Biden Drops Out, Tech Stocks In Turmoil

Political uncertainty dominates the White House, will this roil markets?

INTRO

Who’s been running the White House for the past few years if Joe Biden has been deemed “unfit” to run for re-election? Why is the tech sector selling off? Is the housing market in the early innings of crashing?

In this issue of The David Lin Report newsletter, we cover the biggest market news of the past week, including President Joe Biden’s dropping out of the U.S. presidential election and the subsequent market reaction, the CrowdStrike software update glitch that crashed IT systems globally, the worst tech sector sell-off since 2022, a “seller’s market” in housing developing, and a suspected Bank of Japan intervention that pushed the Yen higher.

Be sure to subscribe so that you never miss an issue.

TABLE OF CONTENTS

MARKET RECAP

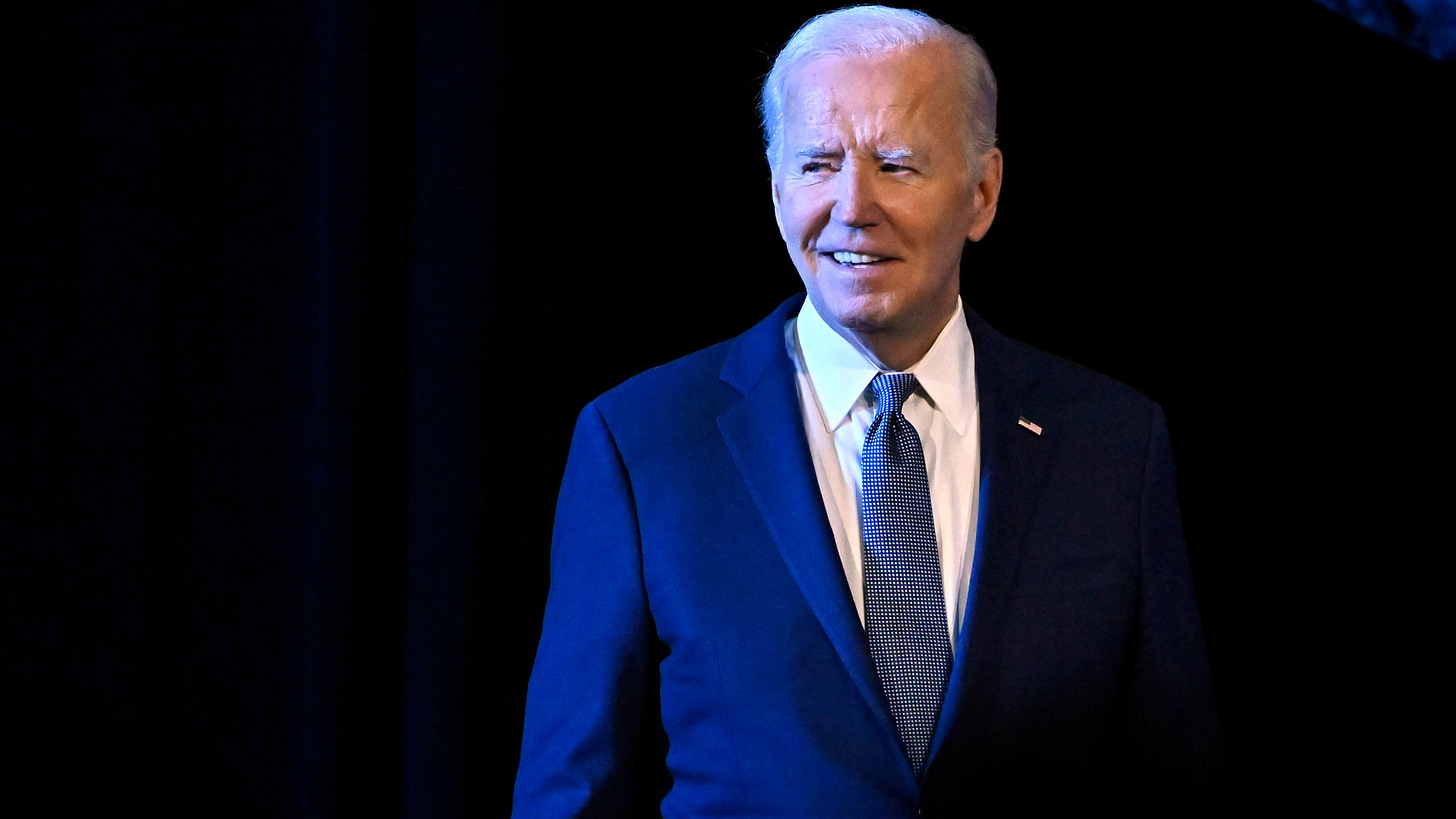

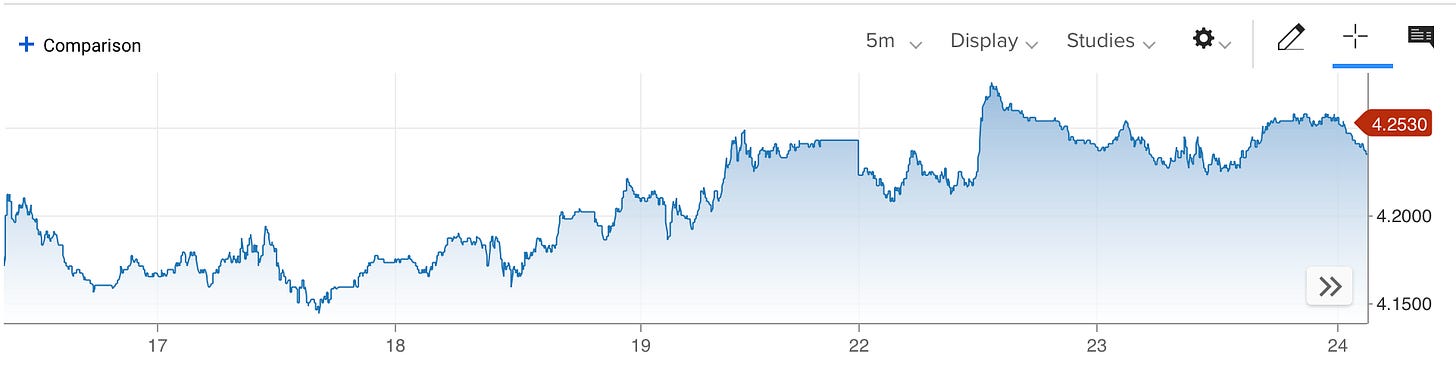

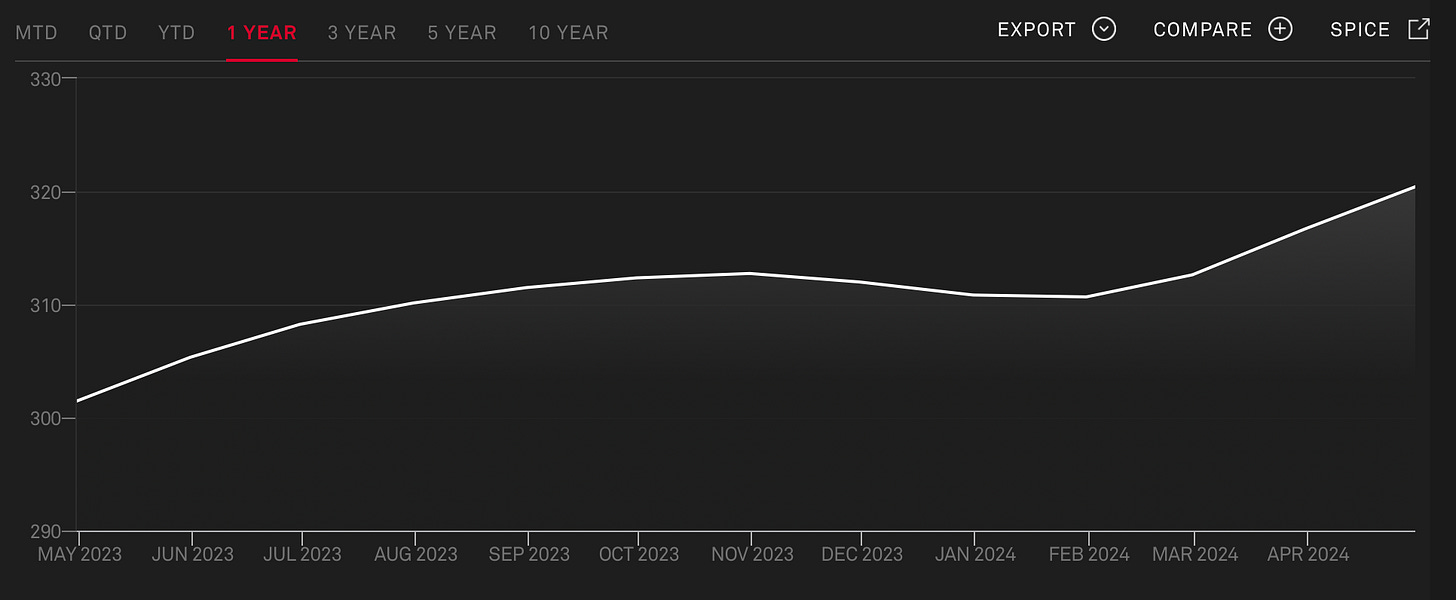

From July 18th to July 24th, the following assets experienced significant swings in value. There appears to have been a rotation out of large caps and into small caps.

Copper. The commodity is down 8 percent over the last week, and has dropped 20 percent from its May highs. It is currently trading at around $4.11 per pound.

WTI Crude. Oil is down 6 percent over the past week, trading at around $75 per barrel.

NASDAQ-100 Tech Sector. The index fell 6 percent to 10,172, driven by sell-offs in The Magnificent 7 tech stocks.

