Is Market Repeating The 2000 Tech Bubble?

The ‘Tipping Point’ Is Here For Stocks, Economy

TABLE OF CONTENTS

Fed Pivots Into Employment Crisis: What’s Next For Markets?

Market Screams Warning: Chaos Approaches As Final Rally Dies

Bitcoin’s Next Cycle Top Revealed; When Does ‘Altcoin Season’ Start?

Labor Market Collapse? What Trump’s New Policies Mean For Jobs

‘Financial World War 3’: What Comes After U.S. Treasury Dump?

Gold To $8,900, Silver To ‘Triple Digits’, Here’s When

Economist Called Bull Rally, Now Says S&P 500 To 10,000, Here’s When

Market Recap

Markets faced a week of reflection, with the S&P 500 ending Friday at 6,649 points, closing out what proved to be a volatile period for artificial intelligence stocks and broader technology leadership. The Dow Jones Industrial Average finished at 46,281.71, up 0.73% on Friday, while the Nasdaq Composite settled at 22,450.45, advancing 0.29% to cap the week. The week began with markets taking a breather from record highs as doubts about the sustainability of the artificial intelligence bull run worried investors. Tuesday through Thursday saw consecutive declines, with the S&P 500 falling from a new intraday high to close at 6,604.72 on Thursday, down 0.50% for the session. Friday’s rebound rescued the week as strong economic data provided reassurance about underlying economic resilience.

The centerpiece of market anxiety centered on Oracle and the broader AI ecosystem, with Oracle shares falling multiple days this week and dropping 5% Thursday alone as investors questioned circular relationships in the AI industry following recent partnerships. Rothschild & Co. Redburn initiated coverage of Oracle with a sell rating, predicting a 40% pullback because the market “materially overestimates” the benefits of Oracle’s AI deals. However, Intel provided the week’s standout story, surging as much as 7.9% Thursday after Bloomberg reported the struggling chipmaker had approached Apple about securing an investment as part of its comeback bid. Economic data supported the Friday rebound, with initial unemployment filings falling to 218,000 for the week ending September 20, well below the consensus estimate of 235,000, while second-quarter GDP was revised upward to 3.8% from a previous estimate of 3.3%. The strong employment and growth data provided reassurance that the Federal Reserve’s September rate cut was an appropriate risk-management measure, rather than a response to economic deterioration. However, core PCE inflation remained elevated at 2.6%, above the Fed’s 2% target.

Monday saw markets post modest gains despite looming concerns over a potential government shutdown, with the S&P 500 advancing 0.3% to close at 6,663.75 points, while the Nasdaq Composite rose 0.4% to finish at 22,540.35. The Dow Jones Industrial Average declined slightly by 0.07% to settle at 46,217 points, reflecting mixed investor sentiment across sectors. The session’s headline story came from Electronic Arts, which announced a record-breaking $55 billion leveraged buyout by Saudi Arabia’s Public Investment Fund, Silver Lake Partners, and Jared Kushner’s Affinity Partners, with shareholders set to receive $210 per share in cash. EA shares surged 5% Monday following a 15% jump on Friday when initial reports of the transaction surfaced, marking what would become the largest private equity-funded buyout in history. Nvidia continued its strong performance with shares advancing approximately 2.8%, contributing significantly to the Nasdaq’s gains as investors maintained conviction in artificial intelligence infrastructure spending. Gold prices reached an all-time high of above $3,830 per ounce amid safe-haven demand driven by fears of a government shutdown and expectations for additional Federal Reserve rate cuts. Robinhood Markets jumped more than 10% after CEO Vlad Tenev announced that Robinhood Prediction Markets surpassed 4 billion event contracts. At the same time, Carnival Corporation beat third-quarter earnings expectations, with earnings per share of $1.43, exceeding forecasts of $1.32. The specter of a Wednesday government shutdown deadline weighed on sentiment, with President Trump scheduled to meet congressional leaders Monday in an effort to reach a funding agreement. However, concerns centered primarily on the potential delay of critical economic data releases, including Friday’s September jobs report, which the Labor Department indicated would not be released during any lapse in funding.

