Economic 'Cracks Are Widening'

How will the government shutdown impact the labor market long-term?

TABLE OF CONTENTS

‘Strongest Buyer’s Market’ In A Decade: Redfin CEO On Falling Home Prices

Market Warning: ‘Topping Phase’ Reached Says Cycle

US Empire Is ‘Over’: Richard Wolff On The Next Global ‘Policeman’, New Alliances

How High Will Gold Price Go In 2025? Investors Face Greatest Risks Since 1941

‘Beginning Of The End’ For Banks: Here’s What’s Next

Stablecoins to $4 Trillion? Chainlink Founder Sergey Nazarov On Future Of Finance

Market Recap

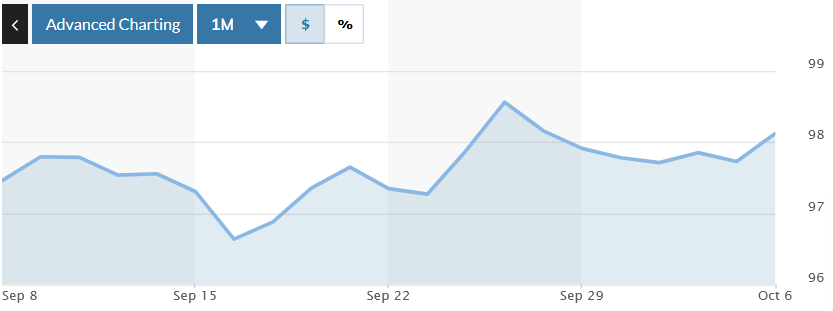

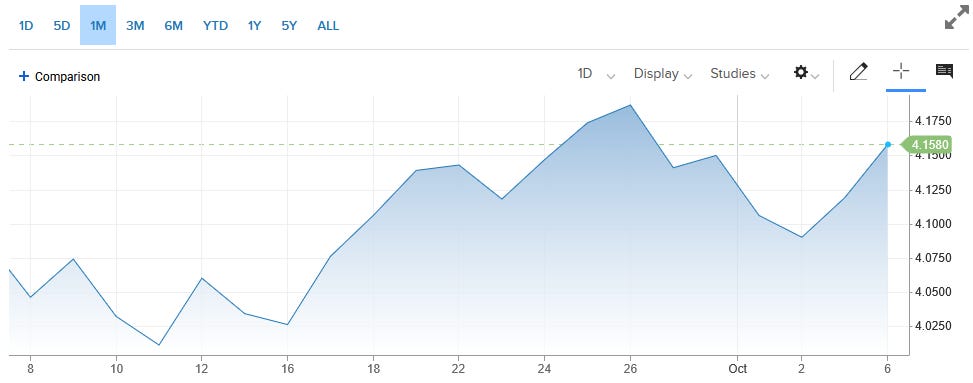

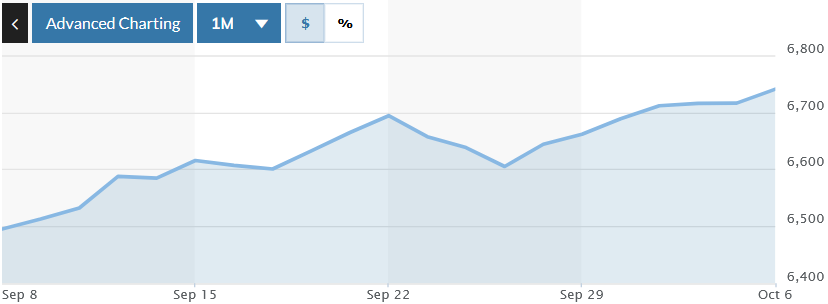

The federal government entered its first shutdown since late 2018 at midnight on Wednesday, October 1, following Congress’s failure to reach an agreement on a spending bill. Prediction markets suggested the shutdown could last approximately 11 days, with traders assigning the highest probability to a resolution around October 15 or later. Despite this political gridlock, markets demonstrated remarkable resilience throughout the week, with the S&P 500 closing Friday at 6,716, the Dow Jones Industrial Average finishing at 46,758, and the Nasdaq Composite ending at 22,781, all posting weekly gains exceeding 1% and notching fresh all-time highs. Wednesday delivered a notable turnaround as the S&P 500 recovered from morning losses to close at a record 6,711, climbing to above 6,700 for the first time, while investors largely shrugged off the shutdown. Friday saw mixed trading as the Dow advanced to reach a new record. At the same time, the Nasdaq fell slightly, as Tesla shares declined despite the electric vehicle maker reporting better-than-expected quarterly deliveries.

Economic data painted a troubling picture of labor market weakness, with Wednesday’s ADP report revealing that private sector employment shed 32,000 jobs in September, marking the largest decline since March 2023 and missing economists’ expectations for a 45,000 gain. The ISM Services PMI released Friday fell to 50.0 in September from 52.0 in August, missing expectations of 51.6 and hitting