Trader Now In 100% Cash, Markets To 'Wreak Havoc' Next Week

What's Ahead For Equities, Crypto, and Commodities?

TABLE OF CONTENTS

MARKETS: Largest Jobs Revision In 50 Years: What’s Ahead For Markets?

MARKETS: Economist Called Bull Market, Now Issues Dire Warning For Economy, Markets

SPONSORED POST: MONETARY METALS

CRYPTO: Satoshi Cited Him, Now He Predicts Bitcoin’s $200T Future

CRYPTO: Crypto’s Next Conquest? It's Bigger Than You Think

COMMODITIES: ‘It’s Life And Death’: Global Supply Chains Crumbling, What’s Next

MARKET RECAP

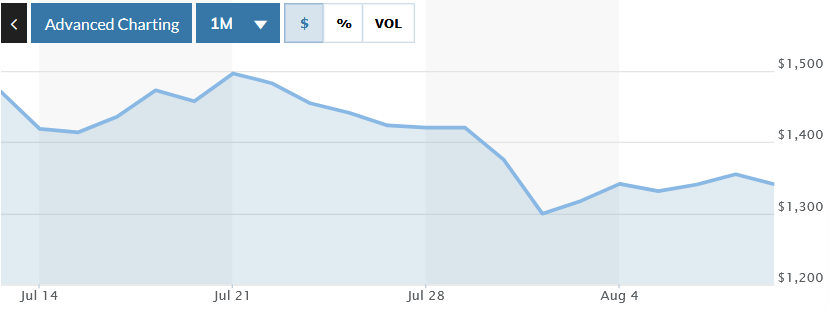

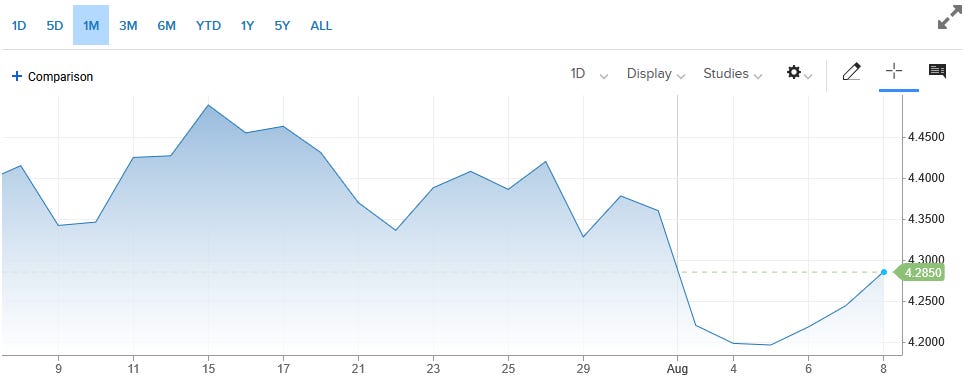

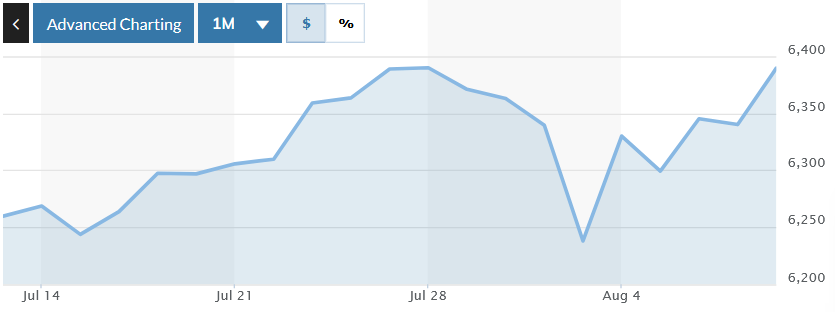

The stock market ended the week with mixed results, having faced significant volatility from the Trump administration's tariffs and weak employment data. The S&P 500 gained 1.8% for the week, closing at 6,389 on Friday after opening Monday at 6,272. Bitcoin held steady around $116,500, down slightly from recent highs above $117,000. Gold surged to new records near $3,400 per ounce, gaining over 1% for the week as investors sought safe-haven assets amid trade tensions.

The week's major political development occurred when President Trump fired Bureau of Labor Statistics Commissioner Erika McEntarfer on Friday, following disappointing jobs data that showed only 73,000 jobs added in July, well below expectations. This controversial move, where Trump claimed the data was "rigged," sparked concerns about the independence of government statistics. Meanwhile, Trump's new tariffs took effect Thursday on over 60 countries, pushing U.S. import duties to their highest level in nearly a century, with rates ranging from 10% to 50% on various nations. Markets now expect a 90% probability of Federal Reserve rate cuts in September, up dramatically from just 40% before the weak jobs report, as investors anticipate the central bank will respond to cooling economic conditions. The combination of economic uncertainty, trade tensions, and political interference in data reporting has created a complex backdrop that markets continue to navigate.

