Will Markets Soar After Fed Pivot?

Powell's Jackson Hole Speech Sent Stocks Soaring, Here's What To Expect After Rate Cut

TABLE OF CONTENTS

MACRO: Monetary Crisis Underway — Peter Grandich & Mike Campbell

GOLD: Adrian Day on why the gold bull market hasn’t even begun

MARKET RECAP

LATEST NEWS. Federal Reserve Chairman Jerome Powell’s speech at Jackson Hole on August 23rd signalled a dovish tone. Stating that “the time has come for policy to adjust,” Powell suggested a strong possibility that the Federal Open Market Committee (FOMC) intends to lower rates at its September meeting.

This caused markets to rally, with The Dow up 1.1 percent after Powell’s speech. The S&P 500 was up 1.2 percent, the Nasdaq Composite was up 1.7 percent, and the Russell 2000 rose 2.2 percent.

The FOMC minutes from its July meeting were released on August 21st, confirming that FOMC members anticipate a dovish pivot and a reduction in the Fed Funds Rate.

To make sense of Powell’s Jackson Hole speech, we were joined by David Rosenberg, President of Rosenberg Research. Rosenberg said that Powell came off as more dovish than markets expected, in part because labor markets are “loosening at a more rapid rate than the Fed had thought.” Indeed, Powell’s speech mentioned the labor market 12 times.

Rosenberg observes that the unemployment rate rose to 4.3 percent in July, despite strong GDP growth. He also notes that the hiring rate has declined significantly, and that this will suppress wage growth and create job insecurity. Rosenberg says that if the labor market continues to deteriorate, the Fed could cut rates by up to 50 basis points at a time.

He also points to the risk of inflation rising again if Donald Trump is elected, due to the Republican candidate’s proposed tariffs. However, Rosenberg says that such an inflationary spike — as much as 6 percent — would be temporary, and that Trump’s corporate tax cuts would be disinflationary in the medium to long run. Rosenberg says that Kamala Harris’s policies would reduce inflation because she promotes tax hikes, which would hamper demand.

