How The Fed Could Shock Markets Next Week

Will the Fed cut by 50 bps or 25 bps next week? Who will win the Presidential election? Your FAQs answered, and more

TABLE OF CONTENTS

Market Recap: Alfonso Peccatiello a 50 bps Fed cut

POLITICS: Who will win the election? Matt Gertken gives prediction

ECONOMY: Lobo Tiggre warns that recession indicators are blinking

MARKET RECAP

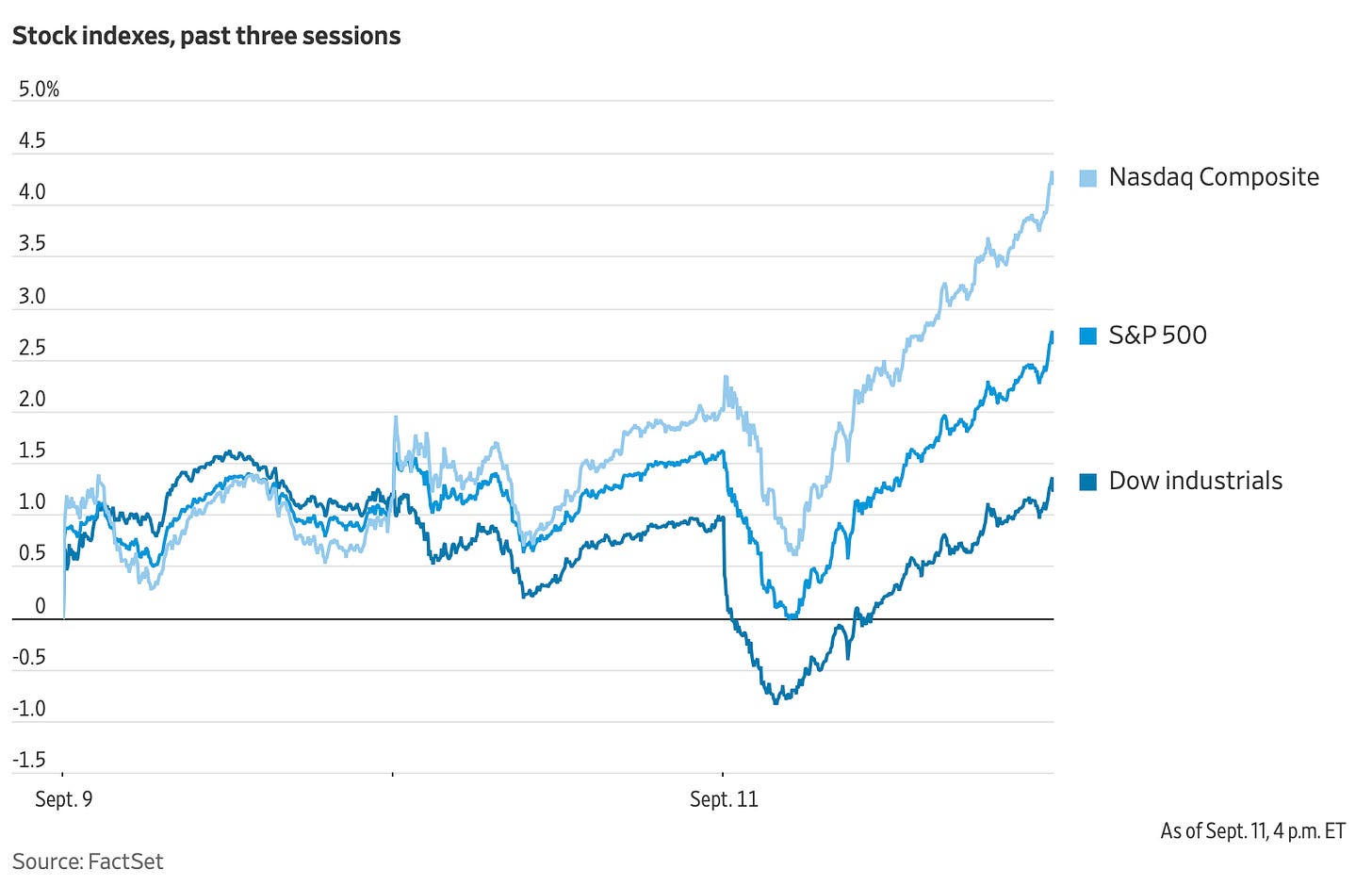

LATEST NEWS. Markets sold off on Wednesday morning after the Bureau of Labor Statistics (BLS) released its CPI report, which came in hotter than expected. Core CPI rose 0.3 percent in August, up from 0.2 percent in July, and higher than the 0.2 percent that economists expected. Treasury yields gained, with the 2-year rising by 50bps, and the stock market fell, with the Dow Jones tumbling 1.3 percent. Since then, equities have regained their losses.

The CPI report’s timing is salient, since the Federal Reserve is expected to cut rates on September 18th after the Federal Open Market Committee’s meeting. Investors are betting on the pace of Fed rate cuts, and the CPI report reduced investor expectations of a 50 bps cut next week.

Investors also reacted to Tuesday night’s presidential debate, which suggested a higher chance of a Kamala Harris win, as per Polymarket. Bitcoin and crypto stocks fell, while solar stocks gained. Former President Trump’s company Truth Social is down 10.5 percent in today’s trading.

To understand what could happen at next week’s FOMC meeting, we were joined by Alfonso Peccadillo, Founder of The Macro Compass (see his Substack