State Street. The asset manager gained 18 percent over the last month.

Crowdstrike. The cybersecurity company’s stock price fell by 26 percent over the past week, due to Crowdstrike’s role in causing a major cyber outage which affected infrastructure, banking, and communications worldwide.

For major assets, the price movements were as follows (all data is from July 25th at 3:00am ET):

DXY (U.S. Dollar Index) — up 0.08 percent.

Bitcoin — up 1.16 percent.

Gold — down 3.9 percent.

U.S. 10-year Treasury yield — up 1.7 percent.

S&P 500 — down 2.1 percent.

Russell 2000 Index — down 1.9 percent.

USD / Yen — down 2.5 percent.

BIDEN DROPS OUT

Matt Gertken, July 22, 2024

Matt Gertken, Chief Geopolitical Strategist at BCA Research, returns to the show to discuss President Biden’s withdrawal from the U.S. presidential race on July 21st. Based on Biden’s debate performance and media appearances, the President does not appear competent to rule, says Gertken, who suggests that Biden, in addition to dropping out of the race, will resign his presidency altogether.

"Biden will probably be forced to resign the presidency,” Gertken predicts. “His position is untenable. If he can't run, he can't rule."

This would then make Kamala Harris the President, a transition that would cause voters to question where power lies in Washington, D.C. However, Gertken suggests that there would be a “bounce” in Democratic Party favourability because of Harris’s support among Independents, African Americans, and women.

“There will be some honeymoon phase for her, and that will show up in the data,” Gertken said. “But the main thing is that the Democratic Party is struggling because we’ve seen such a huge rise in inflation, and what we’ve seen around the world with recent elections is that ruling parties are being punished for having allowed inflation to get so high.”

Gertken said that as of the time of the interview, odds still favor a Trump victory in November.

RON PAUL ON TRUMP, BIDEN, & U.S. DEBT

Ron Paul, July 24, 2024

Former Texas Congressman and Republican presidential candidate Ron Paul joins The David Lin Report in the midst of major political developments.

He begins by addressing President Joe Biden’s resignation from the presidential race due to alleged mental defects, questioning who has been running the country if Biden was unfit for office. Paul suggests that powerful, behind-the-scenes figures have significant control over government actions and public narratives.

Shifting to the assassination attempt on former President Donald Trump, Paul draws parallels to the John F. Kennedy assassination. He suggests that the Secret Service’s failure to protect Trump was not merely incompetence but potentially involved deliberate acts by a few conspirators.

"There were wide open holes, and that to me is all gibberish... it's unbelievable the amount of details they dug out of the Kennedy assassination, and they will on this one too,” says Paul.

