pricing out some of those rate cuts.”

Janaciewicz expressed a bullish outlook on stocks, due to his prediction that corporate earnings and margins will remain strong. He recommended a "risk-on" approach, indicating that investors should favor equities over more conservative assets. He was optimistic about the stock market, particularly after the uncertainties surrounding geopolitical issues and elections clear up.

Janaciewicz highlighted that certain sectors, including technology, financials, consumer discretionary, and industrials, could perform well. He predicted that while tech stocks like the Mag7 would continue to show strength, the market could also see a “broadening out” of performance, meaning other sectors, such as financials and regional banks, could start to pick up as well.

He said, “I wouldn't be shocked if we're closing out all-time highs coming December 31st,” indicating his confidence in the strength of the stock market going forward.

ECONOMY:

FED ‘PANICKED,’ THIS IS WHAT POWELL IS WORRIED ABOUT

Gary Shilling, September 27, 2024

Gary Shilling, President of A. Gary Shilling & Co, joined us again to provide his economic outlook, touching upon the labor market, inflation, and monetary policy.

Shilling emphasized that the U.S. labor market is softening, despite weekly data showing a decline in jobless claims. He noted that while certain sectors, such as tech, are experiencing layoffs, overall indicators like job openings and quit rates suggest the market is becoming less robust.

Shilling said, referring to quit rates, "People don’t want to quit because they may not get new jobs," signalling a shift in the labor market's confidence.

He suggested that the Federal Reserve (Fed) has responded to this trend by cutting rates by 50 basis points.

“In a sense, that suggests the Fed is really panicked because they had had this engraved in stone 2% inflation target,” said Shilling. “The fact that they [cut by] 50 basis points rather than 25 tells me they’re pretty worried about the labor markets deteriorating.”

Shilling discussed the discrepancy between rising GDP and weakness in labor markets. He said that while GDP and Gross Domestic Income (GDI) figures were revised upward, these technical adjustments did not necessarily reflect a healthier economy. While a recession is not certain, Shilling highlighted the slowdown in consumer spending and savings rates, which may cut into earnings.

He said, “corporate profits are probably about as good as they’re going to get.”

Given his economic outlook, Shilling recommended being long on U.S. Treasuries, which he views as a safe haven, expecting interest rates to fall.

He noted, “I’m in it for appreciation…I expect rates to go down.”

Shilling also favored holding the U.S. dollar, given its safe-haven status in uncertain times. He remained bearish on commodities, believing that the global supply exceeds demand, and advised caution with equities, particularly given the recent speculative frenzy around stocks like Nvidia and Bitcoin.

COMMODITIES:

NEW RECORD MARKET HIGHS AMID CHINESE STIMULUS

Jeff Christian, September 28, 2024

We were joined by Jeff Christian, Managing Director of CPM Group, who commented on China’s recent economic stimulus, which is its largest since 2008, and its effect on commodities.

China’s stimulus program was recently unveiled in an effort to revive the country’s slowing economy. Christian said that since China is a managed economy with significant resources and financial levers, it can manage its economic challenges successfully, which would impact commodities.

He said, “If we assume that… Chinese monetary and fiscal policies are successful in plateauing and rejuvenating economic activity, you would expect increased demand for copper, lead, zinc, aluminum, and nickel... China has been one of the major consumers of base metals as well as precious metals for decades.”

When it comes to precious metals, Christian remained bullish due to economic and political pressures. He predicted that the economic environment in the next seven months would remain challenging, with potential for more stress after the U.S. elections. Global political uncertainty and U.S. inflationary pressures would drive gold even hire, he predicted.

"We think that the gold and silver prices will stay high, and that silver prices might move even higher,” he said. “Gold prices may move even higher later in 2025 into 2026.”

He suggested that while gold might not sustain levels of $3,000 per ounce in 2025, a temporary spike to that price could occur under extreme conditions.

“Can gold hit $3,000 on an intraday or daily basis?,” said Christian. “Yes. But sustained at $3,000 for 2025? That seems improbable unless we have a Civil War in the United States.”

Silver, which tracks both base metals and gold, was expected to outperform gold in the short term, said Christian.

He said, “Silver has a lot going for it, and it’s a tighter market, so less money going into silver has a more dynamic effect on the price than the same amount going into gold.”

WHAT TO WATCH

Friday, October 4, 2024

Unemployment Rate: The BLS will release these data, which measure the percentage of the labor force that is unemployed.

Hourly Wages: The BLS will also release these data, which tracks the average earnings per hour for employees in various sectors.

Tuesday, October 8, 2024

Trade Deficit: The Bureau of Economic Analysis (BEA) will release monthly trade deficit data.

Thursday, October 10, 2024

Consumer Price Index: The CPI is used to track the price level and inflation for consumer goods and services, and is released by the Bureau of Labor Statistics (BLS).

Friday, October 11, 2024

Producer Price Index: The PPI is used to track the price level and inflation for producers, and is released by the Bureau of Labor Statistics (BLS).