Market Movements

The following assets experienced dramatic swings in price this past week. Data are up-to-date as of September 29 at approximately 4pm EST.

(Data from StockAnalysis.com)

Intel - up 19.85%

Baba - 10.24%

RobinHood - up 9.47%

Oracle - down 13.83%

Novo Nordisk - down 8.58%

Broadcom - down 4.68%

(Data from https://www.marketwatch.com)

DXY - up .32%

Bitcoin - down .96%

Gold - up 3.54%

Platinum - up 12.41%

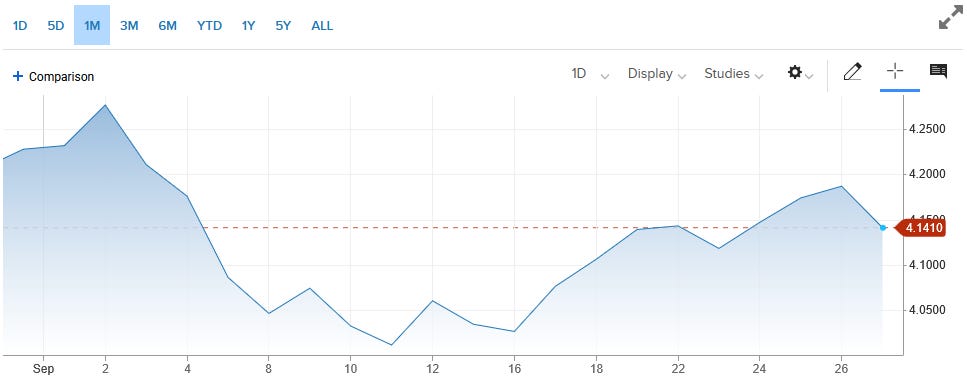

10-year Treasury Yield - up .24%

(10-year data from https://www.cnbc.com)

S&P 500 - up .10%

Russell 2000 - down .44%

Market Analysis

Ted Oakley, Founder and Managing Partner of Oxbow Advisors, characterized current market conditions as resembling the 1999 technology bubble, warning investors against chasing momentum despite Federal Reserve rate cuts amid accelerating inflation. The veteran money manager criticized the Fed’s 25-basis-point reduction as inadequate to stimulate meaningful economic activity, while potentially exacerbating inflationary pressures already evident in consecutive monthly Consumer Price Index increases to 2.9%. Oakley argued the central bank succumbed to political pressure rather than maintaining independence, echoing concerns about Arthur Burns’ capitulation during the 1970s stagflationary period.

Oakley identified housing market dysfunction as a primary economic constraint, noting price-to-wage ratios now exceed 2006 levels by a factor of two, requiring both wage increases and price corrections to restore equilibrium. Unlike previous cycles, where interest rate cuts provided relief, Oakley explained that current mortgage affordability depends more on elevated home prices than on financing costs, with 30-year payments declining only marginally despite the Fed’s action. He predicted companies will accelerate tariff pass-through to consumers after months of margin absorption, citing recent announcements from Home Depot, Macy’s, and Nikon as evidence of this inflection point.

Oakley recommended maintaining a defensive positioning with a 40% treasury allocation, focusing on maturities of two years or less, and avoiding long-duration bonds despite potential short-term rallies. He identified energy sector equities as attractive opportunities, noting that oil companies are trading at depressed valuations while paying dividends of 4-7% after debt restructuring, following the peak in crude prices at $130 three years ago. The manager dismissed artificial intelligence stocks as overvalued “fad stocks” comparable to dot-com era speculation, advocating for cash flow-generating businesses over momentum plays as leverage permeates private equity and credit markets.

Fed Pivots Into Employment Crisis: What’s Next For Markets?

Adam Kobeissi, Founder and Editor-In-Chief of The Kobeissi Letter, projected the S&P 500 reaching 7,500 within twelve months despite acknowledging labor market deterioration, citing unprecedented Federal Reserve easing into an inflationary environment as the primary catalyst. The economist noted that youth underemployment reached 17%, the highest level since the pandemic, while aggregate weekly hours worked declined by 0.2% over three months—the largest drop since 2020. However, Kobeissi argued this weakness would fuel continued Fed accommodation rather than trigger asset crashes, creating a “rush into any search for yield” across risk and safe-haven assets.

