Start Of Another 2008 Financial Crisis?

Is this the start of a major bear market, or just a temporary correction?

TABLE OF CONTENTS

MARKET RECAP

LATEST NEWS. Markets crashed on Monday, August 5th, with stocks sinking to their lowest levels since May. Crypto markets were also adversely affected.

The S&P fell 3 percent, making Monday its worst trading day since September of 2022. The NASDAQ’s 3.4 percent fall was its largest since July 24th. Bitcoin tumbled by 11 percent to a six-month low, its worst price drop since 2021. The CBOE Volatility Index (VIX) spiked to its highest closing level since October of 2022, indicating significant uncertainty in markets.

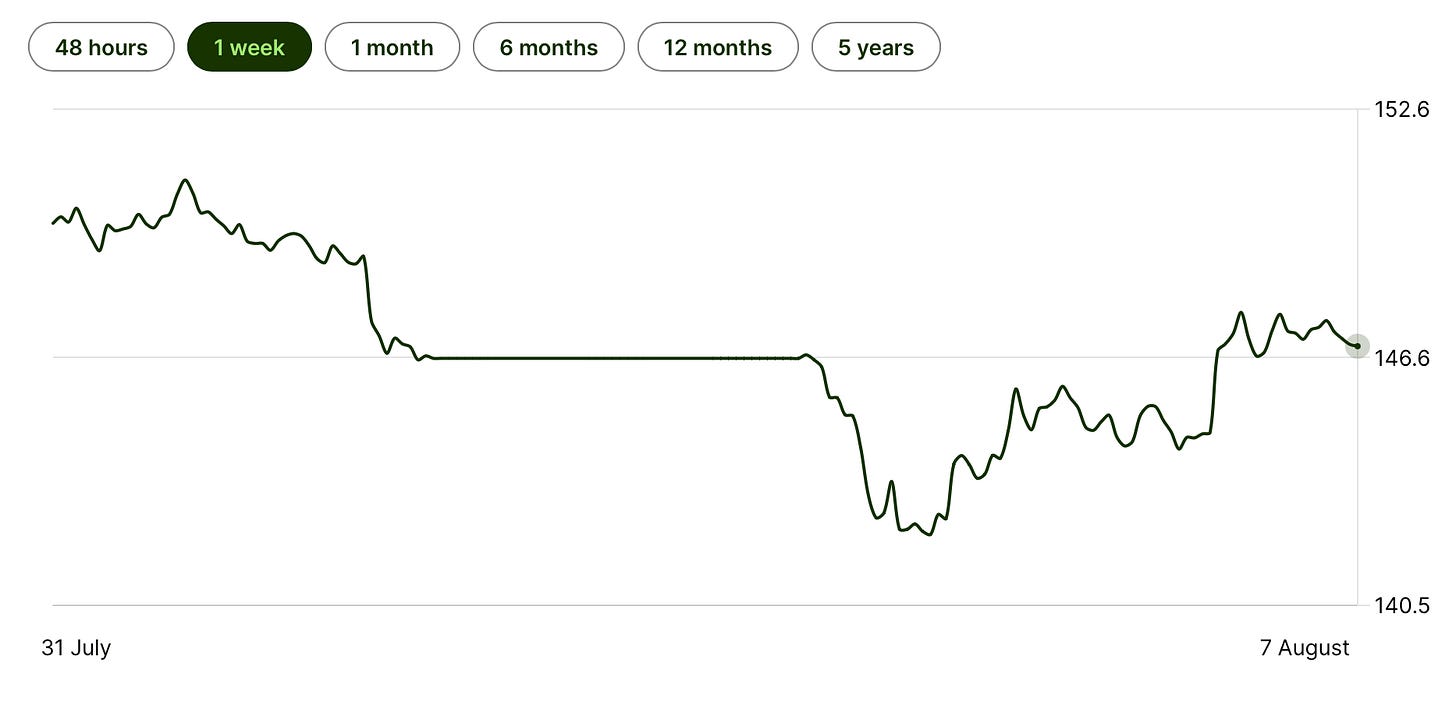

Since then, markets have recovered somewhat, but still remain battered compared to a week ago. Japan’s Nikkei index is down 9.5 percent and the Topix is down 10 percent from August 1st. U.S. stocks and crypto have yet to fully recover their losses.

Japan played a major role in the unfolding market drama, according to Michael Gayed, Publisher of the Lead-Lad Report and a regular guest on our program.

