Nightmare Scenario: Topping Phase Could Trigger 50% Crash

Are There Any Safe Havens?

TABLE OF CONTENTS

‘Peak Bubble’: Bitcoin To ‘Lose A Zero’, Drop To $10k Says Bloomberg Strategist

Inflation Warning: Prices May Soar 50%, Fed ‘Completely Inadequate’

‘Most Bullish In Time In History’: Gold’s Breakout By Year-End Will Be Huge

SPONSORED POST: Monetary Metals

Cardano Founder: Bitcoin Market Cap To $10 Trillion As Banks Die, System Resets

U.S. Becomes World’s 'Most Unequal' Economy

'Very Real' War Risk By December: Will U.S. Fight Global Conflict?

Market Recap

Markets concluded the first full week of September with dramatic intraday reversals that epitomized the seasonally treacherous month, as the S&P 500 touched a fresh all-time high of 6,532 in Friday's opening moments before plunging nearly 90 points to 6,448 within 90 minutes following a dismal jobs report. The broad index ultimately settled around 6,475, surrendering the week's earlier gains despite Thursday's record close at 6,502 as traders grappled with unexpectedly weak employment data that reignited recession fears while simultaneously boosting Federal Reserve rate cut expectations. Technology shares displayed a sharp bifurcation, with Broadcom extending gains from its stellar earnings that included a massive $10 billion AI chip order from an unnamed fourth customer. At the same time, semiconductor peers, including Nvidia, continued to face pressure amid growing questions about artificial intelligence capital expenditure sustainability and competitive positioning.

Employment data delivered the week's most significant shock as the Bureau of Labor Statistics reported a mere 22,000 jobs added in August, dramatically undershooting expectations for 75,000 and marking one of the weakest prints since the pandemic recovery. The unemployment rate edged higher to 4.3% from 4.2%, while the preceding ADP private payrolls report had already signaled weakness with just 54,000 positions created versus 75,000 anticipated. The disappointing labor metrics sent Treasury yields plummeting eight basis points to 4.08%. It triggered an immediate repricing of Fed policy expectations, with futures markets now assigning 88% probability to a September rate cut and 12% odds of an aggressive 50 basis point reduction. The employment weakness overshadowed earlier positive momentum from better-than-expected Consumer Confidence readings and upward GDP revisions, underscoring how rapidly sentiment can shift in an environment where investors remain hypersensitive to economic inflection points ahead of the Fed's September 17 policy meeting.

President Trump's tariff framework continues to generate legal and economic uncertainty as his administration prepares expedited Supreme Court appeals following last week's adverse Federal Circuit ruling, while corporate America braces for crucial inflation readings that could determine the trajectory of monetary policy. The upcoming Producer Price Index on Wednesday and Consumer Price Index on Thursday represent the final major economic data points before the Fed meeting, with headline CPI expected to tick higher to 2.9% from 2.7%. In comparison, core inflation holds steady at 3.1%. Corporate earnings provided selective bright spots beyond Broadcom's AI triumph, particularly Alphabet's 9% surge following a favorable antitrust ruling that allows the company to retain its Chrome browser while avoiding the worst-case regulatory scenarios. The combination of weakening labor dynamics, persistent tariff litigation, and September's historically poor seasonal patterns has investors preparing for heightened volatility as markets navigate between recession concerns and the prospect of more accommodative Federal Reserve policy in the weeks ahead.