The economist highlighted concerning market dynamics, including retail investor inflows four times above the average for 2020-2024, and concentration risk reaching record levels, with the top ten stocks comprising 41% of the S&P 500’s market capitalization. Despite these warning signals typically associated with market tops, Kobeissi maintained his bullish thesis based on massive artificial intelligence capital expenditure by technology giants and political pressure for continued monetary easing. He noted that the Fed cut rates for only the third time since 1996, with the S&P 500 near record highs, historically resulting in an average gain of 15% over the subsequent twelve months.

Kobeissi identified stagflationary conditions emerging as 72% of Consumer Price Index components exceeded the Fed’s 2% target while labor markets weakened simultaneously. The analyst predicted inflation would persist above 3% on core measures, driving asset price appreciation on nominal terms while targeting gold at $4,000 and Bitcoin at $150,000. He characterized current monetary policy as unprecedented, with the Fed cutting rates despite rising inflation, contrary to historical patterns, creating conditions that favor all asset classes amid a persistent search for yield and concerns about dollar debasement.

Market Screams Warning: Chaos Approaches As Final Rally Dies

Chris Vermeulen, Chief Market Strategist at The Technical Traders, identified dangerous sentiment extremes across markets after his proprietary FOMO indicator reached critical thresholds, suggesting investors are capitulating to fear of missing out on recent rallies. The technical analyst noted Jerome Powell’s comments about “fairly highly valued” stocks coincided with his indicator’s warning signal, triggering coordinated selling across equities, gold, and mining stocks. Vermeulen emphasized that understanding broad market sentiment provides insight into poker-like dynamics where investors can anticipate other participants’ moves across multiple asset classes simultaneously.

The trader projected gold reaching $4,100 based on Fibonacci extensions from recent consolidation patterns, representing a potential 8-10% upside, despite the current parabolic price action that typically precedes sharp reversals. Vermeulen warned that while gold’s trend remains intact above the 150-day moving average, the current vertical ascent mirrors dangerous precedents where “everyone who’s going to get in has already got in,” leaving markets vulnerable to abrupt corrections. He noted an increase in FOMO inquiries from retail investors seeking exposure to precious metals at current elevated levels, which he viewed as a contrarian warning signal.

Vermeulen identified structural market weaknesses despite the headline index’s strength, noting that small-cap, mid-cap, and equal-weighted indices were hitting resistance levels. At the same time, the VIX traded at complacent lows, and put-call ratios showed extreme bullish positioning. The analyst argued that gold’s outperformance versus stocks mirrors the conditions preceding major market corrections in 2007, suggesting that money flows are anticipating economic disruption. He recommended maintaining exposure to both asset classes, favoring gold’s 15-30% upside potential over stocks’ limited 3% room to current resistance levels. He emphasized his trend-following approach of rotating between 5-12 positions annually, based on momentum and technical signals.

Bitcoin’s Next Cycle Top Revealed; When Does ‘Altcoin Season’ Start?

Benjamin Cowen, Founder and CEO of Into the Cryptoverse, projected that Bitcoin will reach a cycle peak before 2025 concludes, citing adherence to seasonal patterns that show August highs followed by consolidation periods in September and October across previous bull markets. The technical analyst noted that Bitcoin’s recent performance mirrors 2021 behavior, with the cryptocurrency finding support above the 20-week moving average after August peaks. This suggests that the current price action represents normal cyclical behavior rather than a deviation from historical norms. Cowan emphasized timing over specific price targets, suggesting that any weekly closes below the 50-week moving average, around $100,000, would likely signal the end of the cycle.

The researcher challenged premature altcoin season predictions, arguing that Bitcoin’s dominance near 60% represents a cyclical low rather than a permanent shift toward alternative cryptocurrencies. Cowan demonstrated how previous cycles showed dominance rallying from September lows before final rotation into altcoins, noting that current conditions parallel those of 2017 and 2021, where liquidity returned to Bitcoin before broader market peaks. He maintained that altcoin season remains contingent on Bitcoin dominance completing its final rally, dismissing current calls as premature despite recent Ethereum outperformance following its regression band test.