), who argues that the Fed is “falling behind the curve,” and has failed to “proactively cut interest rates.”Peccatiello forecasts that “there is a chance” the Fed will cut by 50 bps next week, highlighting in particular the weak labor market. The U.S. economy created only 96,000 jobs per month over the last three months, the slowest pace of job creation since 2017. Peccatiello said that these data, which are likely to be revised down further, bolster the case for aggressive Fed action. He also noted that after September, the next Fed meeting is in October — which could be too late for an aggressive cut if it were needed.

As of September 13, the probability of a 50 bps rate cut stands at 43%, according to the CME FedWatch Tool:

It’s important to note that this probability of a 50 bps cut was only less than 20% a few days ago and surged in the last 24 hours.

Despite expected Fed cuts, Peccatiello suggested that the U.S. dollar could strengthen against other currencies because other central banks would be more aggressive with their rate cuts. He also pointed to $13 trillion in dollar-denominated debt owed by foreign entities. As global economies slow down, these borrowers may struggle to repay their debts, increasing demand for dollars.

Peccatiello forecasts that both the dollar and gold could rise simultaneously, driven by a rare combination of inflationary policies and central banks keeping interest rates low. He also pointed out that European economies, particularly Germany, were experiencing significant slowdowns, signalling potential recession risks across the Eurozone.

Market Movements

From September 5 to September 11, the following assets experienced dramatic swings in price. Prices are up-to-date as of September 11 at 4pm ET (approximate).

Palantir Technologies — up 14.8 percent.

Under Armour — down 17.7 percent.

Smith & Wesson — down 13.3 percent.

Natural gas — up 6.5 percent.

Palladium — up 6.4 percent.

For major assets, the price moves were as follows.

DXY — up 0.45 percent.

