TABLE OF CONTENTS

Market Recap: Chris Vermeulen on why a 25 percent market pullback is likely

EQUITIES: Bank of America’s Joe Quinlan on why stocks will thrive in 2025

ECONOMY: Lobo Tiggre on The Fed’s next move and inflation’s return

MARKET RECAP

Latest News. After a significant correction over the past few weeks, markets are starting to recover amidst President-elect Donald Trump’s inauguration on January 20th.

On Friday, January 17th, the S&P was up 1 percent, the tech-heavy Nasdaq rose 1.5 percent, and the Russell 2000 increased by 0.4 percent.

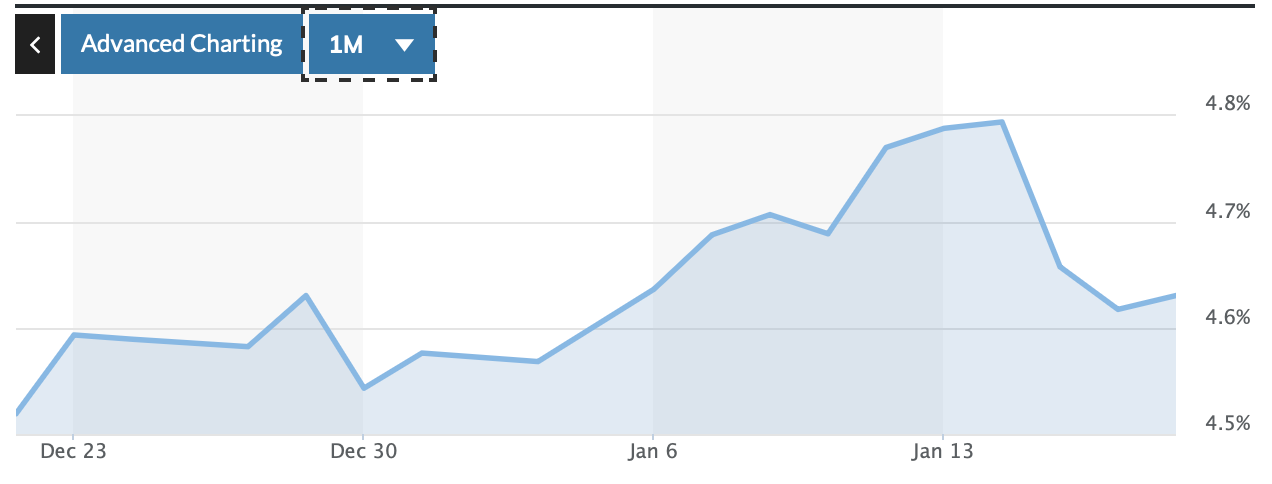

Markets corrected two weeks ago, on January 8th, following news that the Federal Reserve intends to limit the pace of rate cuts in 2025. The news broke after the Fed’s December meeting minutes were released.

As a result, Bitcoin crashed from a high of over $100k on Tuesday, January 7th, to almost $93k on Wednesday, January 8th.

Bitcoin has since recovered from this low, and was trading above $100k on Friday, January 17th.

Over the week starting Monday, January 6th, the S&P 500 was down 1 percent, while the tech-heavy Nasdaq was down 1.2 percent. The 10-year Treasury yield was up 3 percent.

On Friday, January 10th, the markets further fell in intraday trading, following news of a positive jobs report, with unemployment falling to 4.1 percent. This was interpreted as news that the Fed won’t cut rates.

Chris Vermeulen, Chief Market Strategist at TheTechnicalTraders.com, said that chart patterns had been predicting a market correction for a while.

“The market has been telling us for a little while that it’s been rolling over, and the Nasdaq is a good leading indicator,” he said. “The internals were telling us, hey, there’s big money flowing out of this market, and the Nasdaq was the first to give this signal.”

Vermeulen predicted that this would be the start of a longer correction, warning that the markets could “really collapse.”

“I think this could be the start of a much bigger correction,” he said. “I think we could see a big pullback of potentially 15 to 25 percent, and then… we might actually see another much larger drop after that.”

If the Fed does not cut rates, then Vermeulen said that investors would prefer to stay in cash, which would further affect markets negatively.

“If rates are going to stay up here, they [investors] are going to be like, you know what, I’ll just stay in cash, I’ll earn… risk-free interest,” he said. “That’s why the stock market is selling off.”

