To Crash Or Not To Crash, That Is The Question

September rate cut a near certainty, but will markets soar or crash on Fed pivot?

TABLE OF CONTENTS

MACRO: Art Laffer on whether we can expect double-digit inflation

GEOPOLITICS: What happens to oil prices if Iran retaliates — Phil Pilkington

MARKET RECAP

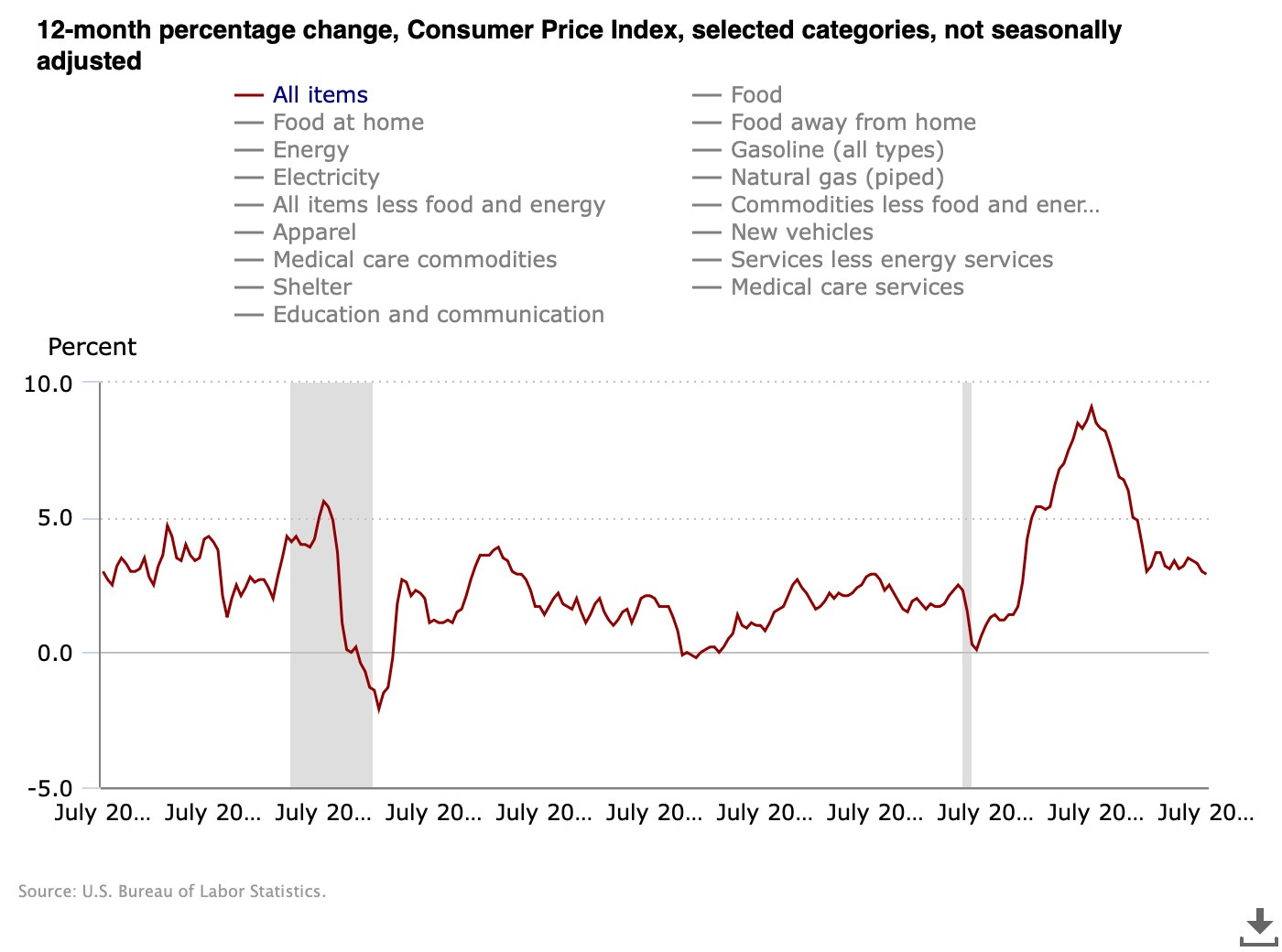

LATEST NEWS. Wednesday’s Consumer Price Index (CPI) report shows that year-over-year inflation was 2.9 percent in July, less than the expected 3 percent. Core inflation — which excludes energy and food — is up 3.2 percent.