the breakeven point between expansion and contraction for the first time since January 2010, while the Business Activity Index slipped into contraction territory at 49.9 for the first time since May 2020. More concerning for inflation watchers, the Prices Paid Index climbed to 69.4, approaching October 2022 levels and marking the tenth consecutive month above 60. The government shutdown delayed the release of the September jobs report, scheduled for Friday, leaving the Federal Reserve without critical employment data ahead of its October meeting. However, most analysts expect the central bank to proceed with another 25-basis-point rate cut. The confluence of weakening labor data and persistent service sector inflation pressures creates a challenging backdrop for monetary policy, even as equity markets continue their ascent to new heights.

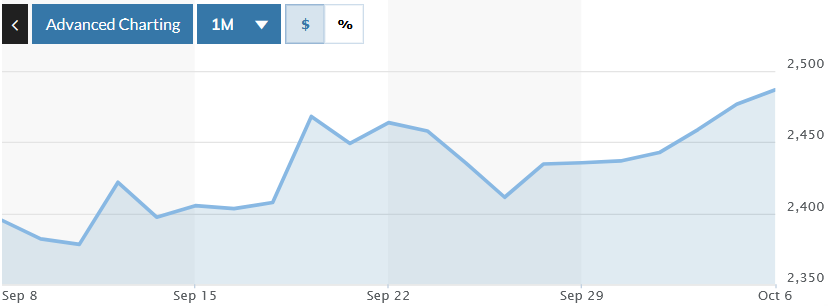

Markets extended their record-setting rally on Monday as the government shutdown entered its second week, with investor enthusiasm for artificial intelligence overwhelming concerns about the fiscal impasse in Washington. The S&P 500 rose to close at 6,740. At the same time, the Nasdaq Composite surged to finish at 22,942, both notching fresh all-time highs as investors demonstrated continued resilience in the face of delayed economic data releases. The Russell 2000 also reached a milestone, crossing 2,500 for the first time to close at a record 2,486. However, the Dow Jones Industrial Average slipped to end at 46,695, weighed down by Verizon shares following the abrupt departure of CEO Vestberg. The session was dominated by Advanced Micro Devices, which skyrocketed following the announcement of a landmark partnership with OpenAI that could grant the ChatGPT maker up to a 10% stake in the chipmaker and generate tens of billions in revenue through massive GPU deployments, adding over $100 billion to AMD’s market capitalization in what marked the company’s second-largest single-day gain in four decades.

Market Movements

The following assets experienced dramatic swings in price this past week. Data are up-to-date as of Oct 6 at approximately 4pm EST.