Chris Vermeulen, Chief Market Strategist at The Technical Traders, announced that he has moved completely to cash this week after closing equity positions near market highs, citing deteriorating technical conditions beneath the surface strength. Despite the S&P 500 and Nasdaq approaching new all-time highs on Friday, Vermeulen warned that the rally depends entirely on the "Magnificent Seven" stocks while broader market internals break down. "The market internals are breaking down. We had a sharp sell-off and now they are drifting higher with just the magnificent seven lifting prices," he explained. Vermeulen compared current conditions to the 2024 pattern, when markets experienced significant April lows followed by multi-month rallies before trend reversals, suggesting that a potential 15-25% correction could begin soon.

Gold's surge to new record highs serves as Vermeulen's primary warning signal for potential stock market turmoil ahead. Using Fibonacci extensions, he projects gold could rally 17-18% to $3,725-$4,100 levels, driven by seasonal tailwinds and mining stocks already breaking out ahead of physical gold. "Gold tends to do well when people get nervous, they are scared about stocks, they are scared about real estate, they are scared about currencies, they move to physical gold," Vermeulen said. He drew parallels to 2007 when gold outperformed during stock market peaks before the financial crisis, noting gold's 38% rally while stocks fell 20%. The analyst emphasized gold's role as a "global barometer" signaling potential financial crisis conditions.

Looking ahead, Vermeulen identified next week as critical for determining market direction, with potential scenarios ranging from continued rallies to a severe "financial reset" bear market. He maintains a $136,000 Bitcoin target using Fibonacci extensions but requires stock market buy signals before entering cryptocurrency positions due to their correlation. On commodities, Vermeulen expressed bearish views on oil, expecting a decline to $56-$ 57 levels after failing to hold above the $70 resistance. "We could go off this cliff into a stage four, a financial reset, a bear market. Like we are talking a tech bubble burst, a multi-year bear market," he warned, comparing potential scenarios to the 1987 crash or 2008 financial crisis, driven by interest rates potentially spiking.

Market Movements

The following assets experienced dramatic swings in price last week. Data are up-to-date as of August 8 at approximately 4pm EST.

Shopify - up 26.15%

Palantir - up 21.16%

Robinhood - up 14.75%

Eli Lilly - down 17.93%

CrowdStrike - down 5.04%

DXY - down .37%

Bitcoin - up 1.88%

Gold - up 1.04%

Platinum - up .86%

10-year Treasury Yield - up 1.42%

S&P 500 - up 1.84%

Russell 2000 - up 1.86%

MARKETS: Largest Jobs Revision In 50 Years: What’s Ahead For Markets?

Thomas Hayes, Founder, Chairman, and Managing Member of Great Hill Capital, criticized Federal Reserve Chair Jerome Powell following the release of massive job revisions and weak employment data, which revealed the central bank's restrictive policy stance. The Bureau of Labor Statistics reported the largest two-month revision since 2013 after adding only 73,000 jobs, versus the expected 106,000, prompting Trump to fire BLS chief Erica McCannifer over data accuracy concerns. "Whether there was a political motivation or not, if you are building a house and you are 4 feet off from where the baseboard should go, you have got a structural problem," Hayes explained. He argued the revisions demonstrate systemic incompetence requiring technological upgrades and better data collection methods.

Hayes warned that Powell faces a dangerous predicament, with growing dissent among Fed governors and mounting evidence that the central bank maintained restrictive policy for too long. "If he is right, he still has a legacy with a high level of dissent that you have not seen since the early 1990s. And if he is wrong, he is screwed because everyone knew he was too late, Powell," he said. The hedge fund manager noted that unemployment typically accelerates once it begins rising, making monetary policy corrections difficult compared to inflation adjustments. Hayes predicted at least two rate cuts this year, arguing Powell's restrictive stance has delayed millennial home buying and family formation by pushing the average first-time buyer age from 28 to 38 years old.

Despite seasonal weakness expectations, Hayes maintains a bullish outlook focused on small-cap value stocks over expensive technology names. He noted that small caps should benefit most from rate cuts due to their higher leverage, while offering 37% expected earnings growth for 2026, versus 14% for the S&P 500. "Institutions and hedge funds have been wrong, and now they are all dramatically behind their benchmark. So they cannot buy the things that are already up," Hayes explained, predicting managers will chase underperforming stocks. His investment approach focuses on "turnaround Tom specials"--businesses trading at discounts to their intrinsic value that he would personally finance with 100% fof his net worth, avoiding speculative growth stocks that already price in decades of perfect execution.