Markets interpreted the cooler inflation figures as a sign that the Federal Reserve will cut interest rates in September. The S&P 500 rose 0.2 percent, the Dow climbed 0.56 percent, and the Nasdaq Composite fell 0.29 percent following Wednesday’s CPI release. Markets continued their upward climb after Tuesday’s Producer Price Index (PPI) publication also revealed less-than-expected wholesale price inflation.

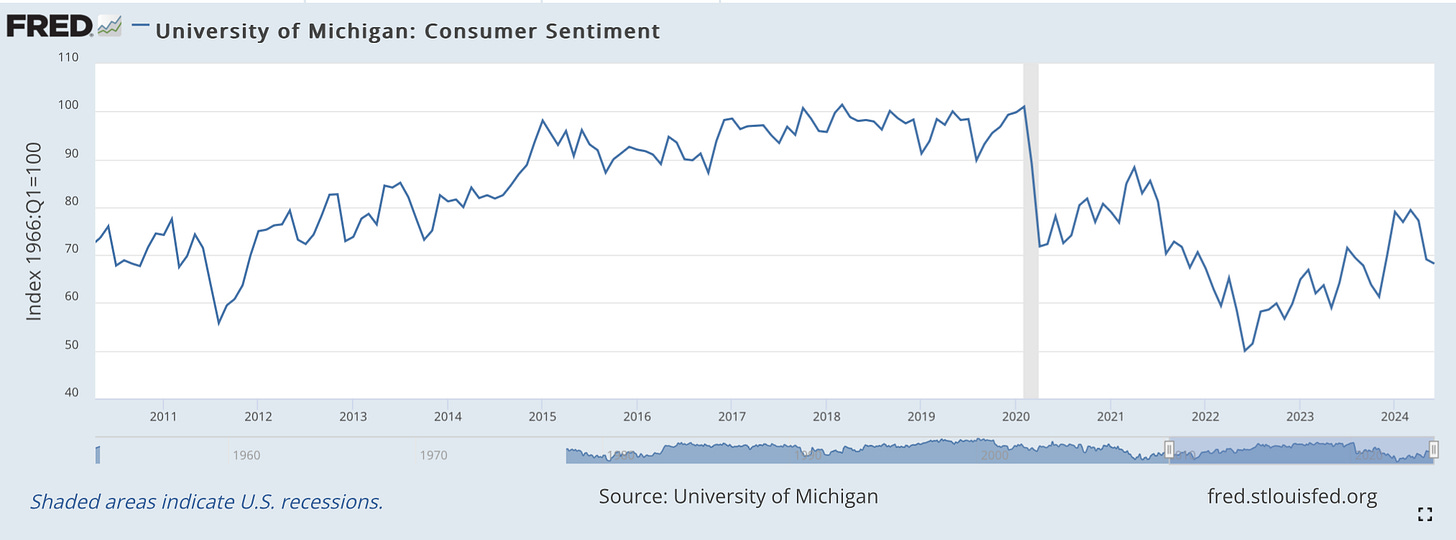

In every prior Fed cut cycle, a recession almost immediately followed a pivot. This chart illustrates this point (grey shaded areas are NBER-designated recessions).

This begs the question, will this time be any different?

We asked this question to Peter Boockvar, CIO of Bleakley Financial Group, who says that no, this time will likely not be different than past Fed cutting cycles. It is also premature to declare victory over inflation, Boockvar said. He predicts continued volatility in inflation, arguing that the downward trend will not stabilize at the Federal Reserve's 2% target, but rather fluctuate over the coming years.

Boockvar claims that the market's focus is shifting from expecting Federal Reserve rate cuts to hoping for real earnings growth. He warns that if inflation stabilizes at a level higher than the Fed's target, or if it becomes more volatile, then it could negatively impact markets.

On his economic outlook, Boockvar said that the U.S. economy is likely to suffer “death by a thousand cuts,” pointing to the recent and poor unemployment data as an example. He warns that the stock market's recent resilience may not last, as it has been buoyed by expectations of Federal Reserve rate cuts — rather than genuine economic growth. Boockvar stresses that future market performance will need to be underpinned by substantive economic and earnings growth rather than mere speculation on monetary policy shifts.