(Data from StockAnalysis.com)

Advanced Micro Devices - up 26.25%

Micron Technology - up 16.56%

Eli Lilly and Company - up 16.32%

Strategy, Inc. - up 10.19%

Philip Morris International - down 5.80%

Wells Fargo - down 4.68%

Netflix - down 3.57%

Meta - down 3.73%

(Data from https://www.marketwatch.com)

DXY - down .05%

Bitcoin - up 11.90%

Gold - up 4.91%

Platinum - up 2.64%

10-year Treasury Yield - up .19%

(10-year data from https://www.cnbc.com)

S&P 500 - up 1.17%

Russell 2000 - up 1.76%

Economic Analysis

Danielle DiMartino Booth, former Fed insider and CEO of QI Research, identified multiple converging economic headwinds as 150,000 federal workers lost severance benefits on September 30, 2025, joining an unemployment pool increasingly dominated by long-term jobless individuals. The former Federal Reserve advisor noted that University of Michigan sentiment surveys showed Gen Z and millennials reporting zero percent good news on employment, matching levels only seen during the depths of the October 2008 financial crisis. Booth documented 1.5 million full-time job losses since January 2025, with 25% of unemployed Americans now jobless for more than six months, crossing the threshold into what economists term labor market scarring.

The researcher argued that credit market failures provide the clearest recession signals, citing 71 record bankruptcies in August, which represented the highest post-pandemic total, with individual failures ranging between $10 billion and $ 50 billion in liabilities. Booth highlighted structural similarities to 2007-2008 conditions after three banks lent against identical collateral in one subprime lender’s bankruptcy, while First Brands’ collapse revealed nearly 100 subsidiary LLCs masking off-balance sheet borrowing. She documented five consecutive months of home price declines, according to S&P data, and four months according to FHFA measurements. Austin, Texas, experienced the nation’s steepest metropolitan area corrections, despite prices remaining 20-25% above 2020 levels.

Booth expressed contrarian caution regarding gold holdings after Morgan Stanley announced 20% client asset allocations to precious metals, warning that margin calls could trigger selling pressure despite gold’s status as a long-term haven. The economist noted that corporate profit growth peaked six quarters prior. At the same time, business investment turned negative, suggesting that recession determinants center on a contraction of capital spending rather than changes in consumer behavior. She recommended defensive portfolio positioning, emphasizing dividend-generating stocks for income production, as Federal Reserve rate cuts reduce money market returns. While cautioning investors to monitor individual stock deterioration, which can signal potential margin call cascades across broader markets.

‘Strongest Buyer’s Market’ In A Decade: Redfin CEO On Falling Home Prices

Glenn Kelman, CEO of Redfin, characterized summer 2025 as the strongest buyers’ market since the post-financial crisis era, with inventory levels and deal cancellation rates matching those of 2013, as the seller-to-buyer ratio reversed dramatically. The real estate executive noted that a 2% year-over-year home price appreciation represents actual deflation in real terms against 3% inflation, marking the first deflationary housing impact in recent memory, despite the Trump administration’s rhetoric about declaring a national housing emergency. Kelman emphasized that approximately 15% of sales are currently being canceled, with buyers walking away over minor inspection issues, given the abundance of alternative options, particularly in new construction markets.

The housing industry leader documented sharp regional divergence, with Midwest markets like Milwaukee and Cleveland posting 9-11% annual gains, while former pandemic boom towns Austin and San Francisco declined by 6%, reflecting an unsustainable pandemic-era doubling that left Sun Belt markets glutted with supply. Kelman reported that 39% of builders cut prices by an average 5% margin, although new construction represents only 20% of total market activity. Meanwhile, buyers gained approximately $20,000 in purchasing power through more aggressive negotiating positions. He warned that couples often remain trapped sharing homes post-divorce, and young families defer moves due to 3% legacy mortgage rates versus the current 6% environment, creating massive pent-up demand that awaits five-handle mortgage rates to unlock.

Kelman criticized housing construction patterns that favor luxury developments over starter homes, noting that only 9% of 2023 new builds fell under 1,400 square feet, compared to 40% in 1982. This reflects a K-shaped economy, where wealth concentration drives builder profit incentives toward higher-margin properties. The executive defended Fannie Mae and Freddie Mac’s role as conservators in stabilizing the 30-year mortgage market while calling for selective tariff relief on housing materials, such as lumber, steel, and copper, that inflate construction costs without providing manufacturing benefits. He projects that 2026 remains highly uncertain, pending the impacts of tariff inflation and the Federal Reserve’s rate trajectory, suggesting that the administration’s economic responsiveness could trigger policy reversals if employment and inflation signals deteriorate.