Cowan projected a 2026 bear market based on a four-year cycle analysis, noting that every midterm year since Bitcoin’s inception has produced negative returns, including 2014, 2018, and 2022. The analyst anticipated diminishing returns, continuing with approximately 70% drawdowns from cycle peaks, representing an improvement from previous corrections of 94%, 87%, and 84%. This approach would maintain painful but manageable resets. He recommended an 80% Bitcoin, 20% Ethereum portfolio allocation, arguing that Federal Reserve policy impacts represent noise rather than fundamental drivers, with narrative following price action instead of preceding it.

Labor Market Collapse? What Trump’s New Policies Mean For Jobs

Steven Camarota, Director of Research at the Center for Immigration Studies, documented a dramatic 2.2 million decline in the foreign-born population from January to July 2025, with approximately three-quarters representing illegal immigrants who appear to have departed voluntarily or through deportations. The researcher argued this represents roughly 10-12% of the estimated illegal immigrant population, concentrated among Latin American men without a college education who arrived within the past 10-15 years. Camarota projected the labor supply reduction could drive wage increases, particularly for lower-skilled native-born workers, potentially drawing millions of sidelined Americans back into the workforce.

The Trump administration’s overhaul of the H-1B visa program, which would impose $100,000 employer fees, drew mixed reactions from immigration experts. Camarota noted that the change addresses longstanding concerns about wage suppression and worker displacement in the technology sector. The researcher challenged physicist Michio Kaku’s claims about America’s science education system, arguing native-born STEM workers comprise 77% of the field and score competitively on standardized assessments despite broader educational concerns. Camarota emphasized that genuine STEM shortages would manifest through rapid wage growth, which data fail to demonstrate across engineering and technology occupations.

Camarota defended the Center’s “low immigration, pro-immigrant” philosophy, advocating for reducing annual legal immigration from current levels of 1.1-1.2 million green cards to approximately 500,000 per decade while supporting integration services for existing immigrants. The researcher challenged Economic Policy Institute projections of six million job losses from deportations, arguing America’s flexible labor market can substitute capital investment and higher wages for immigrant labor while reintegrating the 18 million working-age men currently outside the workforce. He warned that the future impact of artificial intelligence on employment could complicate immigration policy, noting the fundamental difference between adjusting trade flows and managing permanent population changes.

‘Financial World War 3’: What Comes After U.S. Treasury Dump?

Willem Middelkoop, Founder of the Commodity Discovery Fund, argued that the current dollar-centered monetary system, established in 1944, is approaching its historical endpoint, citing his research showing that monetary resets occur every 90 years on average. The investment manager noted the dollar’s 13% decline year-to-date represents the first crisis where investors fled toward gold rather than traditional safe havens, marking a fundamental shift in the $37 trillion debt-burdened system. Middelkoop characterized the current global tensions as “Financial World War III,” with the West’s 1.5 billion population facing BRICS nations, which represent 4-5 billion people, in an economic conflict that is being waged through the use of sanctions, tariffs, and commodity restrictions as weapons.

The Dutch investor warned the United States empire feels cornered and may resort to military conflict around 2027-2028, possibly over Taiwan, as evidenced by Defense Secretary remarks about preparing for confrontation. Middelkoop argued America squandered its reserve currency privilege by spending $37 trillion primarily on unsuccessful wars rather than productive infrastructure like China, creating vulnerabilities as foreign central banks abandon treasury purchases for gold accumulation. He noted that central banks became net gold buyers after the 2008 financial crisis, accelerating their purchases to over 1,000 tons annually following the 2014 regime change in Ukraine.

The fund manager predicted severe commodity shortages driven by de-dollarization trends and Western attempts to decouple from Chinese supply chains, which control 80-90% of specialty metals production. Middelkoop recommended a portfolio allocation of 25% each across cash/Bitcoin, precious metals, and real estate, projecting that silver prices would reach hundreds of dollars per ounce within 5-10 years due to guaranteed physical shortages. He warned of potential sovereign debt crises that could require International Monetary Fund intervention, as countries struggle with rising interest rates following four decades of declining yields, which ended in 2022.

