Brink Of Nuclear War? Israel-Lebanon Conflict Escalates

Israel Tells Its Troops To Prepare For Ground Offensive

TABLE OF CONTENTS

Market Recap: Professor Richard Wolff on escalating Middle East tensions

EQUITIES: Thomas Hayes On ‘Monstrous Rallies’ As Fed Cuts Rates

ECONOMY: Luke Gromen Says The U.S. Can ‘No Longer Afford Debt’

ECONOMIC POLICY: Inequality Is U.S.’s Biggest Crisis — Liz Pancotti

POLITICS: Professor Allan Lichtman Reveals His Prediction for POTUS

MARKET RECAP

Latest News. Escalating tensions between Israel and Lebanon may have muted investors’ optimism about Fed rate cuts last week. On Monday, September 23rd, Israel launched a fresh round of strikes against alleged Hezbollah targets, resulting in hundreds of deaths. Hezbollah has since vowed vengeance, potentially drawing Iran into the conflict. Israel, for its part, has told its troops to prepare for a ground offensive.

To make sense of these geopolitical events and what they mean for the economy, we were joined by Richard Wolff, Professor Emeritus of Economics at the University of Massachusetts Amherst and Founder of Democracy at Work.

Wolff started off by saying that Israel's actions, such as targeting Hezbollah in Lebanon, are escalating tensions, which could potentially lead to a larger regional conflict. This could even result in U.S. troops being deployed to the Middle East.

“I think you are flirting here with an all-out war that we will all engage in,” said Wolff. “Each side will affirm to the other that they won’t use nuclear weapons, and then one of them will, and then it’s over.”

Wolff said that Israel's reliance on U.S. support is crucial for its security and that without this backing, its position would be significantly weakened. He called Israel “an outpost of the United States’s empire.”

He said that the United States is over-extending itself militarily and financially in its support of Israel. He argued that the U.S. is a declining empire, and that its foreign policy overreach is affecting the U.S.’s ability to promote its domestic economy.

“The [United States’s] efforts, like in Ukraine or in Israel, are the efforts of a declining empire directly or indirectly to hold on,” said Wolff.

Wolff said that the U.S. has already poured substantial resources into supporting Ukraine, which has not yielded the desired results, and a similar situation could occur with Israel.

Wolff also said that U.S. dollar dominance is waning globally. He observed that more international trade is being conducted in other currencies, such as the Chinese yuan and the Euro, reducing the global demand for the dollar. This decline in the dollar's dominance could weaken the U.S. economy further by affecting its trade balance and diminishing its influence in global financial markets.

Market Movements

From September 19 to September 26, the following assets experienced dramatic swings in price. Data are up-to-date as of September 26 at 4pm ET (approximate).

Cameco Corporation — up 16.2 percent.

Rivian — down 15.1 percent.

Silver — up 6 percent.

VanEck Junior Gold Miners ETF — up 7.6 percent.

FedEx — down 11.3 percent.

What follows are the price movements of major assets.

DXY — down 0.38 percent.

Bitcoin — up 3.5 percent.

Gold — up 3 percent.

10-year Treasury yield — up 1.3 percent.

S&P 500 — up 0.5 percent.

Russell 2000 — down 1.9 percent.

USD/Yen — up 1.8 percent.

EQUITIES:

’MONSTROUS RALLIES’ AHEAD AS FED CUTS RATES

Thomas Hayes, September 20, 2024

Thomas Hayes, Managing Member of Great Hill Capital, returned to the show to provide his investment outlook following last week’s 50bps Fed rate cut.

Hayes said that small caps, value stocks, and emerging markets historically benefit from Fed easing cycles, explaining that “50 basis points at this time dramatically increases the odds of a soft landing and a growth re-acceleration, which favors cyclicals, which favors small caps, which favors value.”

In the current environment, Hayes said that emerging market stocks benefit from both a weaker U.S. dollar and the global liquidity provided by central bank easing. Predicting that emerging market stocks are “going to be the next thing to surprise people,” Hayes noted that while the broader indices might deliver moderate returns, there could be “monstrous amounts of money” made in emerging markets for investors who position themselves correctly.