Market Warning: ‘Topping Phase’ Reached Says Cycle

Dr. Richard Smith, Chairman of the Board and Executive Director at the Foundation for the Study of Cycles, argued the United States occupies the terminal phase of an 80-100 year debt cycle, with 10-year Treasury yields positioned to rise over the next 5-15 years after reaching unprecedented lows below 2% in the late 2010s. The systems scientist documented historical interest rate patterns extending to 1787, identifying 85-year cyclical intervals that suggest sustained upward pressure on borrowing costs as the federal government faces mounting debt service obligations. Smith projected “stagflation light” conditions featuring debt monetization, constrained growth, and persistently elevated inflation as fiscal dominance redirects capital flows away from productive investment.

The researcher employed spectral analysis techniques, revealing a 64-month inflation cycle that is currently entering an upward phase, with the Consumer Price Index at 2.94% and momentum indicators showing acceleration rather than the disinflation that Federal Reserve officials anticipated. Smith identified a statistically significant 42-month (188-week) S&P 500 cycle, traceable to the mid-1800s, noting that daily data signals suggest near-term weakness into October-November, despite recent all-time highs. Meanwhile, proprietary momentum indicators show descending peaks alongside ascending prices in classic divergence patterns. He documented a 67-month unemployment cycle, similarly pointing to continued labor market deterioration, which creates conflicting pressures as the Federal Reserve attempts to implement rate cuts amid sticky inflation dynamics.

Smith characterized current conditions as presenting asymmetric risks, given extreme debt levels, widening credit spreads, and structural dollar vulnerabilities, despite projecting a near-term dollar rally following recent excessive weakness. The analyst argued that deglobalization and reduced Chinese Treasury purchases undermine the collateral foundation supporting the global reserve currency system, citing studies of empire cycles and generational dynamics that suggest potential fundamental restructuring. Smith’s Bitcoin analysis identified 84-week and 163-week cycles in topping phases, characterized by momentum divergence patterns, projecting possible near-term upside followed by multi-year correction vulnerability. This analysis acknowledged the cryptocurrency’s appeal as a hedge against dollar debasement, alongside gold, in an environment questioning reserve currency assumptions.

US Empire Is ‘Over’: Richard Wolff On The Next Global ‘Policeman’, New Alliances

Professor Richard Wolff, Co-Founder of “Democracy At Work”, characterized recent Russian drone incursions into Polish, Estonian, and Danish airspace as routine occurrences inflated into political theater by European leaders unable to confront deteriorating economic relationships with the United States. The Democracy at Work founder argued that European politicians are displacing anger over the Trump administration’s tariffs and demands for investment extraction onto Russia, noting that Germany’s recession stems from tripled energy costs following Western sanctions that severed Russian oil and gas supplies. Wolff dismissed fears of Russian expansion into Europe as “craziness,” citing historical patterns of Western invasions into Russia rather than the reverse, while emphasizing that Russia’s GDP growth has outpaced the United States and Europe throughout the Ukraine conflict.

The Marxist economist contended that the United States and Israel face unprecedented global isolation, noting that BRICS nations now represent 35% of global GDP, compared to the G7’s 28%, marking a fundamental power shift that Americans struggle to acknowledge. Wolff argued that Trump’s failure to end conflicts in Ukraine and Gaza despite campaign promises, combined with new confrontations with Iran and Venezuela, demonstrates the emptiness of “theater as politics” that reassures constituents of American dominance while the empire declines. He cited European dock workers refusing to handle Israeli cargo and growing pro-Palestinian sentiment in New York’s heavily Jewish population as evidence of shifting political realities that may finally be reaching Trump.