Market Movements

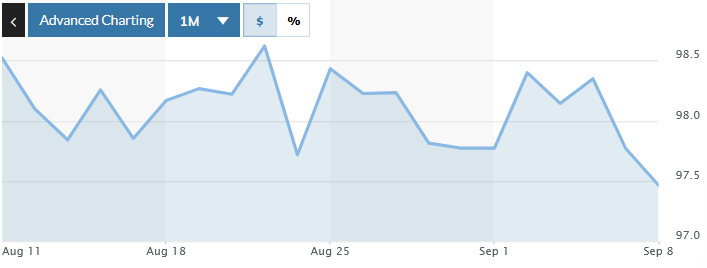

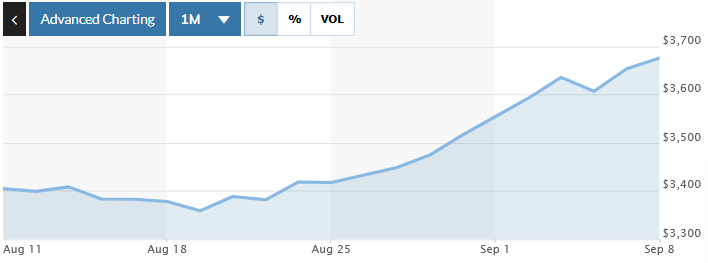

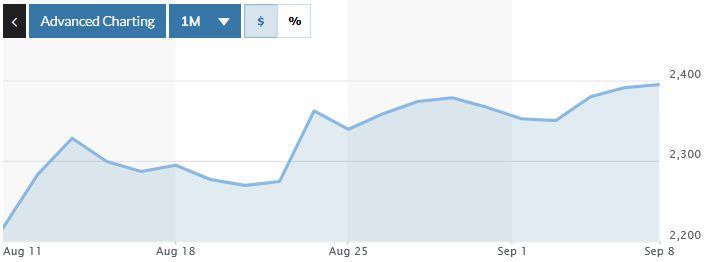

The following assets experienced dramatic swings in price this past week. Data are up-to-date as of September 8 at approximately 4pm EST.

(Data from StockAnalysis.com)

Broadcom - up 15.93%

Micron Technology - up 10.97%

Google - up 10.46%

Texas Instruments - down 6.99%

AMD - down 6.72%

Exxon Mobile - down 3.76%

(Data from https://www.marketwatch.com)

DXY - down .18%

Bitcoin - up 2.72%

Gold - up 3.49%

Platinum - up 1.81%

10-year Treasury Yield - down 6.39%

(10-year data from https://www.cnbc.com)

S&P 500 - up 1.44%

Russell 2000 - up 2.31%

Market Analysis

Chris Vermeulen, Chief Market Strategist at The Technical Traders, addressed criticism of his "perma bear" reputation while explaining his paradoxical position of maintaining long market exposure despite predicting a potential 50%+ crash in major indices. Vermeulen acknowledged being in a stage three topping phase for an extended period, arguing that while the Magnificent 7 stocks continue driving indices to new highs, the broader market shows signs of exhaustion, with equal-weighted S&P 500, small caps, and micro caps forming potential double or triple tops rather than breaking to new highs. He noted Bitcoin's declining dominance, from 66% to 58% since late June, as investors rotate toward Ethereum and other altcoins. He viewed Bitcoin's failure to maintain momentum despite flat stock markets as a warning sign that the cryptocurrency has "lost its shimmer" and its media-driven appeal.

Vermeulen's defensive investment approach stems from personal financial disasters, including his family's bankruptcy due to investment fraud and multiple blown trading accounts during his early career. These experiences taught him to prioritize capital preservation over aggressive growth targeting. He operates using technical analysis across 12 asset classes, incorporating intermarket analysis, and makes 5-12 smaller trades annually that compound 1-3% gains, rather than seeking home run investments. This strategy is explained as protection-focused for investors nearing or in retirement, who lack the 30-year time horizons required for buy-and-hold approaches. His current positioning involves being long in indices while maintaining exit strategies. He has recently taken profits on Bitcoin, silver miners, and communications ETF trades, emphasizing that his bearish warnings serve as risk management rather than trading signals, as he follows price trends regardless of his medium-term market concerns.

Despite acknowledging the seasonal headwinds that typically emerge in late August through October, Vermeulen sees bullish technical patterns in precious metals, with gold's bull flag pointing toward $4,100 and silver potentially spiking to $50 during what he expects could be a 20%+ move in both metals over the next one to two months. He drew parallels to 2007, when gold consolidated for months before shooting up 37% just as stock markets began rolling over, suggesting that the current gold consolidation represents accumulation rather than distribution, despite some analysts turning bearish on the metal. Vermeulen characterized the recent bounce in oil as a temporary "hook" move designed to trap shorts and create false optimism before resuming its downtrend, arguing that news-driven spikes typically reverse quickly. Oil remains under key resistance levels, while recommending early retirement planning through diversified strategies, including whole life insurance, real estate investment, and disciplined long-term saving, starting with the first post-college paychecks.

