Is Labor Market In Danger Of Collapse?

Fed Chair Powell needs to see 'material' cooling in labor market before cuts

This week is dominated by the divergence of central bank policies: the U.S. Federal Reserve kept rates unchanged, while the Bank of England cut rates for the first time in four years a quarter percent to 5 percent. The Bank of Japan, on the other hand, raised rates for the second time in 17 years from 0% to 0.1%. Markets are showing greater signs of volatility, with the major stock indices fluctuating with greater magnitude on a daily basis.

As of Thursday morning, the CME FedWatch tool is projecting a 100% chance of a Fed rate cut by September: 80% chance of a 25 bps cut, and a 20% chance of a 50 bps cut, a decision that Fed Chair Powell said is “not something we’re thinking about right now,” when asked by a reporter if a 50 bps cut is “on the table” for September.

Should the Fed keep rates unchanged until September, it would mean the Fed Funds rate has stayed elevated for a longer period of time before a pivot than both of the prior two Fed pivots (2019 and 2007).

On the fiscal front, the U.S. national debt surpassed $35 trillion in July. Federal interest payment on debt is now reaching $1.1 trillion, roughly 33% of the $3 trillion in federal tax receipts. This debt level is expected to increase. According to the Congressional Budget Office, “Debt held by the public rises from 99 percent of GDP this year to 122 percent in 2034, surpassing its previous high of 106 percent of GDP.”

TABLE OF CONTENTS

MONETARY POLICY: Steve Hanke on whether The Fed is going bankrupt

CRYPTO: Paul Barron on Trump’s proposed Bitcoin strategic reserve

MARKET RECAP

LATEST NEWS. The Federal Reserve maintained interest rates in the 5.25-5.50 percent range on July 31st after the FOMC Meeting. In a press conference following the meeting, Chairman Jerome Powell said that “a reduction in the policy rate could be on the table as soon as the next meeting in September.”

Powell will be looking for indications that Core PCE, the Fed’s preferred inflation measure, is within the Fed’s 2 percent target, and that economic data continues along its current path.

“If that test is met, a reduction in our policy rate could be on the table as soon as the next meeting in September,” Powell said.

When asked by a reporter if a “pre-emptive” rate cut would be considered if the labor market starts showing unexpected signs of “cooling”, Powell said that “I wouldn’t say I wouldn’t want to see any cooling. It would be more material difference. We would be looking at this and if we see that looks like a more significant downturn, that would be something that we would have the intention of responding to.”

Following the announcement, markets responded positively with rallies in stocks and gold. The bond market saw significant movement with the 10-year yield closing down at 4.07%, indicating a massive rally.

To get a deeper perspective on Fed policy, we spoke with Danielle DiMartino Booth, CEO of QI Research, who says that a rate cut in September is highly likely, with more cuts to follow this year. She argues that given the weakening labor market and growing indicators of a recession, the Fed should have cut immediately and more aggressively.

Booth argues that the labor market is experiencing substantial weaknesses, as seen in the fall in construction and professional job openings. She also points to rising under-employment, with 1.5 million full-time jobs lost in the past six months.

On this last point, Booth says, “It’s difficult to make the case that we’re not potentially in a recession, or have been in recession, given the magnitude of the revisions that we’re seeing, and the abruptness of the slowdown.”

Booth claims that inflationary pressures are easing. She notes that significant indicators, such as wage inflation metrics and the Employment Cost Index, are coming in below expectations, suggesting that inflation is on a downward trajectory.

“I think inflation is beaten,” Booth remarks. She also points to a dramatic decline in Trueflation data, a leading indicator she follows closely, which recently came in at 1.51%.

“The disinflationary winds are blowing hard,” says Booth. “Powell’s going to see the additional evidence on the inflation front that he is looking for [to cut rates].”