Market Movements

From January 10rd to January 17, the following assets experienced dramatic swings in price. Data are up-to-date as of January 17th at 9pm ET (approximate).

Sugar (commodity) — down 5.3 percent.

GameStop Corp. — down 14.9 percent.

MicroStrategy — up 20.9 percent.

Trump Media & Technology Group — up 13.4 percent.

GEO Group — up 14.3 percent.

The following major assets experienced the following price movements during the same time interval.

DXY — down 0.2 percent.

Bitcoin — up 9.6 percent.

Gold — up 0.4 percent.

10-year Treasury yield — down 2.9 percent.

S&P 500 — up 2.9 percent.

Russell 2000 — up 3.9 percent.

USD/yuan — No significant change.

EQUITIES:

MARKET SHIFT POST-INAUGURATION

Thomas Hayes, January 16, 2025

Thomas Hayes, Managing Member of Great Hill Capital, said that international equities would benefit following President-elect Donald Trump’s inauguration.

“When Trump was elected [to his first term, starting in 2017]… everyone thought you had to be all U.S.,” he explained. “[But] international and emerging markets actually outperformed after the dollar rolled over, after the inauguration.”

Hayes said that international markets are cheap relative to those in the U.S., yet would generate similar returns.

“International [markets are] going to have 13-14 percent earnings growth compared to the U.S., [which is] about 14 percent earnings growth,” he explained. “The difference is, [in the] U.S., you’re paying 22 times [earnings], [while] international you’re paying 15 to 15.5 times.”

When it comes to Trump’s policies, Hayes said that the President-elect’s proposed trade policies would not be as disruptive as Trump himself suggests.

“We’ve been of the camp it won’t be as bad as advertised,” he said. “I think the advertisement was 60 percent tariffs across-the-board. I think that’s going to be more modest and more reasonable, like we saw in Trump 1.0.”

Hayes predicted that markets would react to Trump in 2025 in a similar manner as they did to his policies in 2017.

“As you saw in 2016 to 2017, while the dollar rallied after the November election and bond yields really accelerated after the election, after the inauguration, bonds got bid, yields compressed for the next year plus, the dollar rolled over, international stocks took off, biotech stocks took off, oil stocks collapsed,” he said. “It was the exact opposite of what everyone was expecting and we think it could be some version of that.”

EQUITIES:

MARKETS SET UP FOR CRASH IN 2025

Darius Dale, January 15, 2025

Darius Dale, Founder of 42 Macro, said that “conditions are in place for a market crash in 2025.”

He pointed in particular to the roles of refinancing government debt, harsher immigration policies, and a more hawkish Federal Reserve.

“If we get a significant deceleration in liquidity this year, at the same time we have a significant acceleration in global refinancing demand, the markets will crash in 2025,” explained Dale.

52.5 percent of Dale’s asset allocation is in cash, a decision he said is based on his firm’s quantitative model, and not purely on fundamental factors, though he also said that his outlook is “risk-off.”

He added that he is worried about the incoming Trump administration’s economic and border policies, and their impact on economic growth.

“[There will be potentially] dramatic fiscal and regulatory policy changes,” he said. “One of those changes, in my opinion, is the likelihood that we’re probably going to see tariffs and a change in border policy that could potentially create a negative supply shock to the economy… That could potentially cause problems in asset markets, alongside the fact that we are likely to see a hawkish shift in treasury net financing policy in terms of the composition of treasury financing.”

In addition, Dale said that the average investor, who maintains a bullish stance on markets, may be in for a surprise in 2025.

“The average investor out there is already positioned for good news, for the resiliency of the economy to persist,” he said. “Essentially what we’re saying is, based on some of the dynamics that we’re observing in our fundamental research process, specifically as it relates to the backup, the hawkish repricing of the treasury curve, and the strength of the U.S. dollar, these are things that may actually cause that positioning to unwind.”

EQUITIES:

WHAT WILL SHOCK MARKETS IN 2025?

Joe Quinlan, January 4, 2025

In 2025, the S&P 500 will reach a level of 6,666, based on good earnings and a strong economy, according to Joe Quinlan, Bank of America’s Head of Market Strategy.