However, Hayes was skeptical about the broader market’s robustness, particularly for heavily-weighted indices like the S&P 500. He said that while the market may rise slightly, the real gains will be found in under-appreciated sectors. He also cautioned investors about defensive sectors like consumer staples and utilities, which have seen high inflows as investors seek safety. Hayes said that these sectors are now overcrowded, making them vulnerable to a potential downturn.

Regarding the bond market, Hayes projected a short-term increase in yields, contradicting the general view that yields would fall with a rate cut. He attributed this to increased confidence in a soft landing for the economy, which would reduce the likelihood of further aggressive rate cuts.

STOCK IDEA:

Li-FT Power (TSXV: LIFT | OTCQX: LIFFF)

(Sponsored Post)

Li-FT Power) is emerging as a notable player in the lithium mining sector, just as global demand for lithium is set to accelerate. Located near Yellowknife in Canada's Northwest Territories—a region celebrated for its mining-friendly policies—the company boasts a world-class lithium deposit with unique advantages that position it strongly in the industry.

Key Highlights:

Exceptional Lithium Deposit: Li-FT Power's project features high-grade lithium-rich spodumene, with preliminary estimates suggesting over 50 million tons of lithium (to be verified in the upcoming resource estimate). Remarkably, much of this resource is at or near the surface, potentially reducing extraction costs and enhancing project economics.

Strategic Infrastructure Advantage: The deposit is just four miles from a major highway connecting to Yellowknife, a mining hub with existing infrastructure and a skilled workforce. This proximity offers significant logistical benefits and cost savings compared to remote projects.

Mining-Friendly Jurisdiction: The Northwest Territories contributes 30% of its GDP from mining activities. With a supportive local government and a community experienced in mining, Li-FT Power operates in a stable and low-risk environment.

Strong Leadership and Backing: Led by CEO Francis Macdonald, Li-FT Power is backed by industry experts and significant investors. The company has invested over $50 million in exploration and drilling, underscoring confidence in the project's potential.

Environmental Considerations: As lithium is crucial for batteries in electric vehicles and renewable energy storage, Li-FT Power's project aligns with the global push toward sustainable and green technologies.

Upcoming Catalysts: The company is expected to release its initial resource estimate and metallurgical studies soon. These developments could further validate the project's viability and attract increased attention.

Li-FT Power presents a compelling opportunity for those interested in the future of clean energy and the critical minerals that support it. With its high-grade deposit, advantageous location, and upcoming milestones, the company is well-positioned to meet the rising demand for lithium driven by the electric vehicle revolution and renewable energy expansion.

Discover More:

Watch our recent interview with Li-FT Power CEO Francis Macdonald, where we delve into the project's unique strengths, the dynamics of the lithium market, and how Li-FT Power aims to play a significant role in powering the world's shift to sustainable energy.

Disclaimer:

is a sponsored post intended for informational purposes only. It does not constitute investment advice. Always conduct your own due diligence before making any investment decisions.

ECONOMY:

U.S. CAN ‘NO LONGER AFFORD DEBT’

Luke Gromen, September 21, 2024

We invited to the show Luke Gromen, Founder and President of Forest For The Trees, to discuss the challenges facing the U.S. economy. In particular, Gromen focused on the U.S. dollar’s weakening global status, as well as the U.S. government’s rising debt levels.

Gromen said that the current U.S. debt level is untenable. He explained that the U.S. government’s fiscal health is tied to the American stock market because “if stocks go down and stay down, the United States’s [tax] receipts will not cover the true interest expense.” This could lead to a situation where the government would have to choose between crowding out private dollar markets or letting the Federal Reserve print more money to cover the gap.

Inflation is an unavoidable consequence of the U.S. government’s fiscal situation, said Gromen. He predicted that inflation will return because the government needs to maintain negative real interest rates to manage its debt. “Inflation is going to be the release valve,” he said, suggesting that the government will continue to print money to avoid default.

Gromen said that the U.S. dollar-centric global monetary system is breaking down. He explained that global central banks have shifted away from holding U.S. Treasuries, instead accumulating gold, signaling a declining trust in the dollar as a reserve asset.

“Global central banks have sold around $300 to $400 billion worth of Treasury Bonds and bought about $500 billion worth of gold bullion over the last 10 years,” he said.