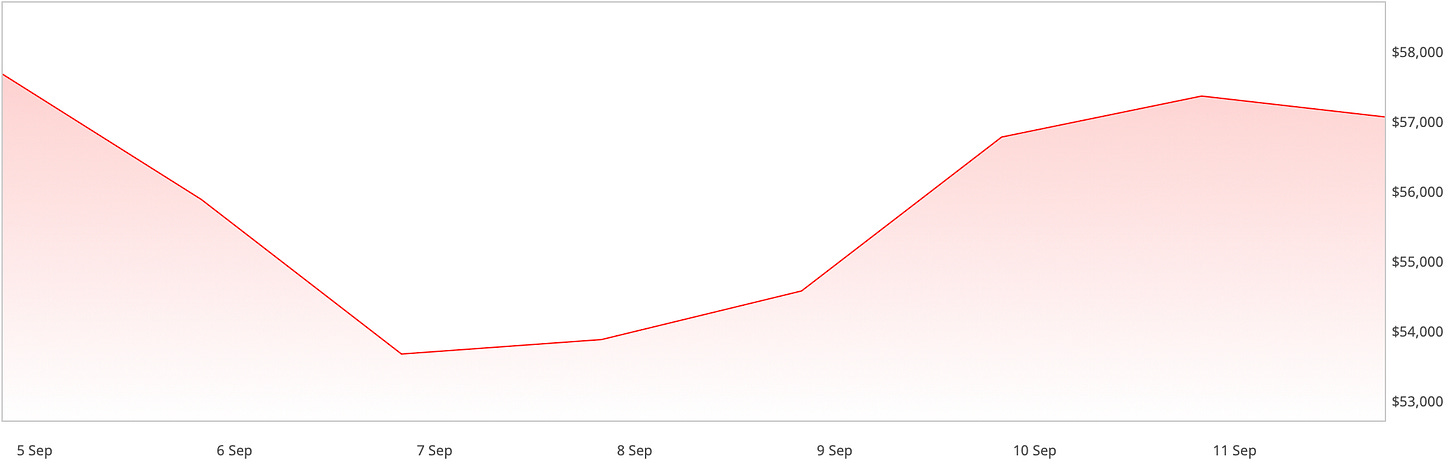

Bitcoin — down 0.97 percent.

Gold — up 0.6 percent.