“[We expect] good earnings overall, better breadth, an economy that continues to expand — say 2.5 percent,” said Quinlan. “We think a lot of these [upcoming] policies… whether it’s lower corporate taxes, deregulation, fires up the animal spirits.”

Quinlan added that the Bank of America does not expect a recession to manifest, and said that even Trump tariffs would not derail the economy.

“Assuming these [tariffs] are targeted, not they’re blanket, and they’re directed more at China than our… trading partners, Mexico or Canada, that you could shave off 0.1-0.2 percent off GDP,” he said. “But there’s enough demand out there, enough capital expenditures out there, to keep the economy moving forward by that 2-2.5 percent over 2025.”

When it comes to Fed policy, the Federal Reserve would closely watch the policies of incoming President Donald Trump, said Quinlan.

“The Fed, in general, is trying to game out what happens to prices if the incoming administration does what they promise to do — raise tariffs, anti-immigration which creates labor problems,” he said.

The Bank of America predicts that the Fed will cut rates twice in 2025, according to Quinlan.

“In general, when you’ve got… high-income consumers out there spending, and you see it in services across the board, then it’s hard to really pencil in this recession, and therefore [have] the Fed continue to cut as aggressively as the Street thought they were going to,” he explained.

ECONOMY:

THE FED’S NEXT MOVE

Lobo Tiggre, January 6, 2025

Lobo Tiggre, Editor of The Independent Speculator, said that the Federal Reserve cut rates in December because of a weak U.S. economy.

“[The Fed] cut anyway, even though they knew that inflation has been going up, and not just [for] one month — two months now,” he explained. “In my view, despite the hawkish cut… the Fed knows that the U.S. economy is weaker than it seems… I think this is why they’re cutting in the face of higher inflation.”

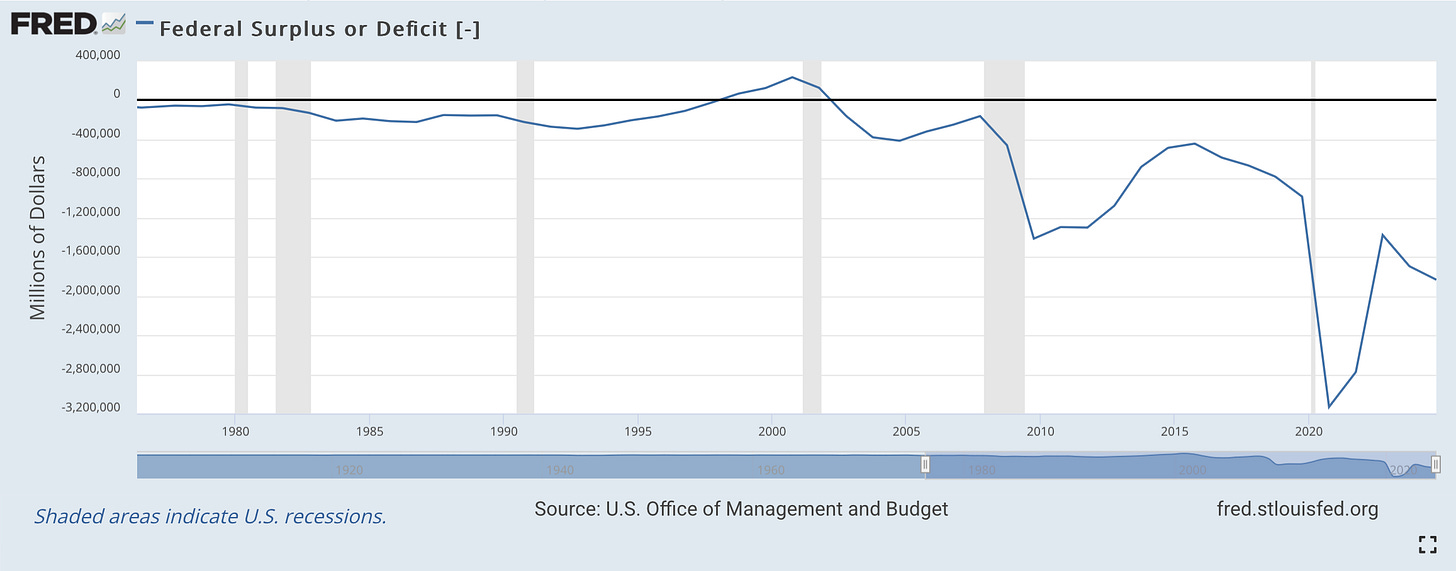

He added that inflation is “coming back,” due to high fiscal spending.