Wolff outlined his “military Keynesianism” thesis, explaining how post-World War II America resolved the contradiction between capitalism’s need for government economic intervention and its fear of democratic control over capitalist interests. The scholar argued that maintaining over 700 global military bases and massive defense spending allows the government to stimulate the economy through deficit spending without explicitly acknowledging Keynesian intervention, as military expenditures are justified through perpetual external threats rather than domestic economic management. He suggested future global governance will either transfer to Chinese hegemony or, preferably, realize Western aspirations for genuine multinational cooperation through reformed international institutions, urging American leadership to seize opportunities for collaborative planetary management.

How High Will Gold Price Go In 2025? Investors Face Greatest Risks Since 1941

Jeff Christian, Managing Partner of CPM Group, characterized current gold and silver price momentum as a “runaway train” unlikely to stop before 2027, projecting gold trading around $4,000 by December 2025 and maintaining $4,000-4,100 throughout 2026 while silver approaches $50 per ounce. The metals consultant argued that global risks and uncertainty exceed any period since December 1941, when the United States entered World War II, citing the accumulation of economic and political anxieties rather than a single catalyst driving the recent surge from $3,650 to $3,800 in just two days. Christian noted the 2019-2025 price trajectory mirrors patterns preceding the 2007-2011 financial crisis, when gold and silver rose five years before recession, continued through economic contraction, and peaked two years afterward during Europe’s sovereign debt crisis.

The analyst identified political risk as the primary driver, over traditional factors such as dollar weakness or real interest rate correlations, which historically show only a negative 16% statistical correlation, despite conventional wisdom suggesting inverse relationships. Christian emphasized that service sector inflation remains stubbornly elevated, despite headline restraint from lower energy prices. New York jewelry district clients have announced 15-25% price increases effective October 1st, due to the impacts of tariffs and immigration policy on labor supply. He highlighted the erosion of Federal Reserve independence as both a short-term demand catalyst and a long-term structural concern, arguing that the loss of central bank autonomy resembles virginity in its difficulty to restore once compromised, while noting that Trump administration officials demonstrably lack fundamental economic knowledge.

Christian reported that investment demand spans high-net-worth individuals, family offices, and institutional investors globally, with Indian and Chinese buyers shifting from jewelry to investment purchases, despite $3,800 gold representing prohibitive costs for lower-income demographics. The consultant dismissed claims about silver shortages, noting that COMEX inventories are now five times higher than they were three years ago. At the same time, London stocks are triple the estimates of the 1990s, and total above-ground bullion reaches 2.5 billion ounces in coins, plus one billion in ETFs. He characterized platinum’s 63% year-to-date gain as primarily marketing-driven hype, following May reports of Chinese deficits and jewelry demand that major importers acknowledged reflected inventory building rather than consumer sales. However, South African production cuts and reduced electric vehicle conversion rates outside China provide genuine support.

‘Beginning Of The End’ For Banks: Here’s What’s Next

Sandy Kaul, Executive Vice President & Head of Innovation at Franklin Templeton, characterized the Genius Act’s passage and expanding stablecoin usage as marking “the beginning of the end of the traditional financial ecosystem,” arguing every dollar migrating from account-based banking into wallet-based systems represents a permanent infrastructure transition rather than a temporary adoption. The digital asset innovation chief noted new SEC generic listing standards reduce crypto ETF approval timelines from 190 days to potentially 30-60 days, establishing predictable criteria, including futures market performance requirements that should accelerate product launches while maintaining professional trading standards. Kaul emphasized that the CFTC’s recommendation to accept stablecoins as collateral on listed derivative trades represents a fundamental integration of crypto-instruments into mainstream finance.