MARKETS: Economist Called Bull Market, Now Issues Dire Warning For Economy, Markets

Sam Burns, Chief Strategist at Mill Street Research, revealed that his equity model experienced its fastest reversal from bearish to bullish in 33 years, following April's tariff-induced selloff and subsequent recovery. "The model has made its fastest round trip from bearish back to bullish in its 33-year history amid continued macro policy uncertainty," Burns explained, noting the S&P 500's unprecedented speed from all-time high to 18% decline and back to new highs since 1960. Despite the bullish model reading of 66%, Burns expressed more caution than in previous years, recommending a barbell strategy that combines technology exposure with defensive sectors, such as utilities and real estate. He warned that speculative enthusiasm and extreme risk appetite levels suggest potential disappointment ahead.

Burns identified a fundamental shift in economic momentum driven by policy changes under the Trump administration. "Coming into this year, the economy had a fair amount of momentum, which is good. But I think we are now losing that momentum in part because fiscal policy broadly defined is turned from essentially a tailwind to a headwind," he said. The strategist characterized current macro policy encompassing tariffs, immigration restrictions, and healthcare changes as "bad" and a significant growth headwind. He cited real consumer spending data showing zero growth for the first half of 2025, down from solid 2% growth in previous years, as evidence that policy impacts are already materializing despite the large economy's slow adjustment process.

Regarding Federal Reserve policy, Burns predicted that the central bank faces a difficult bind, with potentially higher reported inflation resulting from tariffs, while economic growth slows. He expects limited rate cuts this year, possibly one in September and another in December, as the Fed navigates conflicting mandates for inflation and employment. Burns noted Fed Governor Adriana Kugler's resignation provides Trump an opportunity to influence policy through interim appointments, potentially creating more political pressure for aggressive cuts. For the remainder of 2025, he recommended large-cap US equities, particularly leading technology names, while suggesting that investors purchase tariff-sensitive durable goods sooner rather than later, as price increases continue to materialize.

SPONSORED POST: MONETARY METALS

Monetary Metals is transforming how investors think about gold. Rather than just storing it and waiting for price appreciation, investors can now earn a yield on their gold, paid in physical gold. With rates of up to 4%, this model allows gold holders to grow their position in actual ounces, not just dollar terms.

The company’s platform removes the traditional cost burden of storing gold, flipping the model on its head by letting investors get paid to own their metal. The yield is paid monthly in physical ounces, which investors can redeem and take delivery of at any time.

Thousands are already using Monetary Metals to preserve their wealth while generating passive income in the world’s oldest asset. With market uncertainty on the rise and inflation still a concern, this approach to gold ownership offers both security and steady returns. Learn more at Monetary-Metals.com/Lin.

CRYPTO: Satoshi Cited Him, Now He Predicts Bitcoin’s $200T Future

Adam Back, CEO and Co-founder of Blockstream and the creator of Hashcash technology cited in Satoshi Nakamoto's original Bitcoin white paper, discussed Bitcoin's trajectory toward challenging gold's market dominance. Back explained how his early proof-of-work concept, originally designed as a means of combating spam through email postage stamps, became foundational to Bitcoin's mining system. "Within a day of posting that, multiple people independently observed its potential use to solve one of the problems of a decentralized system, which is how do you get money into it," Back explained. He noted Bitcoin's current proximity to gold's market capitalization, stating it remains "within about a factor of nine of reaching the gold market cap."

Back addressed persistent concerns about Bitcoin's technical vulnerabilities, particularly quantum computing threats and potential proof-of-work failures. He dismissed immediate quantum risks, noting that current quantum computers can only factorize simple numbers, such as 21, calling it "very, very early days." On potential hash function failures, Back explained Bitcoin's built-in resilience: "If there is a small advantage, say it becomes two times as easy to mine, the difficulty just doubles, and so you have got this kind of graceful degradation." He predicted quantum-resistant signature schemes would be implemented over the next decade, with unused coins potentially frozen to prevent theft from quantum attacks.

The Bitcoin pioneer highlighted the momentum of institutional adoption while explaining why halving cycles continue to affect markets, despite representing smaller supply percentages. "Over time, people learn to hold coins and not trade them, and so the coins that are left that can be reached in the market are shrinking," he said, explaining why volatility prevents efficient arbitrage of predictable halving events. Back referenced Hal Finney's prescient 2009 prediction of a $200 trillion addressable market for monetary assets, made before Bitcoin had established any market value. "It seems logical that if the institutional adoption continues and the retail interest continues, that Bitcoin could get there," he predicted.