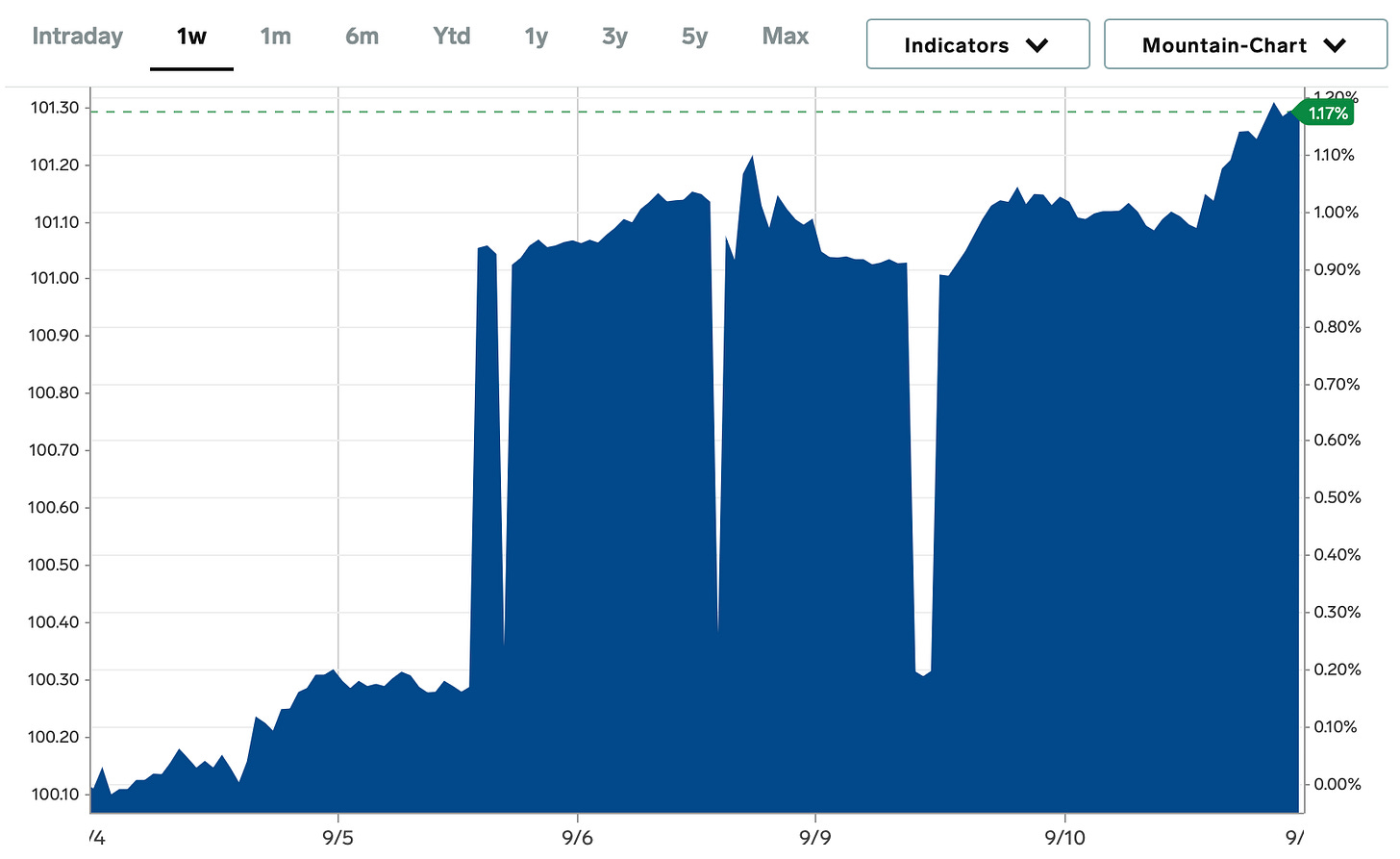

10-year Treasury yield — up 1.17 percent.

S&P 500 — up 0.9 percent.

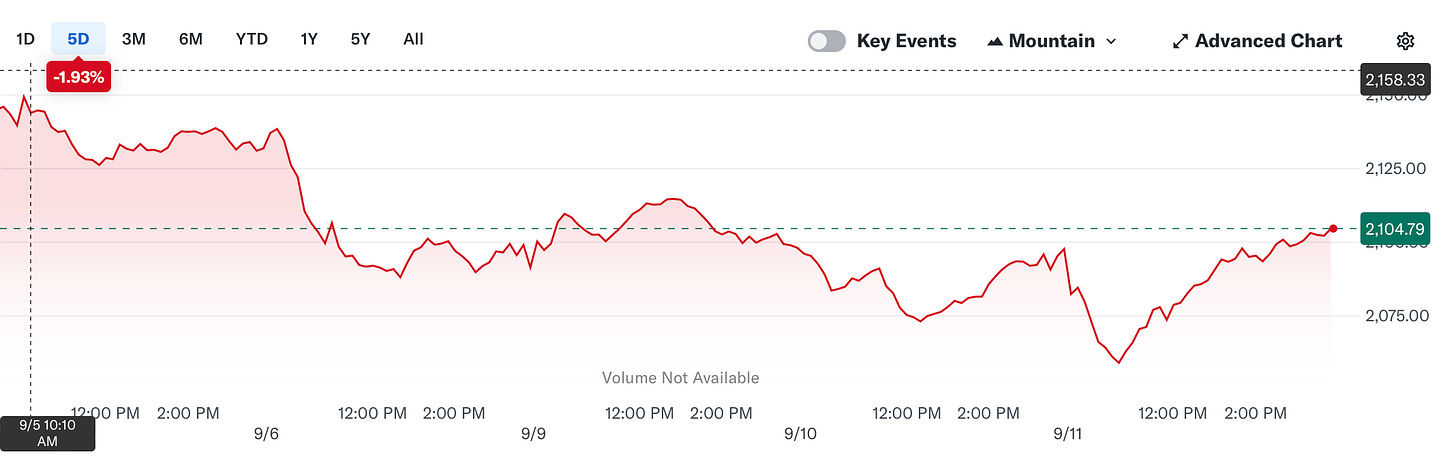

Russell 2000 — down 1.9 percent.

USD/Yen — down 0.7 percent.