Gold To $8,900, Silver To ‘Triple Digits’, Here’s When

Ronald-Peter Stoeferle, Managing Partner of Incrementum AG, identified emerging stagflationary conditions as the September Consumer Price Index data reached 2.9%, marking the third consecutive monthly acceleration from previous readings of 2.7%. The gold analyst argued that Federal Reserve officials face an impossible position between rising inflation pressures and weakening labor market conditions, with initial jobless claims hitting four-year highs. At the same time, the Bureau of Labor Statistics revised down employment by 911,000 jobs over the twelve months ending March 2025. Stoeferle characterized this environment as resembling 1970s inflation patterns, suggesting another wave may be building despite market complacency.

The precious metals strategist maintained his $4,800 gold target by 2030 in the base case scenario, with an alternative projection reaching $8,900 if inflation becomes the primary market driver this decade. The analyst noted three fundamental drivers supporting the secular bull market: structural demand growth from emerging markets, including China and India; central bank allocations averaging 26% globally; and accelerating trust erosion, leading investors toward physical assets over paper contracts.

Stoeferle predicted silver would outperform both gold and Bitcoin in 2026, despite the gold-silver ratio remaining at elevated levels around 88. The strategist emphasized the acceleration of dedollarization trends as geopolitical blocs solidify, particularly following the Shanghai Cooperation Organization meetings, which featured coordination among China, India, and Russia. He characterized gold and Bitcoin as complementary sound money assets, noting wealthy Bitcoin holders increasingly diversify into gold as they age and seek lower volatility exposure while maintaining inflation protection.

Economist Called Bull Rally, Now Says S&P 500 To 10,000, Here’s When

Ed Yardeni, President of Yardeni Research, has escalated his market projections for the S&P 500, reaching 6,000 next year and potentially 10,000 by the decade’s end, characterizing current conditions as the “roaring 2020s” that will extend into the “roaring 2030s.” The economist argued that the Federal Reserve’s 25-basis-point rate cut represented political capitulation rather than economic necessity, noting that other central banks, like the Bank of England, had maintained restrictive policies despite similar labor market concerns. Yardeni contended that the cut increases “melt-up” risks reminiscent of 1999-2000 bubble conditions, while abandoning the inflation mandate when the Consumer Price Index remains at 3% versus the 2% target.

The market strategist dismissed labor market weakness as primarily due to supply-side constraints that monetary policy cannot address, citing a 1.5 million decline in the foreign-born population since March and the effects of artificial intelligence displacement. Yardeni emphasized productivity growth as the key economic driver, arguing that a 3% real GDP expansion with 1-1.5% labor force growth implies 2% productivity gains, which render rate cuts unnecessary. He advocated repealing the Fed’s dual mandate established in the 1940s, suggesting central bankers should focus exclusively on financial stability rather than employment objectives beyond their control.

Yardeni identified baby boomer consumption as a fundamental economic pillar, noting the generation controls $80 trillion in net worth while engaging in significant intergenerational wealth transfers to support younger family members. The economist recommended gold exposure targeting $4,000-$ 5,000, based on central bank diversification away from dollar reserves, while favoring financial services that benefit from renewed IPO and merger activity. He warned that potential debt crises might prove beneficial by forcing fiscal discipline, characterizing current deficits as “generational theft” requiring either extended retirement ages or reduced Social Security benefits for working recipients.

What To Watch

Tuesday, September 30

S&P Case-Shiller home price index (20 cities)

Chicago Business Barometer (PMI)

Job openings

Consumer confidence

Wednesday, October 1

ADP employment

Construction spending

S&P final U.S. manufacturing PMI

ISM manufacturing

Auto sales

Thursday, October 2

Initial jobless claims

Factory orders

Friday, October 3

U.S. employment report

U.S. unemployment rate

U.S. hourly wages

Hourly wages year over year

S&P final U.S. services PMI

ISM services