Market Movements

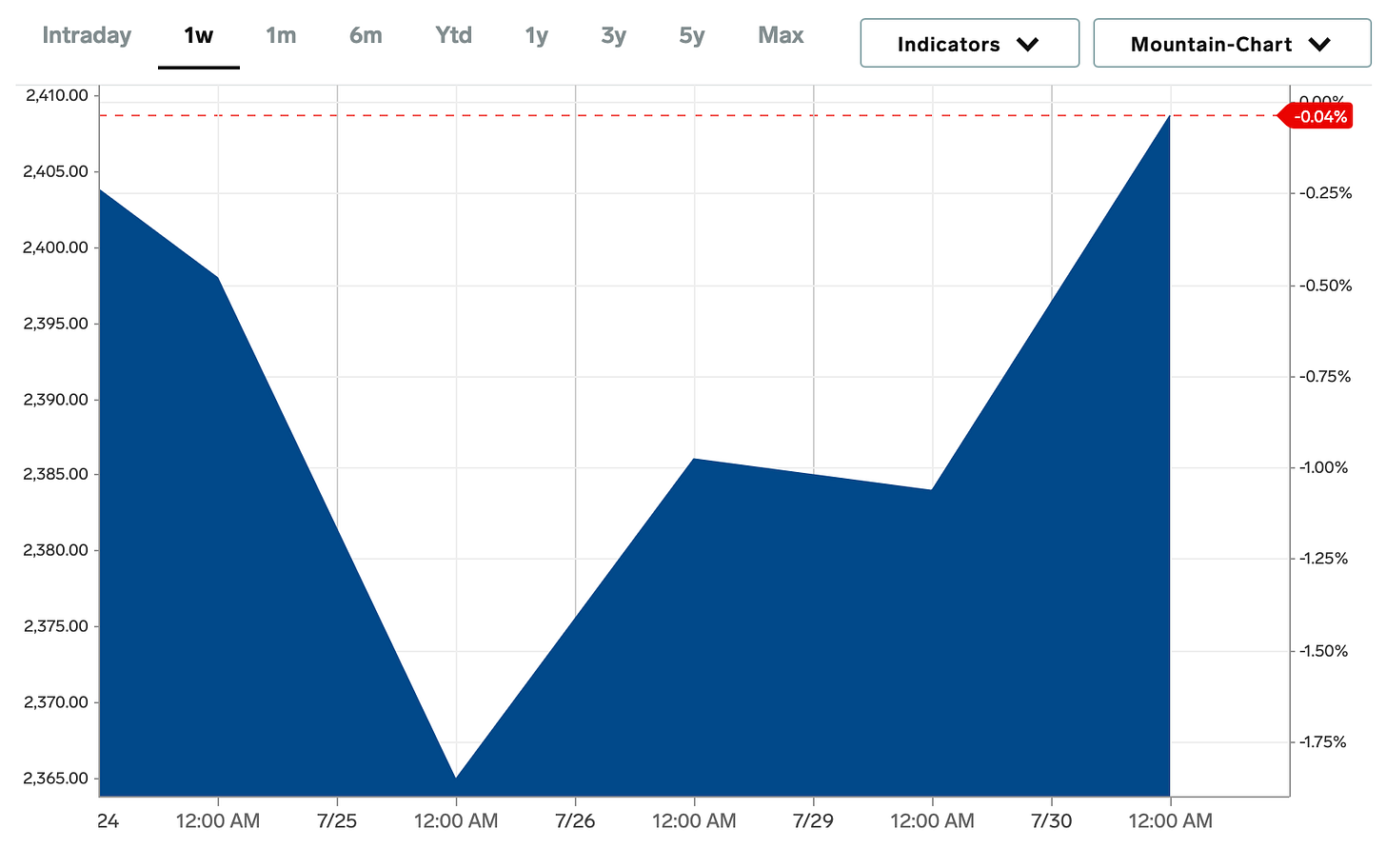

From July 25th to July 31st, the following assets experienced significant swings in value.

Soybeans. The commodity is down 5 percent over the last week, down to its lowest level since October of 2020. It is currently trading at around $1,023/BU.

Tesla. The EV manufacturer is up 6.8 percent over the past 5 trading days.

Coffee. The commodity is down 3.3 percent to $2.29 per pound.

Merck. The drug company fell 11 percent after adjusting its EPS projection downwards.

Crowdstrike. The cybersecurity company continues its decline since a software upgrade caused a major cyber outage. The stock fell 8.6 percent over the past week.

For major assets, the price movements were as follows (all data is from July 31st at approximately 5pm ET):

DXY — down 0.3 percent.

Bitcoin — down 1.6 percent.

Gold — down 0.4 percent.

10-year Treasury yield — down 1.7 percent.

S&P 500 — up 2.2 percent.

Russell 2000 Index — up 2.5 percent.

USD/Yen — down 2.3 percent.

EQUITIES:

THE FOURTH TURNING IS HERE

David Hay, July 31, 2024

David Hay, co-CIO of Evergreen Gavekal, discusses ‘The Fourth Turning’ — the recurring mega-crisis occurring roughly every 80 years, marked by significant economic volatility and social upheaval. Hay believes that we are in the midst of The Fourth Turning, and will experience further inflation and political instability. To prepare for this, Hay recommends investing in proven stocks and hard assets.