POLITICS:

WHO WILL WIN THE PRESIDENTIAL ELECTION?

Matt Gertken, September 12, 2024

This week’s presidential debate between Donald Trump and Kamala Harris provided a boost to confidence in a Democrat win, as noted by geopolitical strategist Matt Gertken. While polls initially showed Trump with a slight lead, Harris gained ground by the end of the debate. Betting markets and polls now show Harris with a marginal advantage.

Gertken attributed Harris' improved standing to a post-nomination bounce and her effective performance in the debate. He highlighted that Harris successfully positioned herself as a candidate for the future, contrasting Trump, whose debate performance was criticized, even by some Republicans.

Gertken also shared his updated election forecast, now giving Harris a 55% chance of winning the presidency, citing a strong job market and expanding economy, particularly in critical swing states like Pennsylvania. However, he warned that rising unemployment in other states could shift the odds before November.

Earlier in the summer, Gertken favored a Trump victory.

“Where I temporarily that Republicans were going to win was in July and August after Biden fell apart, after Trump was nearly assassinated, there was just an enormous momentum behind the party at the time,” he said.

Regarding macroeconomic policies, Trump’s platform, which includes aggressive tariffs and corporate tax cuts, could increase inflationary pressures, according to Gertken. Harris, meanwhile, proposed policies focused on curbing inflation through price controls and housing initiatives, although Gertken expressed skepticism about their effectiveness.

On foreign policy, Gertken stressed that global instability could influence the election outcome. While Trump may lean toward protectionist policies and escalate tensions with China and Iran, Harris faces the challenge of handling both the Ukraine crisis and ongoing U.S.-China tensions.

Gertken concluded that the election remains highly competitive, with factors like economic performance and international events holding significant sway over the final result.

EQUITIES:

INFLATION IS HERE TO STAY?

Cole Smead, September 5, 2024

Cole Smead, CEO of Smead Capital, joined the show to discuss his claim that inflation will stick around for the long term, and that investors need to adjust to this. According to Smead, inflation is currently driven by excessive government spending and deficits, particularly in the aftermath of the COVID-19 pandemic. He argued that inflation would remain elevated due to these structural pressures, and that the Federal Reserve’s temporary success in tempering inflation did not address the underlying issues.

Amidst this inflationary background, Smead said that with risk-free yields on government bonds reaching attractive levels, investors need to be more discerning about the risks they are taking with stocks. Stocks, he argued, are no longer as reliable for protecting against inflation as they had been historically, referencing the 1970s as a period when equities failed to generate real returns during inflationary times.

To hedge against inflation, Smead advocated for investing in tangible assets and cyclical industries, particularly in the energy sector. He highlighted the oil and gas industry as being significantly underinvested, leading to future scarcity and strong returns. He cited Warren Buffett’s investment in Occidental Petroleum as an example of strategic capital allocation in a high-return cyclical industry.

Smead warned that large-cap technology stocks, such as Nvidia and Google, are overvalued and carry significant risks due to their dominance in market indices. He noted that the rapid rise in valuations, particularly for Nvidia, was driven by hype surrounding AI, making these stocks vulnerable to sharp corrections. Nvidia’s stock, for instance, experienced a significant increase in market cap before quickly losing 30 percent of its value.

Smead’s overall investment strategy revolved around capitalizing on under-appreciated cyclical industries, particularly in commodities, while staying cautious about the overvaluation in technology and large-cap stocks in an inflationary environment.

ECONOMY:

’FLASHING RED LIGHTS EVERYWHERE’

Lobo Tiggre, September 10, 2024

Lobo Tiggre, Editor of The Independent Speculator, reacted to U.S. Treasury Secretary Janet Yellen’s recent statement that the U.S. economy remains “solid,” saying that there are several “flashing red lights” to be concerned about. He pointed to commodities like oil and copper, known as indicators of economic health, which are signalling a potential recession. He also highlighted the labor market's weakening, noting that the trend shows increasing unemployment, which is a classic precursor to a recession.