CRYPTO: Crypto’s Next Conquest? It's Bigger Than You Think

Andrew McCormick, Head of eToro US, discussed the platform's evolution from its crypto-focused origins to multi-asset trading, while warning about the inevitable shifts in monetary policy. The exchange, which began Bitcoin trading in 2013, completed its IPO in May, offering 11.9 million shares on NASDAQ. McCormick explained how retail investors differ fundamentally from Wall Street, noting emotional decision-making drives individual traders. "Most of my financial investing regrets are tied to emotion. I sold Bitcoin at $3,000 once," he admitted. Despite emotional trading patterns, McCormick observed persistent bullish sentiment among retail investors who continue buying market dips. His personal Bitcoin journey began through his father's 2013 YouTube discovery, when his dad simultaneously found Bitcoin and pickleball, proving "very fashion forward" on both trends.

McCormick expressed concern about fiscal sustainability while predicting a renewed need for monetary stimulus. "Governments have a bad habit, I think, of just printing money over and over again, and to kind of get us out of trouble at times. And I think long term it leads us to more trouble," he said, citing nearly $40 trillion in federal debt. The eToro executive sees Bitcoin as protection against currency debasement, echoing his father's original concerns about deficit spending. Platform data indicates that users maintain long-term bullish sentiment despite recent volatility, with trading metrics suggesting sustained dip-buying behavior rather than panic selling. McCormick noted that Bitcoin crashes now represent smaller percentage declines, with recent lows around $78,000, compared to previous cycle crashes that ranged from $20,000 to $3,000.

Looking ahead, McCormick predicted traditional finance and cryptocurrency will merge completely within five years, with stocks eventually trading on blockchain infrastructure. "I think 5 years or less, that is all on the blockchain," he said, envisioning direct peer-to-peer stock transactions without intermediaries. eToro settled with the SEC last fall, reducing crypto offerings from 27 assets to three before recently adding 12 new tokens. The platform integrates artificial intelligence to provide portfolio suggestions and analyze social sentiment across 30 million global users. McCormick dismissed concerns that blockchain adoption would eliminate middlemen, noting how commission-free trading seemed impossible just five years ago but now appears "ancient" compared to the previous $8-10 per trade costs.

COMMODITIES: ‘It’s Life And Death’: Global Supply Chains Crumbling, What’s Next

Ian Harris, CEO of Copper Giant, addressed the dramatic volatility in the copper market following President Trump's tariff announcements and subsequent reversals. Copper prices surged 13% when Trump initially announced 50% tariffs on the metal, then crashed 20% in a single day as the premium between London Metal Exchange and COMEX pricing disappeared. "When Trump came out and said, you know what, no tariff on refined copper, that whole arbitrage disappears," Harris explained. The wild swings reflected anticipation and hedging around expected tariffs that ultimately did not materialize for refined copper products.

Harris argued that the tariff discussions signal a fundamental shift toward deglobalization, which will ultimately benefit mining companies in the long term. He noted China controls 60% of global copper smelting capacity, creating strategic vulnerabilities for the United States. "Tariffs deglobalize, right? So, you have to reestablish the production chains, which means you need to have the offtake. You need to have the supply," Harris said. He predicted that this reshoring trend would create fierce competition for copper concentrate supplies as countries build their domestic smelting capacity. The CEO emphasized that mining companies producing copper concentrate would benefit from higher refined copper prices even without direct tariffs on their products.

Copper Giant recently announced impressive drilling results from its project in Colombia. Harris called it "one of the best drill holes in copper in the world for copper". He highlighted the project's strategic advantages, including proximity to power infrastructure and Colombia's status as a major non-NATO ally of the United States. The company aims to complete a preliminary economic assessment by 2026, positioning itself to capitalize on anticipated trends in supply chain reshoring. "This is a project that has 600 million tons of resource," Harris said, noting the potential to contain up to 10 million tons of copper equivalent.

What To Watch

Tuesday, August 12

Consumer price index

CPI year over year

Core CPI

Core CPI year over year

Monthly U.S. federal budget

Wednesday, August 13

Cisco Systems earnings

Thursday, August 14

Initial jobless claims

Producer price index

Core PPI

PPI year over year

Core PPI year over year

Friday, August 15

U.S. retail sales

Retail sales minus autos

Empire State manufacturing survey

Import price index

Import price index minus fuel

Industrial production'

Capacity utilization

Business inventories

Consumer sentiment (prelim)

Let’s be honest , Chris V has been going to cash for years, even when physical Gold was flat.