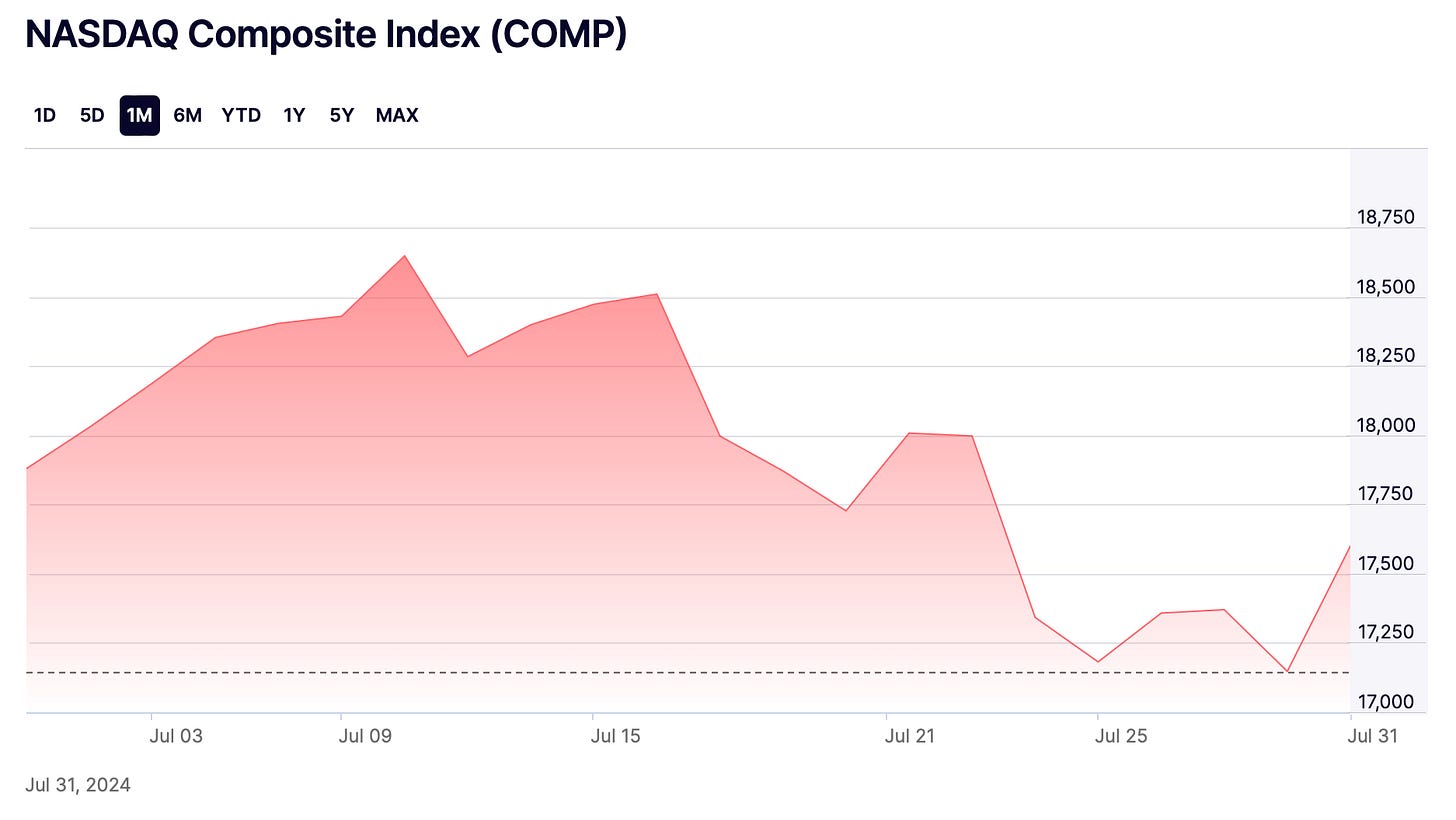

He discusses The NASDAQ's recent drop, driven by a tech sell-off, which he attributes to concerns about economic deceleration and potential interest rate cuts by the Fed. He mentions a sector rotation, whereby small companies gain favor due to perceived economic slowdown, although Hay expresses skepticism about significant rate cuts in the near term.

Regarding investment implications, Hay says that investing in small caps, albeit with caution, could prove profitable. He remains skeptical about a sustained tech rally, warning against overvalued stocks; he prefers mid-caps and reliable dividend stocks. He mentions Ryanair as a company trading at a reasonable valuation.

Hay also discusses the potential bond market stress due to rising interest rates and suggests avoiding long bonds.

In commodities, Hay sees oil as volatile but notes a potential rally if political actions like the Strategic Petroleum Reserve release subside. He is bullish on gold, seeing it as a hedge against inflation and potential revaluation to address debt issues. He also favors silver, palladium, and copper as plays on green energy and economic resilience.