“There is so much money flooding out of Washington… and it takes time for that money to percolate through the economy,” said Tiggre. “They [the government] are running wartime levels of deficit spending and Trump is not proposing to cut that.”

Tiggre said that “sticky inflation is a global phenomenon,” because most countries had increased spending in response to the pandemic.

He also expressed skepticism about Trump’s Treasury Secretary nominee, Scott Bessent, when it comes to his ability to reduce the deficit.

“The markets are pricing in success, not only before it’s happened, but success that has never happened,” said Tiggre, referring to Trump’s plans to reduce the deficit. “By the way, if they do actually manage to cut something, if we do actually increase government efficiency, that in and of itself causes near-term pain… I’ve watched politicians promise this sort of thing before and they’ve never delivered.”

TECH:

TECH BUBBLE 2.0?

Stephen Yiu, January 7, 2025

Stephen Yiu, CIO of The Blue Whale Growth Fund, said that the technology market is unlikely to be in bubble territory, because tech valuations are underpinned by good earnings and efficient technology.

“Technology companies today, while [they’re] a bit more expensive today compared to the last ten years… they are highly profitable,” he explained. “Hence the valuation is less expensive compared to during the tech bubble [of the 1990s].”

He added that technology now is also a lot more efficient than during the 90s, which allows tech companies to have better products and a wider consumer base.

“Today… you can watch YouTube, you can play games, you can socialize with your friends, you can use Teams or Zoom, and there’s a lot more things that you’ll be spending money and time with,” he said. “I would say that building up the AI capability today is a lot easier than building internet infrastructure 20, 30 years ago.”

Yiu’s firm, Blue Whale Growth, aggressively sold shares in Microsoft in 2024, because of the lower return on Microsoft’s investments in artificial intelligence — in particular, Microsoft’s CoPilot AI suite, which requires Microsoft to spend on Nvidia’s infrastructure.

“We are actually seeing, or expecting, the return on invested capital of this company to be coming down from here,” he said. “Hence, we are significantly underweight Magnificent 7, with the exception of Nvidia.”

Because it is required for so many AI applications, Yiu said that he is bullish on Nvidia, but that its future returns would be more muted.

“From our perspective, we still think Nvidia can outperform,” he said. “So if you say to me, oh the S&P is going to do another 10 percent [per] year in the next couple of years, we probably would think Nvidia can do like 15 percent — but it’s not going to make you rich, it’s not going to do what the share has done before.”

POLITICS:

WHY TRUDEAU RESIGNED

January 8, 2025

On Monday, January 6th, Prime Minister Justin Trudeau of Canada announced his intention to resign after his party finds a new leader.

Trudeau also suspended Canadian Parliament until March 24th, which means that Canadians will not get an election before May.

Following Donald Trump’s election as U.S. President, Trudeau has been described by media as “weak,” with Trump threatening to levy 25 percent tariffs on Canada. Trump has even joked that Canada should become the 51st U.S. state.

The poor state of Canada’s economy has weakened Canadians’ support for the Liberal Party, and boosted support for the opposition Conservatives, led by Pierre Poilievre.

In particular, 1-in-4 Canadians live in poverty according to a recent study, and many Canadians struggle with housing affordability — especially in cities like Vancouver and Toronto.

This is exacerbated by wage stagnation, which is driven by weak productivity and lower foreign direct investment.

Based on Polymarket betting odds, the next Prime Minister of Canada is most likely to be Pierre Poilievre.

WHAT TO WATCH

Monday, January 20, 2025

Presidential Inauguration — Donald Trump will be inaugurated as 27th President of the United States.

World Economic Forum (WEF) Annual Meetings — The WEF’s annual meetings will start on January 20th, and continue until January 24th.

Friday, January 24, 2025

Existing home sales — The number of existing homes that were sold over the prior month.

Bank of Japan rate decision — The Bank of Japan will make a decision on its key policy interest rate.

The strength and value is the range of guests and views even if some are individually a bit "out there"

It will all crash

There could be a correction

Not much different to usual

Animal Spirits will make it all boom

As long as there is a difference, markets can continue. Watch out when everyone says the same!