When it comes to investment implications, Boockvar remains bullish on commodities and precious metals, viewing the latter as good hedges in the current economic environment. He is also optimistic about the Chinese economy, and believes that its middle class will continue to grow.

Market Movements

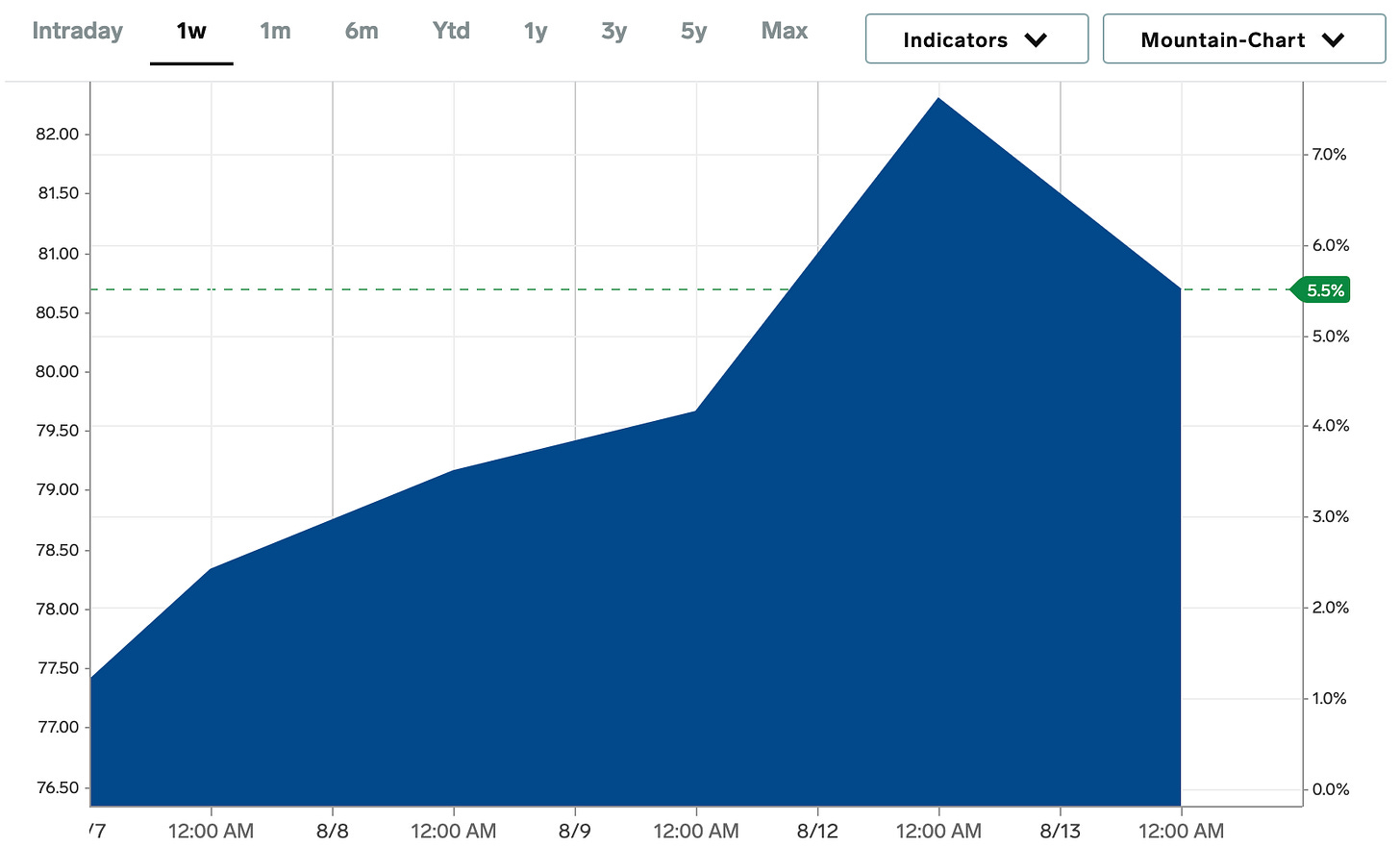

Risk assets have largely rebounded from the dramatic sell-off of early last week. From August 8th to August 14th, the following assets experienced dramatic swings in value. Prices are up-to-date as of August 14th at 4pm ET (approximate).