On the Federal Reserve’s monetary policy, Tiggre suggested that while many expect a rate cut, he believes the Fed should keep rates higher for longer to truly address inflationary pressures. He said that government spending continues to drive inflation, and warned that the government’s continued deficits would only exacerbate inflation in the long term, regardless of which political party is in power.

As for investment implications, Tiggre advised investors to consider precious metals like gold and silver, with a cautious approach toward silver due to its correlation with copper, which is vulnerable in a recession. He remains bullish on uranium, viewing the recent market correction as a buying opportunity.

Tiggre's overall advice was to prepare for a hard landing, with continued inflation and economic turbulence on the horizon. His recommendation for investors was to focus on real assets that can withstand inflationary pressures and to remain cautious in the face of a potential economic downturn.

ECONOMY:

THIS IS THE RECIPE FOR THE NEXT CRISIS

John Butler, September 8, 2024

John Butler, Investment Director at Southbank Investment Research, returned to the show to give his thoughts on the U.S. economy and the presidential elections. Butler highlighted that although the U.S. has not experienced a technical recession — defined as two consecutive quarters of negative GDP growth — the recent growth in the U.S. economy has come from government spending rather than private sector growth, which creates a skewed view of economic health. Full-time private sector employment has slightly declined, which may negatively affect voter confidence, as people feel less job security and growth distribution remains uneven.

Butler argued that inflationary pressures, driven by excessive government spending and loose monetary policy, could lead to economic problems. He also highlighted that the risks posed by persistent government deficits, low private sector investment, and the potential for misguided fiscal policies, such as increased taxes on capital gains, could crash the stock market. Butler suggested that the U.S. could be heading toward a deeper economic crisis if these structural issues aren’t addressed.

In the context of the 2024 U.S. presidential election, Butler discussed the economic proposals of Kamala Harris and Donald Trump. He criticized Harris’s plan for raising capital gains taxes and introducing a minimum income tax for the wealthy, warning that such policies could further dampen investment and reduce long-term economic growth. In contrast, Trump’s plan to cut taxes, while potentially increasing the federal deficit, follows a supply-side economic approach that seeks to leave more capital in the private sector to stimulate growth.

Butler remarked that while political and fiscal effects are important, the Federal Reserve has a dominant influence on the U.S. economy. He said that regardless of who wins the election, economic performance will largely depend on the Fed’s actions, particularly regarding interest rates and inflation control.

ENERGY:

IS THIS THE END OF OPEC?

Doomberg, September 9, 2024

Our favourite green chicken returned to the show to discuss oil prices, the U.S. elections’ effect on oil, and the Organization of Petroleum Exporting Countries (OPEC).

Doomberg began by discussing the decline in WTI crude oil prices, which fell to around $68 a barrel, attributing the drop to various factors, including a de-escalation of geopolitical risks and China's shift toward using LNG-powered trucks instead of diesel. Doomberg emphasized that this switch in China could reduce global diesel demand by approximately 800,000 to 1 million barrels per day, contributing to the softness in oil prices.

Doomberg also said that the oil market is currently oversupplied, despite OPEC’s efforts to limit production. This oversupply, along with U.S. regulation that limits the natural gas exports, is bearish for oil in the short to medium term. He pointed out that geopolitical risk premiums, which traditionally elevate oil prices, have largely been priced out of the market.

On the long-term future of OPEC, Doomberg predicted that the he world’s largest and most important cartel’s influence may wane as more countries increase their oil production capacity, and as technological advancements blur the lines between oil and natural gas. He speculated that defections from OPEC and increased global production could erode OPEC’s ability to control oil prices effectively, leading to its eventual decline. This, he argued, would result in a more competitive, lower-price oil market globally.

In terms of the U.S. presidential election, Doomberg maintained that a Trump victory would be bearish for oil prices. He argued that under Trump, there would likely be increased drilling, which would flood the market with supply, driving prices down. Conversely, a Democratic administration might restrict fossil fuel development, keeping supply tighter and prices higher.