‘Peak Bubble’: Bitcoin To ‘Lose A Zero’, Drop To $10k Says Bloomberg Strategist

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, warned that Bitcoin could lose a zero and fall back to $10,000, marking a dramatic reversal from its recent $100,000 threshold. "I think Bitcoin now it added a zero. I think it loses a zero now. Go back to 10,000," McGlone said during the interview. He explained that Bitcoin has become a risk-on asset with its highest-ever correlation to the S&P 500, making it vulnerable to stock market corrections. McGlone characterized the current environment as "peak bubble" territory, comparing it to internet stocks in 1999 and the Japanese market in 1989.

The strategist predicted gold would reach $4,000 per ounce as investors seek safe havens amid expected market turbulence. McGlone explained that gold thrives during deflationary periods and political uncertainty. "Gold absolutely loves President Trump. Every time he opens his mouth, the gold market smiles," he said, citing concerns about tariff policies and economic disruption. The gold-to-oil ratio has reached historically high levels that typically precede economic slowdowns, with McGlone forecasting crude oil will drop to $40 per barrel due to oversupply and the global shift toward electric vehicles.

McGlone expressed particular concern about market concentration in Bitcoin treasury companies like MicroStrategy, warning of systematic liquidation risks. He noted that cryptocurrency markets now include over 20 million different tokens, undermining Bitcoin's scarcity narrative. "The last quarter of 2025 is not going to be pretty for stocks, risk assets, and Bitcoin," McGlone predicted, suggesting that Federal Reserve rate cuts are already priced in and will not prevent the expected volatility.

Inflation Warning: Prices May Soar 50%, Fed ‘Completely Inadequate’

Lobo Tiggre, Founder of The Independent Speculator, challenged Wall Street's growing narrative that "the worst of Trump shock is behind us," arguing that experienced investors are making a "rookie mistake" by focusing on policy announcements rather than their actual impact on the real economy. Following Trump's imposition of 50% tariffs on India for purchasing Russian oil, Tiggre emphasized that tariff consequences remain ahead, warning that even mainstream economists across the political spectrum acknowledge that US consumers will face higher prices. He dismissed the "transitory" inflation argument, noting that consumers care about absolute price levels rather than rates of change: "They don't care about whether the rate of change is done or not. They care that their prices went up and they're not going down." Tiggre predicted stagflation conditions, characterized by a combination of economic weakness and rising prices, similar to the 1970s when tangible assets, such as gold and silver, significantly outperformed.

Regarding Federal Reserve policy, Tiggre argued the central bank lacks adequate tools for a stagflationary environment, citing a former Fed president's acknowledgment at Jackson Hole that current conditions "sure look like stagflation." He noted Powell's admission of having no plan beyond preventing stagflation, while the Fed's traditional toolkit proves inadequate when the economy requires simultaneous stimulus and tightening. Tiggre predicted the Fed would likely "throw the dollar under the bus" through monetary easing to support employment, especially given political pressure and the recent firing of Fed officials. Regarding gold investment, despite the metal's recent plateau around $3,200-$3,400, he recommended buying at current levels due to central bank purchasing following the dollar's weaponization, arguing that this represents a "one-way door" where countries like China and Russia will not return to trusting dollar reserves.

Tiggre expressed particular bullishness on uranium compared to other commodities, citing the accelerating global nuclear expansion, including Trump's executive orders targeting 300 gigawatts of new US atomic capacity by 2050, as well as Sweden's surprising consideration of uranium mining, despite its historical anti-nuclear stance. He noted uranium's recession resistance due to baseload power requirements for hospitals, airports, and data centers, while supply constraints persist as mines consistently face delays and budget overruns. Regarding a potential return to gold-backed currencies, Tiggre agreed with Ray Dalio's assessment, suggesting that BRICS nations might introduce gold-backed currencies using blockchain technology, with physical gold serving as a trusted intermediary between countries with different ideologies, echoing historical international commerce patterns before the advent of fiat systems.