Starbucks. — up 25 percent.

Starbucks ousted its CEO Laxman Narasimhan, which led its stock price to rise.CBOE Volatility Index (VIX) — down 37 percent.

The VIX fell following the drop in market volatility from last week.Revance Technologies — up 133.8 percent.

The botox competitor announced its merger with Crown Laboratories, which plans to purchase its common stock for $6.66 per share in cash.Nvidia — up 15.8 percent.

Nvidia regained some of the losses it sustained from last week’s market volatility. However, the AI chip maker is still down 8 percent over the past month.JetBlue Airways — down 22 percent.

The airline announced plans to raise more than $3 billion in debt, largely backed by its loyalty program. Moody’s and The S&P downgraded JetBlue from B to B-.

For major assets, the price movements were as follows (All data is from August 14th at approximately 4pm ET.)

DXY — down 0.5 percent.

Bitcoin — up 7.5 percent.

Gold — up 2.7 percent.

10-year Treasury yield — down 3.1 percent.

S&P 500 — up 3.9 percent.

Russell 2000 — up 1.3 percent.

USD/Yen — up 0.3 percent.

MACRO:

EMERGENCY FED RESPONSE?

Thomas Hoenig, August 13, 2024

Thomas Hoenig, former President and CEO of the Kansas City Federal Reserve, joins us to weigh in on the last week’s market volatility, and whether the Fed should implement an emergency rate cut before September. Hoenig says that such an action would be “unfortunate.” He warns that cutting interest rates prematurely, before inflation is under control, would be a mistake that could perpetuate inflationary pressures and destabilize the economy further.

Assuming that inflation comes down to 2 percent, Hoenig believes that the optimal Federal Funds rate should be around 4 percent. He argues that this level is appropriate to maintain a balance between controlling inflation and supporting economic growth.

In response to former President Donald Trump’s suggestion that the U.S. president should have a say in monetary policy, Hoenig disagrees, emphasizing the importance of Fed independence. Hoenig suggests that major shifts in how the Fed operates should be debated and approved by Congress and the President, but the day-to-day decision-making on monetary policy should remain within the purview of the Fed, free from direct presidential influence.

Finally, Hoenig agrees with Vice President Kamala Harris on the importance of community banks. He acknowledges that community banks play a crucial role in supporting small businesses and local economies by providing financial services that are tailored to the specific needs of their communities.

MACRO:

TREASURY ACCUSED OF ‘RIGGING’ ELECTION

Steve Hanke, August 12, 2024

Steve Hanke, Professor of Applied Economics at Johns Hopkins, returned to the show to weigh in on Ukraine’s recent invasion of Russia, as well as accusations that the U.S. Treasury is manipulating interest rates for political reasons.

Hanke admits to being surprised by Ukraine’s incursion into Russia’s Kursk region, calling it a “Hail Mary pass.” Yet, he suggested that the Russians would stage a “fierce counterattack,” and that “the whole thing will end up going for naught.”

The Russian economy has proven resilient to sanctions, growing by a 4 percent annualized rate in Q2 of 2024. Hanke says that this does not surprise him, and attributes Europe's economic struggles partly to the "blowback" effect of these sanctions, which have disrupted trade and access to Russian resources.

On the issue of U.S. monetary policy, Hanke dismisses the recent claims that the U.S. Treasury is manipulating interest rates to influence the upcoming election. He argues instead that the recent decline in long-term bond yields is due to a contraction in the money supply, not Treasury actions. Hanke emphasizes that changes in the money supply, not interest rates, are the true indicators of monetary policy.

Hanke also touches on the growing U.S. national debt, suggesting that long-term solutions such as a constitutional amendment, similar to Switzerland's debt brake, might be necessary to control government spending.

MACRO:

WILL DOUBLE-DIGIT INFLATION RETURN?

Art Laffer, August 11, 2024

In his return to the show, Art Laffer, Chairman of Laffer Associates, discussed inflation, Fed policy, and the importance of low and predictable taxes.

Laffer is critical of the Federal Reserve, noting, “there's nothing the Fed can do that would help the economy more than being stable, solid, secure, mature, and steady as you go.” He argued that the Fed's current focus on interest rates is misguided and that stabilizing the value of the dollar should be its primary concern.