Regarding economic issues, Paul criticizes the manipulation of interest rates and the fiat currency system. A long-time advocate for a return to the gold standard, Paul argues that government interference in monetary policy leads to economic instability. He highlights the dangers of inflation and the unsustainable national debt, predicting severe economic consequences.

"Interest payments on US national debt will shatter $1.14 trillion this year... America is bankrupt, we're just in denial,” Paul remarks.

Paul also touches on the social unrest in the country, attributing it to both economic and moral bankruptcy. He stressed the need for a moral society to sustain a republic and expressed concern about the growing influence of Marxist ideologies. Despite the grim outlook, he saw hope in the libertarian movement, which promotes liberty and limited government.

80% OF BANKS ‘GOING DOWN’

Christopher Whalen, July 23, 2024

Christopher Whalen, Chairman of Whalen Global Advisors, warns that 80 percent of banks could be “going down,” due to balance sheet problems, lower earnings, and regulatory pressures. He singles out the fact that banks do not value their assets at current market prices, or “mark-to-market,” thus inflating their balance sheets.

Whalen says, “"If securities are marked to market at fair value, many banks would be underwater. The industry's yield on loans is well over 6%, but the securities portion of their books is a problem."

In addition, Whalen thinks that the Federal Reserve will cut interest rates by up to one percentage point within the next 12-18 months. He is worried about the ability of consumers and businesses to service their debt without significant rate cuts.

In terms of asset allocation, Whalen says that he has allocated 65 percent to “[fixed] income,” and maintains selective exposure to tech and finance stocks. In particular, he likes bank preferred stocks, citing his collection of Citi preferred securities that pay "9 and three-quarters" percent yields.

AI PREDICTS CHINA INVADES TAIWAN THIS YEAR

Gene Munster, July 20, 2024

China will invade Taiwan this year, according to artificial intelligence models Gemini and Grok. Gene Munster, Managing Partner at Deepwater Asset Management, claims that the AI models also predict that the Magnificent 7 tech stocks (Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia, and Tesla) will see a 35 percent decline by the end of the year.

"The majority of Nvidia chips are made in Taiwan through TSM (Taiwan Semiconductor Manufacturing Company),” observed Munster. “If something would happen in Taiwan, that's going to really throw a wrench in this demand for building AI infrastructure."

Munster, who is ultimately bullish on AI, believes that the market is in the early stages of a 3 to 5 year AI bubble. He predicts occasional pullbacks as part of this growth phase, and draws parallels to the 1994-1999 period, when the NASDAQ saw multiple sell-offs but nevertheless continued to rise.

Despite a potential short-term correction in tech, Munster is long on AI, and his favourite stocks include Meta, Google, and Tesla. Although Tesla is not in Deepwater’s fund due to valuation concerns, Munster personally believes in Tesla’s prospects in autonomous driving and robotics. He also predicts that TSM could be a new entrant into the Magnificent 7, joining the ranks of major tech companies, due to demand for semiconductor chips.

DID JAPAN JUST ‘BREAK’ U.S. FINANCIAL SYSTEM?

Michael Gayed, July 19, 2024

Michael Gayed, Portfolio Manager at Tidal Financial Group, suggests a link between the recent rally in the Japanese yen and the sell-off in tech stocks.

To support the yen, the Bank of Japan likely spent $38 billion in buying yen and selling U.S. dollars acquired from the sale of U.S. Treasuries. This, in turn, weakens the U.S. dollar while strengthening the yen. Up until recently, Gayed claims that the yen’s relative weakness facilitated a carry trade, which was then used to fund tech stocks.

“How much of this AI momentum trade has been driven by the carry trade — investors that are borrowing capital from Japan at basically nothing rates, and then deploying it into the hot stocks of the moment?,” asked Gayed. “So then yen comes back up, and then Nvidia and all the AI names fall. That seems suspicious to me.”

This fall in tech stocks has been a boon for small cap stocks, says Gayed, who claims that hedge funds have been shorting small caps and then “dollar-for-dollar” buying large caps as a “spread trade.”

“Large caps have gone up… and small caps have largely gone sideways with a bunch of chop,” he observed. “Suddenly, large caps have a sell-off, that spread trade goes completely against them, and small caps have what looks like a short-covering rally.”