‘Most Bullish In Time In History’: Gold’s Breakout By Year-End Will Be Huge

Gary Wagner, Editor of TheGoldForecast.com, identified a symmetrical triangle formation in gold's recent price action, arguing that the four-month consolidation period near all-time highs signals an impending breakout rather than distribution. Using Elliott Wave analysis, Wagner traced gold's rally from $2,000 in October 2023 to above $3,500, noting the current pattern features descending upper resistance and ascending lower support lines converging toward an apex. He predicted a breakout above resistance could drive gold to $3,725-$3,800, reasoning that the prevailing uptrend direction should reassert itself after consolidation unless underlying fundamentals change significantly. Wagner emphasized that compression patterns typically break with significant momentum once resistance is breached, targeting the breakout to occur within the next 30 days based on current proximity to resistance levels.

Wagner attributed gold's bullish momentum primarily to policy uncertainty from the Trump administration, rather than traditional geopolitical conflicts, arguing that market participants face unprecedented unpredictability regarding policy changes and their implementation. He highlighted recent developments, including Trump's firing of Fed Governor Lisa Cook and the 50% tariff imposed on India following its purchases of Russian oil, as examples of the uncertainty driving safe-haven demand. Wagner expects a 25-basis-point Fed rate cut in September as Powell attempts to normalize rates while managing dual mandate concerns, though he noted potential stagflation risks if tariffs generate more inflation than currently anticipated. The analyst dismissed the dollar as a competing safe-haven asset, pointing to its 12-13% decline from 109 to 96 on the dollar index since January as contributing to gold's strength.

Regarding silver's recent outperformance since June, Wagner characterized it as catch-up buying after the metal broke above long-term resistance at $33, reaching levels not seen since 2012-2013. However, he maintains a stronger conviction in gold, viewing silver's move as secondary to gold's primary appeal as a safe-haven during uncertain times. Wagner identified key technical levels for gold, with a break below $3,350 support potentially targeting $3,200. A downside break below $3,100 would signal a more significant correction. He expects the symmetrical triangle resolution to occur within two to three weeks, with successful upside breakouts potentially reaching target levels by the first quarter of 2026. He emphasizes that his technical analysis methodology cannot precisely time the breakout but suggests relatively quick movement once resistance is breached.

SPONSORED POST: MONETARY METALS

Monetary Metals is changing how people think about gold. Instead of just letting it sit and hoping the price goes up, investors can now earn a yield on their gold, paid in physical gold. With returns of up to 4%, this model helps gold holders expand their position in actual ounces, not just dollar terms.

Their platform eliminates the usual cost of storing gold and flips the old model on its head by letting investors get paid to hold their metal. The yield is distributed monthly in physical ounces, which investors can redeem and take delivery of at any time.

Thousands of investors are already using Monetary Metals to protect their wealth while earning a steady income in the world’s oldest form of money. With inflation and uncertainty still lingering, this approach to gold investing offers both stability and real returns. Learn more at Monetary-Metals.com/Lin.

Cardano Founder: Bitcoin Market Cap To $10 Trillion As Banks Die, System Resets

Charles Hoskinson, Founder of Cardano & CEO & Founder of Input | Output, defended his decision to leave Ethereum, citing philosophical disagreements about building scalable blockchain systems. He argued that starting from Bitcoin's UTXO model and extending it provided better long-term security than Ethereum's approach. He emphasized that Cardano's research-first methodology, although initially slower, has produced over 250 published papers and fundamental innovations, such as liquid non-custodial staking without slashing or bonding mechanisms that lock user funds. Hoskinson explained that over 70% of ADA supply participates in staking precisely because users maintain liquidity, contrasting with Ethereum's approach, which requires synthetic assets to restore liquidity to locked staked ETH. He positioned Cardano as Bitcoin's "spiritual successor" with a fixed monetary policy, arguing that sound money principles prevent governance debates over inflation rates that plague systems with variable monetary policies.

Hoskinson outlined his vision for algorithmic regulation through smart contracts that embed compliance directly into settlement processes, predicting traditional stock exchanges will become obsolete as decentralized exchanges eliminate custodial risks and order book manipulation. He advocated for tokenized treasuries on blockchains rather than CBDCs, arguing this approach provides government debt backing without centralized control over individual transactions. His Midnight project aims to address privacy challenges through "rational privacy" by utilizing selective disclosure, enabling users to control who can view their transactions while ensuring regulatory compliance through zero-knowledge proofs. Hoskinson predicted that banks adopting stablecoins will thrive. At the same time, those resisting will fail, as the transition is compared to how traditional media companies either adapted to the internet or disappeared, with systems like SWIFT becoming unsustainable due to legacy complexity and security vulnerabilities.