Because of these trends, Gromen is bullish on gold and Bitcoin, based on his thesis that the U.S. government will use inflation to prevent an economic crash. He also sees potential value in American industrial stocks, due to the strong possibility of re-shoring and rising protectionism.

ECONOMY:

INTEREST RATE TO 2% NEXT YEAR

Jim Thorne, September 19, 2024

“The Four Horsemen of Deflation” could pose a significant threat to economic growth according to Jim Thorne, Chief Market Strategist at Wellington-Altus Private Wealth.

Thorne said that deflationary forces from artificial intelligence, excess capacity in China, globalization, and an aging population pose a greater risk to the economy than inflation, and that the Fed’s rate cuts are “not a magic bullet” to prevent an economic downturn in late 2025. Deflationary pressures, along with reduced fiscal stimulus and a private sector recession, will plunge the economy into a recession in the next 12 months.

“I’m going to refer to Mike Tyson who eloquently put, ‘Everyone has a plan until they’re punched in the face,’” said Thorne. “The economy is going to be punched in the face late next year.”

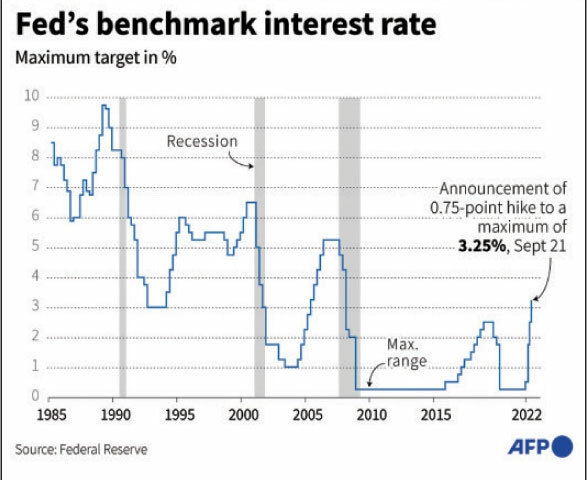

Thorne said that the Federal Reserve would be forced to cut rates to 2 percent as the economy falters.

He compared the current economic scenario to previous rate cuts in times of crisis, such as 2020, 2008, and 2001, emphasizing that the current situation differs due to the absence of a financial crisis. Thorne said that the economy resembles the post-World War II transition from a wartime to a peacetime economy, with unsustainable fiscal spending and a private sector heading into recession.

Discussing the broader market, Thorne highlighted the historical pattern where rate cuts have been followed by economic downturns. He also expressed skepticism about the notion of a new inflationary era, asserting that markets, left to their own devices, are deflationary.

“We’re going to go back down to secular stagnation and deflation,” said Thorne. “We’re going back to a period of time from 2011 to 2019. Take out the cloud, put in AI, put in low growth.”

He concluded by stressing the need for careful investment strategies, favoring secular growth stocks, low-volatility assets, gold, and Bitcoin as potential hedges against the uncertain economic environment ahead.

MONETARY POLICY:

EX-FED PRESIDENT ON WHAT FED SHOULD DO NEXT

Jim Bullard, September 23, 2024

We welcomed Jim Bullard, former President and CEO of the St. Louis Federal Reserve, to the show to give his views on monetary policy and how the Federal Open Market Committee (FOMC) operates.

Predicting that the U.S. economy is heading towards a soft landing, Bullard argued that the Fed’s policy rate is too high. He said that “inflation isn't as high as it was before,” and that the Fed can “navigate inflation back to 2 percent” at a lower rate.

He was also optimistic about the economy’s growth potential, particularly in the long term. He mentioned, “I'm a little more optimistic that we're going to see technological change feed into business sector productivity and drive growth a little faster.”

Bullard said that the economy is shifting to conditions similar to those of the 1990s or early 2000s. He said that, despite inflation cooling, maintaining a cautious stance is crucial: “I think the Fed is being more cautious in projecting what's going to happen based on possibly stickier inflation.”