Market Movements

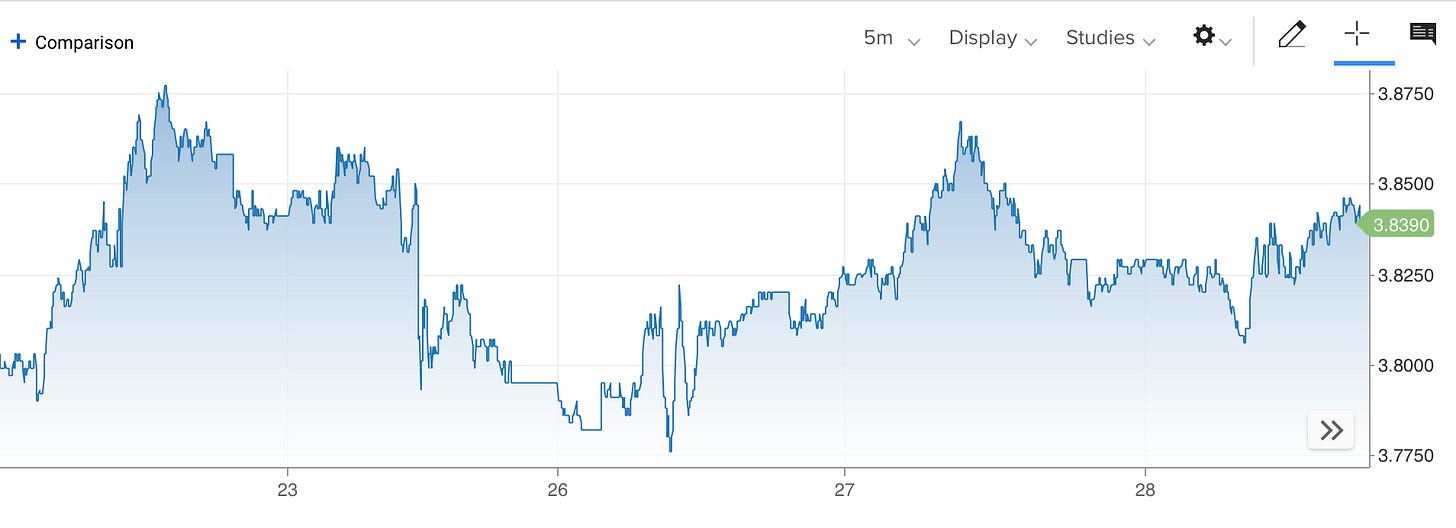

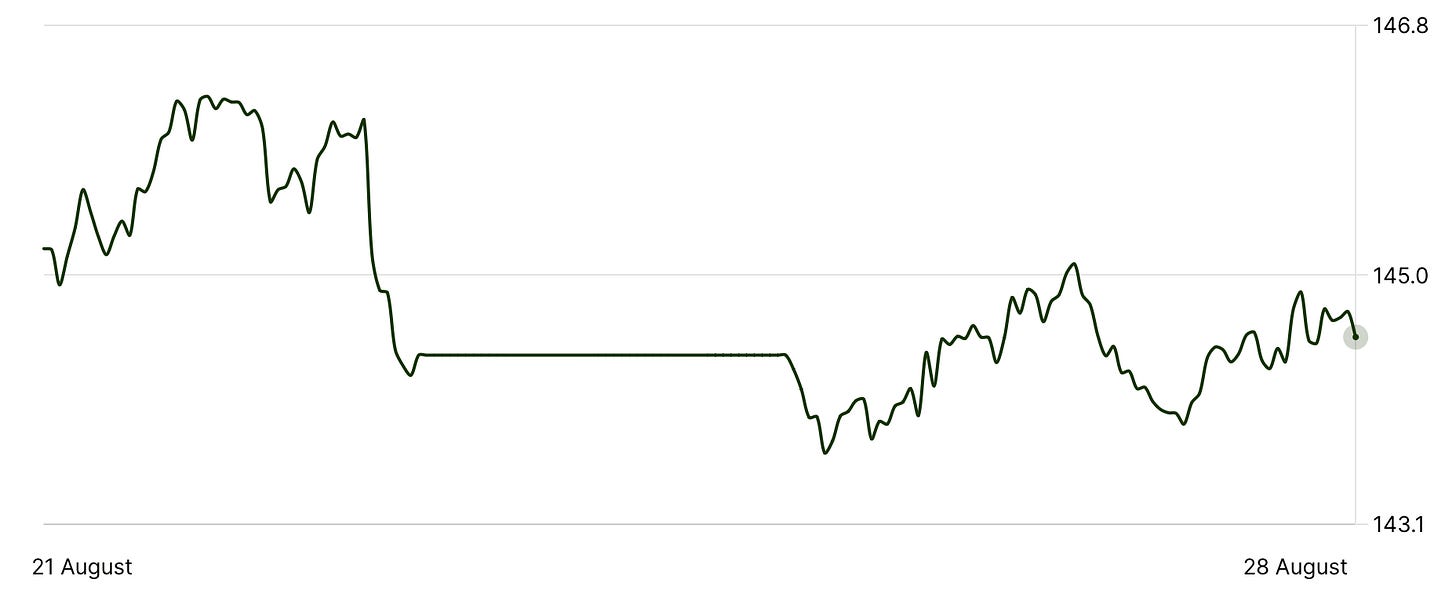

From August 22 to August 28, the following assets experienced dramatic swings in price. Prices are up-to-date as of August 28th at 4pm ET (approximate).

PDD Holdings, which owns the online retailer Temu, fell by 39.7 percent following a disappointing sales outlook.

Sugar — up 11 percent.

Peloton Interactive — up 18.7 percent.

Abercrombie & Fitch — down 16.7 percent.

Coffee — up 4 percent.

For major assets, the price moves were as follows.

DXY — down 0.75 percent.

Bitcoin — down 3.1 percent.

Gold — down 0.3 percent.

10-year Treasury yield — up 0.7 percent.

S&P 500 — down 1 percent.

Russell 2000 — up 1.7 percent.

USD/Yen — down 0.7 percent.

EQUITIES:

FED SIGNALLING MAJOR RECESSION

Gareth Soloway, August 26, 2024

Gareth Soloway, Chief Market Strategist of Verified Investing, is worried that the S&P 500’s current chart patterns are strikingly similar to those in 2007, prior to the Great Financial Crisis. He said that this implies the S&P could face a 66 percent drop, in line with his technical analysis and reading of investor psychology.

Soloway also discusses the impending Federal Reserve pivot, emphasizing that historically, markets tend to decline after the Fed begins cutting rates. He predicts that the 10-year yield could drop to 3.2-3.3%, driven by further rate cuts as the economy weakens. He warns that rate cuts could signal deeper economic trouble.

Soloway is cautiously optimistic about Bitcoin. He points out that Bitcoin has been moving within a bullish consolidation pattern and could reach $69,000 if this trend continues. However, he warns of significant downside risks if Bitcoin breaks below $53,000, which could trigger a further decline.

Gold, according to Soloway, remains a strong buy, particularly on pullbacks. He sets a long-term price target of $2,660 an ounce by early 2025, driven by a weakening dollar, Fed rate cuts, and central bank purchases. Despite short-term overbought signals, he sees gold as a safe haven amidst economic uncertainty.

EQUITIES:

’RESET OF A LIFETIME’

Mike McGlone, August 20, 2024

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, joined the show to voice his concerns about “the reset of our lifetimes,” forecasting that a major correction is due. Drawing parallels to The Great Depression, he said that “the U.S. stock market is the most expensive [on a] market cap-to-GDP basis versus the late 1920s and early 30s.”

McGlone also points to global economic slowdown, highlighting China and Europe in particular. He notes that China’s declining bond yields indicate economic distress, while observing that Europe is “clearly having issues.” Over the course of 2023, the Eurozone experienced almost zero growth. This global fall in demand, along with contagion from Europe, could contribute to economic peril in the United States.

Gold and long-term U.S. bonds will benefit from the coming correction, said McGlone, whose price target for gold is $3,000 an ounce. He said gold will continue to rise as investors seek safe havens amid economic uncertainty. He also says that long bonds are likely to perform well, as the economy shifts towards deflationary forces and the Federal Reserve eventually begins cutting rates.