Gayed first claimed in August of 2023 that the yen carry trade — whereby investors borrow in negative interest rates in Japan to fund high-yielding investments in the U.S. — would unwind, causing a market disruption. When the Bank of Japan raised interest rates by 0.25 percentage points on July 31st, 2024, this triggered a sell-off in U.S. risk assets, so that investors could cover higher interest payments in Japan, says Gayed.

The unemployment data release on Friday, August 2nd, added to the stress, showing that U.S. unemployment had increased to 4.3 percent in July, up from 4.1 percent in June.

Gayed believes that there will be “more pain” to come in the coming weeks, due to the ongoing risk of default in corporate credit markets, and because of broader economic problems signalled by sustained yield curve inversion. He says that there needs be a “repricing of default risk in corporate credit.”

Gayed also warns that Federal Reserve rate cuts could exacerbate the problem in markets, explaining that cuts would narrow the interest rate differential between the U.S. and Japan — hence accelerating the reverse carry trade.

To prepare for this, Gayed suggests holding risk-off assets such as gold, treasuries, and utility companies, stating that, “If you're going to be long only, or you want to just take some risk off the table... gold, treasuries, the dollar itself, utilities those all make sense."

Market Movements

From August 1st to August 7, the following assets experienced dramatic moves in value. Prices are up-to-date as of August 7th at 4:20pm ET. (approximate).

S&P 500 — down 6.1 percent.

Bitcoin — down 16.1 percent.

Nasdaq Composite — down 8.2 percent.

Lumen Technologies — the telecommunications firm is up 101.5 percent since last Thursday, after securing a $5 billion deal to provide AI connectivity.

Russell 2000 — down 9.7 percent.

For major assets, the price movements were as follows (All data is from August 7th at approximately 4:20pm ET.)

DXY — down 1.3 percent.

Bitcoin — down 16.1 percent.

Gold — down 2.5 percent.

10-year Treasury yield — up 2 percent.

S&P 500 — down 6.1 percent.

Russell 2000 — down 9.7 percent.

USD/Yen — down 2 percent.

EQUITIES:

’THE MARKET IS BROKEN’

Chris Vermeulen, August 5, 2024

Billionaire investor Warren Buffett’s recent disclosure that his company, Berkshire Hathaway, had sold almost half of its Apple stock added to the market panic on Monday, says Chris Vermeulen, Chief Market Strategist at TheTechnicalTraders.com.

Despite the intense sell-off, Vermeulen claims that this might represent an intermediate low, with potential for a short-term bounce. He revealed that he and his team had exited long positions two weeks prior, anticipating market volatility. He cautions against the "buy the dip" mentality, suggesting that while a bounce is possible, he does not foresee new all-time highs in the near future. Instead, he predicts a choppy market that might form a bearish flag pattern, potentially leading to a further significant leg down.

Vermeulen emphasizes the importance having a strategic plan, noting that panic selling is often driven by emotional rather than rational decisions. He predicts that the Magnificent 7 tech stocks (Apple, Amazon, Alphabet, Meta, Microsoft Nvidia, Tesla) could shed $1 trillion in value. Vermeulen highlights the value of moving to cash or safe assets when market trends turn unfavorable, prioritizing capital protection over chasing gains.

In particular, Vermeulen is bullish on the U.S. dollar, citing its history of performing well during economic downturns. He anticipates that the U.S. dollar index (DXY) could reach the 116-120 range; it is currently trading around 103. He also claims that short-term government bonds, cash and cash equivalents, and inverse ETFs could perform well during periods of market volatility.

MACRO:

’THINGS ARE SHAKING’ SAYS MOODY’S ECONOMIST

Mark Zandi, August 4, 2024

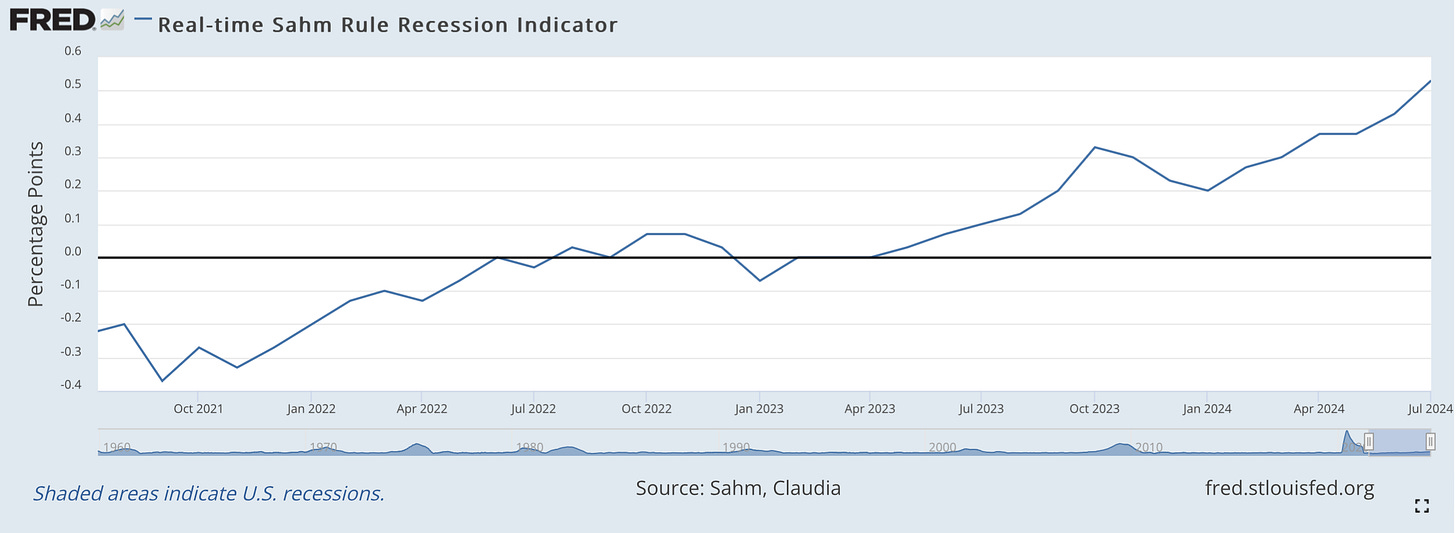

The Sahm Rule, which is used to determine whether the economy has entered a recession, was triggered on Friday following bleak unemployment data. The Rule is triggered when the three-month moving average of the unemployment rate is at least 0.5 percentage points above its 12-month low.

However, Mark Zandi, Chief Economist of Moody’s, argues against this interpretation of The Sahm Rule, claiming that the unemployment increase is due to mass immigration, and not an economic downturn.

Zandi highlights that despite some weakening in job growth, the economy continues to create a substantial number of jobs, with payroll employment still rising. He points out that the current job growth rate, although slower, is largely a result of the Federal Reserve's deliberate efforts to cool the economy by raising interest rates. This, he believes, does not signal a recession but rather a controlled moderation of economic activity.

The Federal Reserve needs to cut rates, according to Zandi, who argues that maintaining high rates risks damaging the economy. “If the economy is already doing well, and inflation is on the right track, why do we need cuts?,” says Zandi. He says that the economy can only handle the high rates for a limited time before something breaks, as evidenced by recent stresses in the financial system and labor market.

Zandi also touches on the impact of the U.S. presidential and congressional elections, noting that a Republican sweep in November, whereby Trump wins the presidency and the GOP wins Congress, could lead to higher inflation due to policies like tariffs and tax cuts. He says that a Democratic sweep would lead to spending on more social programs, and that a divided President/Congress would likely lead to a continuation of the status quo.

MACRO:

FED TO CAUSE MORE DAMAGE

Jim Bianco, August 3, 2024

Although markets expect the Federal Reserve to cut rates in September, Bianco Research President, Jim Bianco, claims that rate cuts could be disastrous, reigniting inflation. Bianco claims that the current state of the economy and labor market means that a rate cut is not needed, and expresses skepticism about a September rate cut.

Bianco places himself in the “no landing” camp, suggesting that the economy will continue to grow without a recession. He highlights the rising unemployment rate, attributing it to demographic changes due to mass immigration rather than an economic slowdown. “The rising unemployment rate is a reflection of a changing demographic in the United States, not a slowing economy,” Bianco explains, noting that the payroll report has remained strong.

Discussing potential rate cuts' impact on the stock market, Bianco outlines two scenarios. In a strong economic environment, a rate cut could act as a stimulus, boosting the market by providing cheaper money. However, if economic data worsens, it could be seen as a panic move, leading to negative market reactions. “If the data turns seriously south, then a rate cut is going to be perceived as a bit of a panic,” he remarks.