The Franklin Templeton strategist announced a partnership with Binance, the world’s largest cryptocurrency exchange by wallet count, to develop initiatives tailored for digital-native investors whose needs may diverge significantly from those of traditional finance customers. Kaul argued that tokenization enables any asset to function as both a payment and a store of value, projecting a “high-tech barter society” where consumers could pay for rent or coffee purchases using tokenized gold, money market funds, or, eventually, individual equities, such as Tesla shares. She outlined a two-phase ETF evolution, beginning with trust structures that own traditional ETFs, and advancing to fully tokenized securities where investors could “burn” index wrappers to instantly receive proportional exposure to underlying constituent tokens, potentially eliminating traditional ETF structures.

Kaul defended Bitcoin’s suitability as a strategic reserve asset despite concerns about volatility, noting that centuries-old hedging techniques, such as futures and options contracts, apply equally to cryptocurrency as to oil or other volatile commodities that governments already reserve. The former commodity analyst projected sovereign wealth funds would act “irresponsibly” by not tokenizing strategic reserves to maximize utility in financial ecosystems, while identifying two critical missing pieces for complete digital transition: blockchain-based settlement rails replacing 24-hour delays and upgraded digital identity solutions superseding duplicative know-your-customer checks. Kaul emphasized that Franklin Templeton’s proprietary transfer agent system enables real-time books and records, positioning the firm uniquely to operate at digital-native speeds while bringing 80 years of active management expertise onto emerging rails.

Stablecoins to $4 Trillion? Chainlink Founder Sergey Nazarov On Future Of Finance

Sergey Nazarov, Founder of Chainlink, characterized the passage of the Genius Act and the proliferation of stablecoins as driving stablecoins from the 18th largest US Treasury holder, above Japan, toward a projected $1-4 trillion market capitalization, representing fundamental diversification from sovereign holders to hundreds of millions of individual consumers. The oracle network pioneer argued that the total value locked in DeFi, reaching all-time highs of $360-386 billion, stems from dollar yields significantly exceeding traditional finance returns, as Federal Reserve rate cuts widen the spread. Meanwhile, deglobalization forces create demand for frictionless payment alternatives, as traditional trade rails face restrictions. Nazarov dismissed Russian advisor claims about the United States using stablecoins to devalue its $37 trillion debt, noting that even repricing gold reserves to $15,000 per ounce fails to reduce debt by 10% due to insufficient arithmetic.

The blockchain infrastructure executive positioned financial system tokenization as a generational reformation occurring every 50-70 years, comparing current blockchain adoption to 1970s database and internet integration that enabled US market share gains through first-mover technological advantages. Nazarov emphasized that Chainlink’s $25 trillion transaction value, secured over five years, uniquely positions the oracle network to meet traditional finance requirements for identity verification, cross-chain interoperability, regulatory compliance, and real-time valuation data, which simple peer-to-peer cryptocurrency transactions lack. He confirmed major banks, including JP Morgan, already operate tokenized deposit systems on private chains, projecting production implementation on public blockchains throughout 2025-2026 as separate digital asset teams initially offer tokenized products before blockchain infrastructure inevitably powers entire banking operations.

Nazarov detailed Chainlink’s partnership with Swift and UBS, converting ISO 20022 financial messaging standards into blockchain transactions, which enables traditional institutions to describe operations in existing protocols while executing settlements on-chain through oracle network intermediation. The entrepreneur highlighted the Commerce Department’s collaboration in providing economic data, including GDP and the PCE index, across multiple blockchains, while identifying pending market structure legislation as the next critical milestone for legitimizing token issuance beyond stablecoins to encompass all digital assets. Nazarov argued that tokenized equities, commodities, and funds, offering 24/7 trading, collateral posting capabilities, and programmable compliance, will demonstrate utility advantages so compelling that financial system participants will demand tokenized versions once the ecosystem infrastructure for secondary markets and automated risk management matures beyond its current pilot stages.

What To Watch

Wednesday, October 8

Minutes of Fed’s September FOMC meeting

Thursday, October 9

Federal Reserve Chair Jerome Powell opening remarks

Initial jobless claims

Wholesale inventories

Pepsico earnings

Delta Air Lines earnings

Friday, October 10

Consumer sentiment (prelim)

Monthly U.S. federal budget

2026 looking to be super bad.