CRYPTO:

BITCOIN VS. GOLD DEBATE

Jack Mallers & Peter Schiff, September 7, 2024

Jack Mallers, CEO of Strike, joined Peter Schiff, Chief Market Strategist at Euro Pacific Asset Management, to debate the monetary merits of gold as opposed to Bitcoin, with Schiff taking the pro-gold side and Mallers arguing in favour of Bitcoin.

Mallers argued that Bitcoin represents the best form of money due to its unique properties, including scarcity, divisibility, portability, and its ability to function without trusted third parties like governments or banks. He pointed out that Bitcoin has outperformed gold and most other assets since its inception and sees it as the future of money, particularly because of its decentralized and censorship-resistant nature.

Schiff defended gold as a reliable store of value with thousands of years of historical precedence. He criticized Bitcoin for lacking intrinsic value, claiming that unlike gold, Bitcoin has no practical use beyond speculation. He said that Bitcoin is a bubble and could collapse at any moment.

Mallers contended that Bitcoin’s decentralized nature and resistance to government control make it a superior monetary asset for the modern, globalized world. Schiff remained skeptical, maintaining that gold’s proven history as a store of value would ultimately prevail, especially in times of economic uncertainty.

CRYPTO:

THIS COULD TAKE BITCOIN TO $100K

Jake Boyle, September 6, 2024

Jake Boyle, Chief Commercial Officer at crypto exchange Caleb & Brown, discussed the effects of the Federal Reserve's anticipated interest rate cuts on markets, focusing on Bitcoin. Boyle noted that Bitcoin's performance has become increasingly tied to traditional markets, especially as it gains institutional support. With the Fed expected to cut rates, Boyle predicted a temporary “euphoria” in the Bitcoin market, potentially driving prices to $65,000 or even $70,000. However, he cautioned that the excitement may be short-lived.

Boyle turned to the ongoing debate about whether a rate cut signals a weaker economy or provides a liquidity boost for risk assets like Bitcoin and tech stocks. He explained that, for now, Bitcoin moves in tandem with other risk assets, such as the S&P 500 and NASDAQ, and is yet to decouple as an independent asset. This alignment is further supported by Bitcoin’s increasing adoption by institutional investors, leading it to behave more like traditional financial assets.

On the U.S. election, Boyle said that if Donald Trump wins, Bitcoin could reach $100,000. Boyle said that Trump’s outspoken support for Bitcoin, combined with pro-crypto figures like Robert F. Kennedy Jr. aligning with him, could create a favorable environment for Bitcoin. However, he also noted that if Kamala Harris wins, the outlook for Bitcoin may be less favourable, with a continuation of tight regulations and a more challenging environment for crypto adoption.

Overall, Boyle remains bullish on Bitcoin’s future, particularly if the U.S. election or increasing institutional adoption continue to favour the digital currency. However, he acknowledged the volatility and uncertainty in the current economic landscape, emphasizing that investors should remain cautious and informed.

WHAT TO WATCH

Thursday, September 12, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

Producer Price Index: The BLS will release the PPI, which measures the average producer’s price for their inputs.

European Central Bank rate decision: The ECB Governing Council will meet in Frankfurt to make an interest rate decision for the Eurozone.

Tuesday, September 17, 2024

U.S. Retail Sales: this shows consumer spending in retail stores, online, and restaurants, and is released monthly by the U.S. Census Bureau.

Wednesday, September 18, 2024

FOMC interest-rate decision: This decision, made by the Federal Reserve's Federal Open Market Committee (FOMC), determines the target federal funds rate.

Housing Starts: This measures the number of new residential construction projects, and is released monthly by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Thursday, September 19, 2024

Bank of England interest rate decision: The Bank of England’s monetary policy committee will decide on the direction of interest rates.

Bank of Japan interest rate decision: The Bank of Japan’s monetary policy committee will meet to decide on the direction of its key interest rate.

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

Existing Home Sales: This shows the number of sales of existing homes, and is released monthly by the National Association of Realtors (NAR).