Laffer said that the Fed should focus on stabilizing its balance sheet rather than trying to control interest rates directly. He praises the approach of former Fed Chairman Paul Volcker, who allowed market forces to determine interest rates, a strategy Laffer believes should be re-adopted.

Regarding inflation, Laffer asserts that it can be controlled through lower taxes, which incentivized productivity growth. He also warns against weakening the dollar, as it would lead to higher inflation and interest rates, citing historical examples such as the 1970s devaluation, which led to double-digit inflation.

Last, Laffer suggests that low taxes incentivize economic growth, with reference to his book Taxes Have Consequences: An Income Tax History of the United States, which Laffer co-authored with Brian Domitrovic and Jeanne Cairns Sinquefield.

GEOPOLITICS:

’GLOBAL SHORTAGE OF OIL’

Philip Pilkington, August 8, 2024

Geopolitical expert and macroeconomist Philip Pilkington joins the show to explain the rising tensions in the Middle East, and how they may impact the price of oil.

With reference to escalating hostilities between Iran and Israel in particular, Pilkington said that if Iran were to block the Strait of Hormuz, this would effectively cut off the Persian gulf’s oil supplies, and would be equivalent to the 1973 oil crisis. A global oil shortage, accompanied by a sharp increase in prices, would ensue. Pilkington further suggests that markets have not fully priced in this possibility.

He argued that while a full-scale war could lead to a significant economic impact, the likelihood of this escalating into a global conflict like World War III remains low. Instead, he sees it more as a proxy war similar to the situation in Ukraine. He also highlights the importance of watching developments in the South China Sea, which could lead to severe economic disruptions if tensions with China escalate, especially through sanctions.

CRYPTOCURRENCIES:

START OF BIGGER ‘CONTAGION’?

Ran Neuner, August 7, 2024

In this interview, Crypto Banter founder Ran Neuner discussed the recent volatility in the crypto market, particularly focusing on Bitcoin's sharp decline. He attributed this drop to broader macroeconomic factors, specifically the unwinding of the Japanese yen carry trade. Neuner explains that the Bank of Japan's unexpected interest rate hike has prevented investors from borrowing yen at near-zero interest rates to invest in riskier assets like U.S. stocks and Bitcoin. As interest rates rise, these previously low-risk loans are no longer attractive, which could pressure global markets.

Neuner highlights that while the immediate crisis has been mitigated by the Bank of Japan’s decision to pause further rate hikes, the underlying issues remain unresolved. He draws parallels with the U.S. Federal Reserve's actions during the Silicon Valley Bank collapse, where temporary measures were taken without addressing the root problems.

Despite these challenges, Neuner remains cautiously optimistic about the market's future. He believes that the overall four-year cycle of Bitcoin is intact, and that we are in a phase of sideways movement before the next significant rally. He said that he would be disappointed if Bitcoin doesn't reach at least $200,000 during this cycle, which he expects to peak around the end of 2025.

He also claims that if global liquidity increases due to central banks cutting rates, risk assets like Bitcoin are likely to benefit. However, he warns that the market's expectation of multiple rate cuts by the Federal Reserve are overly optimistic, unless the economy significantly worsens.

Neuner also discusses the potential of Ethereum and Solana in this market cycle, noting that Solana is emerging as a major player due to its fast and cheap transactions, which have made it popular for trading meme coins.

WHAT TO WATCH

Thursday, August 15, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

U.S. Retail Sales: This measures the total receipts of retail stores in the United States, reflecting consumer spending and economic health.

Friday, August 16, 2024

Housing Starts: This tracks the number of new residential construction projects that have begun, indicating the health of the housing market and overall economy.

Wednesday, August 21, 2024

Minutes of Fed’s July FOMC Meeting. A detailed record of the committee's discussions and decisions regarding monetary policy, including their assessments of the economy, inflation, and interest rates

Thursday, August 22, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

Existing Home Sales: The total number of completed transactions for homes that were previously owned, measured monthly. This data is published by the National Association of Realtors (NAR).

Friday, August 23, 2024

Fed Chairman Jerome Powell to speak at Jackson Hole. Powell is expected to speak at the annual Jackson Hole Economic Symposium in Wyoming.

New Home Sales: This refers to the number of newly constructed single-family homes that have been sold over a given period, typically reported monthly. It is published by the U.S. Census Bureau and the Department of Housing and Urban Development (HUD).