Looking toward Bitcoin's future, Hoskinson predicted that the cryptocurrency will reach $250,000 before the current bull market ends and achieve a $10 trillion market cap within five years, driven primarily by Bitcoin DeFi, which enables yield generation on previously dormant holdings. He argued that Bitcoin layer-2 solutions will create a "tourism" effect where Bitcoin visits other blockchains for utility before returning to its base layer, benefiting networks like Cardano through transaction fees while preserving Bitcoin's store-of-value properties. Hoskinson rejected the notion of zero-sum thinking between cryptocurrencies, arguing that Bitcoin's focus on sound money cannot address use cases such as decentralized social networks, medical records, or complex smart contracts, thereby creating space for specialized blockchains. He framed his work as fundamentally spiritual and philosophical, seeking to rebuild economic, political, and social systems through blockchain technology to restore trust and objective reality in an era where traditional institutions lose credibility every political cycle, emphasizing that the next decade will determine whether humanity achieves liberation through decentralized systems or falls into a "dystopian panopticonal hellscape" controlled by central authorities.

U.S. Becomes World’s 'Most Unequal' Economy

Economist Richard Wolff, Co-Founder of Democracy At Work, warned of deepening economic instability during a recent interview, citing rising inequality and unpredictable tariff policies as major concerns for the American economy.

Wolf explained that US income inequality has worsened relentlessly for 35 years. "We have shot ahead of all the other European countries to become one of the most unequal economies in the world," he said. Recent Bank of America data shows wage growth for lower-income households dropped to 1.3% while higher-income households saw 3.2% growth.

The economist criticized Trump's erratic tariff implementation and called it "radical uncertainty." He said businesses cannot plan investments when policies change unpredictably. "Why come to the United States if the tariff that protects the American market will not be there in three months or six months?" Wolf explained.

Wolf drew parallels to the Smoot-Hawley tariffs that worsened the Great Depression. He noted global economic power has shifted eastward, with BRICS nations now representing 35% of global GDP compared to the G7's 28%. The government's recent 10% stake in Intel particularly concerned Wolf. He called it a "fascistic merger of the corporate and political party top," comparing it to 1930s Germany and Italy.

'Very Real' War Risk By December: Will U.S. Fight Global Conflict?

Geopolitical analyst Trita Parsi, Executive Vice President of The Quincy Institute, warned that Israel will likely launch another war with Iran before December, potentially triggering a broader Middle East conflict with global economic implications. Speaking after Israeli airstrikes killed Yemen's Houthi prime minister, Parsi explained Israel's escalating "decapitation strategy" across the region. "The Israelis are continuing their strategy of trying to decapitate all kinds of movements or governments in the region," he said.

Parsi identified Trump's role as the critical variable. "If Trump decides not to be involved, the Israeli maneuverability is extremely limited," he explained. Without US defensive support, Israel cannot defend against Iranian missile barrages that previously consumed 25% of America's THAAD interceptor stockpile. The analyst predicted Iran would "strike back hard right away" in any renewed conflict, potentially closing the Strait of Hormuz and disrupting global oil supplies. Despite this risk, oil prices fell nearly 1% following the Yemen strikes.

European powers triggered snapback sanctions against Iran this week, automatically restoring UN penalties lifted under the 2015 nuclear deal. Parsi called this "escalatory" rather than diplomatic. China and Russia will likely avoid direct involvement, Parsi said. "They want to trade with everyone and stay out of their fights. I wish the United States had much more of a policy that resembled that of the Chinese."

What To Watch

Tuesday, September 9

Oracle earnings

Wednesday, September 10

Producer price index

Core PPI

PPI year over year

Core PPI year over year

Wholesale inventories

Thursday, September 11

Consumer price index

CPI year over year

Core CPI

Core CPI year over year

Initial jobless claims

Monthly U.S. federal budget

Adobe earnings

Kroger earnings

Friday, September 12

Consumer sentiment (prelim)

U.S. employment report

U.S. unemployment rate

U.S. hourly wages

Hourly wages year over year