EQUITIES:

MOST BEARISH SIGNAL EVER

Gareth Soloway, July 26, 2024

Gareth Soloway, Chief Market Strategist at VerifiedInvesting.com, claims that despite a temporary rebound, the correction in tech stocks is not over. He states that valuations of mega-cap tech stocks are significantly out of line with reality, citing high P/E ratios and slowing economic growth. He expects further downside, especially once the Federal Reserve starts cutting rates, which historically is associated with market declines.

Soloway has turned bullish on Bitcoin, noting its consolidation pattern. He expects Bitcoin to make an upward move in the next few months, comparing its current behavior to previous patterns observed in 2019. He points to the significance of the pivot line at $64,000, suggesting that as long as Bitcoin stays above this line, it remains bullish. Soloway's price target for Bitcoin is to retest its all-time highs, which are around $70,000 to $75,000.

Regarding Ethereum, Soloway explains its recent decline despite the launch of the Ethereum ETF, attributing the drop to broader market sell-offs, especially in tech stocks. He cautions that altcoins, including Ethereum, are more closely tied to the performance of risk assets like tech stocks.

Soloway also mentions other assets such as gold, silver, and oil. He remains bullish on gold in the long term due to continuous “money printing” and the U.S. growing debt burden. However, he suggests that gold could see a short-term correction. Silver, while weaker than gold, is expected to head down towards $26 before resuming its upward trend. On oil, Soloway predicts a decline to $50 per barrel by next year, driven by a potential recession and global economic slowdown.

MONETARY POLICY:

IS FED GOING BANKRUPT?

Steve Hanke, July 28, 2024

Professor of Applied Economics at Johns Hopkins University, Steve Hanke, returns to the show to discuss inflation, Federal Reserve policy, and U.S. debt.

Emphasizing the role of the M2 money supply in determining inflation rates, Hanke predicts that Consumer Price Index (CPI) inflation will fall to between 2.5% and 3% by the end of the year, aligning with his long-held views. The latest CPI reading for June of 2024 suggests annual inflation of 3.3 percent.

Hanke criticizes the Federal Reserve's interest rate target, saying that their lack of focus on the money supply amounts to bad policymaking. He explains that the Fed's significant losses, over $100 billion in 2023 due to its underwater securities holdings, will have more of a fiscal impact than a monetary one. These losses mean less money transferred to the government, potentially increasing the federal deficit.

Hanke dismisses the idea of a uniform global inflation rate, claiming that individual countries’ money supply growth determines inflation. He mentions that countries with inflation "roller coasters," such as the U.S. and Eurozone, had significant M2 growth, while those with more stable inflation rates, like China and Japan, did not.

Professor Hanke agrees with Elon Musk's assertion that America's fiscal path is unsustainable, suggesting that the solution lies in either reigning in government spending, increasing taxes, or using inflation to pay for spending. He advocates for a constitutional amendment similar to Switzerland's ‘debt brake’ to control spending and balance the budget.

Furthermore, Hanke critiques the idea of weakening the dollar to boost exports, as proposed by Republican Vice Presidential candidate JD Vance, labeling it a “stupid idea.” He argues that a strong dollar is beneficial, enabling the U.S. to run trade deficits and finance them at low interest rates. He points out that countries with weak currencies, like Argentina, suffer from high inflation and economic instability.

Last, Hanke touches on the concept of a U.S. Bitcoin strategic reserve, comparing it to El Salvador's approach and dismissing it as “Third World rubbish.” He argues that Bitcoin, as a highly speculative asset with no fundamental value, is unsuitable for such a role.

CRYPTOCURRENCIES:

THIS CAN SAVE THE U.S. FROM ITS DEBT PROBLEM

Paul Barron, July 30, 2024

Paul Barron, CEO of the Paul Barron Network, discusses the significance of former President Donald Trump's speech at The Bitcoin Conference, in which Trump proposed a strategic Bitcoin reserve and the firing of SEC Chair Gary Gensler. He views these moves as potentially transformative for Bitcoin adoption and the broader crypto market. It could also position the U.S. as a leader in the digital asset economy.

Barron highlights that such moves could mainstream Bitcoin, providing a significant boost to its price and adoption, potentially even helping to address the U.S.'s substantial debt situation. He posits that Bitcoin's appreciation as an asset could offer a strategic reserve to mitigate the U.S.’s fiscal challenges.