When it comes to investment implications, Bianco prefers small-cap stocks and energy. He anticipates a rebound in energy prices, driven by potential economic improvements in China. Yet, he remains cautious about the financial and technology sectors, citing concerns about over-valuation and potential disruptions. He described the technology sector, particularly stocks associated with artificial intelligence, as being in a bubble, similar to the late 1990s tech bubble. “There's no doubt that there's an AI bubble,” Bianco asserted, warning of the risks associated with inflated expectations.

MONETARY AND FISCAL POLICY:

’SLOW MOTION FISCAL CRISIS’

Lyn Alden, August 1, 2024

Lyn Alden, Founder of Lyn Alden Investment Research, is concerned about the U.S. national debt, which has surpassed $35 trillion, noting that such high levels could lead to a “slow-motion fiscal crisis.” Alden predicts that this issue will not cause trouble in the next year or two, but will likely become more problematic over the next five years; as the debt increases, there could be a shortage of buyers, requiring the Federal Reserve to step in and purchase more debt, even if inflation remains above target.

Alden explains that the Fed is waiting for more data before making any cuts, as the Fed is balancing its inflation and employment mandates. Alden claims that there are mixed signals from different sectors of the economy. Manufacturing has been in a recession for over a year and a half, while the service and travel sectors remain strong. Alden suggests that the Fed's cautious approach makes sense given the uncertainty.

Alden claims that fiscal dominance is apparent, explaining that fiscal deficits have become larger than new bank loans. Thus, interest rate hikes impact federal interest expenses more than private-sector lending. If rates are cut but remain higher than previous lows, Alden claims that the economic impact would be limited. Many mortgages and corporate debt may not be refinanced, as many have already locked in lower rates during previous periods.

Addressing the potential for a sovereign debt crisis, Alden differentiates the current situation from the 2008 private sector debt crisis, suggesting that a prolonged fiscal issue could arise if central banks accommodate deficits amid high inflation.

In terms of investment, Alden prefers equities with strong earnings yields, selective emerging markets, and the energy sector over bonds. Alden also sees opportunities in oil, gas, uranium, and certain infrastructure plays, noting that these areas offer better returns than traditional bonds.

CRYPTOCURRENCIES:

CALM BEFORE ANOTHER STORM?

Ran Neuner, August 7, 2024

Ran Neuner, Founder of Crypto Banter, responds to the recent crash in Bitcoin’s price, suggesting that this is due to factors such as the unwinding of the yen carry trade, which caused a sell-off of risk assets like Bitcoin. Neuner claims that this drawdown could present a cyclical buying opportunity, since Bitcoin’s fundamentals remain robust.

The interview delves into the implications of the Bitcoin halving cycles, with Neuner asserting that the current cycle is in line with historical patterns, which typically see a period of sideways movement before a significant upward trend. He draws parallels with past cycles, suggesting that the current market conditions are not unique.

Neuner also touches on the broader market implications of potential rate cuts by the Federal Reserve, indicating that increased liquidity and quantitative easing could spur a rally in risk assets, including Bitcoin. He notes, “Risk assets should rally into those kind of conditions,” though he expresses skepticism about the likelihood of a 50 basis point rate cut in the near term.

Furthermore, Neuner discusses the potential of Ethereum and Solana, highlighting Ethereum's strong fundamentals and the significant activity on the Solana network, particularly in the meme coin market. He remains confident in the long-term value of these cryptocurrencies despite short-term volatility.

WHAT TO WATCH

Thursday, August 8, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

Monday, August 12, 2024

Monthly U.S. federal budget: Released by the U.S. Treasury, this monthly report shows receipts and outlays, and whether the U.S. federal government is in a monthly surplus or deficit.

Tuesday, August 13, 2024

Producer Price Index: The Bureau of Labor Statistics will release the monthly PPI, which measures the level in selling prices domestic producers receive for their output.

Wednesday, August 14, 2024

Consumer Price Index: The Bureau of Labor Statistics will release the monthly CPI, which measures the price level that consumers pay for goods and services.

Thursday, August 15, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

U.S. Retail Sales: This measures the total receipts of retail stores in the United States, reflecting consumer spending and economic health.

Friday, August 16, 2024

Housing Starts. This tracks the number of new residential construction projects that have begun, indicating the health of the housing market and overall economy.

Well done and thanks for the summary.