MACRO:

MONETARY CRISIS HAS BEGUN

Peter Grandich & Michael Campbell, August 22, 2024

Peter Grandich, Founder of Peter Grandich & Co., and Michael Campbell, Host of Michael Campbell’s MoneyTalks Show, joined the show to provide their economic outlook. Grandich opened by voicing concern about the Bureau of Labor Statistics’s recent revisions to non-farm job numbers, which revealed that job growth was in fact 30 percent less than previously reported.

“The Federal Reserve… has to be concerned that the economy now wasn’t anywhere as strong as it was,” said Grandich. “That’ll lead to more talk of easing.”

Campbell agreed that a rate cut is likely in September, while expressing skepticism that the Fed can manage inflation effectively. Grandich suggested that the Fed has room for a rate cut in September but warned that political factors would heavily influence the economic landscape in the coming years, particularly with the rise of the BRICS nations and their potential to challenge the U.S. dollar's dominance.

Grandich, who had previously advocated for gold, acknowledged its recent success but suggested that while it may still perform well, the focus should now shift towards capital preservation rather than appreciation. Campbell emphasized the importance of protecting purchasing power in an environment where inflation and rising debt levels could erode wealth. He also noted that Canadian oil stocks and short-term investments might offer some resilience in the current volatile economic climate.

MACRO:

FOMC MINUTES CONFIRM RATE CUT LIKELY

Bob Elliott, August 21, 2024

Bob Elliott, Co-Founder of Unlimited, expressed skepticism regarding the market's expectations of aggressive Fed rate cuts — markets are currently pricing in up to 200 basis points of cuts within a year. He noted that such cuts have historically only occurred during severe economic downturns, which the current economic indicators do not support. Elliot stated, “This is not an economy that is consistent with 200 basis points of Fed cuts in the course of 12 months.”

Despite some signs of slowing, Elliott says that the labor market remains robust, with unemployment rates still low by historical standards. He points out that the economy continues to add jobs, albeit at a slower pace, and that this supports ongoing consumer spending, which is a critical component of economic resilience.

On asset allocation, Elliot advised investors to reconsider the traditional 60/40 portfolio of stocks and bonds, suggesting a more diversified approach that includes assets like gold and Treasury Inflation-Protected Securities (TIPS). He noted that both stocks and bonds are currently overvalued, with stocks pricing in no likelihood of a recession and bonds pricing in a certainty of one.

Elliot was particularly cautious about the future performance of bonds, indicating that the expected Fed cuts might not materialize as quickly as the market hopes, which could lead to rising bond yields and declining prices. He also highlighted the overvaluation in stocks, where earnings growth expectations are unrealistically high given the current economic environment.

GOLD:

GOLD BULL MARKET HAS NOT STARTED

Adrian Day, August 21, 2024

Adrian Day, President of Adrian Day Asset Management, Day asserts that the gold bull market is far from over, arguing that previous gold bull markets have seen gold stocks rise by 400-500%, a level not yet approached in the current cycle. He emphasizes that gold stocks are still significantly undervalued compared to their historical highs, particularly from 2010-2011.

Day is skeptical that inflation will consistently reach the Federal Reserve's 2 percent target without a significant economic downturn. He points out that while inflation has cooled recently, it remains elevated compared to the Fed's target. He attributes this to the fact that money created during the pandemic is now circulating in the real economy, unlike in previous periods of low inflation where money supply increases were largely confined to banks.

Regarding unemployment, Day notes that the unemployment rate has been rising, partly due to increased immigration and a shift from full-time to part-time jobs. He suggests that this trend, coupled with a low labor participation rate, indicates underlying economic weakness.

On the topic of gold stocks, Day expects juniors to catch up as the bull market progresses. He also highlights a recent shift in gold demand, with Western institutions and large investors increasingly buying gold, which he believes will drive gold stocks higher.

Day is cautious about long-term bonds, predicting that yields will need to rise to attract buyers, especially as traditional large buyers like China and Japan reduce their purchases. He advises against buying 10-year bonds at current yields, instead favoring short-term bonds for their relatively attractive returns. Overall, Day remains bullish on gold and gold stocks, viewing the current market as a significant opportunity for investors.

WHAT TO WATCH

Friday, August 30, 2024

Personal Consumption Expenditures (PCE): This is released by the U.S. Bureau of Economic Analysis (BEA) and measures the average changes in prices paid by consumers for goods and services, serving as an important indicator of inflation.

Wednesday, September 4, 2024

U.S. Trade Deficit: The BEA releases these data, which show how much more the U.S. imports than it exports.

Job Openings: The U.S. Bureau of Labor Statistics (BLS) releases the Job Openings and Labor Turnover Survey (JOLTS) data for July.

Bank of Canada Policy Rate Decision: The Bank of Canada will announce its interest rate decision.

Thursday, September 5, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

Friday, September 6, 2024

Unemployment Rate: The BLS releases this statistic, which shows the percentage of the U.S. labor force which is unemployed.