Barron also delves into the recent tech sell-off, noting that while mainstream analysts remain optimistic about the sector, he remains cautious due to potential market fatigue and the emergence of new competitors. He specifically mentions Nvidia, expressing a belief in its continued dominance in the GPU sector despite rising competition, but he maintains a cautious stance due to high valuations.

Furthermore, Barron discusses the potential for innovation and competition within the chip-making industry, particularly between Nvidia and Apple. He speculates that Apple's advancements in AI through partnerships and in-house chip development could challenge Nvidia's market position in the future.

On the subject of cryptocurrencies, Barron is optimistic about the long-term prospects of Bitcoin, Ethereum, and other blockchain technologies. Barron also discusses the potential impact of upcoming Ethereum and Solana ETFs, noting their significance for broader market adoption and the development of web3 applications.

CRYPTOCURRENCIES:

BITCOIN STRATEGIC RESERVE COMING?

Fred Thiel, July 26, 2024

Fred Thiel, CEO of Marathon Digital Holdings, discusses the company's recent $100 million Bitcoin purchase and provides insights into the current and future state of Bitcoin and cryptocurrency markets.

Thiel explains that Marathon Digital, a major Bitcoin mining company, decided to purchase additional Bitcoin to strategically enhance its assets. He mentions that although Marathon Digital mines Bitcoin, it also mines other cryptocurrencies like Kaspa, which can be sold to buy Bitcoin at a lower cost. Thiel highlights the economic advantage of holding Bitcoin over fiat currency, which loses value due to inflation, whereas Bitcoin has historically generated significant returns.

Thiel also touches on broader themes such as the potential for institutional adoption of Bitcoin, citing the growing interest in Bitcoin ETFs and the increasing involvement of institutional investors. He mentions that the U.S. might consider holding Bitcoin as a strategic reserve asset, similar to gold, to project financial power and stability.

Furthermore, Thiel discusses the importance of Bitcoin mining within the U.S., explaining that it enhances transactional control and regulatory oversight. He suggests that government incentives, such as tax and energy incentives, could attract more Bitcoin mining operations to the U.S.

Looking ahead, Thiel has a bullish outlook for Bitcoin, driven by institutional investment and the limited supply of Bitcoin. He also outlined Marathon Digital's future plans, including continued expansion, technology development, and innovative projects like using mining heat for residential heating.

DEMOGRAPHICS:

WILL HUMANITY GO EXTINCT?

Melissa Kearney, July 27, 2024

U.S. fertility has been falling below the replacement rate of 2.1 children per woman, according to Melissa Kearney, Professor of Economics at the University of Maryland and Director of the Aspen Institute’s Economic Strategy Group. The trend towards fewer children poses serious challenges, including a shrinking working-age population and looming economic stagnation.

A smaller working-age population could lead to slower economic growth and increased fiscal pressures on social insurance programs such as Medicare and Social Security. Kearney emphasizes the need for more legal immigration to bolster the workforce, and increased investment in human capital and technology to maintain productivity levels despite a smaller population.

Professor Kearney notes that younger generations are prioritizing career and leisure over raising children, a trend consistent with other high-income countries. This shift, she argues, results in fewer children being born, which could lead to reduced economic dynamism, less innovation, and ultimately lower living standards.

When it comes to policy, Kearney is skeptical about the effectiveness of incremental pronatalist policies, such as tax deductions and childcare subsidies, which have shown limited success in countries like Japan and Hungary. Instead, she suggests that more fundamental investments in family-friendly policies and broader social and cultural changes are necessary to support families and encourage higher fertility rates. This includes expanding parental leave, providing high-quality childcare, and implementing an expanded child tax credit.

Additionally, Kearney highlights the importance of addressing economic inequalities that contribute to declining marriage rates and fertility, particularly among non-college-educated men whose declining economic prospects make them less desirable and necessary as marriage partners. This, she argues, amplifies the overall fertility decline.

By making it easier for individuals to have children without sacrificing their careers, society can better support families and sustain economic growth. Moreover, Professor Kearney advocates for more comprehensive immigration policies to immediately address workforce shortages and for substantial investments in research and technology to drive long-term economic innovation and productivity.

WHAT TO WATCH

Friday, August 2, 2024

U.S. unemployment rate. This measures the percentage of American workers in the labor force who are unemployed. The data is released by the BLS.Monday, August 5, 2024

Monday, August 5, 2024

S&P Final U.S. Services PMI: This leading indicator is released monthly, and surveys executives in private-sector service companies. An index is then generated to gauge economic activity; a reading above 50 is seen as bullish.

Tuesday, August 6, 2024

U.S. Trade Deficit: The Bureau of Economic Analysis releases this data, which will be up-to-date for June of 2024.

Thursday, August 8, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.