When it comes to FOMC decision-making, Bullard said that the chair’s role has evolved over time. Under former chairs like Alan Greenspan, the chair exerted more influence over the committee's direction. However, this changed with Ben Bernanke, who democratized the process, allowing more input from committee members. This approach has been continued by subsequent chairs, including Janet Yellen and Jerome Powell. Bullard noted that the chair’s job is now to stay “in the middle of the committee” and ensure a balanced representation of all members’ views.

ECONOMIC POLICY:

’WEALTH INQUALITY’ IS ECONOMY’S BIGGEST CRISIS

Elizabeth Pancotti, September 24, 2024

Elizabeth Pancotti, Director of Special Initiatives at Roosevelt Forward, joined the show to discuss Vice President Kamala Harris’s economic policy proposals, focusing on tax reforms, wealth inequality, and fiscal initiatives.

Pancotti said that wealth and income inequality constitute a crisis, because they hurt economic productivity and growth. She said that the concentration of wealth at the top causes less economic mobility and opportunity for the majority, which hampers the economy's potential.

“Inequality is a huge drag on GDP,” said Pancotti. “The greater the wealth and income inequality in your country, the more it hinders economic growth and prosperity for all.”

Pancotti said that Harris’s economic plan involves taxing the wealthy, particularly through the proposed billionaire minimum tax (BMT), which targets individuals with over $100 million in assets. This tax would ensure the ultra-wealthy pay a minimum of 25 percent on all income, including unrealized capital gains.

Pancotti said, “The effective tax rate once you include those unrealized capital gains for the wealthiest taxpayers is about 9%, which is far less than what nurses, teachers, or even myself pay.”

Addressing concerns about inflation, Pancotti defended the American Rescue Plan, which she said was crucial for economic recovery post-pandemic. She acknowledged that fiscal stimulus may have contributed to inflation but said that it was necessary to support economic growth and recovery: “The risk of going too big versus going too small was one that we really weighed. I’m glad we erred on the side of going too big.”

When discussing foreign policy and trade, Pancotti criticized former President Trump’s broad tariffs as economically harmful, contrasting them with Harris’s more targeted approach to protect specific industries and address unfair practices.

POLITICS:

’PROPHET’ OF U.S. ELECTIONS REVEALS WINNER

Allan Lichtman, September 25, 2024

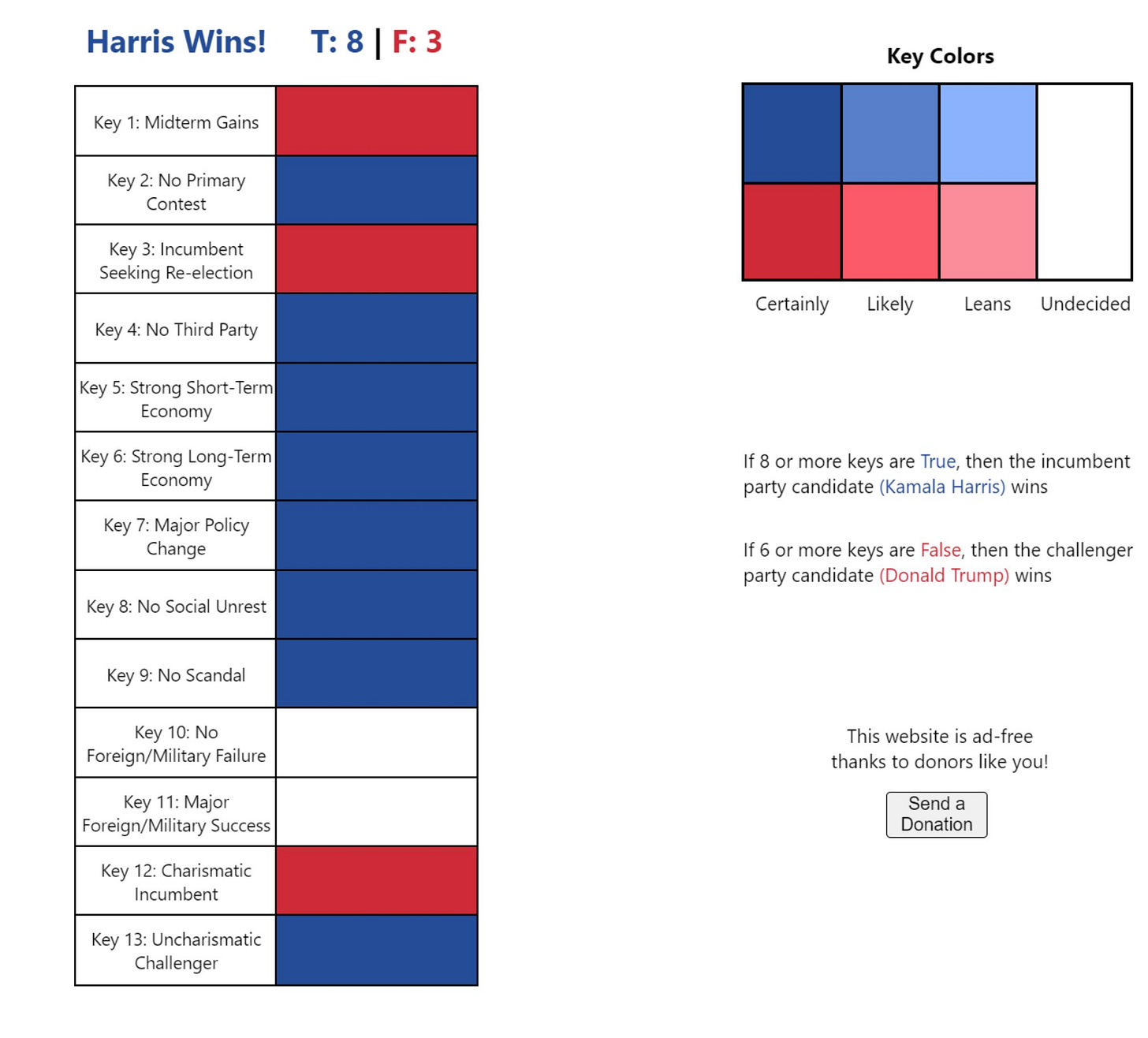

Professor Allan Lichtman, Distinguished Professor at American University known for accurately predicting every presidential election since 1984, returned to the show to tell us why he predicts that Kamala Harris will win The White House in 2024.

The professor’s system involves 13 keys; if a presidential candidate succeeds in gaining most of the keys, then their win is guaranteed.

Lichtman dismissed the impact of recent events, such as the assassination attempt on Trump and Joe Biden's withdrawal from the race, saying that these events do not influence his keys; winning the presidential race requires broader, long-term transformational qualities and stable leadership.

“If you want to develop your own [forecasting] system, go right ahead and do it,” said Lichtman. “But if you’re going to use my system, you’ve got to stick with how I define the keys.”

He was critical of the use of public polls as predictive tools, saying that, “polls are snapshots, they’re not predictors... they’re almost entirely noise anyway.”

He said that his model does not rely on speculative projections but rather on specific, historical criteria. He dismissed political pundits' claims and potential future economic impacts of candidates' policies as “partisan talking points” that hold no predictive value.

He stated that Biden’s exit from the race cost the Democrats the incumbency key, but they managed to salvage the contest key by uniting behind Kamala Harris.

Lichtman concluded by affirming the robustness of his system, saying, “The keys have survived enormous changes in our society, our economy, our demography, and our politics.”

WHAT TO WATCH

Thursday, September 26, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

Pending Home Sales: This measures the number of homes under contract but not yet closed, indicating future activity in the housing market.

Friday, September 27, 2024

Personal Consumption Expenditures: This measures the average level of prices paid by consumers for goods and services and is the Federal Reserve's preferred gauge for inflation.

Tuesday, October 1, 2024

Job Openings: also known as the Job Openings and Labor Turnover Survey (JOLTS), this measures the number of job vacancies in the U.S. economy and is released monthly by the BLS.

Construction Spending: The U.S. Census Bureau will release the total amount spent on construction projects across the country.

Thursday, October 3, 2024

Initial Jobless Claims: This measures how many American workers applied for unemployment insurance for the first time during the past week.

Friday, October 4, 2024

Unemployment Rate: The BLS will release these data, which measure the percentage of the labor force that is unemployed.

Hourly Wages: The BLS will also release these data, which tracks the average earnings per hour for employees in various sectors.