Gayed believes the Japanese yen will continue to appreciate, leading to potential forced selling of large-cap tech stocks. He is skeptical of the recent small-cap rally, seeing it more as a short squeeze rather than a fundamental shift. However, he is bullish on treasuries, expecting a significant flight to safety and a drop in yields as the Fed cuts rates aggressively to counter economic stress.

NASDAQ HAS WORST DAY SINCE 2022, WILL CORRECTION CONTINUE?

Jason Shapiro, July 17, 2024

Jason Shapiro, Owner of CrowdedMarketReport.com, supports the view that the recent rally in the Russell 2000 suggests a rotation out of large caps and into small caps. He emphasizes that small caps will continue to perform well due to this positioning shift.

"I think people were so short Russell relative to everything else that suddenly there came this rotation thing... they're getting out of those names and they are getting into the Russell names,” says Shapiro. "I think calls for like, oh, you know, Nvidia is going to crash and lose 70%, I think those are ridiculous personally, but it doesn't mean that the market can't go down."

Shapiro reveals that he looks at the Commitment of Traders report to determine his positioning. His trading strategy looks for where there is “overcrowding” on a position, so that he can make the opposite bet. For this reason, he takes a more bearish view towards gold and other overbought commodities.

"For me, it's too over-owned,” says Shapiro. “The market is too long gold here... from a risk-reward perspective, I don't think it's a great risk-reward to be long gold here."

Shapiro also foresees a market sell-off ahead of the Fed’s anticipated rate cut in September. He is long on the Swiss franc and short on the Australian dollar, based on current market-wide positioning on those currencies.

REAL ESTATE: MORTGAGE RATES WILL FINALLY FALL?

Zelman & Associates, July 17, 2024

Home prices will see continued deceleration due to affordability issues, climate change, and rising inventories, according to Zelman & Associates. Ivy Zelman, Co-Founder of Zelman & Associates, and Alan Ratner, Managing Director of Zelman & Associates, join David Lin in this far-reaching interview.

A shift towards smaller, more affordable housing units, including townhomes and multifamily units, is expected to address some affordability issues, while climate change is anticipated to impact housing markets over the long term, with increased insurance costs and potential migration away from high-risk areas “with excessive heat and flooding.”

The 10-year treasury yield, which influences mortgage rates, is not expected to drop significantly even if the Federal Reserve cuts rates. Any benefits from rate cuts will be limited due to the current inverted yield curve. However, mortgage rates could fall as the spread between the 10-year and 30-year yields falls.

"The spread between the 10-year and 30-year fixed mortgage rate is wider than normal,” Zelman observed. “We expect that spread will compress when the curve de-inverts and that has been historically a correlation that we should start to see and benefit from.”

In summary, Zelman & Associates foresee a housing market that is stabilizing and adjusting to new economic realities, with moderated price growth, cautious homebuilding activity, and ongoing affordability challenges.

WHAT TO WATCH

Over the next week, several significant U.S. economic events and data releases are scheduled. Here are some of the major ones:

Friday, July 26

PCE Index: The Personal Consumption Index (PCE) and Core PCE Index, the Federal Reserve’s preferred measure of inflation, is released at 8:00 am ET.

Tuesday, July 30, 2024

Consumer Confidence: This survey is conducted by The Conference Board, and measures how consumers feel about their present financial status.

Job Openings: The Job Openings and Labor Turnover Survey (JOLTs), published by the Bureau of Labor Statistics (BLS), reports the number of job vacancies, hires, and separations, reflecting the demand for labor and the ease with which employers can hire workers.

Wednesday, July 31, 2024

FOMC Interest Rate Decision: The Federal Reserve’s Open Market Committee (FOMC) will decide on whether to raise, lower, or maintain the Fed Funds rate within its current bounds. This announcement, at 2pm ET, will be followed by a press conference at 2:30pm ET.

Thursday, August 1, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

U.S. Productivity. The Bureau of Labor Statistics will release the U.S.’s quarterly productivity data for Q2.

Friday, August 2, 2024

U.S. unemployment rate. This measures the percentage of American workers in the labor force who are unemployed. The data is released by the BLS.